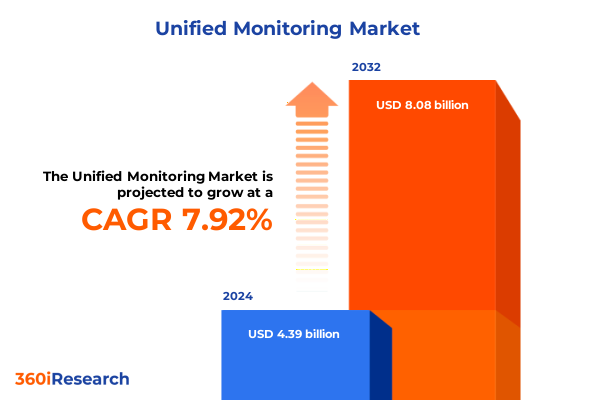

The Unified Monitoring Market size was estimated at USD 4.67 billion in 2025 and expected to reach USD 4.96 billion in 2026, at a CAGR of 8.15% to reach USD 8.08 billion by 2032.

Setting the Stage for Unified Monitoring Excellence by Exploring the Transformative Power of Integrated Observability in Complex IT Infrastructures

In today’s hyper connected digital ecosystem, unifying monitoring across applications, infrastructure, networks, and user experiences has become mission critical for organizations striving to maintain optimal performance and drive operational efficiency. As technology stacks grow ever more complex, the ability to correlate data from real user monitoring, synthetic tests, database performance metrics, network availability, server health, storage utilization, and website uptime in a cohesive manner empowers decision makers to detect anomalies, reduce mean time to resolution, and proactively address emerging issues.

This executive summary introduces the fundamental concepts of integrated observability, underscoring how a unified monitoring framework transcends siloed point solutions. By harmonizing telemetry across diverse components such as Real User Monitoring and Synthetic Monitoring for applications, SQL and NoSQL performance data for databases, wired and wireless network telemetry, virtual and physical server metrics, block file and object storage analytics, and both content and e-commerce monitoring for websites, organizations can achieve end-to-end visibility. As a result, resource utilization is optimized, user satisfaction is elevated, and competitive differentiation is realized.

Throughout this analysis, readers will gain a clear understanding of the market landscape, the transformative shifts reshaping monitoring paradigms, the cumulative impact of evolving tariff policies in the United States, in-depth segmentation insights, regional adoption patterns, and the strategic imperatives that leading vendors and end-users must embrace. This introduction lays the groundwork for an informed exploration of how unified monitoring is redefining operational excellence and fueling digital innovation in 2025 and beyond.

Navigating the Rapid Evolution of Monitoring Technologies Driven by Cloud Native Architectures Microservices Proliferation and AI Powered Analytics Integration

Over the past few years, the convergence of cloud native architectures, microservices proliferation, and AI powered analytics has fundamentally altered the monitoring landscape. Traditional, reactive, and siloed monitoring approaches struggle to keep pace with continuously deployed code, dynamic containerized environments, and distributed edge infrastructure. As organizations migrate workloads to public clouds and orchestrate hybrid and multi-cloud deployments, the demand for an agile, holistic monitoring strategy has never been greater.

Simultaneously, the rise of edge computing and 5G networks has expanded the perimeter of enterprise IT, introducing new points of telemetry that require real-time visibility and low-latency data processing. Security considerations have become intertwined with performance monitoring, as threats originate at the application layer and traverse through network and infrastructure components. To stay ahead of potential disruptions, businesses are increasingly leveraging machine learning models to detect anomalies and forecast capacity constraints before service degradation occurs.

In response to these shifts, unified monitoring platforms are evolving toward self-healing architectures that can autonomously remediate common faults and support continuous integration and continuous delivery (CI/CD) pipelines. By embedding observability directly into development workflows, teams can instrument code from inception through production, creating a seamless feedback loop that accelerates innovation. These transformative shifts signify a departure from tool sprawl toward integrated suites offering end-to-end transparency and context-aware insights.

Understanding the Far Reaching Consequences of 2025 United States Tariff Policies on Hardware Supply Chains Component Costs and Technology Innovation Landscape

The introduction of new tariff policies by the United States in 2025 has created significant ripple effects throughout the unified monitoring supply chain. Increased duties on imported network switches, server hardware, and specialized storage devices have driven up acquisition costs for both on-premises and colocation deployments. These elevated capital expenditures have, in turn, accelerated the shift toward cloud based and hybrid models, where infrastructure is procured through IaaS, PaaS, and SaaS consumption models that mitigate upfront investment risks.

Furthermore, tariffs on semiconductor components have strained the availability of advanced processors and custom ASICs used in high-speed data analysis appliances. Vendors have responded by diversifying manufacturing footprints, partnering with contract manufacturers in untaxed markets, and investing in software defined solutions that reduce dependence on specialized hardware. This realignment has also spurred innovations in synthetic monitoring agents that run directly within containers or at the edge, lessening reliance on dedicated probes shipped across borders.

These policy changes have indirectly influenced pricing models for unified monitoring subscriptions, pushing service providers to offer flexible tiering and modular add-ons that reflect passing tariff costs transparently. End-user organizations are demanding predictable total cost of ownership and are negotiating service level agreements that incorporate escalation clauses tied to hardware duty fluctuations. Ultimately, the tariff landscape of 2025 underscores the imperative for agile procurement and vendor diversification strategies to sustain robust monitoring capabilities.

Dissecting Market Segmentation Dynamics Across Component Deployment Modes and End User Verticals to Reveal Actionable Insights for Tailored Monitoring Strategies

Analyzing unified monitoring through the lens of component, deployment mode, and end-user vertical segmentation yields crucial insights for solution architects and procurement leaders. When dissecting components, application monitoring splits into real user monitoring and synthetic monitoring, each addressing distinct use cases from user-centric performance analysis to automated transaction testing. Database monitoring differentiates between SQL and NoSQL engines, reflecting the growing need to support relational and schema-less data stores within a singular telemetry platform. Network monitoring’s evolution across wired and wireless domains recognizes the heterogeneity of connectivity in campus, branch, and edge scenarios. Simultaneously, server monitoring’s focus on physical versus virtual environments highlights capacity planning challenges strained by container orchestration. Storage monitoring’s breakdown into block, file, and object storage underscores varying performance and scalability requirements, while website monitoring’s content and e-commerce dimensions stress the criticality of uptime for digital storefronts.

Turning to deployment modes, organizations face a spectrum of choices ranging from cloud based solutions leveraging IaaS, PaaS, and SaaS offerings to hybrid architectures integrating multiple clouds and single cloud environments. On premises strategies still prevail in regulated industries where colocation and dedicated data centers provide control over sensitive workloads. The interplay between these deployment options reveals that enterprises are gravitating toward multi-cloud observability fabrics that unify telemetry across decentralized IT estates.

Finally, examining end-user industries, financial services companies spanning banking, capital markets, and insurance demand stringent compliance, resiliency, and low-latency analytics. Government agencies at federal, state, and local levels prioritize security hardening and transparent audit trails. Healthcare providers operating hospitals and pharmaceutical research centers require real-time analytics to guarantee patient safety and streamline clinical trials. IT and telecom firms, both IT services companies and telecom operators, push high-volume, low-latency monitoring for global networks. Manufacturing, in discrete and process segments, is adopting predictive maintenance use cases, while both offline and online retail businesses emphasize customer experience monitoring to drive conversion rates.

Together, these segmentation dimensions paint a nuanced picture of diverse monitoring requirements and adoption catalysts across the market.

This comprehensive research report categorizes the Unified Monitoring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- End User Industry

Unearthing Regional Variations in Unified Monitoring Adoption Across Americas EMEA and Asia Pacific with Focus on Regulatory Shifts and Technological Maturity

Regional developments in unified monitoring adoption exhibit distinct patterns in the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, rapid digital transformation initiatives, coupled with high cloud penetration rates, have driven extensive uptake of unified monitoring solutions in both large enterprises and mid-market organizations. The United States remains a dominant hub for innovation, spurring local vendors to specialize in AI enabled observability platforms that integrate natively with hyperscale cloud providers.

In Europe Middle East & Africa, diverse regulatory landscapes from GDPR compliant data privacy frameworks to localized national regulations shape deployment preferences. Enterprises in Western Europe often adopt hybrid monitoring models to balance data sovereignty with cloud agility, while Middle East governments invest heavily in smart city and digital infrastructure programs that rely on real-time analytics. Africa, though nascent in unified monitoring adoption, presents growth opportunities as mobile network expansions and SaaS offerings lower barriers to entry.

The Asia-Pacific region is characterized by both mature markets such as Japan and Australia, which emphasize reliability and security in mission critical systems, and high-growth markets including India and Southeast Asia. These emerging economies are deploying unified monitoring to support rapid e-commerce expansion and digital financial services. Furthermore, localized vendors in China are developing homegrown observability stacks that comply with national cybersecurity mandates, fostering a dynamic competitive environment.

This comprehensive research report examines key regions that drive the evolution of the Unified Monitoring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Differentiation Strategies of Leading Unified Monitoring Providers Through Innovation Partnerships and Comprehensive Solution Portfolios

The competitive landscape of unified monitoring encompasses a blend of established enterprise software giants, cloud platform leaders, and specialized observability startups. Many leading providers differentiate through embedded AI engines that auto-correlate events and recommend remediation steps, enabling IT teams to focus on strategic initiatives rather than firefighting. Partnerships with major cloud hyperscalers have become a central theme, as native integrations with infrastructure services enhance data ingestion rates and streamline licensing models.

Several vendors have expanded their capabilities by acquiring complementary startups, integrating log analytics, security event management, and developer-centric tracing into cohesive platforms. Others have introduced modular offerings, allowing customers to assemble bespoke solutions that map precisely to their environment and budget. Open source projects also influence the market, with some companies contributing heavily to observability frameworks and offering enterprise-grade support subscriptions.

As customer expectations evolve, unified monitoring providers are placing greater emphasis on developer experience, embedding context-rich dashboards and collaboration tools that bridge DevOps, IT operations, and security teams. The ability to deliver transparent pricing and predictable support SLAs is increasingly viewed as a key differentiator, particularly among mid-market enterprises seeking to avoid surprise costs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Unified Monitoring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BMC Software, Inc.

- Broadcom Inc.

- Cisco Systems, Inc.

- Datadog, Inc.

- Dynatrace, Inc.

- International Business Machines Corporation

- Microsoft Corporation

- New Relic, Inc.

- Paessler AG

- SolarWinds Corporation

- Splunk Inc.

Empowering Industry Leaders with Actionable Strategies to Enhance Monitoring Capabilities through AI Automation Cross Platform Integration and Scalability Best Practices

To harness the full potential of unified monitoring, industry leaders must adopt a strategic approach that prioritizes scalability, automation, and cross-functional collaboration. Initially, aligning observability objectives with business outcomes is crucial, ensuring that monitoring investments directly support user experience targets and revenue-impacting metrics. Embedding AI and machine learning capabilities within monitoring workflows accelerates anomaly detection, root cause analysis, and predictive maintenance, reducing operational overhead and minimizing downtime.

Next, organizations should foster a culture of shared ownership between development, operations, and security teams by implementing unified dashboards and integrated incident management systems. This collaborative model promotes faster decision-making and ensures that insights flow seamlessly across organizational silos. Additionally, leveraging infrastructure as code and container instrumentation solidifies monitoring as an integral facet of continuous delivery pipelines, enabling teams to shift left and catch performance regressions early.

Finally, building a flexible procurement strategy that balances cloud based subscriptions with on premises deployments and hybrid architectures allows businesses to optimize total cost of ownership while maintaining control over sensitive workloads. Establishing vendor diversification practices and periodic audit reviews of SLAs can further safeguard against tariff-driven cost escalations and service disruptions. By following these recommendations, leaders can elevate their observability posture and outpace competitors in an era of digital acceleration.

Elucidating the Rigorous Research Approach Involving Primary Expert Interviews Secondary Data Analysis and Multi Layered Validation to Ensure Insightful Outcomes

This research adopts a rigorous methodology designed to deliver robust and reliable insights into the unified monitoring market. The process commenced with an extensive review of secondary sources, including publicly available technical whitepapers, vendor product briefs, industry regulatory publications, and scholarly articles on observability best practices. This foundational work established current technology benchmarks and emerging trend frameworks.

Subsequently, a series of in-depth interviews were conducted with senior IT executives, DevOps leads, cloud architects, and compliance officers across diverse verticals such as financial services, healthcare, manufacturing, and retail. These primary conversations provided firsthand perspectives on deployment challenges, feature priorities, and strategic investment plans. To enhance data reliability, responses were triangulated against vendor case studies and anonymized performance data shared under non-disclosure agreements.

Quantitative analysis was performed by aggregating telemetry volume metrics and licensing model breakdowns from representative organizations spanning small to large enterprise segments. Multi-layered validation ensured consistency between qualitative insights and observed market behaviors. The final dataset underwent peer review by domain experts to certify accuracy and contextual relevance, culminating in a research output that empowers stakeholders with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Unified Monitoring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Unified Monitoring Market, by Component

- Unified Monitoring Market, by Deployment Mode

- Unified Monitoring Market, by End User Industry

- Unified Monitoring Market, by Region

- Unified Monitoring Market, by Group

- Unified Monitoring Market, by Country

- United States Unified Monitoring Market

- China Unified Monitoring Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 3021 ]

Summarizing Key Takeaways from Unified Monitoring Trends Tariff Impact Segmentation Insights and Recommendations to Drive Informed Decision Making

In summary, the unified monitoring market is undergoing rapid transformation driven by cloud native adoption, AI powered analytics, and evolving regulatory landscapes such as the 2025 United States tariffs. A detailed segmentation analysis reveals distinct requirements across components, deployment modes, and industry verticals, while regional variations from the Americas to APAC highlight divergent adoption drivers. Competitive dynamics emphasize the importance of integrated solution portfolios, strategic partnerships, and transparent pricing models.

For technology and business leaders, embracing a unified observability strategy that aligns with overarching digital transformation goals is paramount. The recommended actionable steps-ranging from embedding machine learning in monitoring workflows to enforcing procurement agility-serve as a blueprint for optimizing performance, mitigating risk, and sustaining innovation. As organizations continue to navigate complexity, the insights and methodologies presented in this report offer a trusted foundation for informed decision making and long-term success.

Engaging Directly with Our Sales Leadership to Secure Your Access to the Full Unified Monitoring Market Report and Gain a Competitive Edge in 2025 and Beyond

To take the next step toward gaining a competitive advantage in the rapidly evolving unified monitoring landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By partnering with his team, you’ll secure comprehensive insights into component dynamics, regional trends, tariff implications, and strategic recommendations that drive business growth. Engage with our experts to customize the report to your organization’s unique needs and unlock the full potential of integrated observability solutions.

- How big is the Unified Monitoring Market?

- What is the Unified Monitoring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?