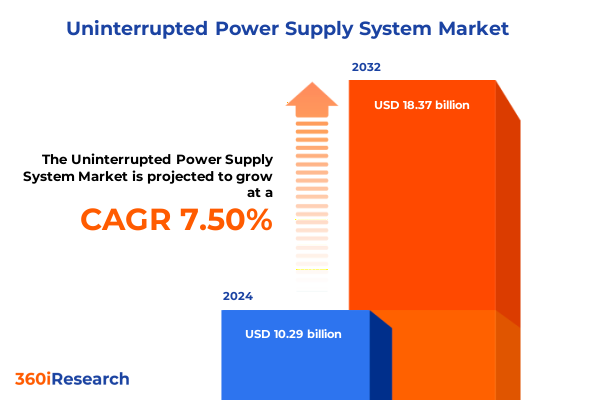

The Uninterrupted Power Supply System Market size was estimated at USD 11.03 billion in 2025 and expected to reach USD 11.83 billion in 2026, at a CAGR of 7.55% to reach USD 18.37 billion by 2032.

Unveiling the Critical Importance of Uninterrupted Power Supply Systems Amidst Growing Demand for Reliability, Efficiency, and Technological Innovation

The evolving landscape of critical infrastructure underscores the essential role of uninterrupted power supply (UPS) systems as foundational enablers of business continuity, data integrity, and operational resilience. Organizations across industries are confronted with increasingly stringent uptime requirements, driven by the proliferation of digital processes and the imperative to safeguard sensitive information. Advances in automation, the rise of edge computing, and the accelerating adoption of cloud-based services have collectively heightened the stakes for reliable power backup solutions.

As global energy grids face challenges ranging from extreme weather events to shifting regulatory frameworks, the relevance of UPS technologies has never been more pronounced. Stakeholders are demanding sophistication in form factor, efficiency, and remote management capabilities. In response, manufacturers and system integrators are investing in advanced electrochemical storage, intelligent power management software, and modular architectures designed to streamline deployment and maintenance. This report provides a concise yet comprehensive executive summary, establishing the contextual foundation needed to navigate the latest industry trends and strategic considerations around UPS deployment.

Exploring the Transformative Technological Shifts and Industry Dynamics Reshaping the Uninterrupted Power Supply Landscape for Future Resilience

The UPS landscape is undergoing a paradigm shift, propelled by the convergence of digital transformation initiatives, heightened sustainability mandates, and seamless integration with renewable energy sources. Traditional static power backup models are giving way to dynamic, software-defined solutions that adapt to real-time load variations and grid conditions. Cloud-native architectures are no longer confined to data centers; they encompass edge sites that demand resilient, decentralized power intelligence.

In parallel, environmental imperatives are prompting a reevaluation of battery chemistries and system lifecycle impacts, leading to the growing adoption of lithium-ion and next-generation storage materials. Smart grid interoperability and IoT-enabled asset monitoring are creating feedback loops that optimize energy consumption and extend equipment longevity. This transformational ecosystem requires strategic alignment across R&D, regulatory compliance, and end-user education, redefining competitive moats and unlocking new pathways for differentiation.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Component Costs, Supply Chains, and Strategic Sourcing for Power Backup Solutions

The implementation of targeted tariffs in the United States during 2025 has exerted notable pressure on component sourcing, manufacturing economics, and global supply chain strategies within the UPS sector. Lithium-ion cells, power semiconductors, and transformer laminates originating from key trading partners have become subject to increased duties, prompting OEMs and distributors to reassess vendor relationships and cost structures. This regulatory environment has driven a partial repatriation of assembly activities, alongside intensified negotiations to secure favorable long-term procurement contracts.

While short-term cost inflation has challenged pricing models and margin stability, strategic players have mitigated impacts through localized inventory stocking, multimodal logistics optimization, and collaborative partnerships with domestic suppliers. Furthermore, the tariff framework has catalyzed renewed investment in research around alternative materials and process efficiencies, offering potential avenues for cost recovery and resilience enhancement. Understanding this cumulative tariff landscape is critical for stakeholders aiming to preserve competitiveness and supply continuity.

Revealing In-Depth Segmentation Insights Based on Technology, Capacity, Phase, and Application to Illuminate Market Dynamics and Targeted Opportunities

Insight into the UPS ecosystem requires a nuanced understanding of how technology typologies influence performance, adoption, and service models. The study examines Double Conversion architectures, which offer the highest level of voltage regulation and isolation, alongside Line Interactive systems, valued for their balance of cost-effectiveness and response speed, and Offline Standby units ideal for low-density, budget-sensitive applications.

Capacity categorizations are equally pivotal, extending from compact systems designed for less than 5 KVA through midrange configurations spanning 5 to 10 KVA and 10 to 20 KVA, up to high-capacity installations exceeding 20 KVA that support large-scale data centers and industrial operations. These scale classifications inform decisions around footprint, redundancy, and lifecycle support.

The report also contrasts Single-Phase setups commonly deployed in small offices and retail environments with Three-Phase topologies that underpin enterprise-grade installations and heavy industrial processes. Finally, the analysis delves into application segments, encompassing the BFSI sector with its constituent banking, insurance, and investment firm subverticals; healthcare facilities spanning clinics, diagnostic centers, and hospitals; industrial environments across manufacturing, mining & metals, and oil & gas; and IT & telecom domains, which include hyperscale data centers, network operations hubs, and critical telecom infrastructure.

This comprehensive research report categorizes the Uninterrupted Power Supply System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Capacity

- Phase

- Application

Examining Regional Variations in Uninterrupted Power Supply Adoption and Development Across the Americas, Europe Middle East Africa, and Asia Pacific

Geographic considerations reveal distinct adoption patterns and growth trajectories for UPS solutions. In the Americas, robust corporate investment and advanced regulatory frameworks have spurred the integration of high-efficiency systems in financial services, healthcare networks, and edge computing facilities. North American emphasis on carbon reduction targets has accelerated the replacement of legacy units with smart, modular alternatives.

Across Europe, the Middle East, and Africa, diverse market maturity levels have created a tapestry of demand drivers. Western Europe prioritizes compliance with stringent energy efficiency directives, while emerging markets in Eastern Europe and the Middle East focus on strengthening grid reliability and expanding industrial output. In Africa, electrification initiatives and infrastructure modernization projects are elevating interest in scalable, off-grid capable UPS architectures.

The Asia-Pacific region exhibits the fastest pace of infrastructure expansion, underpinned by significant data center buildouts and accelerated adoption in telecommunications networks. Government incentives for renewable integration, coupled with increasing investment in manufacturing capacity, have positioned APAC as a hotbed for both domestic innovation and multinational partnerships. These regional dynamics underscore the need for tailored go-to-market strategies that account for regulatory regimes, capital expenditure cycles, and cultural procurement preferences.

This comprehensive research report examines key regions that drive the evolution of the Uninterrupted Power Supply System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Emerging Innovators Driving Competitive Strategies, Strategic Partnerships, and Product Differentiation in Power Backup Markets

The competitive landscape within the UPS domain is defined by a blend of established multinational corporations and agile technology challengers. Industry veterans leverage their extensive service networks, global supply chains, and brand equity to maintain leadership in high-value segments such as data centers and critical infrastructure. Simultaneously, emerging innovators are carving out niches with specialized offerings in modular design, digital monitoring platforms, and integrated energy storage functionalities.

Collaboration between technology providers and channel partners is intensifying, with strategic alliances aimed at bundling UPS hardware with software-as-a-service models for predictive maintenance and performance analytics. Investment in R&D remains a key differentiator, as companies race to optimize conversion efficiencies, reduce total cost of ownership, and streamline system scalability. Observers note that mergers, acquisitions, and joint ventures continue to reshape market contours, creating opportunities for new entrants to access complementary competencies and geographic footholds.

This comprehensive research report delivers an in-depth overview of the principal market players in the Uninterrupted Power Supply System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Delta Electronics, Inc.

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- General Electric Company

- Huawei Digital Power Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Piller Power Systems

- Schneider Electric SE

- Toshiba Corporation

- Vertiv Holdings Co

Delivering Actionable Strategic Recommendations for Industry Leaders to Enhance Innovation, Supply Chain Resilience, and Market Positioning in Power Backup Systems

To navigate an increasingly complex ecosystem, industry leaders should prioritize diversification of their supply chains by integrating alternative material sources and regional manufacturing hubs. Embracing modular, scalable system architectures will allow faster deployment and more flexible maintenance schedules, reducing downtime risk and lowering capital requirements. Organizations should also invest in advanced analytics and IoT-enabled monitoring to transition from reactive support models to predictive maintenance frameworks, unlocking service revenue streams and extending equipment lifespan.

Sustainability must be embedded at the core of product roadmaps, with a focus on eco-friendly battery chemistries and recyclable component designs. Additionally, forging partnerships with renewable energy providers can facilitate hybrid deployments that optimize on-site generation and storage. Finally, investing in workforce development-through certification programs and cross-functional teams-will ensure the specialized expertise needed for complex installations and ongoing support, positioning stakeholders for long-term value creation.

Detailing the Rigorous Research Methodology Employing Primary Insights, Secondary Data, and Analytical Rigor to Ensure Quality and Accuracy of Findings

This report synthesizes findings from extensive primary research, including in-depth interviews with C-level executives, system integrators, and end users across key industry verticals. Secondary sources, such as government publications, regulatory filings, and technical white papers, provided contextual grounding to validate market drivers and technological trends. Quantitative data points were triangulated against industry datasets and proprietary surveys to reinforce accuracy while minimizing bias.

The research methodology incorporated rigorous data cleansing and normalization protocols, ensuring consistency in terminology and classification across regional and segmental analyses. Statistical techniques, including variance analysis and correlation mapping, were employed to identify relationships between macroeconomic indicators and UPS deployment patterns. Qualitative insights were captured through structured discussions and scenario workshops, enabling a holistic perspective on emerging challenges and innovation priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Uninterrupted Power Supply System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Uninterrupted Power Supply System Market, by Technology

- Uninterrupted Power Supply System Market, by Capacity

- Uninterrupted Power Supply System Market, by Phase

- Uninterrupted Power Supply System Market, by Application

- Uninterrupted Power Supply System Market, by Region

- Uninterrupted Power Supply System Market, by Group

- Uninterrupted Power Supply System Market, by Country

- United States Uninterrupted Power Supply System Market

- China Uninterrupted Power Supply System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing Critical Conclusions Highlighting Market Dynamics, Technological Evolution, and Future Outlook to Guide Stakeholder Decision Making

As enterprises grapple with growing operational complexities and evolving risk profiles, uninterrupted power supply systems stand at the forefront of ensuring service continuity and data integrity. Technological innovation, regulatory influences, and shifting procurement strategies have collectively redefined the parameters of UPS selection, deployment, and life-cycle management. This synthesis underscores how powerful segmentation frameworks, tariff impact assessments, and regional nuances converge to inform strategic choices.

Stakeholders equipped with a comprehensive view of current dynamics can better anticipate supply chain disruptions, optimize total cost of ownership, and align investments with organizational resilience goals. Ongoing collaboration between technology developers, end users, and policy makers will shape the next generation of UPS solutions, integrating smarter energy management, modular scalability, and sustainable design principles into the backbone of critical infrastructure.

Empowering Your Strategic Decisions with Expert-Guided Research Insights Contact Ketan Rohom to Secure the Comprehensive Uninterrupted Power Supply Market Report

To gain an authoritative, data-driven understanding of the uninterrupted power supply ecosystem and accelerate strategic decision making, please reach out to Ketan Rohom. Armed with in-depth segment analyses, tariff impact evaluations, and region-specific insights, this report empowers executives to optimize investments, de-risk supply chains, and capitalize on emerging technology trends. Leveraging personalized guidance from Ketan Rohom, Associate Director for Sales & Marketing, prospective clients can tailor acquisition strategies, secure customized research packages, and position their organizations at the forefront of resilience and innovation in critical power infrastructure. Engage today to transform insights into competitive advantage, mitigate uncertainty, and drive sustainable growth across increasingly complex energy environments.

- How big is the Uninterrupted Power Supply System Market?

- What is the Uninterrupted Power Supply System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?