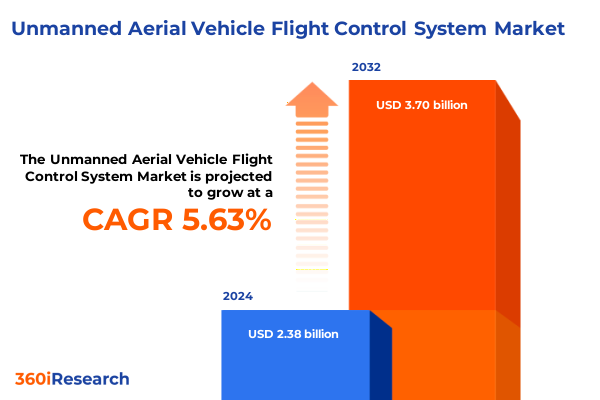

The Unmanned Aerial Vehicle Flight Control System Market size was estimated at USD 2.49 billion in 2025 and expected to reach USD 2.64 billion in 2026, at a CAGR of 5.78% to reach USD 3.70 billion by 2032.

Understanding the Critical Role and Evolution of Flight Control Solutions in Unmanned Aerial Vehicles Across Diverse Operational Theaters

Unmanned aerial vehicle flight control systems have rapidly transitioned from experimental prototypes to indispensable components driving a myriad of critical applications across civil, commercial, and defense domains. At their core, these systems integrate hardware, software, and services to govern flight dynamics, navigation, and communications, enabling UAVs to execute missions with precision and reliability. As technological convergence accelerates, next-generation flight controls are embedding artificial intelligence, sensor fusion, and advanced stabilization algorithms to deliver resilient performance under diverse environmental and operational stressors. From routine inspections to high-stakes defense operations, modern flight control architectures are characterized by modularity and interoperability, allowing stakeholders to tailor configurations to specific mission profiles without compromising on safety or scalability.

Beyond foundational capabilities, the maturation of the UAV flight control ecosystem reflects a broader shift toward autonomous decision-making and predictive maintenance frameworks. Flight controllers no longer simply interpret pilot inputs; they analyze real-time telemetry to anticipate component fatigue, adapt control gains in response to changing mission parameters, and autonomously reroute paths to avoid emerging hazards. Coupled with the proliferation of reliable communication modules and resilient data links, these advances are underpinning a new era of trust in unmanned systems. This introductory overview sets the stage for exploring how transformative shifts, regulatory developments, and nuanced segmentation insights collectively inform decision-making for industry leaders and stakeholders.

Emerging Technological Innovations and Regulatory Developments Reshaping the Unmanned Aerial Vehicle Flight Control Landscape Globally

The landscape of UAV flight control systems has undergone transformative shifts driven by innovations in sensor technologies, embedded AI, and evolving regulatory frameworks. Advancements in computer vision and machine learning have empowered flight controllers with real-time object detection and terrain recognition capabilities, reducing pilot workload and enabling fully autonomous workflows. These capabilities are further augmented by deep integration of GNSS constellations beyond GPS, incorporating Galileo, GLONASS, and Beidou to deliver centimeter-level positioning accuracy and improved resilience against interference. Concurrently, the rise of hybrid VTOL platforms and modular hardware configurations has reshaped design considerations, forcing developers to balance endurance, payload flexibility, and vertical takeoff performance within a unified flight control architecture.

Regulatory environments are also evolving in parallel, with authorities worldwide drafting and refining frameworks for beyond visual line of sight (BVLOS) operations, urban air mobility corridors, and drone traffic management systems. These policy developments have catalyzed collaboration between industry consortia and public-sector agencies, leading to standardized communication protocols and certification pathways for safety-critical flight control components. Together, technological breakthroughs and harmonized regulations are driving the UAV sector toward new frontiers in scalability and interoperability, offering unprecedented opportunities for end users to integrate unmanned systems into complex multi-domain operations.

Analyzing the Complex Consequences of 2025 United States Tariffs on Components and Supply Chains within the UAV Flight Control Ecosystem

In 2025, the United States implemented a series of targeted tariffs affecting the import of critical UAV flight control components, including communication modules, sensors, and integrated autopilot units. These measures, aimed at safeguarding domestic manufacturing capabilities and fostering advanced research, have introduced complexity into global supply chains. Component suppliers and original equipment manufacturers (OEMs) are recalibrating sourcing strategies to mitigate increased costs, with some shifting assembly and integration operations to regions outside affected zones or pursuing partnerships with domestic providers. The tariffs have also sparked a renewed focus on localizing critical hardware production, as industry leaders seek to ensure continuity of supply for defense and civil applications that hinge on consistent flight control performance.

While the short-term impact has manifested in higher acquisition costs for imported hardware, the long-term ramifications are accelerating investments in in-house research and development of core subsystems. Stakeholders are embracing vertical integration models to reduce exposure to tariff-related volatility and to capture higher value within the supply chain. This shift is driving a wave of innovation in sensor fusion algorithms, neural network–based stabilization, and adaptive gain control technologies-all designed to enhance platform resilience and reduce reliance on external sourcing for mission-critical flight control elements.

Unveiling Strategic Segmentation Insights Across Application Platforms System Types and Component Technologies in UAV Flight Control

The UAV flight control system market can be unpacked through multiple lenses, each offering unique insights into demand drivers and strategic priorities. Segmentation by application reveals how civil stakeholders rely on these systems for disaster management missions, search and rescue operations, and urban traffic monitoring, while commercial entities harness inspection, surveying, and mapping workflows alongside agricultural and delivery services. Defense operators, in turn, prioritize combat support, intelligence surveillance reconnaissance, and logistics, fueling demand for robust, secure control architectures capable of operating in contested environments.

Platform-based analysis further highlights differentiated needs across fixed-wing, hybrid VTOL, and rotary-wing UAVs. Fixed-wing vehicles requiring catapult launch or conventional runway operations emphasize long-range endurance and high-speed cruise, whereas rotary-wing systems drive interest in multi-rotor configurations, including hexacopters and octocopters, for highly maneuverable, low-altitude missions. Hybrid VTOL platforms merge the strengths of both classes, demanding flight controllers that seamlessly switch between vertical lift and forward flight modes. Parallel segmentation by system type underscores the balance between hardware components-such as actuators, sensors, and communication modules-and the software ecosystems that govern autopilot, flight management, and simulation. Service-oriented needs for installation, maintenance, and training round out the segmentation framework, illustrating the comprehensive support ecosystem vital to operational success.

This comprehensive research report categorizes the Unmanned Aerial Vehicle Flight Control System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Component

- Platform

- Technology

- Application

Comparative Regional Dynamics Highlighting Divergent Regulatory Frameworks Adoption Rates and Priority Use Cases for UAV Flight Control Systems

Regional dynamics in the UAV flight control system market reflect a tapestry of divergent priorities, regulatory environments, and technology adoption rates. In the Americas, demand is driven by expansive civil and defense budgets that prioritize large-scale disaster management, border security, and agricultural monitoring. North American authorities have pioneered frameworks for advanced drone traffic management, positioning the region as a testbed for BVLOS operations and urban air mobility trials. Latin American stakeholders, meanwhile, emphasize cost-effective rotary-wing platforms for infrastructure inspection and environmental monitoring, spurring interest in simplified, robust flight controllers.

Europe, the Middle East, and Africa (EMEA) present a mosaic of adoption scenarios shaped by varying levels of regulatory maturity and investment capacity. European Union regulations emphasizing safety certification and data privacy have elevated demand for encrypted communication modules and fail-secure autopilot designs. The Middle East is witnessing significant government-led initiatives deploying UAVs for logistics and smart city management, while Africa’s nascent air mobility networks focus on medical deliveries and wildlife conservation, underscoring the need for resilient, maintenance-friendly flight control packages. In the Asia-Pacific region, rapid industrialization and smart agriculture programs in countries such as China, Japan, and Australia are fueling uptake of advanced flight controllers that integrate lidar-based obstacle avoidance and AI-driven route optimization to maximize operational efficiency.

This comprehensive research report examines key regions that drive the evolution of the Unmanned Aerial Vehicle Flight Control System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Market Forces and Strategic Alliances Driving Competition and Technological Differentiation among UAV Flight Control Providers

The competitive landscape for UAV flight control systems is characterized by a blend of legacy aerospace firms, specialized technology startups, and software-focused disruptors. Established aerospace OEMs leverage decades of avionics expertise to deliver integrated flight management systems with certified safety standards, often bundling proprietary autopilot software with hardware offerings. Concurrently, technology-driven entrants are carving niches in neural network–based stabilization and advanced sensor fusion, challenging incumbents with agile development cycles and modular architectures designed for rapid customization.

Collaborations and mergers are shaping the market’s trajectory, as larger players seek to augment their portfolios with specialized capabilities such as deep learning–powered computer vision or satellite-based communication relays. Service providers are differentiating through value-added offerings, including predictive maintenance analytics, on-demand training modules, and end-to-end platform integration. Strategic partnerships between control system developers and aircraft manufacturers are increasingly common, enabling tighter integration of flight electronics with airframe design, ultimately enhancing system reliability, reducing weight, and optimizing power consumption across diverse mission profiles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Unmanned Aerial Vehicle Flight Control System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroVironment Inc.

- Autel Robotics Co., Ltd.

- BAE Systems plc

- Delair SAS

- Draganfly Inc.

- Elbit Systems Ltd.

- General Atomics Aeronautical Systems

- HENSOLDT AG

- Hindustan Aeronautics Ltd

- Honeywell International Inc.

- ideaForge Technology Ltd.

- Intel Corporation

- Israel Aerospace Industries Ltd.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Parrot Drones SAS

- Safran SA

- Skydio Inc.

- SZ DJI Technology Co. Ltd.

- Teledyne FLIR LLC

- Textron Inc.

- Thales Group

- The Boeing Company

- UAV Navigation SL

- Yuneec International Co. Ltd.

Implementing Integrated Software Expertise and Regulatory Engagement Strategies to Strengthen Resilience and Accelerate Innovation in UAV Flight Control

To maintain a competitive edge and mitigate emerging risks, UAV operators and system integrators should prioritize the development of in-house software expertise, ensuring seamless adaptation of flight control algorithms to proprietary mission requirements. Investing in cross-functional teams that bridge avionics, artificial intelligence, and regulatory compliance will expedite time to market for advanced controllers. Moreover, stakeholders must cultivate supplier diversification strategies, onboarding secondary hardware vendors and exploring regional production partnerships to buffer against tariff-related disruptions.

Proactively engaging with standards bodies and regulatory agencies will yield early insights into evolving certification pathways for autonomous operations and data security mandates. Collaborative pilot programs with government entities can help validate new flight control concepts under real-world conditions, accelerating acceptance and scaling. Finally, operators should leverage data-driven maintenance frameworks, employing predictive analytics to preemptively address potential control system anomalies, thereby reducing unscheduled downtimes and extending component lifecycles.

Employing a Comprehensive Mixed Research Approach with Data Triangulation Expert Panels and Operational Case Studies to Ensure Robust Market Insights

This research synthesis is grounded in a rigorous methodology combining extensive primary and secondary investigations. Secondary research entailed reviewing public filings, patent databases, regulatory publications, and technical white papers to establish a foundation of market context and historical trends. Complementing this, primary research involved structured interviews with system integrators, UAV operators across civil and defense sectors, component manufacturers, and regulatory officials, yielding nuanced perspectives on emerging demands and technology roadmaps.

Data triangulation techniques were applied to reconcile diverse inputs and validate findings, ensuring consistency across quantitative metrics and qualitative insights. Market segmentation analyses were informed by operational case studies and vendor disclosures, while regional assessments incorporated economic indicators and policy forecasts. The iterative validation cycle, featuring expert panel reviews and controlled data modeling, underpins the credibility of the insights presented and aligns with best-practice research standards in aerospace and defense market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Unmanned Aerial Vehicle Flight Control System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Unmanned Aerial Vehicle Flight Control System Market, by System Type

- Unmanned Aerial Vehicle Flight Control System Market, by Component

- Unmanned Aerial Vehicle Flight Control System Market, by Platform

- Unmanned Aerial Vehicle Flight Control System Market, by Technology

- Unmanned Aerial Vehicle Flight Control System Market, by Application

- Unmanned Aerial Vehicle Flight Control System Market, by Region

- Unmanned Aerial Vehicle Flight Control System Market, by Group

- Unmanned Aerial Vehicle Flight Control System Market, by Country

- United States Unmanned Aerial Vehicle Flight Control System Market

- China Unmanned Aerial Vehicle Flight Control System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4134 ]

Concluding Reflections on Innovation Integration Supply Chain Resilience and Collaborative Pathways in the UAV Flight Control Ecosystem

The UAV flight control system domain stands at the nexus of technological innovation, regulatory evolution, and supply chain realignment. Autonomous capabilities enabled by artificial intelligence and sensor fusion are redefining mission scopes across civil, commercial, and defense use cases, while tariff-induced market shifts are accelerating localized production strategies. Segmentation and regional analyses underscore the multifaceted nature of demand, with each end-user domain prioritizing distinct performance attributes and support ecosystems.

As competitive dynamics intensify, organizations that successfully integrate advanced software paradigms with resilient hardware architectures will lead the next wave of unmanned flight applications. Collaborative engagements with regulatory bodies and cross-industry partnerships will further shape certification pathways and unlock new operational envelopes. This report provides a strategic compass, guiding stakeholders through a rapidly evolving landscape and equipping decision-makers with actionable insights to navigate opportunities and challenges alike.

Connect with the Associate Director of Sales & Marketing for a Customized Briefing on the UAV Flight Control System Research Report and Unlock Strategic Advantages

To further explore the comprehensive insights offered in this report and discuss tailored solutions for your organization’s strategic needs, reach out directly to Ketan Rohom. As Associate Director of Sales & Marketing, Ketan specializes in aligning market intelligence with business objectives, ensuring you gain a competitive edge. Engage with Ketan for a personalized briefing, deeper data access, or to arrange a demo of key findings that resonate with your operational priorities. Secure your copy today and leverage this authoritative research to drive innovation, efficiency, and growth within your UAV flight control system initiatives.

- How big is the Unmanned Aerial Vehicle Flight Control System Market?

- What is the Unmanned Aerial Vehicle Flight Control System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?