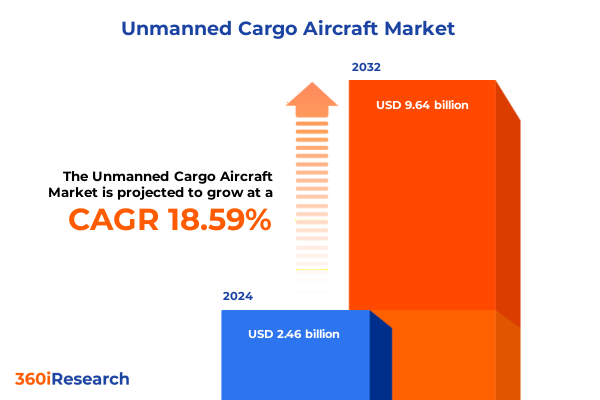

The Unmanned Cargo Aircraft Market size was estimated at USD 2.92 billion in 2025 and expected to reach USD 3.46 billion in 2026, at a CAGR of 18.61% to reach USD 9.64 billion by 2032.

Pioneering the skies with autonomous precision and strategic agility, unmanned cargo aircraft are revolutionizing logistics and supply chain operations globally

The advent of unmanned cargo aircraft represents a pivotal transformation in global logistics, combining autonomous systems with advanced aeronautical engineering to redefine freight movement. Over the past decade, organizations across industries have grappled with the complexities of last-mile delivery, the fragility of extended supply chains, and mounting pressure to reduce emissions. Unmanned cargo aircraft address these challenges by offering rapid, reliable, and cost-efficient transport solutions that can navigate congested urban environments, remote regions, and critical areas under time-sensitive constraints.

Recent breakthroughs in battery energy density, electric propulsion technologies, and artificial intelligence–powered navigation have accelerated the maturation of unmanned cargo platforms. What once existed primarily in proof-of-concept trials has rapidly evolved into commercially viable services, with pilots demonstrating successful deliveries of medical supplies, industrial parts, and consumer goods. Such developments reflect a confluence of factors: growing e-commerce demand, heightened focus on supply chain resilience following global disruptions, and regulatory bodies embracing conditional airspace integration frameworks. As a result, stakeholders ranging from logistics providers to defense agencies are investing in these next-generation aircraft to future-proof their operations and achieve strategic agility.

Looking ahead, unmanned cargo aircraft stand poised to transform critical sectors including healthcare, agriculture, mining, and postal services. The fusion of autonomy, connectivity, and green propulsion opens avenues for scalable, on-demand logistics networks that transcend traditional constraints. It is against this backdrop of rapid technological evolution and shifting market dynamics that decision-makers must assess strategic pathways, align investment priorities, and prepare for the operational integration of unmanned cargo services.

Emerging technological breakthroughs and regulatory evolution are driving a paradigm shift in unmanned cargo aircraft deployment and operational models

The unmanned cargo aircraft landscape is undergoing profound shifts driven by converging technological, regulatory, and commercial forces. Autonomous flight controls powered by advances in artificial intelligence and machine learning now enable systems to dynamically adjust routes in real time, optimize energy usage, and respond to unpredictable environmental conditions. Meanwhile, the transition toward electric and hybrid propulsion systems is gaining traction as manufacturers and operators seek to reduce carbon footprints and comply with stringent emissions regulations.

Regulatory evolution is also reshaping the playing field. Aviation authorities worldwide are formulating new airworthiness standards, remote identification requirements, and airspace corridors dedicated to unmanned systems. In parallel, public–private partnerships are emerging to standardize data-sharing protocols and ensure interoperability across platforms, facilitating cross-industry collaboration. This regulatory momentum is complemented by growing investor interest in start-ups and established OEMs developing scalable solutions that integrate hardware, software, and services into cohesive operational frameworks.

Commercial adoption is further influenced by the imperative to fortify supply chains against future shocks. Companies are piloting unmanned cargo routes to reduce dependence on traditional ground transport, mitigate labor shortages, and unlock delivery capabilities in areas lacking robust infrastructure. Additionally, sustainability considerations are driving demand for quieter, low-emission alternatives to conventional aircraft, especially in densely populated regions. As these transformative dynamics accelerate, organizations that proactively integrate unmanned cargo aircraft into their logistics strategies will gain a competitive edge and set new benchmarks for operational efficiency.

Escalating trade tensions and layered duty impositions in 2025 are reshaping cost structures and supply chain strategies for unmanned cargo aircraft operators

In 2025, the United States has intensified its trade policy measures affecting unmanned aircraft systems, layering multiple tariff actions that significantly influence cost structures and supply chain strategies for operators. The Commerce Department’s initiation of a Section 232 investigation into imported drones and their components underscores national security imperatives and could culminate in additional duties beyond existing measures. Concurrently, high-profile exemptions granted in April for a range of electronic imports notably excluded drones, leaving them subject to an unprecedented cumulative duty rate that aggregates Section 301 tariffs with subsequent executive orders, fentanyl-related penalties, and reciprocal levies. These combined actions have driven the total rate to as much as 170%, imposing substantial cost pressure on consumer and professional-grade unmanned cargo platforms.

The ripple effects extend throughout the UAV ecosystem. Importers facing elevated duties are compelled to either absorb costs, eroding margins, or pass them onto end users, potentially deterring adoption. Simultaneously, component suppliers that rely on cross-border trade are navigating heightened scrutiny and logistical delays at U.S. ports. Lead times have expanded, and procurers are increasingly evaluating alternative sourcing strategies, including nearshoring to Mexico or diversification across Southeast Asian manufacturing hubs. Moreover, domestic OEMs are advocating for supportive policies such as production tax credits and streamlined certification processes to bolster local competitiveness and diminish reliance on foreign-sourced assemblies.

While the ultimate outcome of the Section 232 probe remains pending, industry participants are adopting proactive measures to mitigate tariff impacts. Collaborative forums are emerging to share best practices for duty management, supply chain reconfiguration, and tariff engineering. At the same time, investment is flowing into in-country manufacturing partnerships and research initiatives aimed at lowering the total cost of ownership. As trade policy continues to evolve, agile operators that align procurement, engineering, and strategic planning functions will be best positioned to navigate the shifting tariff environment and sustain growth trajectories.

Segmentation analysis highlights how propulsion and airframe types, applications, payload capacity, range, components, and operation modes steer market direction

Segmentation analysis highlights how propulsion and airframe types, applications, payload capacity, range, components, and operation modes steer market direction. Electric propulsion systems are gaining prominence due to their low operating costs and alignment with environmental regulations, while fuel cell and hybrid configurations offer extended range options that appeal to longer-route deployments. Gas turbine–driven platforms remain in niches where heat tolerance and rapid refueling are critical, particularly in defense missions requiring high-endurance sorties.

Airframe configurations are equally diverse, ranging from fixed-wing craft optimized for efficiency on longer corridors to rotary-wing designs that excel at vertical take-off and landing in constrained spaces. Innovations in VTOL technology-both EVTOL multirotor and lift-plus-cruise variants-are unlocking last-mile delivery and rapid response use cases. Application segmentation reveals differentiated demand patterns: agriculture stakeholders leverage unmanned platforms for seeding and crop monitoring, healthcare providers integrate them into urgent medical supply chains, and logistics operators deploy fixed-wing systems for middle-mile conveyance while reserving VTOL variants for last-mile fulfillment.

Payload capacity and range considerations further refine deployment strategies. Under-2 kg platforms serve ultra-light tasks such as sensor deployment, while higher-capacity craft in the 25 kg to 100 kg bracket support small-parcel deliveries. Above-100 kg systems are tailored for substantial cargo lifts in industrial and defense contexts, especially when paired with extended-range classifications surpassing 500 km. Component segmentation underscores the interplay between hardware, software, and services: robust avionics suites and modular airframes form the physical backbone, advanced autonomy and fleet management software orchestrate operations, and specialized services-from training to maintenance-ensure sustained mission readiness. Finally, operation modes span fully automated to semi-automated regimes, with mixed configurations allowing human oversight in complex airspace and fully automated workflows in controlled corridors.

This comprehensive research report categorizes the Unmanned Cargo Aircraft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Aircraft Type

- Application

- Payload Capacity

- Range

- Component

- Operation Mode

Regional dynamics reveal divergent growth trajectories and adoption patterns for unmanned cargo aircraft across the Americas, EMEA, and Asia-Pacific markets

Regional dynamics reveal divergent growth trajectories and adoption patterns for unmanned cargo aircraft across the Americas, EMEA, and Asia-Pacific markets. In North America, the United States leads with robust R&D investments, a maturing regulatory framework under the Federal Aviation Administration’s UAS Integration Pilot Program, and significant military and commercial partnerships. Canada is advancing in parallel, emphasizing cross-border logistics corridors and mining support operations in remote regions.

Across Europe, Middle East, and Africa, regulatory harmonization efforts by the European Aviation Safety Agency and joint initiatives among Gulf Cooperation Council nations are catalyzing cross-sector collaboration. European carriers are piloting medical and industrial supply routes, while Middle Eastern governments are exploring UAS networks to service desert tourism and infrastructure inspection. Meanwhile, African stakeholders are testing unmanned cargo for humanitarian aid delivery and agricultural support in areas with underdeveloped road networks.

In Asia-Pacific, China continues to dominate manufacturing and component supply chains, leveraging cost-competitive production and vertical integration. Regulatory sandboxes in Japan and Australia are facilitating trials for e-commerce deliveries and emergency response missions, while India’s drive for Atmanirbhar Bharat (self-reliance) is spurring domestic innovation and local assembly partnerships. Southeast Asian nations, including Singapore and Vietnam, are emerging as strategic drone hubs, offering favorable investment climates and proximity to global shipping lanes.

This comprehensive research report examines key regions that drive the evolution of the Unmanned Cargo Aircraft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Industry leaders are driving technological innovation, forming strategic partnerships, and adapting to regulations to dominate the unmanned cargo aircraft market

Industry leaders are driving technological innovation, forming strategic partnerships, and adapting to regulations to dominate the unmanned cargo aircraft market. Established aerospace and defense OEMs are integrating autonomous flight control systems into existing platforms, leveraging decades of certification expertise to accelerate time to market. Simultaneously, technology start-ups specializing in electric propulsion and software-defined avionics are collaborating with logistics incumbents to pilot specialized last-mile delivery corridors and medical supply routes.

Strategic alliances between supply chain integrators and UAV manufacturers are enabling end-to-end service offerings that combine hardware deployment, real-time fleet management, and predictive maintenance. These partnerships not only distribute risk but also foster standardization across disparate systems, enhancing interoperability and data sharing. At the same time, key players are engaging with regulatory bodies through consortiums and industry associations to shape favorable airspace integration policies, ensuring that certification pathways and remote identification protocols align with operational realities.

Beyond partnership models, leading companies are making targeted acquisitions to bolster their capabilities in autonomy, battery technology, and service delivery. By acquiring specialized software firms or precision components manufacturers, they are building vertically integrated portfolios that optimize performance, reliability, and cost efficiency. These strategic moves are complemented by proactive engagement in pilot programs and demonstration projects that validate use cases, gather operational data, and refine performance parameters under real-world conditions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Unmanned Cargo Aircraft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Drone Delivery Canada Corporation

- Elroy Air, Inc.

- Insitu, Inc.

- Lockheed Martin Corporation

- Matternet, Inc.

- Sabrewing Aircraft Company, LLC

- UAVOS, LLC

- Volansi Inc.

- Wingcopter GmbH

- Zipline International Inc.

Key strategic imperatives for industry leaders to drive innovation, strengthen supply chains, navigate evolving regulations, and seize emerging opportunities

Key strategic imperatives for industry leaders to drive innovation, strengthen supply chains, navigate evolving regulations, and seize emerging opportunities include prioritizing modular architecture design to enable rapid technology upgrades and mission flexibility. By adopting standardized interfaces for propulsion, avionics, and payload modules, manufacturers can shorten development cycles, reduce costs, and accelerate certification processes.

To fortify supply chains, organizations should implement near-term tactics such as dual sourcing of critical components and establishing assembly lines in tariff-protected jurisdictions. Longer-term investments in domestic manufacturing partnerships, coupled with government incentives like production tax credits, will mitigate exposure to layered duties and geopolitical disruptions. Additionally, embedding supply chain visibility tools underpinned by blockchain or IoT technologies can provide real-time tracking of parts provenance and compliance status.

Engagement with regulatory agencies must be proactive and ongoing. Companies should contribute to working groups focused on airspace management, remote identification, and safety standards, ensuring that operational feedback informs policy evolution. Finally, business models should emphasize service-based revenue streams-such as maintenance, training, and data analytics-to create diversified income sources and deepen customer relationships. By aligning strategic planning with market dynamics, stakeholders can navigate uncertainty and capitalize on the transformative potential of unmanned cargo aircraft.

Methodology combining primary interviews, secondary research, and quantitative analysis to triangulate data and deliver validated, accurate insights

Methodology combining primary interviews, secondary research, and quantitative analysis to triangulate data and deliver validated, accurate insights. Our research began with an extensive review of regulatory filings, corporate announcements, and technical white papers related to unmanned cargo aircraft, providing a foundational understanding of market drivers and barriers. In parallel, we conducted in-depth interviews with C-level executives, engineering leads, and regulatory officials across key regions, gathering firsthand perspectives on technology adoption, supply chain dynamics, and policy trends.

Complementing these qualitative inputs, we employed quantitative models to analyze historical shipment data, track manufacturing capacity changes, and evaluate tariff impacts. Through cross-validation with independent data sets and financial disclosures, we ensured the robustness of our findings. Segmentation frameworks were developed to capture nuances across propulsion types, aircraft configurations, applications, payload capacities, range segments, components, and operation modes. Finally, all insights underwent multiple rounds of peer review by subject-matter experts to eliminate bias and confirm consistency with observable industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Unmanned Cargo Aircraft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Unmanned Cargo Aircraft Market, by Propulsion Type

- Unmanned Cargo Aircraft Market, by Aircraft Type

- Unmanned Cargo Aircraft Market, by Application

- Unmanned Cargo Aircraft Market, by Payload Capacity

- Unmanned Cargo Aircraft Market, by Range

- Unmanned Cargo Aircraft Market, by Component

- Unmanned Cargo Aircraft Market, by Operation Mode

- Unmanned Cargo Aircraft Market, by Region

- Unmanned Cargo Aircraft Market, by Group

- Unmanned Cargo Aircraft Market, by Country

- United States Unmanned Cargo Aircraft Market

- China Unmanned Cargo Aircraft Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Summarizing the strategic drivers, emerging challenges, and future pathways shaping the evolution of unmanned cargo aircraft within global supply chains

As unmanned cargo aircraft ascend from experimental stages to operational maturity, their impact on global logistics and supply chain architectures is becoming increasingly tangible. Strategic drivers such as cost reduction, environmental sustainability, and service differentiation continue to fuel technological innovation and market entry, while challenges related to regulatory harmonization, tariff volatility, and airspace integration persist.

Looking forward, the industry is set to progress along several trajectories. Advancements in energy storage, propulsion efficiency, and artificial intelligence will unlock new mission profiles and extend range capabilities. Regulatory bodies will likely converge on international standards for safety, security, and airspace management, fostering scalability and reducing certification timelines. Additionally, the emergence of digital ecosystems-where data from multiple operators and platforms is aggregated-will deliver enhanced operational intelligence and continuous optimization.

Ultimately, stakeholders that align their strategies with these evolving trends-fostering modular innovation, resilient supply chains, and collaborative policy engagement-will secure a leadership position in the burgeoning unmanned cargo aircraft market. By embracing a proactive, insight-driven approach, organizations can transform logistical challenges into competitive advantages and chart a course toward sustainable, agile, and efficient cargo mobility solutions.

Connect with Ketan Rohom to access the full market research report and gain immediate strategic insights

Connecting with Ketan Rohom, Associate Director of Sales & Marketing, offers you direct access to in-depth analysis, expert perspectives, and strategic guidance that can inform critical decisions. By engaging with an experienced industry professional, you can secure the comprehensive market research report tailored to unmanned cargo aircraft, equipping your organization with the insights needed to outpace competitors and capture emerging opportunities. Reach out today to unlock the data, trend analysis, and actionable recommendations that will drive your next phase of growth and innovation.

- How big is the Unmanned Cargo Aircraft Market?

- What is the Unmanned Cargo Aircraft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?