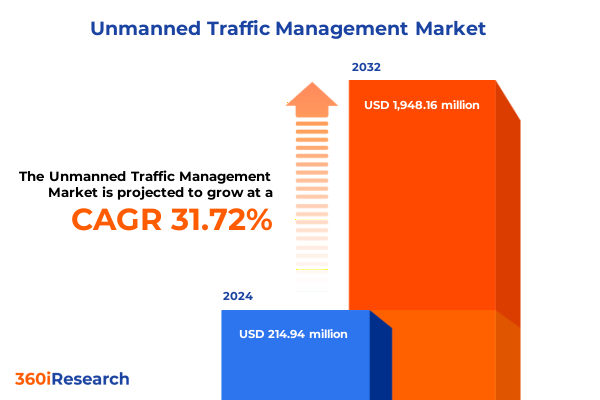

The Unmanned Traffic Management Market size was estimated at USD 278.65 million in 2025 and expected to reach USD 363.39 million in 2026, at a CAGR of 32.02% to reach USD 1,948.16 million by 2032.

Shaping the Skies with Unmanned Traffic Management as the Foundation for Safe, Scalable, and Regulated Drone Integration

Unmanned traffic management (UTM) is rapidly emerging as a critical framework for integrating drones and autonomous aerial vehicles into shared airspace. This paradigm shift transcends conventional air traffic control by introducing a scalable ecosystem that balances safety, efficiency, and regulatory compliance. Historically, the proliferation of small unmanned aerial systems operated almost exclusively under very low altitude corridors, often with minimal oversight. As drone operations expand across commercial delivery, infrastructure inspection, and emergency response, stakeholders now require an advanced management platform to deconflict traffic, share situational awareness, and ensure collision avoidance in increasingly congested skies.

A robust UTM system orchestrates communication protocols between unmanned vehicles, ground-based service providers, and regulatory authorities, facilitating dynamic routing and real-time monitoring. By establishing standardized data exchanges and automated separation assurances, UTM solutions promise to unlock new business models while safeguarding public safety and privacy. Moreover, this innovation aligns with evolving regulations from the Federal Aviation Administration and global counterparts, which are progressively authorizing beyond-visual-line-of-sight operations and denser traffic scenarios. Consequently, the introduction of UTM marks a decisive turning point for both incumbents and newcomers seeking to capitalize on the burgeoning unmanned systems market.

Navigating Convergence of Cutting-Edge Technologies and Evolving Regulations Reshaping the Unmanned Traffic Management Ecosystem

The unmanned traffic management landscape is undergoing transformative shifts driven by technological breakthroughs, evolving regulatory frameworks, and the convergence of data-driven operations. Emerging communication architectures now support machine-to-machine interactions at millisecond latency, enabling real-time airspace deconfliction and automated contingency responses. Simultaneously, the advent of edge computing and distributed ledger technologies is enhancing system resilience, allowing flight data to be processed closer to drone endpoints while preserving immutable audit trails for compliance.

Regulatory bodies worldwide are adopting risk-based frameworks that replace prescriptive requirements with performance-based metrics. This transition empowers operators to demonstrate safety through dynamic geofencing, trajectory management, and detect-and-avoid capabilities rather than by adhering to rigid operational limits. In parallel, industry consortia are forging standards for interoperable UTM services, ensuring that solutions from multiple vendors can seamlessly interconnect. Together, these developments are dismantling traditional silos between software platforms, hardware providers, and air navigation service entities, cultivating a collaborative environment where unmanned and crewed aircraft can coexist efficiently.

Evaluating the Cumulative Consequences of Tariff Measures on U.S. Unmanned Traffic Management Supply Chains and Domestic Production Shifts

United States tariff policies have exerted a cumulative impact on unmanned traffic management supply chains throughout 2025, as levies on critical avionics and communication hardware imported from overseas have increased component procurement costs and extended delivery lead times. Drone manufacturers reliant on foreign-sourced sensors and control modules faced heightened price pressures, prompting some to seek alternative suppliers and reconfigure system architectures to localize production. Concurrently, tariff-induced constraints accelerated the adoption of domestic manufacturing initiatives, supported by federal incentives to expand onshore fabrication of printed circuit boards, radio frequency transceivers, and navigation processors.

As a result, system integrators and software developers have adapted by shifting towards modular architectures that can accommodate a broader range of domestically available communication systems, control units, and surveillance modules. This reconfiguration reduces exposure to trade disputes while fostering enhanced supply chain transparency and resilience. In turn, service providers offering consulting and traffic management capabilities have begun advising end users on how to optimize fleet deployment strategies and maintenance schedules, mitigating the operational impact of tariff-related disruptions. Ultimately, these cumulative measures are redefining procurement strategies, driving innovation in hardware design, and accelerating the maturation of a more self-reliant UTM ecosystem within the United States.

Unveiling Deep-Dive Insights into Component, Service, Software, and Operational Segment Variations Driving UTM Adoption

Segmentation analysis uncovers distinct patterns in component adoption, system architecture complexity, and service preferences across the unmanned traffic management landscape. Hardware segments such as communication systems, control units, and surveillance systems serve as the backbone of any UTM framework, with communication platforms commanding early prioritization due to their role in continuous data exchange. Meanwhile, control units that manage flight planning and trajectory adjustments have advanced to incorporate AI-driven decision-making, and surveillance systems now integrate multispectral sensors for enhanced situational awareness.

Service offerings cluster around consulting services, which guide regulatory compliance and operational integration, and traffic management services, which deliver live monitoring and conflict resolution capabilities. These services often bundle modular software suites, including air traffic control systems that handle flight authorization and corridor management, alongside simulation software that enables stakeholders to conduct virtual scenario testing and training. The non-persistent type of operations, characterized by dynamic mission profiles and ad hoc flight authorizations, contrasts with persistent operations that follow predefined corridors and continuous surveillance models. End users in agriculture deploy drones predominantly for crop monitoring and livestock management, leveraging persistent aerial routes to gather repeatable data. The construction sector prioritizes progress monitoring and site surveying in non-persistent modes, enabling on-demand mapping of evolving job sites. Public safety agencies blend both types, using disaster management flights to support rapid response and law enforcement sorties to maintain continuous perimeter surveillance.

This comprehensive research report categorizes the Unmanned Traffic Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Type

- End-User

Analyzing Diverse Regional Progressions and Collaborative Frameworks Shaping Unmanned Traffic Management Globally

Regional dynamics in unmanned traffic management reveal that the Americas lead in regulatory harmonization and commercial integration, driven by national UTM pilot programs and cross-border coordination initiatives. In North America, collaborative testbeds have enabled real-world trials for urban air mobility corridors, while South American countries leverage UTM to expand medical and goods delivery to remote areas. Within Europe, the Middle East, and Africa, regulatory authorities are converging on a unified framework under the Single European Sky initiative, complemented by the Gulf Cooperation Council’s early UTM guidelines and South Africa’s drone corridor experiments, collectively fostering a diverse innovation landscape.

Asia-Pacific markets demonstrate remarkable agility, with nations like Japan and Australia integrating UTM into broader smart city agendas and leveraging advanced 5G networks for ultra-low-latency connectivity. China’s civil aviation regulators are prioritizing the development of regional UTM platforms to support e-commerce delivery and disaster relief operations, while Southeast Asian archipelagos emphasize the use of UTM for agricultural sustainability and infrastructure inspection. Across these regions, the alignment of policy, technology partnerships, and operator demand underscores the critical importance of localized strategies to accommodate varying airspace classifications, spectrum allocations, and stakeholder ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Unmanned Traffic Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Major Stakeholders’ Strategic Partnerships and Innovations Catalyzing Next-Generation Unmanned Traffic Management Platforms

Leading enterprises and solution providers are actively shaping the unmanned traffic management domain through strategic collaborations, platform enhancements, and regulatory engagement. A number of avionics manufacturers have partnered with software developers to deliver integrated UTM suites that combine communication systems, control logic, and real-time surveillance feeds. Industry participants are competing on the basis of interoperability, reliability, and the ability to scale services from urban to remote environments, with some organizations investing heavily in edge compute nodes and AI-driven analytics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Unmanned Traffic Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroVironment, Inc.

- Airbus SAS

- AirHub B.V.

- AirMap, Inc. by DroneUp, LLC

- AirMarket Inc.

- Altitude Angel Limited

- ANRA Technologies, LLC

- Delair SAS

- DFS Deutsche Flugsicherung GmbH

- Droniq GmbH

- ENAV S.p.A.

- EuroUSC Italia S.r.l.

- Frequentis AG

- HIGHLANDER AVIATION LTD.

- L3Harris Technologies Inc.

- Leonardo S.p.A. by Fincantieri

- Lockheed Martin Corporation

- Nokia Corporation

- OneSky Systems, by Sumitomo Corporation

- PrecisionHawk, Inc.

- Raytheon Technologies Corporation

- Sharper Shape Inc.

- Simulyze, Inc.

- Skye Air Mobility Pvt. Ltd.

- Skyguide

- SZ DJI Technology Co., Ltd.

- Terra Drone Corporation

- Thales Group

- Unifly NV

- Viasat, Inc.

Driving Strategic Interoperability, Resilient Supply Chains, and Smart Simulation Practices for UTM Industry Leadership

Industry leaders are advised to prioritize cross-domain interoperability by engaging in open-architecture initiatives and aligning their development roadmaps with emerging standards. By fostering collaborative partnerships between hardware vendors, software integrators, and regulatory bodies, organizations can preemptively address system compatibility challenges and accelerate certification processes. Additionally, diversifying component sourcing strategies-balancing domestic production capabilities with international supplier networks-will enhance resilience against tariff fluctuations and supply chain disruptions.

Leaders should also invest in advanced simulation and digital twin environments to validate UTM solutions under varied operational scenarios, thereby reducing time to market and improving safety margins. Furthermore, cultivating a feedback loop with end users across agriculture, construction, and public safety will yield valuable operational insights, informing iterative enhancements to traffic management services and user interfaces. Embracing adaptive risk-based frameworks and demonstrating continuous compliance through transparent data sharing will strengthen trust with regulators and the public, laying the groundwork for broader beyond-visual-line-of-sight applications and urban air mobility integration.

Detailing a Rigorous Triangulated Research Approach Integrating Secondary Insights, Expert Consultations, and Empirical Operational Data

This research leverages a triangulated methodology combining exhaustive secondary research, expert interviews, and synthesis of primary operational data. The secondary research phase encompassed regulatory documents, technical papers, and white papers published by aviation authorities and standards bodies. Through expert consultations with UTM architects, avionics engineers, and policy advisors, key insights were validated and contextualized against practical deployment experiences. Primary operational data was sourced from anonymized flight logs, system performance metrics, and case studies provided by leading UTM testbed operators.

Qualitative and quantitative inputs were integrated to ensure comprehensive coverage of segment-specific characteristics, regional nuances, and tariff-driven supply chain dynamics. Rigorous cross-validation techniques were employed to reconcile divergent viewpoints and minimize bias. Data gaps were addressed through targeted follow-up inquiries, ensuring that final insights reflect current capabilities and anticipate near-term regulatory evolutions. This robust methodology underpins the credibility of the findings and supports actionable recommendations for stakeholders across the unmanned traffic management ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Unmanned Traffic Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Unmanned Traffic Management Market, by Components

- Unmanned Traffic Management Market, by Type

- Unmanned Traffic Management Market, by End-User

- Unmanned Traffic Management Market, by Region

- Unmanned Traffic Management Market, by Group

- Unmanned Traffic Management Market, by Country

- United States Unmanned Traffic Management Market

- China Unmanned Traffic Management Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Synthesizing Strategic Imperatives and Market Dynamics That Underscore the Future Trajectory of Unmanned Traffic Management

Unmanned traffic management stands at the forefront of modern aviation innovation, offering a scalable, secure pathway to integrate drones into shared airspace. Through the convergence of advanced communication protocols, performance-based regulations, and collaborative platform architectures, UTM is poised to unlock a multitude of commercial and societal benefits. The cumulative impact of tariff policies has accelerated the transition toward domestic production and modular system designs, while segmentation analysis highlights distinct opportunities across hardware, services, software, and varied operational use cases.

Regional progress reflects tailored regulatory strategies and infrastructure investments, underscoring the necessity for localized approaches. Key companies have demonstrated that interoperability, strategic partnerships, and investment in simulation environments are essential to navigate evolving standards and market demands. By implementing the recommended strategic imperatives, industry participants can enhance resilience, expedite certification, and foster trusted stakeholder relationships. As the unmanned traffic management ecosystem matures, those who balance innovation with adaptability will secure leadership positions in reshaping the future of aerial mobility.

Unlock Comprehensive Insights into Unmanned Traffic Management Trends and Strategies with Direct Access to Ketan Rohom’s Customized Research Report

To explore the full depth of unmanned traffic management opportunities, Ketan Rohom, Associate Director of Sales & Marketing, invites you to secure the comprehensive research report. This strategic asset delivers deep analysis of regulatory shifts, technological innovations, and market dynamics to guide investment choices and operational strategies. Engage directly with Ketan Rohom to request a detailed proposal, receive customized data extracts, and discuss tailored advisory services that align with your organizational objectives. Position your team at the forefront of unmanned traffic management by obtaining the definitive guide to current trends, competitive landscapes, and actionable intelligence needed to drive sustainable growth and regulatory compliance.

- How big is the Unmanned Traffic Management Market?

- What is the Unmanned Traffic Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?