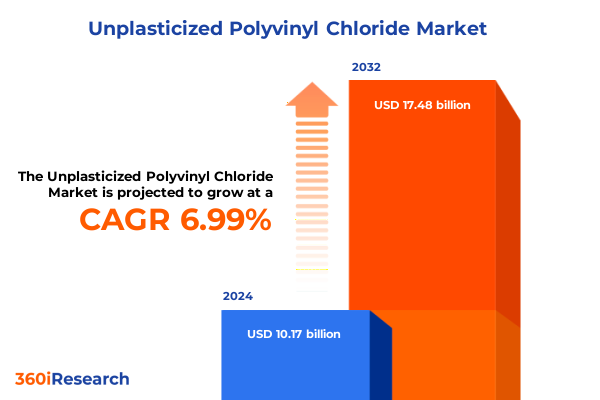

The Unplasticized Polyvinyl Chloride Market size was estimated at USD 10.81 billion in 2025 and expected to reach USD 11.49 billion in 2026, at a CAGR of 7.10% to reach USD 17.48 billion by 2032.

Unplasticized Polyvinyl Chloride Emerging as a Cornerstone Material Across Industries with Rigorous Properties Fuelling Market Innovation

Unplasticized polyvinyl chloride (uPVC) has emerged as a pivotal material in numerous industrial and commercial applications, valued for its exceptional rigidity, chemical resistance, and dimensional stability. Renowned for its ability to maintain performance under demanding environmental conditions, uPVC has become a mainstay in sectors where durability and reliability are non-negotiable. The material’s intrinsic properties enable it to excel in applications requiring long service life and minimal maintenance, catalyzing interest among manufacturers, architects, and engineers seeking sustainable alternatives to traditional materials.

Growing awareness of environmental sustainability has further underscored uPVC’s importance, as its recyclability and lower life-cycle emissions compared to alternative polymers enhance its appeal. Consequently, stakeholders across the value chain are intensifying efforts to optimize formulations, streamline processing methods, and integrate circular economy principles. As the material transitions from conventional usage toward innovative applications, market participants are recalibrating strategies to harness uPVC’s full potential, setting the stage for a dynamic period of growth and technological advancement.

Rapid Technological Advances and Sustainability Imperatives are Reshaping the Unplasticized PVC Market Dynamics and Value Chain Across Geographies

In recent years, the landscape of the unplasticized PVC market has been dramatically reshaped by converging forces of technological innovation and sustainability mandates. Breakthroughs in formulation techniques have enabled the development of custom compound blends that deliver enhanced mechanical performance while reducing environmental impact. At the same time, digital transformation across the supply chain-from predictive maintenance in processing equipment to blockchain-enabled provenance tracking-has increased transparency, improved quality control, and bolstered stakeholder confidence.

Equally significant are the mounting regulatory demands and voluntary industry initiatives aimed at minimizing carbon footprints and eliminating hazardous additives. This has spurred the proliferation of bio-based stabilizers and additives that comply with stringent global standards. The shift toward circularity is further exemplified by advanced recycling methods that recover high-purity uPVC for reuse in high-value applications. Together, these trends are rewriting the value proposition of unplasticized PVC, compelling established players and new entrants alike to innovate or risk obsolescence.

The Convergence of Trade Policies and Tariff Escalations Has Reshaped Supply Chains and Cost Structures for Unplasticized Polyvinyl Chloride in the United States

The cumulative impact of recent United States tariff measures has introduced a new set of constraints and cost considerations for stakeholders in the uPVC supply chain. On February 1, 2025, the U.S. government enacted a 25 percent tariff on imports of key plastic materials from Canada and Mexico, alongside a 10 percent levy on products originating in China, invoking emergency powers under the International Emergency Economic Powers Act as part of a broader trade policy realignment. These measures were designed to address perceived imbalances in trade flows but have also translated into elevated import costs for resin and compounds critical to uPVC production.

Further compounding the situation, on March 3, 2025, additional reciprocal tariffs raised the effective duty on plastic product imports from China from 10 percent to 20 percent, with specific categories facing total applied rates as high as 50 percent depending on Harmonized Tariff Schedule classifications. The combined effect of these layered tariff regimes has prompted producers and converters to reevaluate sourcing strategies, accelerate near-shoring of feedstock procurement, and absorb or pass through higher input costs. Longer-term, the adjustment has catalyzed investment in domestic capacity expansion and supply chain diversification as companies strive to maintain competitive price positions and secure supply continuity.

Delineating Market Behavior Through Formulation Methods Applications Processing Techniques and Product Types Reveals Granular Growth Drivers in Unplasticized PVC

Examining the market through the lens of key segmentation parameters provides a comprehensive understanding of growth trajectories and strategic priorities. When assessed by form, the distinction between specialized compounds engineered for performance-critical applications and base resin designed for broader utility sheds light on divergent value propositions and margin dynamics. Likewise, application-based analysis reveals how evolving construction requirements, stringent electrical and electronics standards, expanding healthcare regulations, and innovative packaging solutions are each sculpting demand profiles and driving customization of uPVC formulations.

Process segmentation further elucidates the competitive landscape: calendered sheets deliver uniform thickness and surface finish for façade and decorative uses, while extrusion processes enable the mass production of high-precision pipes, fittings, and profiles. Injection molding, on the other hand, supports the creation of intricate components with tight tolerances, opening pathways into burgeoning specialty markets. Overlaying these dimensions is product type segmentation, where film and sheet offerings cater to protective and aesthetic functions, pipes and fittings address critical infrastructure needs, and profiles contribute to structural and architectural applications. Together, these segmentation insights guide R&D focus, capital allocation, and go-to-market strategies across the value chain.

This comprehensive research report categorizes the Unplasticized Polyvinyl Chloride market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Application

- Process

- Product Type

Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific Highlight Emerging Opportunities and Challenges in the Unplasticized Polyvinyl Chloride Ecosystem

Regional market dynamics underscore the interplay of economic growth patterns, regulatory environments, and infrastructural investments in shaping uPVC adoption. In the Americas, modernization of water and sanitation systems combined with housing renovation initiatives is fueling robust uptake of pipes and fittings, while burgeoning demand for energy-efficient window profiles reflects a shift toward sustainability-led building standards. North America’s emphasis on reliable supply and localized production is likewise prompting upstream investments in resin capacity.

Across Europe, the Middle East, and Africa, regulatory frameworks governing construction materials, electrotechnical safety, and healthcare compliance are driving a methodical move toward certified uPVC grades. This region’s mature recycling infrastructure also fosters closed-loop practices, creating competitive advantages for producers offering recycled-content products. Meanwhile, Asia-Pacific’s rapid urbanization, expanding industrial base, and escalating packaging requirements are amplifying consumption of both film and sheet and injection-molded components. Here, cost-competitive manufacturing hubs and strategic trade agreements play a pivotal role in dictating market positioning and cross-border flows.

This comprehensive research report examines key regions that drive the evolution of the Unplasticized Polyvinyl Chloride market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Are Advancing Competitive Strategies Through Capacity Expansions Strategic Partnerships and Portfolio Diversification in Unplasticized PVC

Key participants in the uPVC market are leveraging strategic initiatives to fortify their positions and capture emerging opportunities. Leading chemical conglomerates with integrated production networks are optimizing feedstock versatility and logistics synergies to deliver value across the resin-to-finished-goods spectrum. At the same time, specialized compounders focus on niche segments, deploying proprietary additive technologies and customer-centric service models that differentiate their offerings.

Several industry champions are forging partnerships with equipment manufacturers and end users to co-develop tailored solutions, thereby accelerating innovation cycles and driving penetration in high-growth verticals. Strategic alliances with recycling firms and sustainability-focused investors underscore a commitment to circular economy goals, enabling these companies to enhance brand credibility and comply with increasingly stringent global regulations. Collectively, these efforts reflect a competitive environment where scale, agility, and technological leadership determine market leadership and future resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Unplasticized Polyvinyl Chloride market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Formosa Plastics Corporation

- Ineos Group Holdings S.A.

- Kem One S.A.S.

- LG Chem Ltd.

- Occidental Chemical Corporation

- Orbia Advance Corporation S.A.B. de C.V.

- Shin-Etsu Chemical Co., Ltd.

- The Dow Chemical Company

- Vinnolit GmbH & Co. KG

- Westlake Chemical Corporation

Proactive Strategies Emphasizing Supply Chain Resilience Digital Integration and Sustainable Practices Will Empower Industry Leaders to Excel in Unplasticized PVC Markets

To navigate the complexities of the evolving uPVC landscape, industry leaders should prioritize a multi-faceted approach that balances cost management with strategic investment. Strengthening supply chain resilience by diversifying feedstock sources and establishing regional production hubs will mitigate exposure to tariff volatility and logistical disruptions. Concurrently, forging cross-industry collaborations can accelerate adoption of next-generation stabilizers and reinforcements, positioning stakeholders at the forefront of performance-driven segments.

Digital tools present an invaluable opportunity to optimize operations and unlock new revenue streams. Implementing real-time analytics in manufacturing processes can elevate yield efficiency and reduce waste, while digital marketplaces and advanced customer relationship management systems can enhance market reach and service differentiation. Finally, embedding circularity principles through take-back schemes and closed-loop recycling initiatives not only addresses regulatory pressures but also resonates with end users increasingly focused on sustainability metrics, thereby unlocking long-term competitive advantage.

Comprehensive Methodological Framework Incorporating Primary Interviews Secondary Data Analysis and Advanced Modelling Ensures Robust Insights into the Unplasticized PVC Market

The research underpinning this analysis was founded on a rigorous methodological framework that integrates both primary and secondary data sources. Primary research included in-depth interviews with senior executives across resin producers, compounders, process equipment manufacturers, and end-user sectors to capture first-hand insights into market dynamics, technology adoption, and strategic priorities. Secondary data collection drew from a broad spectrum of industry publications, peer-reviewed journals, trade association reports, and customs databases to ensure a holistic understanding of regulatory developments and trade flows.

Quantitative modeling techniques, including trend extrapolation and scenario analysis, were employed to contextualize historical data and assess the implications of tariff changes, sustainability mandates, and technological innovations. Validation workshops with subject-matter experts further refined key findings and ensured alignment with real-world market conditions. This comprehensive approach guarantees that the conclusions and recommendations presented herein are underpinned by robust evidence and nuanced industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Unplasticized Polyvinyl Chloride market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Unplasticized Polyvinyl Chloride Market, by Form

- Unplasticized Polyvinyl Chloride Market, by Application

- Unplasticized Polyvinyl Chloride Market, by Process

- Unplasticized Polyvinyl Chloride Market, by Product Type

- Unplasticized Polyvinyl Chloride Market, by Region

- Unplasticized Polyvinyl Chloride Market, by Group

- Unplasticized Polyvinyl Chloride Market, by Country

- United States Unplasticized Polyvinyl Chloride Market

- China Unplasticized Polyvinyl Chloride Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Reflections on Market Evolution Industry Resilience and Strategic Imperatives Underpinning the Future Trajectory of Unplasticized Polyvinyl Chloride

As the unplasticized PVC market continues to mature, the intersection of technological advancement, regulatory evolution, and geopolitical shifts will define its trajectory. Stakeholders equipped with a deep understanding of segmentation nuances, regional drivers, and the competitive landscape will be best positioned to anticipate disruptions and capitalize on emerging growth areas. The imperative to innovate-whether through novel compound formulations, sustainable processing techniques, or digital integration-will only intensify as end users demand higher performance, transparency, and environmental accountability.

Ultimately, success in this dynamic ecosystem will hinge on the ability to embrace change proactively, leveraging data-driven insights to inform strategic decisions and foster collaborative partnerships that transcend traditional industry boundaries. Organizations that align their core capabilities with market imperatives and demonstrate agility in responding to external shocks will drive enduring value and shape the future of unplasticized PVC.

Engage with Ketan Rohom to Unlock In-Depth Unplasticized Polyvinyl Chloride Market Intelligence and Empower Strategic Decision Making with the Industry Report

Are you looking to gain a competitive edge in the fast-evolving unplasticized polyvinyl chloride market and unlock actionable insights that drive strategic growth and operational excellence? Connect today with Ketan Rohom, Associate Director, Sales & Marketing, to secure comprehensive market research tailored to your needs and empower your organization with data-driven intelligence and expert guidance that navigates the complexities of supply chain dynamics, regulatory landscapes, and emerging opportunities in unplasticized PVC.

- How big is the Unplasticized Polyvinyl Chloride Market?

- What is the Unplasticized Polyvinyl Chloride Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?