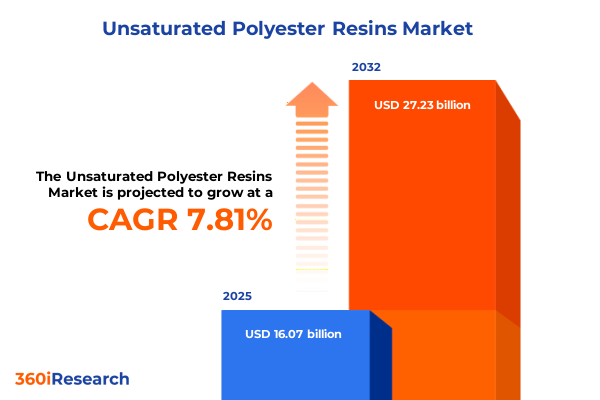

The Unsaturated Polyester Resins Market size was estimated at USD 16.07 billion in 2025 and expected to reach USD 17.25 billion in 2026, at a CAGR of 7.81% to reach USD 27.23 billion by 2032.

Setting the Stage for Innovation and Growth: How Unsaturated Polyester Resins Are Redefining Performance and Sustainability Across Global End-Use Sectors

Unsaturated polyester resins occupy a pivotal position in modern manufacturing, undergirding the performance of composites, coatings, adhesives, and laminates across a wide range of applications. These versatile polymers, derived from the reaction of unsaturated dicarboxylic acids and polyhydric alcohols, impart essential properties such as mechanical strength, chemical resistance, and lightweight durability. As demand intensifies for materials that deliver both high performance and environmental responsibility, the industry has accelerated the adoption of bio-based and recycled feedstocks. For instance, a leading specialty chemicals firm launched a line of bio-based unsaturated polyester resins in early 2025 to meet rising customer demand for sustainable solutions in automotive and construction sectors. Moreover, global awareness of carbon reduction has fueled research into renewable monomers that align with circular economy principles and reduce reliance on fossil-based inputs, demonstrating the sector’s commitment to environmental stewardship.

In parallel with sustainability initiatives, performance-driven innovation continues to define the sector’s evolution. Advanced curing agents introduced by several major manufacturers have significantly shortened reaction times while enhancing mechanical strength and thermal stability in composite mouldings. Notably, new curing chemistries deployed in mid-2024 have demonstrated up to a 30% reduction in post-cure cycle times, enabling faster throughput and lower energy consumption in production lines. Furthermore, strategic partnerships between resin producers and end-use fabricators are catalyzing application-specific formulations - from flame-retardant compounds in building materials to high-durability coatings for harsh chemical environments - underscoring the resin industry’s agility in responding to specialized market requirements.

Beyond raw materials and chemistry, the integration of digital and artificial intelligence (AI) platforms is redefining resin development processes. In mid-2025, a leading polymer technology company announced the embedding of AI-driven predictive analytics into its formulation workflow, enabling real-time optimization of resin properties and accelerating new product introductions by an estimated 25%. This digital transformation not only enhances R&D efficiency but also supports data-driven decision-making in supply chain management, quality control, and customer service. As the industry continues to embrace advanced manufacturing technologies, digitalization will remain a key enabler of innovation, competitiveness, and operational excellence.

Identifying the Transformative Technological, Regulatory, and Sustainability-Driven Shifts Reshaping the Future of Unsaturated Polyester Resin Production

Over the past several years, the unsaturated polyester resin industry has undergone transformative shifts driven by technological breakthroughs, regulatory realignments, and escalating sustainability demands. One of the most significant changes is the widespread integration of AI and machine learning into resin design platforms, enabling companies to predict resin behavior under diverse conditions and tailor formulations with unprecedented precision. In June 2025, a prominent resin producer publicly showcased its use of AI algorithms for optimizing wood panel manufacturing, reporting that simulation-driven insights reduced trial-and-error cycles by nearly 40%. Simultaneously, manufacturers are adopting digital twins to model composite lay-up processes, improving production consistency and reducing material waste.

Regulatory dynamics have also reshaped market priorities. The U.S. Environmental Protection Agency finalized amendments to volatile organic compound (VOC) standards for aerosol coatings in January 2025, tightening emission limits and mandating lower-reactivity ingredients to curb ozone formation. At the same time, state-level rulemaking bodies have proposed further restrictions on consumer products and architectural coatings, prompting resin suppliers to reformulate low-VOC and zero-VOC variants. Industry associations have mobilized to guide stakeholders through evolving compliance deadlines, emphasizing collaboration between manufacturers, regulators, and downstream formulators to maintain supply chain continuity and uphold environmental objectives.

On the sustainability front, leading resin producers are committing to ambitious carbon reduction targets and transitioning to renewable energy sources. A German specialty chemicals company began sourcing green electricity for its polybutadiene production facility in July 2025, aiming to cut scope 1 and 2 emissions by 25% by 2030 while offering mass-balanced product lines under international certification schemes. In tandem, patents filed in mid-2023 outline methods for increasing the renewable content of unsaturated polyester backbones through the exclusive use of naturally derived fumaric acid and bio-based diols, signaling a shift toward more sustainable chemical pathways that do not compromise resin performance.

Assessing the Cumulative Impact of Recent U.S. Trade Tariffs and Policy Measures on Unsaturated Polyester Resin Supply Chains and Prices in 2025

The cumulative impact of U.S. trade measures enacted in 2025 has introduced new complexities for unsaturated polyester resin supply chains and cost structures. Beginning on March 4, 2025, imports from Canada and Mexico have been subject to a 25% tariff, while shipments from China face a 10% levy under national emergency authorities, aimed at addressing broader geopolitical concerns. At the same time, chemical feedstocks such as monoethylene glycol and ethanol are expected to experience freight cost increases between 170% and 228%, with underlying prices projected to climb by 33% to 37%, intensifying pressure on downstream producers to absorb or pass through higher input expenses.

Industry associations have raised alarms over potential supply chain disruptions and margin erosion resulting from these measures. The American Chemistry Council highlighted that such tariff-induced cost escalations could stifle competitiveness and constrain capital investments, particularly in sectors like polyester fiber, composite resins, and plastics that rely heavily on imported monomers and intermediates. Meanwhile, coatings and adhesives manufacturers have expressed concern over regulatory uncertainty and retaliatory measures, such as proposed European Union counter-tariffs on U.S. resin imports, which could further restrict market access and exacerbate volatility in global trade flows.

Consequently, resin suppliers and end users are reassessing sourcing strategies, exploring nearshoring of critical chemical production, and negotiating long-term supply agreements to mitigate tariff risks. Some major resin producers have accelerated capacity expansions in Asia-Pacific and Middle Eastern manufacturing hubs, where tariff exposure is lower and feedstock supplies are more secure. These strategic adjustments underscore the sector’s proactive response to a rapidly changing trade environment and the imperative to safeguard resilient, diversified supply chains.

Uncovering Key Segmentation Insights Revealing How Resin Type, Product Form, Curing and Manufacturing Processes, and End-Use Industries Drive Market Dynamics

Resin type segmentation reveals distinct performance and application profiles that guide product development and customer engagement strategies. Flame retardant grades continue to address fire safety requirements in construction and transportation, while isophthalic variants find favor where superior chemical resistance is critical. Neopentyl glycol-based resins are prized for enhanced weathering and hydrolytic stability, particularly in outdoor applications, and orthophthalic formulations remain cost-effective solutions for general-purpose composite fabrications.

Product form segmentation underscores the balance between handling convenience and processing efficiency. Liquid unsaturated polyester resins dominate large-scale composite manufacturing due to easier impregnation of fiber reinforcements, whereas powder counterparts gain traction in solid surface and sheet molding applications, offering solvent-free handling and precise dosing benefits.

Curing process segmentation delineates resin behavior and end-use properties. Ambient cure formulations provide straightforward room-temperature crosslinking for maintenance and repair operations. Bulk molding compound and dough molding compound processes leverage pre-formulated mixtures for high-volume automotive and appliance components, while sheet molding compounds deliver both aesthetic quality and mechanical performance where surface finish and strength are paramount.

Manufacturing process segmentation highlights the adaptability of unsaturated polyester resins across diverse production techniques. Filament winding excels in creating cylindrical or pressure-bearing structures such as pipes and tanks. Hand lay-up remains a cost-effective, low-volume method for custom parts in marine and architectural applications. Pultrusion enables continuous production of profiles and reinforcements with consistent mechanical properties, and resin transfer molding supports complex geometry components without extensive trimming. Spray-up offers rapid deposition for large-area parts like boat hulls, underscoring the importance of process compatibility in resin selection.

End use industry segmentation points to the unsaturated polyester resin market’s reliance on key demand sectors. The automotive and transportation industry prioritizes lightweight, high-strength composites to improve fuel efficiency and component durability. The construction sector relies on resin-based products for corrosion-resistant piping, decorative panels, and structural reinforcement. Electrical and electronics manufacturers utilize resins for insulation and protective coatings, while marine applications demand resins with antifouling properties and UV stability. Wind energy harnesses the structural efficiency of composite blades, where unsaturated polyester resins provide cost-effective fabrication and long service life.

This comprehensive research report categorizes the Unsaturated Polyester Resins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Product Form

- Curing Process

- Manufacturing Process

- End Use Industry

Mapping Critical Regional Insights That Highlight Rapid Growth Drivers and Challenges Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exhibit pronounced variance in demand drivers and strategic imperatives for unsaturated polyester resin suppliers. In the Americas, a mature industrial base and growing infrastructure investments sustain stable consumption, with the United States leading demand through construction and wind energy blade production. North American resin producers have responded by enhancing downstream integration and forging long-term partnerships with OEMs, ensuring aligned capacity expansions and innovation roadmaps to meet evolving specifications.

Europe, the Middle East, and Africa (EMEA) represent a mosaic of advanced manufacturing clusters and emerging markets. Western Europe’s stringent environmental regulations and advanced automotive sector spur demand for high-performance and low-VOC resins, prompting regional suppliers to invest heavily in R&D and localized production. Simultaneously, Middle Eastern petrochemical hubs leverage abundant feedstock availability to emerge as competitive resin exporters, while African markets are at an earlier stage of adoption, characterized by growing infrastructure projects and localized composite manufacturing capabilities.

Asia-Pacific remains the fastest-growing region, fueled by robust construction activity, rapid urbanization, and substantial government spending on renewable energy infrastructure. China and India dominate consumption, supported by expanding wind turbine installations and automotive assembly volumes. Resin producers have accelerated capacity builds in proximity to key end-use clusters, optimizing logistics and reducing tariff exposure. Southeast Asian nations also attract investment for regional distribution centers and joint ventures, reflecting the strategic importance of proximity to high-growth markets.

This comprehensive research report examines key regions that drive the evolution of the Unsaturated Polyester Resins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Innovators and Strategic Initiatives Steering Competitive Dynamics in the Unsaturated Polyester Resins Market

Leading resin manufacturers have demonstrated diverse strategic priorities that shape competitive dynamics. One global specialty chemicals company has underscored its commitment to sustainability through a high-profile 2024 report, detailing a 10.6 million metric ton reduction in greenhouse gas emissions and the commercial rollout of bio-based vinyl esters for wood coatings. Concurrently, the firm has integrated AI-driven optimization into wood panel manufacturing, setting a benchmark for data-centric innovation in resin development.

Other key players are focused on capacity expansion, product portfolio diversification, and strategic collaborations. A leading U.S.-based resin supplier expanded manufacturing capacity at its Asia-Pacific facility in early 2025 to address surging demand from infrastructure projects in India and Southeast Asia. That same company launched a bio-based polyester resin line designed for the automotive and construction sectors, illustrating the drive toward sustainable material solutions. Global chemical conglomerates have formed partnerships with wind turbine OEMs to co-develop flame-retardant resin systems optimized for blade performance, while major European producers continue to deploy novel curing agents that balance processing efficiency with mechanical performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Unsaturated Polyester Resins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allnex Belgium SA

- AOC Resins B.V.

- Arakawa Chemical Industries, Ltd.

- Ashland Global Holdings Inc.

- Covestro AG

- CVC Thermoset Specialties Germany GmbH

- DIC Corporation

- Hexion Inc.

- Polynt-Reichhold S.p.A.

- Scott Bader Company Limited

- Sinopec Shanghai Petrochemical Company Limited

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Supply Chain Disruptions, Sustainability Demands, and Emerging Market Opportunities

To navigate the evolving landscape, companies should prioritize the integration of sustainable feedstocks into resin portfolios. By accelerating research into bio-based monomers and leveraging partnerships with academic and startup ecosystems, resin producers can differentiate their offerings in markets that increasingly value circular economy credentials. The success of recent bio-based resin launches highlights the commercial viability of renewable chemistries and underscores the importance of early mover advantage in next-generation materials development.

Simultaneously, firms must strengthen supply chain resilience through geographic diversification and collaborative sourcing strategies. The introduction of tariffs on key chemical imports underscores the need for nearshoring critical manufacturing and engaging in proactive policy dialogue with trade associations. Aligning with industry groups to advocate for stable regulatory frameworks will help balance national security objectives with the operational realities of chemical manufacturing. By adopting a comprehensive risk management approach, organizations can mitigate cost volatility, safeguard production continuity, and position themselves for sustained profitability.

Transparent Research Methodology Outlining Rigorous Data Collection, Analysis Techniques, and Expert Validation Processes Ensuring Report Integrity

This research combines extensive secondary data gathering with primary validation to ensure rigorous, actionable insights. Secondary sources include government publications, regulatory filings, patent databases, corporate press releases, and credible industry news outlets. Relevant policy documents were reviewed from environmental agencies to assess regulatory impacts, and patent filings were analyzed to track innovation trends.

Primary research involved in-depth interviews with senior executives, R&D leaders, and supply chain managers at resin manufacturers, composite fabricators, and end-use industry associations. These discussions provided firsthand perspectives on market drivers, technology adoption, and strategic priorities. Data points obtained through primary and secondary channels were cross-verified through triangulation, ensuring consistency and reliability.

Quantitative data analysis was conducted using a bottom-up approach, mapping resin production volumes and technology adoption rates against known facility capacities and industry benchmarks. Qualitative insights were synthesized to contextualize numerical findings, highlighting emerging trends and strategic inflection points. The resulting framework offers a holistic view of the unsaturated polyester resin ecosystem, equipping decision-makers with a clear roadmap for prioritizing investments and innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Unsaturated Polyester Resins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Unsaturated Polyester Resins Market, by Resin Type

- Unsaturated Polyester Resins Market, by Product Form

- Unsaturated Polyester Resins Market, by Curing Process

- Unsaturated Polyester Resins Market, by Manufacturing Process

- Unsaturated Polyester Resins Market, by End Use Industry

- Unsaturated Polyester Resins Market, by Region

- Unsaturated Polyester Resins Market, by Group

- Unsaturated Polyester Resins Market, by Country

- United States Unsaturated Polyester Resins Market

- China Unsaturated Polyester Resins Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Insights and Strategic Imperatives to Guide Decision-Makers in Accelerating Growth and Sustainability in the Unsaturated Polyester Resins Market

In summary, the unsaturated polyester resin industry stands at a critical inflection point characterized by accelerating sustainability mandates, regulatory realignments, and rapid technological advancements. The convergence of bio-based feedstocks, AI-driven formulation platforms, and advanced curing chemistries is reshaping performance benchmarks and unlocking new applications across traditional and emerging sectors.

Tariff-driven supply chain reconfigurations highlight the importance of strategic resilience, prompting capacity shifts and collaborative sourcing strategies. Meanwhile, segmentation insights reveal that resin type, product form, curing method, manufacturing process, and end-use industry remain foundational to product differentiation and market penetration. Regional dynamics underscore the need for localized strategies, with growth peaking in Asia-Pacific while the Americas and EMEA navigate regulatory and infrastructural nuances.

By synthesizing competitive intelligence on leading companies, actionable recommendations, and a transparent research approach, this report equips stakeholders with the clarity and confidence to pursue sustainable growth. As the industry transitions toward circular economy principles and digital transformation, organizations that embrace innovation, supply chain agility, and regulatory engagement will emerge as market leaders in the unsaturated polyester resin domain.

Engage with Our Associate Director to Secure Comprehensive Unsaturated Polyester Resin Market Research and Accelerate Strategic Growth with Expert Guidance

To take advantage of these comprehensive insights and position your organization for success in an evolving market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to obtain the full research report. Ketan’s expertise in strategic market positioning and deep understanding of industry dynamics will ensure you receive the tailored support you need to navigate complex supply chains, regulatory changes, and emerging opportunities in the unsaturated polyester resins sector. Contact Ketan today to secure your copy of the report and embark on a data-driven journey toward innovation and sustainable growth.

- How big is the Unsaturated Polyester Resins Market?

- What is the Unsaturated Polyester Resins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?