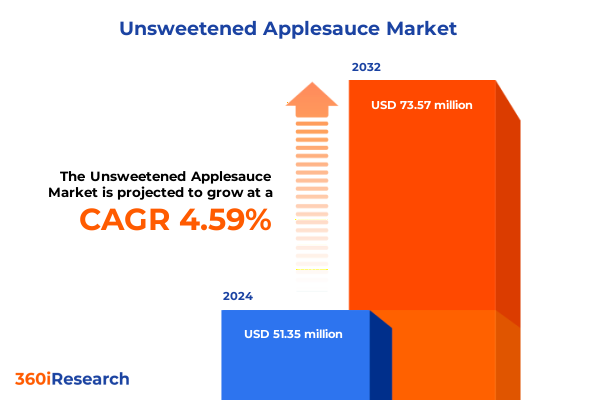

The Unsweetened Applesauce Market size was estimated at USD 53.76 million in 2025 and expected to reach USD 55.98 million in 2026, at a CAGR of 4.58% to reach USD 73.57 million by 2032.

Exploring the Rise of Unsweetened Applesauce as a Health-Conscious Snack Segment Driven by Consumer Demand and Industry Innovation

The unsweetened applesauce category has emerged as a dynamic and health-oriented segment within the broader snack industry, capturing the attention of both manufacturers and consumers seeking cleaner labels and reduced sugar intake. Renewed emphasis on dietary guidelines worldwide has heightened awareness of added sugars, prompting consumers to embrace natural fruit preparations free from sweeteners and preservatives. As health authorities and nutrition experts continue to advocate for minimally processed foods, unsweetened applesauce has become a staple in health-forward diets, offering a versatile ingredient for culinary applications and a convenient, nutritious snack option.

This shift is underscored by global sales data showing that unsweetened applesauce represented 42% of total category volumes in 2024, reflecting a measurable rise in consumer preference for no-sugar-added variants and an expansion of product offerings in both conventional and organic formats. Concurrently, fruit-based snack alternatives are benefitting from supportive public health campaigns and growing retailer shelf space dedicated to clean-label products, positioning unsweetened applesauce as a strategic growth area for manufacturers and retailers alike. Transitioning from a traditional pantry item to a mainstream convenience staple, unsweetened applesauce is setting new benchmarks in taste, functionality, and nutritional appeal.

Charting Transformative Shifts in Unsweetened Applesauce Market Dynamics Spurred by Health Trends Packaging Breakthroughs and Digital Growth

The unsweetened applesauce landscape is undergoing profound transformations driven by evolving consumer expectations, packaging innovation, and digital retail expansion. Manufacturers increasingly emphasize organic ingredients and transparent sourcing, leveraging certifications and origin storytelling to differentiate products in crowded supermarket aisles. Clean-label claims such as “no added sugar” and “non-GMO” are now table stakes, reflecting a broader wellness trend that places ingredient integrity at the forefront of purchase decisions.

Packaging innovation has played a critical role in capturing on-the-go consumption occasions. In North America, shelf-stable pouch formats accounted for nearly 47% of applesauce sales in 2024, underscoring the format’s appeal for convenience-seeking shoppers and parents providing mess-free snacks to children. Concurrently, manufacturers are piloting recyclable and biodegradable packaging solutions, responding to increasing environmental commitments from both retailers and consumers.

Digital commerce has emerged as a powerful catalyst for market expansion. E-commerce platforms contributed roughly 21% of global applesauce sales in 2024, a reflection of shoppers gravitating toward online grocery channels and subscription-based snack delivery services. Brands are investing in targeted digital marketing campaigns and data analytics to refine consumer segmentation online, driving personalized promotions and optimizing supply chains for rapid home delivery. Together, these shifts redefine the parameters of product innovation, distribution, and consumer engagement in the unsweetened applesauce category.

Assessing the Cumulative Impact of 2025 United States Tariffs on the Unsweetened Applesauce Supply Chain Pricing and Competitive Landscape

The introduction of revised U.S. tariffs in 2025 has exerted significant pressure on the unsweetened applesauce value chain, particularly for companies dependent on imported apple derivatives. As detailed by Farm Credit East, higher tariffs on imports from key trading partners such as China, Canada, and Mexico have prompted domestic processors to reassess sourcing strategies due to increased input costs and constrained availability. This realignment has translated into tighter margins for manufacturers and shifts in pricing structures across multiple distribution channels.

Moreover, U.S. companies importing apple-based products face both direct and indirect cost exposures. High duties on Chinese apple juice concentrates and pulp have contributed to elevated raw material prices, while exemptions for Canadian and Mexican produce under USMCA provide partial relief but do not fully offset overall cost volatility. Retailers and foodservice providers are navigating these dynamics by adjusting value-added offerings and exploring alternative supply partners. However, the specter of retaliatory tariffs and evolving trade policies continues to inject uncertainty into long-term procurement planning and investment decisions within the unsweetened applesauce segment.

Unpacking Key Segmentation Insights Revealing How End Users Product Types Channels Packaging and Materials Shape Applesauce Market Opportunities

The unsweetened applesauce market is characterized by diverse end-user segments that each present distinct consumption patterns and value drivers. Within foodservice, institutional catering programs and cafeteria operations integrate applesauce as a health-forward side, while restaurants craft artisanal applications from scratch purées to elevate menu offerings. In the household domain, multigenerational families gravitate toward multi-serve formats for batch usage in baking and meal preparation, whereas single-person households increasingly adopt on-the-go cups and pouches that align with busy lifestyles.

Product type segmentation underscores the dichotomy between conventional and organic formulations. Conventional variants maintain broad accessibility through established supply channels, balancing cost considerations with consumer expectations of freshness and taste. Organic unsweetened applesauce, meanwhile, appeals to premium-oriented shoppers prioritizing pesticide-free cultivation and sustainability credentials, often commanding higher price points and fostering brand loyalty among wellness-focused demographics.

Distribution channels further differentiate market approaches. Chain and independent convenience stores stock grab-and-go portions to meet impulse purchase behaviors, while specialty retailers-ranging from gourmet shops to natural food stores-showcase premium and niche brands in curated assortments. Supermarkets and hypermarkets anchor the category’s volume sales through strategic shelf placement and promotional support. Complementing these traditional channels, brand websites and third-party e-commerce platforms facilitate direct-to-consumer engagement and subscription models. Packaging strategies also reveal contrasts between multi-serve bulk containers in jars or bulk pouches and single-serve cups or pouches, each optimized for either value or convenience. Material choices span flexible sachets and stand-up pouches that minimize packaging weights, as well as glass and plastic designs that convey premium positioning and recyclability.

This comprehensive research report categorizes the Unsweetened Applesauce market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End User

- Product Type

- Distribution Channel

- Packaging

- Packaging Material

Delivering Key Regional Insights Highlighting Unique Consumption Behaviors and Growth Drivers across Americas EMEA and Asia-Pacific Markets

In the Americas, the United States dominates consumption and innovation within unsweetened applesauce, accounting for over 27% of global volumes in 2024. Consumer demand is driven by health-centric snacking trends and strong penetration of digital grocery channels. Canada follows as a growth market, spurred by parallel wellness movements and robust e-commerce infrastructure. Latin American markets, while smaller in scale, show increasing adoption of unsweetened varieties as disposable incomes rise and brand awareness expands.

Europe, Middle East & Africa (EMEA) present a nuanced landscape where regulatory frameworks and cultural heritage influence product preferences. Western European countries emphasize organic certifications and sustainable packaging, with Germany and France leading annual organic applesauce sales growth by more than 15%. In the Middle East and select African nations, urbanization and lifestyle changes are gradually nurturing interest in convenience-based fruit snacks, paving the way for international brands to enter through modern trade alliances.

Asia-Pacific stands out for rapid year-on-year growth, with overall applesauce consumption rising by approximately 9% in 2024 as urban consumers embrace Western snacking habits. Countries such as China, Japan, and India are witnessing an influx of imported unsweetened applesauce brands, supported by expanding supermarket chains and e-grocery platforms. Local manufacturers are starting to adopt advanced packaging formats and flavor innovations to capture share in this burgeoning market.

This comprehensive research report examines key regions that drive the evolution of the Unsweetened Applesauce market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Presenting Key Company Insights Spotlighting Strategic Initiatives Collaborations and Innovations Driving Leadership in the Unsweetened Applesauce Segment

Leading players in the unsweetened applesauce segment are leveraging product innovation and sustainability initiatives to solidify market leadership. Materne’s GoGo Squeez brand introduced an organic pouch line in 2023 designed for low-sugar, high-fiber content, resulting in a notable uptick in market penetration within North America. TreeTop expanded its portfolio by launching organic applesauce cups in early 2023, featuring flavor extensions such as apple cinnamon and apple strawberry, thereby enhancing consumer engagement and retail visibility.

Knouse Foods responded to rising environmental concerns by implementing recyclable packaging solutions for its applesauce products in 2023, demonstrating a strong commitment to ESG objectives and influencing peer companies to follow suit. Vermont Village captured the keto and low-sugar market niche with its unsweetened organic variant released in 2024, reinforcing the brand’s positioning among health-aware consumers. Similarly, Santa Cruz Organic’s introduction of mixed-fruit combinations in 2024 generated incremental sales and broadened appeal to gourmet and wellness segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Unsweetened Applesauce market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Charles & Alice SAS

- Diamond Fruit Growers, Inc.

- Eden Foods, Inc.

- Gerber Products Company

- GoGo Squeez

- Knouse Foods Cooperative, Inc.

- Lucky Leaf

- Materne North America Corp.

- Mott's LLP

- Mountain Top Apple Sauce Co.

- Musselman's

- Nestlé S.A.

- Santa Cruz Natural Incorporated

- Solo Foods, Inc.

- The J.M. Smucker Company

- TreeTop, Inc.

- Vermont Craft Canning LLC

- Wacky Apple, Inc.

- White House Foods

Actionable Recommendations for Industry Leaders to Capitalize on Health Innovation Emerging Markets and Sustainable Packaging Strategies

Industry leaders must prioritize expansion of organic and unsweetened product lines to meet escalating consumer demands for cleaner label options. The prevalence of unsweetened variants representing over 42% of global sales underscores the necessity of investing in premium ingredient sourcing and transparent supply chains to sustain brand credibility. Companies can differentiate offerings by pursuing targeted acquisitions or partnerships that enhance proprietary capabilities in natural fruit processing.

Accelerating packaging innovation and digital commerce initiatives will be critical for capturing convenience-oriented and omnichannel shoppers. With pouch formats comprising nearly half of North American sales and e-commerce channels accounting for 21% of global volumes in 2024, scaling sustainable pouch development and optimizing online storefront experiences can yield significant competitive advantages. Collaborations with leading e-grocery platforms and investments in digital marketing analytics will further drive personalized engagement and loyalty.

To mitigate volatility from trade policies and raw material fluctuations, firms should reinforce supply-chain resilience by diversifying sourcing across tariff-exempt regions and exploring alternative apple derivatives. Farm Credit East’s analysis of tariff impacts highlights the value of agile procurement strategies and proactive cost management to preserve margin integrity amid evolving U.S. trade frameworks.

Detailing a Robust Research Methodology Combining Primary Interviews Secondary Data Sources and Rigorous Analytical Frameworks

This research employs a rigorous, multi-tiered methodology designed to deliver robust and actionable insights into the unsweetened applesauce market. Primary data was collected through in-depth interviews with key stakeholders, including manufacturers, distributors, retailers, and industry experts, enabling a comprehensive understanding of market drivers, challenges, and innovations. These qualitative inputs were supplemented by a broad review of secondary data sources, such as trade publications, government trade statistics, and industry association reports, to contextualize market trends and regulatory dynamics.

Quantitative analysis entailed data triangulation across multiple reputable databases to ensure accuracy and consistency. Advanced analytical frameworks, including scenario analysis and sensitivity modeling, were applied to evaluate the potential impacts of tariff changes, sourcing disruptions, and consumer behavior shifts. Finally, iterative validation workshops with subject-matter experts were conducted to confirm findings and refine strategic recommendations, guaranteeing the credibility and relevance of the research deliverables.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Unsweetened Applesauce market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Unsweetened Applesauce Market, by End User

- Unsweetened Applesauce Market, by Product Type

- Unsweetened Applesauce Market, by Distribution Channel

- Unsweetened Applesauce Market, by Packaging

- Unsweetened Applesauce Market, by Packaging Material

- Unsweetened Applesauce Market, by Region

- Unsweetened Applesauce Market, by Group

- Unsweetened Applesauce Market, by Country

- United States Unsweetened Applesauce Market

- China Unsweetened Applesauce Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Drawing Insightful Conclusions on the Unsweetened Applesauce Landscape and Its Strategic Implications for Stakeholders Across the Value Chain

The unsweetened applesauce category has achieved a pivotal inflection point, transitioning from a niche offering to a mainstream staple driven by clean-label advocacy, packaging reinvention, and digital-enabled distribution. Health-oriented consumers now view unsweetened applesauce not only as a low-sugar snack alternative but also as a versatile culinary ingredient. This evolution has compelled leading brands to elevate product quality, broaden flavor portfolios, and enhance sustainability credentials to capture shifting demand patterns.

Looking ahead, the interplay between evolving trade policies, regional consumption dynamics, and segmentation strategies will dictate the competitive landscape. Stakeholders equipped with nuanced insights into tariff ramifications, end-user preferences, and channel performance will be best positioned to capitalize on emergent opportunities. By aligning strategic investments in organic innovation, packaging optimization, and digital engagement, companies can forge resilient pathways to sustainable growth in the unsweetened applesauce market.

Take the Next Step with Ketan Rohom to Unlock Comprehensive Insights and Secure Your Unsweetened Applesauce Market Intelligence Report Today

Ketan Rohom, our Associate Director of Sales & Marketing, is ready to guide you through the unique opportunities uncovered in this market research report. By partnering with Ketan, you gain direct access to in-depth analyses and strategic recommendations tailored to your organization’s priorities, ensuring you stay ahead in the rapidly evolving unsweetened applesauce segment.

Secure your copy today to leverage comprehensive insights on consumer trends, tariff impacts, segmentation strategies, and competitive landscapes. Engage with Ketan to discuss customized data solutions and begin transforming these market intelligence findings into actionable growth initiatives that will propel your organization forward.

- How big is the Unsweetened Applesauce Market?

- What is the Unsweetened Applesauce Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?