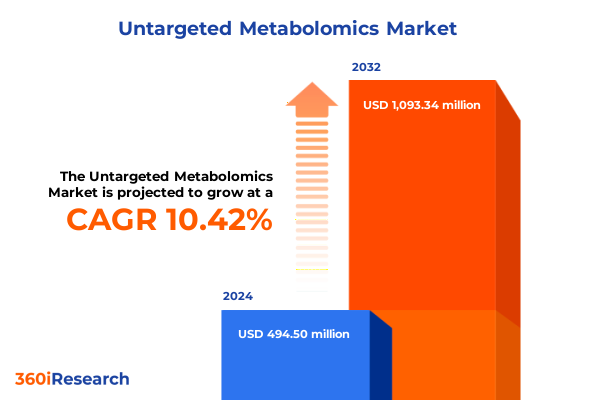

The Untargeted Metabolomics Market size was estimated at USD 540.40 million in 2025 and expected to reach USD 598.99 million in 2026, at a CAGR of 10.59% to reach USD 1,093.34 million by 2032.

Exploring the Transformative Role of Untargeted Metabolomics in Uncovering Comprehensive Molecular Profiles Across Diverse Research Domains

Untargeted metabolomics has emerged as a pivotal approach in modern biosciences, enabling researchers to cast a wide net over thousands of small molecules without predefined targets. This strategy contrasts with targeted workflows by capturing the holistic metabolic state of a sample, whether derived from cell cultures, clinical specimens, food matrices, or environmental sources. By combining high-resolution mass spectrometry with complementary nuclear magnetic resonance spectroscopy, untargeted metabolomics provides an unprecedented window into dynamic biochemical pathways, allowing scientists to discover novel biomarkers, elucidate complex disease mechanisms, and accelerate drug and nutritional research.

Recent advancements in instrument sensitivity and data handling have propelled untargeted metabolomics into mainstream applications, spanning academic and government research, pharmaceutical and biotechnology development, as well as food and beverage quality control. Moreover, integration with artificial intelligence and machine learning has transformed raw spectral data into actionable insights, reducing the time from sample acquisition to meaningful interpretation. As the demand for deeper biological understanding intensifies across precision medicine and systems biology, untargeted metabolomics stands poised to reshape the landscape of molecular research, providing clarity where targeted methods might overlook critical changes in the metabolome.

How Cutting-Edge Instrumentation, AI-Driven Workflows, and Collaborative Data Standards Are Reshaping Untargeted Metabolomics Practices with Unprecedented Precision

Over the past five years, untargeted metabolomics has undergone a profound transformation driven by breakthroughs in analytical instrumentation, software ecosystems, and interdisciplinary collaborations. High-resolution mass spectrometers now routinely achieve parts-per-billion sensitivity, enabling the detection of low-abundance metabolites that were once beyond reach. Concurrently, the maturation of nuclear magnetic resonance platforms has facilitated non-destructive analysis of complex mixtures, broadening the scope of sample types amenable to multiplatform workflows.

Algorithmic innovations have kept pace, with machine learning frameworks now embedded into data processing pipelines to automate peak detection, deconvolution, and compound annotation. These software advancements have dramatically increased throughput and reproducibility, allowing research teams to focus on biological interpretation rather than manual curation. In parallel, cloud-native infrastructures and FAIR data principles have fostered a collaborative ethos, enabling secure, cross-institutional sharing of high-dimensional datasets without compromising privacy or intellectual property. As untargeted metabolomics converges with precision medicine initiatives and environmental monitoring, these transformative shifts underscore a broader trend toward integrated, systems-level exploration of metabolic networks.

Navigating the Economic Headwinds of Expanded Section 301 Tariffs in 2025 by Embracing Supply Chain Diversification and Domestic Partnerships

The implementation of expanded Section 301 tariffs in early 2025 has introduced new cost pressures and strategic complexities for untargeted metabolomics stakeholders. Instruments incorporating semiconductor components, such as high-resolution mass spectrometers and chromatography systems, now face duty rates of up to 50 percent when sourced from Chinese manufacturers. Laboratory consumables and accessories reliant on electronic components have similarly experienced tariff-driven price increases, prompting many organizations to evaluate alternative sourcing strategies or to absorb incremental costs to avoid disruptions in research timelines.

These tariff adjustments have also catalyzed a reevaluation of supply chain resilience. Leading research institutions and contract laboratories are increasingly diversifying procurement by engaging with European and North American vendors, despite the occasional trade-off in lead times and product availability. Furthermore, some end users have resorted to stockpiling critical consumables, from sample preparation kits to isotopically labeled internal standards, to mitigate the risk of sudden price escalations or customs delays. The resulting ripple effects extend to software and services, where multinational providers are recalibrating support agreements and maintenance packages to account for added logistical expenses.

While the immediate impact has been upward pressure on operational budgets, a longer-term benefit may emerge as incentives to develop localized production capabilities gain traction. Academic and government laboratories, pharmaceutical R&D centers, and food testing facilities are collaborating with domestic instrument manufacturers to co-design next-generation systems optimized for untargeted metabolomics. This shift toward regional self-reliance not only reduces vulnerability to external trade policies but may also accelerate innovation by aligning product roadmaps with specific regulatory and application needs.

Decoding Diverse Usage Patterns and Investment Focus across Components, Technologies, Applications, End Users, and Sample Types for Untargeted Metabolomics

A granular examination of untargeted metabolomics illuminates distinct patterns of demand and investment across the major components, technologies, applications, end users, and sample types. Consumables and accessories-including extraction kits, chromatography columns, and ionization probes-remain foundational for consistent sample preparation, while the choice among chromatography instruments, mass spectrometry platforms, and NMR spectrometers hinges on analytical priorities. Within mass spectrometry, capillary electrophoresis-MS excels at polar compound detection, gas chromatography-MS is preferred for volatile metabolites in environmental or nutritional studies, and liquid chromatography-MS serves as the workhorse for broad-spectrum profiling.

On the software front, advanced data processing suites that integrate statistical modeling and spectral libraries play an increasingly vital role, particularly for workflows that demand seamless transitions from raw data to biological interpretation. Biomarker discovery and metabolic profiling dominate application scenarios in drug discovery and clinical diagnostics, whereas nutritional research benefits from targeted investigations into dietary components and their metabolic fates. Academic and government research institutions leverage untargeted approaches to underpin systems biology and environmental metabolomics projects, while pharmaceutical and biotechnology companies prioritize high-throughput pipelines for molecule characterization. Sample types span from controlled cell culture experiments, through complex plasma and serum analyses, to tissue biopsies and urine collections, underscoring the versatility of untargeted metabolomics across life science domains.

This comprehensive research report categorizes the Untargeted Metabolomics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Sample Type

- Application

- End User

Understanding Regional Leadership and Growth Dynamics in the Americas, Europe-Middle East-Africa, and Asia-Pacific Shaping the Future of Untargeted Metabolomics

Geographical tendencies in untargeted metabolomics reflect both established research hubs and emerging innovation centers. The Americas continue to lead in instrument procurement, driven by significant funding for precision medicine initiatives and the concentration of pharmaceutical R&D facilities. North American laboratories often serve as early adopters of cutting-edge platforms and as beta sites for software trials, influencing global validation studies and methodological standards.

Europe, Middle East & Africa benefit from collaborative research networks anchored by public-private partnerships and pan-EU frameworks. This region emphasizes harmonization of protocols and regulatory compliance, particularly for clinical diagnostics and environmental monitoring applications. Investments in state-of-the-art core facilities enable academic consortia to tackle large-scale metabolomics projects, fostering interdisciplinary exchanges between biochemistry, data science, and systems biology.

Asia-Pacific presents one of the fastest growth trajectories, with rising governmental support for life science infrastructure and a surge of local instrumentation manufacturers. Regional laboratories are scaling up untargeted metabolomics capabilities to address public health challenges, agricultural optimization, and food safety. The confluence of strong academic talent, manufacturing ecosystems, and governmental incentives underscores the Asia-Pacific region as a critical driver of innovation in untargeted metabolomics.

This comprehensive research report examines key regions that drive the evolution of the Untargeted Metabolomics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How Leadership in Integrated Instrumentation, Advanced Software, and Strategic Partnerships Is Defining the Competitive Landscape of Untargeted Metabolomics

The competitive landscape of untargeted metabolomics is shaped by integrated solutions providers and specialized innovators. Major instrument vendors continuously refine mass spectrometry and chromatography systems to deliver higher sensitivity, speed, and adaptability, while NMR developers emphasize non-invasive analysis capabilities. Leading software companies diversify offerings by embedding machine learning modules for automated feature extraction and spectral annotation. Contract research organizations and service providers differentiate through turnaround speed, data quality assurance, and customizable workflows that cater to niche applications such as biomarker validation and exposomics.

Partnerships between instrumentation manufacturers and computational tool developers have become essential for end-to-end solutions, marrying hardware performance with advanced analytics. These collaborations drive bundled offerings that streamline deployment, training, and support, reducing the barrier to entry for new adopters. Moreover, strategic alliances with academic centers of excellence foster co-development of next-generation platforms, ensuring that product roadmaps are informed by real-world research use cases and regulatory requirements. This synergy underscores a broader trend toward platform interoperability and value-added service integration, elevating the overall maturity of the untargeted metabolomics ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Untargeted Metabolomics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies Inc.

- Bio-Rad Laboratories, Inc.

- Biocrates Life Sciences AG

- Bruker Corporation

- Danaher Corporation

- LECO Corporation

- Metabolon, Inc.

- PerkinElmer, Inc.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

Adopt Modular Technologies, Data Science Expertise, and Regional Partnerships to Drive Operational Agility and Scientific Breakthroughs in Untargeted Metabolomics

To thrive amid rapid technological advancements and evolving trade complexities, industry leaders should adopt a proactive stance that balances innovation with operational resilience. First, investing in modular platforms that support multiplatform data acquisition can hedge against component shortages and provide flexibility for diverse sample matrices. By aligning procurement strategies with vendor roadmaps and participating in user advisory boards, organizations can influence product development to better suit untargeted metabolomics requirements.

Second, cultivating in-house expertise in data science and bioinformatics will unlock the full potential of AI-driven analytics, transforming raw spectral outputs into biologically relevant insights. Cross-functional teams that blend analytical chemistry with computational modeling can streamline workflow automation and reduce time to result. Third, engaging early in regulatory discussions and standardization consortia will ensure that operational protocols meet emerging compliance frameworks, particularly for clinical and environmental applications.

Finally, establishing regional partnerships for consumables manufacturing and instrument servicing can attenuate exposure to international tariff fluctuations. Co-development agreements and joint ventures with domestic suppliers will enhance supply chain agility and may qualify organizations for government incentives aimed at strengthening local production capabilities. By executing these actionable recommendations, leaders can position their operations for sustained growth and innovation in untargeted metabolomics.

Combining Literature Reviews, Expert Interviews, Survey Data, Trade Analytics, and Competitive Benchmarking for a 360° View of Untargeted Metabolomics Dynamics

This study leverages a multi-tiered research methodology, beginning with a comprehensive review of peer-reviewed literature and white papers on untargeted metabolomics trends, instrumentation advancements, and analytical best practices. Expert interviews with leading scientists, laboratory directors, and industry executives provided qualitative insights into evolving workflows, procurement challenges, and unmet needs. These interviews were supplemented by a survey of global academic and commercial laboratories to quantify adoption rates and technology preferences.

A secondary analysis of import-export databases and tariff schedules informed the assessment of trade policy impacts, while regional investment reports and government funding announcements illuminated geographic growth drivers. Competitive benchmarking was performed through a combination of product portfolio mapping and patent landscaping to identify innovation hotspots and collaboration networks. Finally, the findings were synthesized through cross-functional workshops involving subject matter experts in analytical chemistry, data science, and supply chain management, ensuring a holistic perspective on the untargeted metabolomics ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Untargeted Metabolomics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Untargeted Metabolomics Market, by Component

- Untargeted Metabolomics Market, by Technology

- Untargeted Metabolomics Market, by Sample Type

- Untargeted Metabolomics Market, by Application

- Untargeted Metabolomics Market, by End User

- Untargeted Metabolomics Market, by Region

- Untargeted Metabolomics Market, by Group

- Untargeted Metabolomics Market, by Country

- United States Untargeted Metabolomics Market

- China Untargeted Metabolomics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Technological, Trade, Segmentation, and Regional Insights to Illuminate the Strategic Imperatives of Untargeted Metabolomics Moving Forward

Untargeted metabolomics is at the nexus of technological innovation and scientific discovery, offering unparalleled depth in molecular profiling across diverse research and industrial domains. The convergence of high-resolution instrumentation with AI-powered analytics has expanded the frontiers of sensitivity, specificity, and throughput, positioning untargeted workflows as indispensable tools in precision medicine, biomarker discovery, and environmental monitoring. Although recent tariff measures have introduced cost and supply chain complexities, they have simultaneously spurred initiatives toward regional manufacturing resilience and collaborative product development.

Segmentation insights reveal a dynamic marketplace where strategic investments in consumables, instrumentation, software, and services are tailored to specific applications and sample types. Regional nuances further underscore the importance of local ecosystems in supporting growth and innovation. As the ecosystem continues to mature, organizations that integrate modular technologies, domain expertise, and flexible sourcing approaches will unlock the full potential of untargeted metabolomics. This comprehensive analysis equips stakeholders with the strategic intelligence necessary to navigate a rapidly evolving landscape and to harness the transformative power of metabolomics for scientific and commercial success.

Seize the Opportunity to Gain Unparalleled Competitive Intelligence in Untargeted Metabolomics by Connecting with Our Associate Director of Sales & Marketing Now

If you’re ready to deepen your strategic understanding of untargeted metabolomics and translate insights into actionable growth plans, don’t hesitate to secure your copy of the in-depth market research report. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored options, discuss enterprise licensing, or request an extended data extract. Whether you’re aiming to refine product pipelines, identify regional expansion opportunities, or benchmark performance against leading players, this comprehensive study provides the competitive intelligence you need to position your organization at the forefront of untargeted metabolomics innovation.

- How big is the Untargeted Metabolomics Market?

- What is the Untargeted Metabolomics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?