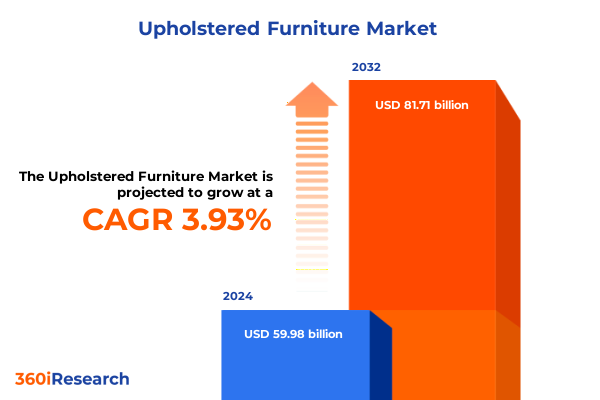

The Upholstered Furniture Market size was estimated at USD 62.40 billion in 2025 and expected to reach USD 64.40 billion in 2026, at a CAGR of 3.92% to reach USD 81.71 billion by 2032.

Exploring the Expansive World of Upholstered Furniture Through Comprehensive Market Dynamics, Emerging Consumer Behaviors, and Innovative Growth Trends

The executive summary opens by painting a vivid picture of the upholstered furniture landscape, where consumer tastes and production techniques converge to shape new opportunities. In an era defined by shifting lifestyles and digital empowerment, companies must adapt swiftly to meet demands for personalization, quality, and sustainability. This introduction situates the analysis within a broader economic context, emphasizing the interplay between material innovation, consumer expectations, and global supply chain dynamics that define the competitive arena today.

Building on this context, the summary outlines its own structure and objectives, guiding readers through a logical progression of insights. It promises a deep dive into transformative market shifts, an assessment of U.S. tariff impacts on cost structures and sourcing strategies in 2025, and a multi-angle segmentation framework. The narrative further sets expectations for regional and company analyses, culminating in actionable recommendations and methodological transparency. This roadmap ensures that decision-makers gain clarity on emerging trends and strategic levers to propel growth in the upholstered furniture sector.

Unveiling the Transformative Forces Shaping the Upholstered Furniture Landscape Amidst Digitalization, Sustainability, and Consumer Personalization Demands

The upholstered furniture sector is experiencing a profound transformation driven by technological integration and evolving consumer ideals. Digital commerce platforms now serve as primary touchpoints, enabling high-resolution virtual showrooms and design customization tools that bridge the gap between imagination and tangible products. Concurrently, sustainability has moved from a niche concern to a core brand attribute, with manufacturers increasingly incorporating eco-friendly materials and transparent supply chain practices to build consumer trust. These dual forces of digital and sustainable innovation are redefining what it means to deliver value in a traditionally tactile industry.

Another notable shift arises from a pervasive desire for personalization. Today’s consumers seek pieces that reflect their unique tastes and lifestyles, driving brands to offer modular designs and bespoke upholstery services. This trend dovetails with a broader emphasis on experiential retail, where in-store and online environments deliver immersive interactions rather than mere transactions. Retailers and manufacturers are thus collaborating on hybrid concepts, blending physical craftsmanship with digital analytics to tailor product assortments according to regional and demographic preferences.

Furthermore, resilience in supply chain operations has emerged as a strategic priority. Fluctuations in raw material availability and transportation disruptions have prompted leaders to diversify sourcing, leverage nearshoring tactics, and invest in supply chain visibility solutions. This holistic approach positions the industry to navigate geopolitical tensions and market uncertainties, ensuring consistent delivery of high-quality upholstered furniture to global consumers.

Assessing the Collective Consequences of United States Tariff Measures in 2025 on Upholstered Furniture Supply Chains, Cost Structures, and Strategic Sourcing Models

In 2025, new tariff measures introduced by the United States have exerted a cumulative influence on the upholstered furniture industry, reshaping cost structures and prompting strategic recalibration. Tariffs targeting imported timber and certain metal components have driven up the expense of foundational materials, compelling manufacturers to reassess their sourcing strategies. Domestic producers, in turn, have sought to fill the gap by forging partnerships with local mills and metalworks, fostering resilience even as input costs remain elevated.

The ripple effects of these tariffs extend beyond direct material expenses, affecting logistical considerations across the supply chain. Increased duties on imported raw hides and leather have led to a realignment of fabrication centers closer to high-quality tanneries, particularly within North America. This geographic shift introduces new efficiencies in lead times but also necessitates greater investment in regional manufacturing infrastructure. As a result, companies are balancing the trade-off between duty savings and capital expenditure to optimize their long-term cost base.

Strategic responses to tariff pressures also include material innovation and design adaptation. Manufacturers are experimenting with composite backings and recycled foam to offset the expense of traditional leather and hardwood frames. By integrating alternative materials without compromising on durability or aesthetics, brands are maintaining competitive price points and meeting consumer expectations for both quality and environmental responsibility. These initiatives underscore an industry-wide pivot toward greater supply chain autonomy and material versatility.

Delving into Critical Segmentation Perspectives That Illuminate Product Typologies, Material Preferences, Usage Scenarios, and Evolving Sales Channels in the Upholstery Sphere

A nuanced understanding of product typologies is essential for identifying growth pockets and tailoring product portfolios. Upholstered furniture offerings span from standalone chairs and loveseats to versatile ottomans, recliners, sectionals, and traditional sofas, each with subcategories that cater to specific consumer needs. Footstool and storage ottomans address multifunctional living spaces, while manual and power recliners serve both comfort and accessibility markets. Sectional configurations in L-shape, modular assemblies, and U-shape layouts enable customizable seating for diverse room dimensions, and sofas in corner, three-seater, and two-seater formats meet a spectrum of lifestyle requirements. Insights derived from these distinctions empower product teams to align design innovation with shifting usage scenarios.

Material preferences further delineate consumer segments, as fabric, faux leather, genuine leather, and microfiber capture varying value and performance propositions. Fabric variants such as cotton, polyester, and velvet each present unique tactile experiences and durability profiles. Similarly, faux leather alternatives differentiated by PU and PVC compositions offer cost-effective entry points, while leather grades of full grain, genuine, and top grain satisfy premium market expectations. Microfiber options, including nylon and polyester microfiber, strike a balance between stain resistance and softness, guiding material engineers and marketing strategists in curating product assortments that resonate across price tiers.

Application scenarios bifurcate the market into commercial and residential domains. Within commercial environments, healthcare seating demands rigorous hygiene and safety standards, hospitality settings prioritize aesthetic versatility, and office furnishing emphasizes ergonomic support. Residential applications split between bedroom and living room contexts, where design language and functional needs diverge based on room usage and consumer lifestyle choices. Recognizing these distinctions helps suppliers refine production runs and channel strategies.

Finally, distribution pathways range from traditional offline outlets to rapidly expanding online platforms. Department stores, furniture specialty shops, mass merchandisers, and dedicated furniture retailers dominate the brick-and-mortar segment, leveraging in-person display experiences. E-commerce channels span manufacturer websites, global marketplaces, and third-party retail platforms, each presenting unique customer journeys and fulfillment challenges. Detailed segmentation of these sales channels illuminates the competitive dynamics of distribution, enabling brands to optimize channel mix and enhance customer reach.

This comprehensive research report categorizes the Upholstered Furniture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Application

- Sales Channel

Revealing Regional Dynamics in Americas, Europe Middle East & Africa, and Asia-Pacific That Drive Diverse Demand Patterns and Market Opportunities in Upholstered Furniture

Regional dynamics play a pivotal role in shaping the strategic imperatives of upholstered furniture stakeholders. In the Americas, robust home renovation trends in the United States and Canada coexist with emerging growth corridors in Latin America. Consumers across these markets increasingly favor multifunctional and eco-friendly furnishings, prompting suppliers to emphasize sustainable sourcing and versatile design. Cross-border trade agreements and regional logistics hubs further facilitate streamlined distribution, reducing lead times and bolstering supply chain resilience in a geography marked by diverse economic and cultural profiles.

Across Europe, the Middle East, and Africa, a tapestry of mature and nascent markets drives eclectic demand patterns. Western Europe continues to lean toward premium craftsmanship and heritage brands, with an emphasis on artisanal quality and design pedigree. Meanwhile, the Middle East exhibits strong appetite for luxury upholstery imbued with bespoke finishes, and Africa’s expanding urban centers are awakening to mid-tier offerings that balance affordability with durability. Navigating regulatory frameworks and import duties remains paramount in this expansive region, urging companies to adopt locally tailored entry strategies and distribution partnerships.

In the Asia-Pacific arena, rapid urbanization and rising consumer incomes underpin a surge in demand for contemporary upholstered pieces. China and India spearhead volume growth, fueled by urban millennials seeking stylish, customizable solutions at accessible price points. Australia’s mature market underscores demand for sustainable and high-end offerings, while Southeast Asian economies exhibit dynamic e-commerce adoption, reshaping conventional retail footprints. Success in this region hinges on agile product adaptation and omnichannel integration that resonate with digital-first shoppers and traditional retail customers alike.

This comprehensive research report examines key regions that drive the evolution of the Upholstered Furniture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Pioneering Industry Players and Their Strategic Initiatives Fueling Innovation, Market Expansion, and Competitive Advantage in Upholstered Furniture

Key players in the upholstered furniture domain are amplifying their competitive edge through concerted investments in innovation, branding, and operational excellence. Established manufacturers are channeling resources into research and development for advanced textiles and smart features, ranging from stain-repellent coatings to integrated charging ports. Meanwhile, forward-thinking disruptors are forging direct-to-consumer models, leveraging digital analytics to anticipate design trends and personalize offerings at scale.

Strategic alliances and acquisitions are also reshaping the competitive landscape, as industry titans seek to complement their portfolios with niche design studios and sustainable material specialists. By integrating emerging brands with distinctive aesthetics or proprietary processes, these conglomerates are broadening their consumer reach and accelerating time-to-market for innovative products. In parallel, mid-market players are capitalizing on agile manufacturing techniques and local craftsmanship to differentiate through quality and lead times.

Marketing strategies are increasingly omnichannel, with social commerce, influencer collaborations, and immersive showrooms coalescing to foster brand loyalty. Companies are adopting data-driven demand forecasting and digital supply chain management to refine inventory levels and minimize markdown pressures. Collectively, these initiatives underscore a market driven by both technological adoption and a renewed focus on consumer-centric design, setting the stage for the next phase of competitive rivalry in upholstered furniture.

This comprehensive research report delivers an in-depth overview of the principal market players in the Upholstered Furniture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arhaus

- Ashley Furniture Industries Inc

- B&B Italia

- Bassett Furniture Industries Inc.

- Bernhardt Furniture Company

- DFS Furniture PLC

- Ekornes ASA

- Flexsteel Industries, Inc.

- Haworth Inc.

- HNI Corporation

- Hooker Furnishings Corporation

- Inter IKEA Systems B.V.

- Jason Furniture (Hangzhou) Co., Ltd.

- Kimball International Inc.

- La-Z-Boy Incorporated

- Man Wah Holdings Ltd.

- MillerKnoll, Inc.

- Natuzzi S.p.A.

- Okamura Corporation

- Roche Bobois

- Rolf Benz

- Steelcase Inc.

- Stickley Furniture Inc.

- Williams-Sonoma, Inc.

Strategic Recommendations Empowering Industry Leaders to Navigate Market Complexities, Harness Emerging Trends, and Enhance Operational Resilience in Upholstery

To thrive amidst evolving consumer preferences and operational complexities, industry leaders must adopt a multifaceted strategic playbook. First, elevating digital capabilities through investments in immersive online configurators and augmented reality experiences will cultivate deeper customer engagement while reducing return rates. These platforms should be underpinned by robust data analytics, enabling precise demand forecasting and targeted personalization that resonate with diverse buyer personas.

Secondly, diversifying material sourcing and forging strategic partnerships with eco-certified suppliers will mitigate tariff risks and align product portfolios with rising environmental expectations. Embracing circular design principles-such as modular components and recyclable frameworks-can unlock new value streams and strengthen brand equity in sustainability. Operationally, regional manufacturing hubs and flexible assembly models can expedite delivery timelines and buffer against logistical disruptions.

Finally, cultivating an omnichannel ecosystem that harmonizes offline tactile experiences with digital convenience is imperative. Flagship showrooms equipped with virtual design stations should complement streamlined e-commerce interfaces, while after-sales support and customization services reinforce long-term customer relationships. By embedding these strategic pillars-digital innovation, sustainable supply chain, and omnichannel integration-industry leaders can secure resilient growth and a durable competitive advantage in the dynamic upholstered furniture market.

Comprehensive Research Methodology Integrating Primary Insights, Desk Analysis, and Multiregional Data Collection for Robust Upholstered Furniture Market Intelligence

The research methodology underpinning this analysis integrates both qualitative and quantitative approaches to ensure comprehensive and reliable insights. Primary research involved in-depth interviews with senior executives across manufacturing, distribution, and retail segments, complemented by surveys of end-users across key regions. These engagements captured first-hand perspectives on emerging design preferences, supply chain challenges, and channel dynamics.

Secondary research encompassed an exhaustive review of industry publications, trade associations, regulatory filings, and corporate disclosures. Data triangulation was achieved by cross-referencing company performance reports with customs databases and logistics provider metrics, providing a multifaceted view of trade flows and material costs. Regional market intelligence was enriched through localized desk research and consultations with field experts in North America, EMEA, and Asia-Pacific.

Analytical rigor was maintained through segmentation modeling based on product typology, material composition, application usage, and sales channel distribution. Comparative analysis of tariff and policy impacts leveraged official government sources and industry association data. This multilayered methodology ensured that findings reflect the most current market realities, delivering actionable intelligence that informs strategic decisions across the upholstered furniture value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Upholstered Furniture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Upholstered Furniture Market, by Product Type

- Upholstered Furniture Market, by Material

- Upholstered Furniture Market, by Application

- Upholstered Furniture Market, by Sales Channel

- Upholstered Furniture Market, by Region

- Upholstered Furniture Market, by Group

- Upholstered Furniture Market, by Country

- United States Upholstered Furniture Market

- China Upholstered Furniture Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesis of Key Findings Emphasizing Adaptability, Segmentation Depth, and Regional Nuances to Guide Decision-Making in the Upholstered Furniture Sector

In summary, the upholstered furniture sector is at a strategic inflection point, driven by digital transformation, sustainability imperatives, and evolving consumer desires for personalization. The cumulative impact of U.S. tariff adjustments in 2025 has reshaped supply chain configurations and spurred material innovation, reinforcing the need for agile sourcing and manufacturing strategies. Multi-layered segmentation insights reveal distinct opportunities across product types, materials, applications, and channels, while regional analyses underscore the importance of tailored approaches in Americas, EMEA, and Asia-Pacific markets.

Competitive landscapes are being redefined by enterprises that excel in omnichannel engagement, supply chain resilience, and strategic collaboration. To navigate this dynamic environment successfully, industry stakeholders must embrace an integrated framework of digital capabilities, sustainable practices, and customer-centric design. By synthesizing these strategic pillars with rigorous research insights, decision-makers can steer their organizations toward long-term growth and market leadership.

Engage with Associate Director Ketan Rohom to Secure the Definitive Upholstered Furniture Market Research Report for Informed Strategic Planning and Growth

Seize the Full Spectrum of Upholstered Furniture Insights to Guide Your Strategic Decisions and Accelerate Growth in a Competitive Landscape

Ready to transform your strategic approach with unparalleled market intelligence? Ketan Rohom, Associate Director, Sales & Marketing, is poised to guide you through the comprehensive report that unpacks every facet of the upholstered furniture domain. From deep segmentation analysis to regional dynamics and industry best practices, this report equips you with the insights needed to outpace competitors and capitalize on emerging opportunities.

Reach out to explore tailored packages, unlock exclusive data sets, and engage in a one-on-one strategy session with Ketan to customize findings for your unique business challenges. Secure your copy today and embark on a data-driven journey toward sustainable growth and innovation in the upholstered furniture market.

- How big is the Upholstered Furniture Market?

- What is the Upholstered Furniture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?