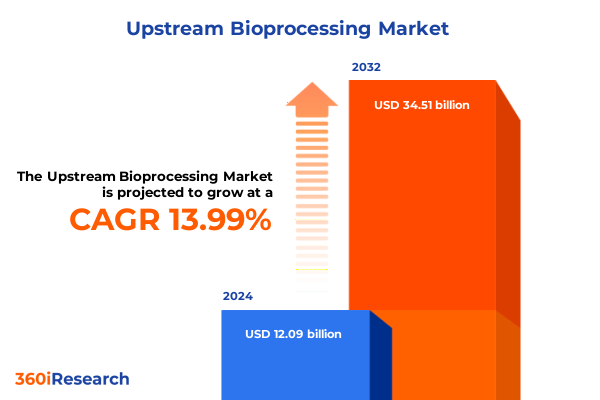

The Upstream Bioprocessing Market size was estimated at USD 13.81 billion in 2025 and expected to reach USD 15.77 billion in 2026, at a CAGR of 13.97% to reach USD 34.51 billion by 2032.

Setting the Stage for Innovation in Upstream Bioprocessing with Insights into Core Principles Emerging Challenges and Market Drivers

Upstream bioprocessing lies at the very heart of modern biologics development, encompassing the cultivation, growth, and initial processing of cells and microorganisms. This foundational stage shapes the quality, yield, and integrity of a wide range of life-saving therapies, from monoclonal antibodies and recombinant proteins to gene therapies and vaccines. By controlling environmental conditions such as temperature, pH, dissolved oxygen, and nutrient supply, manufacturers can optimize productivity and consistency in a way that directly influences downstream purification and final product performance.

As the biopharmaceutical industry advances, upstream bioprocessing has evolved into a complex ecosystem of technologies, protocols, and regulatory requirements. What was once limited to traditional stainless steel reactors now spans single-use systems, continuous processing platforms, and highly automated sensor networks. This evolution highlights the critical importance of robust process development, scale-up strategies, and cross-functional collaboration between R&D, manufacturing, quality, and supply chain teams.

In this report, we delve into the driving forces reshaping the upstream bioprocessing landscape, examine the cumulative effects of 2025 U.S. tariff policies, and offer actionable recommendations for decision-makers. Through a balanced integration of strategic analysis and real-world case studies, this executive summary sets the stage for deeper exploration into segmentation, regional nuances, and competitive dynamics that will define success in the next phase of biologics manufacturing.

Unveiling Transformative Technological and Operational Shifts Reshaping Upstream Bioprocessing for Enhanced Agility and Control

The upstream bioprocessing arena has witnessed remarkable shifts that extend far beyond incremental improvements. Digital transformation initiatives have introduced advanced data analytics and machine learning algorithms, enabling predictive modeling of culture behavior and real-time quality monitoring. This convergence of biotechnology and information technology has empowered manufacturers to minimize variability, accelerate process development timelines, and reduce operational costs through enhanced process control and remote monitoring capabilities.

Simultaneously, the adoption of single-use technologies has accelerated, driven by their lower capital requirements, reduced cleaning validation burdens, and enhanced flexibility for multi-product facilities. Single-use bioreactors and associated fluid handling components have enabled rapid changeover between campaigns, supporting personalized medicine and smaller batch sizes with greater economic viability. At the same time, continuous bioprocessing approaches are gaining traction, promising sustained productivity gains and smaller facility footprints by integrating upstream and downstream stages into unified, continuous flows.

Furthermore, the industry is experiencing a paradigm shift toward modular facility design, where prefabricated units and standardized hardware accelerate the build-out of new manufacturing capacity. This shift is accompanied by increased collaboration between equipment suppliers, contract development and manufacturing organizations, and end-user companies seeking to co-innovate novel solutions. As these transformative forces converge, organizations that embrace agility, digitalization, and collaborative ecosystems will be best positioned to lead the next wave of biomanufacturing innovation.

Examining the 2025 U S Tariff Developments and Their Strategic Influence on Upstream Bioprocessing Supply Chain Resilience

In 2025, new U.S. tariff measures targeting key inputs for bioprocessing introduced a complex layer of supply chain considerations. Specifically, higher duties on select raw materials and disposable components imported from certain regions have elevated procurement costs and encouraged manufacturers to reassess supplier partnerships. Companies have responded by exploring alternative sourcing strategies, including near-shoring and local supplier development, to mitigate exposure to tariff volatility and ensure uninterrupted supply of critical media components, filters, and single-use bioreactor bags.

The cumulative impact of these tariff changes has also accelerated the adoption of innovation in raw material alternatives. For instance, there has been increased investment in the development of chemically defined media formulations that reduce reliance on imported growth supplements and animal-derived components. Concurrently, manufacturers are streamlining buffer systems and salts to concentrate purchasing volumes and negotiate more favorable terms with domestic producers.

These adjustments have ripple effects across process economics and project timelines. Procurement teams are now integral partners in process development, collaborating closely with R&D to align material specifications with commercially viable, tariff-resilient supply chains. While short-term cost pressures have posed challenges, they have also driven more strategic supplier evaluation frameworks and intensified the quest for supply chain transparency and resilience.

Distilling Complex Segmentation Landscapes across Products Technologies Applications End Users Scales and Cell Types for Strategic Clarity

A nuanced understanding of product segmentation reveals distinct innovation trajectories and investment priorities within upstream bioprocessing. When examining Accessories And Consumables alongside Bioreactors, it becomes clear that single-use equipment is galvanizing demand for pre-sterilized, disposable components. Within Media And Reagents, the evolution from basal media anchors through chemically defined formulations to serum-free alternatives highlights the drive for more consistent, animal-component-free cell culture systems. Buffers And Salts have consolidated around high-purity, ready-to-use formats, while specialized cell culture supplements and growth factors are increasingly tailored to specific cell lines and therapeutic applications.

On the technology front, diverse bioreactors-from Airlift and Fixed-Bed to Stirred-Tank and Wave systems-address a spectrum of scale and process complexity requirements. Single-Use Bioreactors have gained particular momentum in early-stage process development and small-batch production, where their modular attributes align with flexibility and speed to market.

Application segmentation further underscores process diversity. Monoclonal antibody and recombinant protein production continue to leverage high-density suspension cultures, whereas gene and cell therapy vector production demands ultra-high potency bioprocess controls. Vaccine manufacturing, reinvigorated by global health imperatives, relies on robust microbial fermentation strategies and enhanced viral culture systems.

End users range from academic and research institutes pioneering early-stage innovations to large biopharmaceutical companies scaling up commercial campaigns. Contract research organizations bridge development gaps through specialized services, while government laboratories contribute to foundational research and regulatory validation. Across scales-from lab bench proofs to pilot demonstrations and large-scale commercial reactors-the market reflects a tapestry of tailored solutions optimized for each cell type, including insect and plant culture, mammalian systems, and microbial platforms.

This comprehensive research report categorizes the Upstream Bioprocessing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Scale

- Cell Type

- Application

- End User

Unraveling Diverse Regional Dynamics Shaping Upstream Bioprocessing Investment Innovation and Regulatory Trends

Regional dynamics play a pivotal role in determining the trajectory of upstream bioprocessing innovation and investment. In the Americas, a strong emphasis on expanding commercial biomanufacturing capacity has been matched by incentives for domestic production of raw materials to mitigate import dependencies. This region’s well-established contract development and manufacturing organizations are pioneering flexible facility designs that can be rapidly reconfigured to meet evolving therapeutic demands.

Meanwhile, Europe, the Middle East & Africa continue to focus on regulatory harmonization and sustainability. European initiatives targeting carbon footprint reduction in bioprocessing have spurred interest in energy-efficient equipment and solvent-free cleaning processes. In the Middle East, burgeoning biotechnology hubs are benefiting from government-backed innovation funds aimed at cultivating local talent and infrastructure. Across Africa, collaborative research networks are leveraging public-private partnerships to accelerate vaccine production capabilities.

In Asia-Pacific, the rapid growth of biopharmaceutical markets in China, India, Japan, and emerging Southeast Asian economies has driven both capacity expansion and local innovation. Strong government support for biotech clusters has fostered an environment where domestic equipment manufacturers and media producers are investing heavily in R&D. Collectively, these regional ecosystems demonstrate divergent yet complementary pathways to meet global biologics demand and enhance supply chain agility.

This comprehensive research report examines key regions that drive the evolution of the Upstream Bioprocessing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Moves and Collaborative Innovations That Define the Competitive Landscape in Upstream Bioprocessing

Market participants in upstream bioprocessing are distinguishing themselves through targeted investments, collaborative partnerships, and proprietary technology portfolios. Leading equipment suppliers continue to augment single-use bioreactor offerings with integrated sensor arrays and modular skids that facilitate rapid deployment. At the same time, media and reagent specialists are entering strategic alliances with academic institutions to co-develop next-generation formulations that deliver enhanced cell viability and productivity.

Contract development and manufacturing organizations are notably broadening their solution suites, adding end-to-end process development services that span high-throughput screening to scale-up in commercial bioreactors. These CDMOs are leveraging digital twins and automated sampling to accelerate process qualification timelines and reduce critical path durations. Meanwhile, biotechnology innovators focusing on continuous processing are forging M&A transactions to consolidate technologies for seamless upstream-downstream integration.

Emerging start-ups are disrupting conventional models with decentralized manufacturing approaches and containerized facility modules, while established biopharma companies are internalizing critical capabilities through joint ventures and minority investments. This dynamic competitive landscape underscores the importance of strategic differentiation, intellectual property management, and customer-centric solution design in maintaining a leadership position.

This comprehensive research report delivers an in-depth overview of the principal market players in the Upstream Bioprocessing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abzena Ltd.

- Bio-Rad Laboratories, Inc.

- Boehringer Ingelheim International GmbH

- Corning Incorporated

- Danaher Corporation

- Distek, Inc.

- Eppendorf AG

- Esco Lifesciences Group Pte. Ltd.

- FUJIFILM Holdings Corporation

- GEA Group AG

- Lonza Group AG

- Meissner Filtration Products, Inc.

- Merck KGaA

- PBS Biotech, Inc.

- Pierre Fabre S.A.

- Rentschler Biopharma SE

- Repligen Corporation

- Sartorius AG

- Solvias AG

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Actionable Roadmap for Industry Leaders to Bolster Resilience Embrace Digitalization and Cultivate Strategic Collaborations in Bioprocessing

To thrive amid the evolving complexities of upstream bioprocessing, industry leaders should prioritize several key strategic actions. First, embedding supply chain risk management into early process design will create resilience against future tariff shifts and material shortages. By partnering with a diverse supplier base and investing in dual-sourcing strategies, organizations can minimize disruptions and optimize cost structures without compromising quality.

Second, accelerating the adoption of digital process platforms will yield substantial gains in productivity and regulatory compliance. Companies should pursue integrated manufacturing execution systems that unify data streams from bioreactors, sensors, and analytical instruments, enabling real-time quality assurance and process optimization. Cross-functional teams, including IT, quality, and operations, must collaborate to standardize data schemas and governance protocols.

Third, fostering open innovation through strategic collaborations with academic centers, technology developers, and contract organizations will expand access to emerging platforms such as continuous bioprocessing and advanced cell culture formulations. By co-investing in pilot projects and validation studies, stakeholders can de-risk technology transitions and accelerate time to clinic.

Lastly, developing flexible facility footprints that support both single-use and hybrid processing modes will provide the agility needed to respond to shifting product pipelines and market demands. Incorporating modular design elements and prefabricated units will reduce capital expenditure timelines and support scalable growth models.

Detailing a Rigorous Multi-Layered Research Approach Integrating Secondary Literature Expert Interviews and Quantitative Validation

This research synthesis was developed through a multi-tiered methodology combining secondary research and subject matter expert engagement. Initially, an exhaustive review of scientific literature, industry publications, patent filings, and regulatory guidelines was conducted to establish a foundational understanding of upstream bioprocessing technologies and market trends. This phase included analysis of peer-reviewed journals, white papers, and conference proceedings to ensure comprehensive coverage of recent advances.

In parallel, interviews were conducted with senior executives and technical specialists across equipment manufacturers, media and reagent companies, contract development organizations, and end-user biopharmaceutical firms. These discussions provided critical insights into real-world challenges, technology adoption drivers, and strategic priorities at the intersection of R&D and manufacturing.

Quantitative data sets were then synthesized to identify overarching patterns in regional investment, tariff impacts, and process scalability considerations. Data validation steps included cross-referencing publicly available corporate filings, industry reports, and import/export databases to confirm the influence of 2025 tariff measures on raw material flows.

Finally, the report underwent rigorous internal review by an interdisciplinary team of process engineers, market analysts, and regulatory experts. This iterative feedback loop ensured accuracy, relevance, and actionable clarity across all sections of the analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Upstream Bioprocessing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Upstream Bioprocessing Market, by Product

- Upstream Bioprocessing Market, by Technology

- Upstream Bioprocessing Market, by Scale

- Upstream Bioprocessing Market, by Cell Type

- Upstream Bioprocessing Market, by Application

- Upstream Bioprocessing Market, by End User

- Upstream Bioprocessing Market, by Region

- Upstream Bioprocessing Market, by Group

- Upstream Bioprocessing Market, by Country

- United States Upstream Bioprocessing Market

- China Upstream Bioprocessing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Insights on the Critical Convergence of Innovation Resilience and Collaboration Shaping the Future of Bioprocessing

The upstream bioprocessing landscape stands at a critical juncture defined by technological breakthroughs, supply chain recalibrations, and evolving global dynamics. As manufacturers advance single-use platforms, continuous processing methods, and data-driven controls, the potential for enhanced productivity and reduced time-to-market has never been greater. However, the landscape is equally shaped by strategic considerations tied to regional policy shifts, tariff frameworks, and the integration of sustainable practices.

Success in this environment will belong to those organizations that proactively align process design with supply chain resilience, leverage digitalization to standardize and streamline operations, and foster open innovation through collaborative ecosystems. By strategically navigating segmentation nuances-from media formulation preferences to cell type requirements-industry leaders can refine their portfolio approaches and capitalize on emerging applications in cell therapy, gene therapy, and advanced vaccine development.

Looking ahead, the continued convergence of biology and automation promises a future where upstream bioprocessing is more agile, precisely controlled, and environmentally conscious. Stakeholders who embrace modular facility designs, advanced sensor integration, and integrated data analytics will set the benchmark for efficiency and quality in biomanufacturing.

This executive summary provides a cohesive roadmap for decision-makers, highlighting the essential shifts, risks, and opportunities that will define the next chapter of upstream bioprocessing innovation.

Engage with Ketan Rohom to Unlock Comprehensive and Tailored Upstream Bioprocessing Market Intelligence for Strategic Leadership

If you are seeking the most comprehensive and actionable research insights into upstream bioprocessing, reach out to Ketan Rohom, who leads sales and marketing efforts at 360iResearch. Ketan’s expertise in translating complex industry dynamics into strategic decisions makes him the ideal partner to guide you through this market analysis. By initiating a conversation with Ketan, you gain direct access to tailored intelligence, customized support, and an expedited purchasing process.

Don’t miss the opportunity to equip your organization with an authoritative report that addresses the latest technological advancements, supply chain considerations, tariff impacts, and strategic opportunities across all segments and regions. Connect with Ketan Rohom today to secure your copy and position your team at the forefront of upstream bioprocessing innovation and resilience.

- How big is the Upstream Bioprocessing Market?

- What is the Upstream Bioprocessing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?