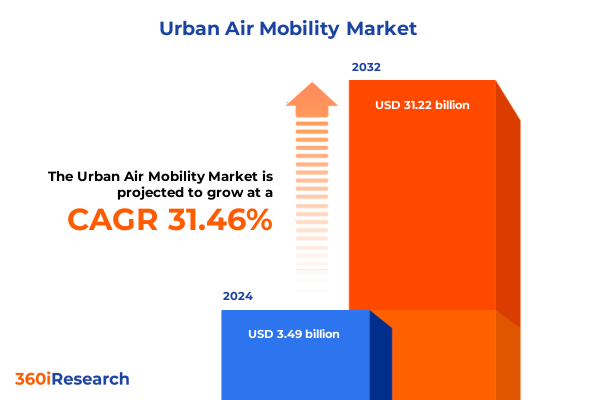

The Urban Air Mobility Market size was estimated at USD 4.52 billion in 2025 and expected to reach USD 5.84 billion in 2026, at a CAGR of 31.79% to reach USD 31.22 billion by 2032.

A concise introduction describing how vehicle innovation, airspace integration, and public policy are converging to create operational urban air mobility systems

Urban Air Mobility is no longer a speculative subplot in transportation planning: it is an emergent multimodal ecosystem where aircraft innovation, digital air traffic management, and new ground infrastructure are simultaneously maturing. The industry has moved beyond singular technical demonstrations into coordinated certification, airspace integration, and community engagement activities that bridge aerospace OEMs, traditional airlines, municipal planners, and emergency services. This convergence is driving pragmatic planning conversations about vertiports, charging and refueling networks, and the interoperability of traffic management systems with existing air navigation services.

Because progress depends as much on regulatory clarity and public acceptance as on vehicle performance, attention has shifted toward interoperable standards, pilot and maintenance training frameworks, and first‑mile/last‑mile connectivity strategies. These shifts are producing a distinct set of commercial pathways: piloted initial operations that leverage existing rotorcraft and airport infrastructure, hybrid piloted/autonomous models that reduce operating cost over time, and fully autonomous concepts that will require phased regulatory adaptation. As stakeholders evaluate market entry and infrastructure siting, they must reconcile acoustics, safety, land use, and multimodal access requirements in metropolitan planning processes.

How regulatory milestones, traffic management evolution, propulsion advances, and infrastructure investment are jointly redefining the UAM competitive and operational landscape

The landscape for urban air mobility is being reshaped by multiple parallel transformations that are as strategic as they are technical. Regulatory breakthroughs that establish a powered‑lift aircraft category and clarified pilot training requirements have removed long-standing institutional uncertainty and created a credible pathway for commercial air taxi and short‑haul cargo operations within controlled airspace. These regulatory milestones, paired with implementation roadmaps from national aviation authorities, are accelerating commitments from legacy OEMs and new entrants to finalize type certification programs and real‑world demonstration corridors. The maturation of air traffic management functionality-particularly workstreams focused on Unmanned Aircraft System Traffic Management and the integration of AAM into NextGen systems-has begun to define the data, connectivity, and performance thresholds required for safe, high-density operations.

At the same time, propulsion and energy system developments are broadening viable mission profiles. Advances in battery specific energy, rapid charging interfaces, and hybrid/hydrogen architectures are enabling diversified vehicle designs that match operational use cases ranging from short urban hops to longer intercity commutes. Parallel investments in vertiport design, grid upgrades, and distributed charging/refueling demonstrate that private capital and municipal planners increasingly see infrastructure as a foundational element of commercial launch plans. These combined shifts mean that project timelines and investment choices are being made in an environment where technical feasibility, regulatory acceptance, and infrastructure readiness are aligned in ways they were not a few years ago. For reference on the regulatory progress toward powered‑lift rulemaking and implementation plans, see FAA publications and related announcements.

An evidence-based review of how U.S. tariff policy actions in 2024–2025 materially altered sourcing risk, supplier strategies, and industrial localization calculus for UAM participants

The tariff environment in 2024–2025 has introduced a new layer of complexity for companies designing, sourcing, and operating urban air mobility platforms and their supply chains. Policy actions that adjusted section 301 duties and later implemented broader reciprocal tariffs have increased import risk for key subsystems and components, particularly for battery materials, electrical components, and certain airframe and propulsion assemblies. These changes have pressured procurement teams to reassess supplier concentration, near‑shore alternatives, and the cost‑benefit tradeoffs of vertical integration versus distributed sourcing. Public documentation of these tariff actions and the sectors targeted clarifies which inputs are most exposed and which exemptions or phase‑ins may be available to preserve continuity in certification and production programs.

Practically, the combined effects of targeted duties on electric powertrain components and the emergence of broader reciprocal import levies have tightened timelines for supply‑chain localization and created incentives for production footprints to shift toward tariff‑exempt geographies. Companies that had planned for globalized, lowest‑cost sourcing are reweighting their build strategies to mitigate margin erosion and avoid production interruptions. These dynamics also amplify the strategic value of long‑term supplier partnerships, contractual safeguards such as price indexing and hedging for raw materials, and investment in domestic manufacturing capacity for high‑exposure elements. For the specific policy references and public statements that shaped the 2024–2025 tariff environment, see U.S. government memoranda and executive orders that outline the sectoral adjustments and broader reciprocal tariff measures.

Actionable segmentation insights showing how vehicle type, propulsion, range, autonomy, infrastructure, application, and end user define distinct commercialization pathways for UAM

Segment-level dynamics reveal differentiated pathways to commercialization driven by vehicle architecture, propulsion choice, mission range, and levels of autonomy. Vehicle type distinctions-ranging from small inspection drones and vertical‑lift eVTOL air taxis to larger passenger aerial vehicles-determine regulatory entry points, insurance frameworks, and community engagement needs, with drones typically following a faster integration path for aerial survey and logistics use cases while passenger platforms face the most stringent certification and public acceptance hurdles. Propulsion technology similarly creates bifurcated supplier ecosystems: electric architectures concentrate risk on battery cells, power electronics, and thermal management, whereas hybrid electric and hydrogen fuel cell approaches require investment in fuel infrastructure, hydrogen supply chains, and different maintenance regimes.

Range segmentation differentiates operational economics and infrastructure placement; short‑range vehicles favor dense vertiport networks and rapid‑charge systems, medium‑range platforms can bridge suburban corridors to urban centres with fewer ground assets, and long‑range aircraft necessitate higher‑energy propulsion systems and regional vertiport distribution. Autonomy level is another axis that shapes workforce planning, liability models, and incremental certification strategies: piloted and remote‑piloted operations are expected to dominate early commercial deployments while semi‑autonomous and fully autonomous capabilities evolve through staged approvals that combine human oversight and certified automated functions. Infrastructure segmentation is centered on digital and physical enablers-air traffic management integration, interoperable charging or refueling stations, and modular vertiport design-that must be procured and permitted in coordination with local authorities. Application and end‑user segmentation further refines revenue models and stakeholder engagement; aerial survey and inspection use cases can often scale rapidly via performance‑based regulatory regimes, cargo transport leverages existing logistics networks for cost‑efficient freight and specialized medical supply missions, emergency services require rigorous reliability and mission‑ready maintenance protocols, and passenger transport remains the most complex value stream because it aggregates safety certification, customer experience, and urban land‑use constraints. The segmentation taxonomy thus provides a practical framework for aligning product roadmaps, infrastructure investments, and commercialization sequencing.

This comprehensive research report categorizes the Urban Air Mobility market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Propulsion Type

- Autonomy Level

- Infrastructure

- Application

- End User

Key regional contrasts across the Americas, Europe‑Middle East‑Africa, and Asia‑Pacific that determine where UAM pilots, manufacturing, and infrastructure will first coalesce

Regional dynamics are shaping distinct commercialization rhythms across the Americas, Europe–Middle East–Africa, and Asia‑Pacific, each with institutional strengths and constraints that influence strategic entry choices. In the Americas, regulatory progress and municipal partnerships in selected U.S. cities have fostered early pilot corridors, supported by supportive rulemaking for powered‑lift aircraft and implementation planning that integrates AAM into national airspace modernization efforts. These conditions, coupled with access to venture and airline capital, make North American markets attractive for early rollouts that leverage existing airport infrastructure and air taxi lanes.

In Europe, the Middle East, and Africa, regulatory fragmentation is balanced by ambitious national‑level programs and city partnerships; some European states are advancing harmonized vertiport standards and urban planning pilots, while Gulf states are actively funding infrastructure pilots and public‑private demonstrations. Asia‑Pacific presents a heterogeneous picture but features concentrated manufacturing capability, integrated urban planning in leading megacities, and rapid adoption of drone logistics use cases. Across regions, the interplay of trade policy, industrial incentives, and local permitting regimes determines where manufacturing, maintenance, and commercial routes are most likely to coalesce, requiring market entrants to construct differentiated regional strategies that reflect regulatory timelines, infrastructure readiness, and procurement priorities.

This comprehensive research report examines key regions that drive the evolution of the Urban Air Mobility market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

A strategic assessment of how incumbent OEM strength, eVTOL innovators, and service ecosystem companies are positioning to capture critical value in early UAM deployments

Corporate positioning in urban air mobility is currently characterized by a mix of aerospace incumbents scaling expertise and newer, dedicated eVTOL developers moving rapidly through certification milestones. Established aerospace firms bring decades of systems‑integration experience, deep supplier networks, and an ability to underwrite long certification timelines, while newer manufacturers are focused on optimized electric propulsion, low noise signatures, and customer experience designed for short‑haul urban trips. Strategic partnerships between airframers, airlines, logistics providers, and infrastructure developers are increasingly the norm; these alliances address gaps in air operations, ground handling, and route commercialization while allowing each partner to leverage core competencies.

Beyond vehicle OEMs, ecosystem participants that provide battery systems, thermal management, avionics, sense‑and‑avoid, and vertiport construction are critical to capturing program value. Service providers concentrating on vertiport operations, software for traffic management and fleet orchestration, and specialized maintenance, repair, and overhaul will play outsized roles in early commercial networks. Companies that have prioritized demonstrable safety cases, robust pilot‑in‑the‑loop operations, and verified community noise mitigation plans are in the strongest position to secure municipal approvals for initial corridors. Finally, logistics and emergency service operators that have already adopted drone and advanced air mobility testbeds demonstrate that non‑passenger use cases will continue to lead revenue realization and operational learning for the broader passenger market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Urban Air Mobility market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus S.A.S.

- Airspace Experience Technologies Inc. by Detroit Aircraft Corporation

- Archer Aviation Inc.

- Ascent Flights Global Pte. Ltd.

- BETA Technologies, Inc.

- EHang Holdings Limited

- Electra Aero, Inc.

- Embraer SA

- Hyundai Motor Group

- Joby Aviation, Inc.

- Leonardo S.P.A

- Lockheed Martin Corporation

- Metro Hop

- Pipistrel Group by Textron

- Safran SA

- Skydrive Inc.

- Skyports Infrastructure Limited

- The Boeing Company

- Vertical Aerospace Group Ltd.

- Volocopter GmbH

Clear, operational recommendations for C‑suite and program leaders to phase commercialization, diversify supply chains, secure municipal buy‑in, and scale operations responsibly

Leaders preparing to compete and collaborate in urban air mobility should adopt a pragmatic, phased approach that aligns technology, regulation, and infrastructure investment with commercially viable use cases. First, prioritize low‑friction applications-such as inspection, mapping, surveillance, and targeted cargo or medical supply routes-to establish operational credibility and to mature maintenance and systems integration workflows. These early programs reduce risk while generating operational data that supports certification and community acceptance processes. Second, pursue supply‑chain diversification and contractual protections for high‑exposure components, particularly battery cells, power electronics, and specialized avionics, and evaluate near‑shore manufacturing or bonded production arrangements where tariffs or logistics risk are significant.

Third, engage proactively with regulators and municipalities to co‑design vertiport site standards, public engagement plans, and noise mitigation strategies; well‑structured community outreach and demonstrable noise and safety performance will materially shorten permitting cycles. Fourth, build partnerships with logistics providers, emergency services, and airlines to aggregate demand and to accelerate utilization of initial corridors. Finally, allocate resources to resilient software platforms for fleet orchestration, secure data exchange for ATM integration, and workforce development programs for pilots and maintenance personnel so that operational scale‑up does not outpace human and digital infrastructure readiness.

A transparent description of the research approach integrating stakeholder interviews, regulatory literature, corporate filings, and scenario validation to ensure methodological rigor

This research synthesized primary interviews with airframe developers, avionics and propulsion suppliers, regulators, and municipal infrastructure planners, combined with an analysis of public‑domain regulatory materials, corporate filings, certification updates, and observed demonstration programs. Qualitative interviews focused on certification timelines, supplier concentration risks, and infrastructure planning assumptions, while document analysis validated regulatory milestones and policy shifts that materially shape commercialization choices. The segmentation framework was applied to cross‑check which vehicle and propulsion combinations align with specific applications and infrastructure archetypes, and regional case studies were developed to illustrate where regulatory readiness and infrastructure investment converge.

Data integrity was preserved through document cross‑referencing and corroboration of corporate milestones with regulator disclosures and company press releases. Where public policy actions affected supply‑chain strategies-most notably tariff measures announced in 2024 and expanded in 2025-these were mapped to exposed input categories and to plausible mitigation pathways. The methodology prioritized transparency in source attribution, a multi‑stakeholder perspective to avoid single‑party bias, and scenario‑based validation to demonstrate how segmented pathways lead to different operational timelines and capital requirements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Urban Air Mobility market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Urban Air Mobility Market, by Vehicle Type

- Urban Air Mobility Market, by Propulsion Type

- Urban Air Mobility Market, by Autonomy Level

- Urban Air Mobility Market, by Infrastructure

- Urban Air Mobility Market, by Application

- Urban Air Mobility Market, by End User

- Urban Air Mobility Market, by Region

- Urban Air Mobility Market, by Group

- Urban Air Mobility Market, by Country

- United States Urban Air Mobility Market

- China Urban Air Mobility Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

A synthesis conclusion emphasizing phased commercialization, supply chain resilience, regulatory coordination, and infrastructure as the determinant of long‑term success

Urban air mobility is progressing from promise to pragmatic deployment as regulatory, technical, and infrastructural building blocks align around a set of feasible early use cases. Near‑term commercialization will be uneven across vehicle classes and regions, and it will favor applications that can be staged within existing operational frameworks-inspection, mapping, logistics, and constrained passenger routes that leverage airport infrastructure. The industry’s ability to scale beyond pilots will depend on three linked capabilities: resilient and diversified supply chains for high‑exposure components, repeatable permitting and community engagement processes, and robust integration of new traffic management layers with conventional air navigation services.

Looking ahead, organizations that adopt phased commercialization strategies, invest in regional manufacturing and supplier partnerships where policy risk is concentrated, and prioritize measurable community and safety outcomes will have a durable advantage. The most successful operators will be those that treat infrastructure as a strategic asset, collaborate to standardize interoperability across ATM and vertiport systems, and use early non‑passenger revenues to de‑risk passenger operations. With clear regulatory pathways now established in several jurisdictions and with demonstrable progress on certification programs, the industry is positioned for incremental, measurable growth-provided stakeholders remain attentive to supply‑chain resilience, public policy shifts, and community acceptance dynamics.

A clear next-step offering to purchase the urban air mobility report and schedule a tailored briefing with the Associate Director, Sales & Marketing

For direct access to the full market research report and to discuss tailored licensing, enterprise data packages, or bespoke briefing sessions, please reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan will coordinate a personalized walk-through of the report’s scope, methodology, and deliverables, and can advise on how to align the findings to procurement, regulatory engagement, and strategic partnership needs. He will arrange demonstrations of the proprietary data dashboards, answer questions on segmentation and regional analysis, and coordinate timelines for delivery and customized appendices tailored to specific corporate or public-sector priorities.

Engaging with Ketan provides a practical short‑path to deploy insights for immediate decision-making: from procurement and supplier diversification to regulatory scenario planning and vertiport planning support. To schedule a briefing or request a bespoke proposal, ask for a conversation with Ketan Rohom, Associate Director, Sales & Marketing, who will manage next steps and ensure a rapid, confidential engagement to translate the research into operational actions.

- How big is the Urban Air Mobility Market?

- What is the Urban Air Mobility Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?