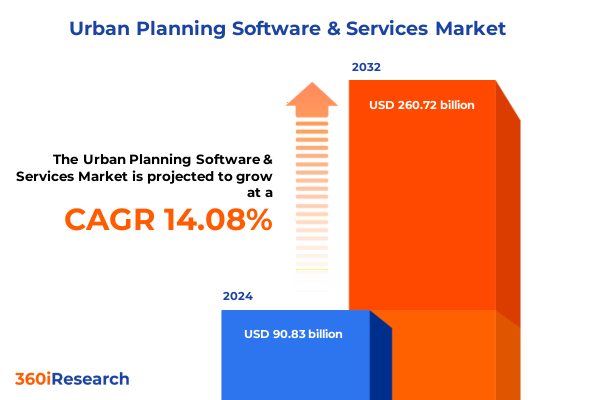

The Urban Planning Software & Services Market size was estimated at USD 103.41 billion in 2025 and expected to reach USD 117.74 billion in 2026, at a CAGR of 14.12% to reach USD 260.72 billion by 2032.

Discover the Multifaceted Landscape of Urban Planning Software and Services Catalyzing Modern City Development and Strategic Growth

The urban planning software and services sector stands at the intersection of technological innovation and public policy, fundamentally reshaping how cities envision, design, and manage their built environments. Over recent years, rapid advancements in digital modeling, data analytics, and cloud technologies have converged with growing societal demands for sustainable, resilient urban spaces. This confluence has spurred a wave of transformation, challenging traditional workflows while unlocking unprecedented potential for efficiency, stakeholder collaboration, and evidence-based decision making.

Amid this evolution, municipal authorities, private developers, and infrastructure providers are grappling with increasingly complex project requirements, tighter budgets, and the imperative to integrate smart city capabilities. At the same time, software developers and service consultancies are racing to deliver modular, scalable solutions that enable seamless integration with existing systems, real-time data visualization, and predictive analytics. By navigating these shifting dynamics, organizations can accelerate urban renewal projects, optimize land use, and enhance public safety through data-driven planning approaches that align with long-term socio-economic goals.

Unveiling the Core Transformative Trends Reshaping Urban Planning Technology and Service Delivery Across Global Markets

The landscape of urban planning is undergoing seismic shifts driven by breakthrough technologies and evolving stakeholder expectations. Cloud-native deployments now underpin collaborative platforms, allowing planners, engineers, and policymakers to co-author 3D models and simulations across dispersed teams. This cloud-enabled synergy replaces static, siloed approaches with continuous, iterative feedback loops that improve both design accuracy and project delivery timelines.

Simultaneously, the maturation of building information modeling and geographic information systems is merging physical and spatial data into unified digital twins. These dynamic virtual replicas offer granular insights into infrastructure performance, traffic flow patterns, and environmental impact, which, when paired with data analytics, empower predictive scenario testing. As a result, urban authorities can simulate development alternatives, evaluate resource allocation, and optimize emergency response procedures-all before breaking ground.

Furthermore, the integration of AI and machine learning algorithms is supercharging planning tasks by automating routine analyses, identifying hidden correlations in large datasets, and providing recommendations for zoning, land use, and transportation optimization. By embracing these transformative shifts, stakeholders are redefining the nature of urban planning from a sequential process to a real-time, adaptive strategy that fosters resilient, people-centric cities.

Analyzing the Far-Reaching Consequences of 2025 US Tariffs on Urban Planning Software and Professional Service Ecosystems

The 2025 imposition of tariffs on key software imports and professional service engagements has sent ripples throughout the urban planning ecosystem in the United States. By raising the cost of proprietary modeling tools and niche consultancy support, these trade measures have compelled both public and private stakeholders to seek more cost-effective, domestically sourced alternatives. Procurement teams are now reevaluating licensing agreements, exploring open-source geospatial platforms, and negotiating bundled service arrangements to mitigate elevated expenditure.

At the same time, domestic software providers and systems integrators have seized the moment to bolster their market positions by accelerating innovation cycles and expanding maintenance-and-support offerings. Local consultants are also forging strategic alliances to provide end-to-end implementation services, ranging from data migration and system integration to training and ongoing technical assistance. This shift toward onshore solutions not only addresses compliance concerns but also reduces lead times and fosters closer collaboration with end users.

Regulatory bodies have responded by streamlining certification processes for homegrown digital planning tools and facilitating access to public-sector pilot programs. These initiatives have created a virtuous cycle in which tariff-driven constraints spur domestic investment, ultimately strengthening the national ecosystem of urban planning software and services and enhancing its global competitiveness.

Illuminating Critical Segmentation Insights Driving Decision Making in Urban Planning Software and Services Market

Examining the market through a component lens reveals a dual landscape of software and services that complement and reinforce one another. Software offerings encompass building information modeling, spatial analytics, geographic information systems, and simulation tools, each tailored to address specific planning imperatives. On the services front, consulting forms the strategic backbone, guiding municipalities and developers through regulatory frameworks and project scoping. Integration and implementation services subsequently translate these strategies into functional systems, with customization, data migration, and system integration ensuring seamless operation. Maintenance and support preserve system integrity over time, while training equips in-house teams to maximize platform utility.

Deployment preferences further stratify the market into cloud, hybrid, and on-premise models. Cloud deployments prioritize rapid scalability and remote collaboration, whereas hybrid solutions balance existing infrastructure investments with new-technology flexibility. On-premise options remain viable for organizations with stringent data sovereignty requirements. End-user segmentation ranges from federal, state, and local government agencies to private developers, transportation authorities, and utilities, each with distinct operational mandates and budgetary constraints.

Large enterprises leverage enterprise resource planning integrations and advanced analytics to coordinate multi-phase infrastructure projects at scale, while small and medium enterprises, including mid-size and smaller firms, focus on agile software adoption and targeted service engagements. Application-driven segmentation spans infrastructure management, land-use planning, smart city solutions such as emergency response management and IoT-driven traffic oversight, transportation planning, and urban analytics, demonstrating the diverse use cases that drive technology selection and vendor partnerships.

This comprehensive research report categorizes the Urban Planning Software & Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- End User

- Organization Size

- Application

Evaluating Regional Dynamics and Distinctive Drivers Shaping Urban Planning Software and Services Adoption Worldwide

Regional nuances underscore how varying regulatory priorities, funding mechanisms, and development objectives shape adoption patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, public-sector initiatives centered on infrastructure renewal and climate resilience spur robust uptake of digital twins and BIM-enabled workflows. Private developers are likewise investing in analytics-driven land assessments to accelerate project approvals and optimize capital allocation.

Within Europe, Middle East & Africa, stringent data privacy regulations and ambitious smart city mandates drive demand for interoperable GIS platforms and end-to-end systems integration. Governments are funding pilot programs that incorporate IoT-enabled traffic management and emergency response modules, fostering vendor ecosystems that specialize in localized customization and multilingual support.

Asia-Pacific stands out for its rapid urbanization and mega-city expansions, prompting widespread adoption of cloud-native modeling services and AI-enhanced simulation tools. Major metropolises are leveraging public-private partnerships to deploy comprehensive land-use planning suites and integrated transportation platforms, underscoring the region’s appetite for scalable, future-proof solutions that address density challenges and mobility demands.

This comprehensive research report examines key regions that drive the evolution of the Urban Planning Software & Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Enterprises and Emerging Innovators Steering Evolution in Urban Planning Software and Services Domain

Leading corporations in this domain consistently blend organic innovation with strategic acquisitions to broaden their technological portfolios and service capabilities. Industry stalwarts known for pioneering building information modeling and GIS integration have extended their reach by adding advanced analytics modules and cloud orchestration services. Other prominent players have diversified through partnerships with IoT device manufacturers and AI research labs, embedding predictive maintenance and real-time monitoring functionalities into their offerings.

Emerging challengers are carving out niches by focusing on user-centric design, rapid deployment frameworks, and flexible subscription models that lower barriers to entry for smaller municipalities and private developers. These agile vendors often integrate third-party APIs to provide specialized applications-such as emergency response management or traffic analytics-demonstrating the value of modular ecosystems.

Furthermore, leading service consultancies have expanded their portfolios by offering cross-disciplinary teams that encompass urban planners, data scientists, and change-management experts. By delivering end-to-end advisory, integration, and training services, these firms ensure that transformative technologies are adopted smoothly and yield measurable operational improvements from project inception through to ongoing support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Urban Planning Software & Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accela, Inc.

- AECOM

- Arcadis N.V.

- Aurecon Group Pty Ltd

- Autodesk, Inc.

- Bentley Systems, Incorporated

- Cyburbia LLC

- Environmental Systems Research Institute, Inc.

- Felt Maps, Inc.

- Hexagon AB

- Jacobs Engineering Group Inc.

- Locus Technologies, Inc.

- Sasaki Associates, Inc.

- Smart Cities Council, Inc.

- Stantec Inc.

- Topcon Corporation

- Trimble Inc.

- UrbanFootprint, Inc.

- UrbanSim, Inc.

- WSP Global Inc.

Strategic Imperatives and Actionable Recommendations Empowering Industry Leaders to Capitalize on Urban Planning Innovations

Industry leaders should prioritize the development of cloud-native platforms that facilitate seamless collaboration among multi-disciplinary teams, ensuring both scalability and secure data sharing. Emphasizing open architecture and robust APIs will increase interoperability with existing infrastructure management systems, allowing clients to integrate new capabilities without disruption. Moreover, embedding AI and machine learning within analytics modules can automate routine spatial analyses, freeing planners to focus on high-value strategic tasks.

In parallel, vendors must refine their service portfolios by offering outcome-based consulting and support packages that align commercial incentives with client success metrics. Tailoring training and maintenance programs to specific end-user segments-from federal agencies to small developers-will enhance client retention and drive repeat engagements. Additionally, adopting flexible pricing structures that accommodate subscription-based and pay-as-you-use models can unlock new revenue streams and foster long-term partnerships.

Finally, proactive engagement with regulatory bodies and participation in pilot programs can position providers as thought leaders in the formulation of standards for digital twins, data privacy, and smart city interoperability. By contributing to policy dialogues and demonstrating compliance with emerging mandates, organizations can build credibility, reduce market entry barriers, and accelerate adoption across diverse regions.

Comprehensive Research Methodology Underpinning the Analysis of Urban Planning Software and Services Market Dynamics

This research was conducted using a rigorous, multi-faceted methodology that combines primary and secondary data collection. Secondary research comprised the review of industry journals, regulatory filings, public procurement records, and technology white papers to map landscape evolution and historical technology adoption patterns. Primary research involved in-depth interviews with senior executives, technical architects, and project managers across government agencies, private development firms, and leading solution providers to validate market trends and capture real-world implementation challenges.

Quantitative analyses were performed on anonymized procurement data and platform usage metrics to identify adoption rates across deployment models and application areas. Qualitative insights were triangulated with case studies of flagship urban development initiatives, enabling a holistic view of how component, deployment, and end-user dynamics converge. A three-stage validation process-comprising peer reviews, expert panels, and stakeholder workshops-ensured the research findings withstand scrutiny and remain relevant amid evolving regulatory and technological landscapes.

To maintain analytical integrity, the study adhered to strict confidentiality protocols, ethical guidelines, and data-security standards. Limitations, such as variations in reporting criteria among agencies and the nascent nature of certain technologies, were transparently documented. This methodological approach guarantees that the insights presented are robust, replicable, and actionable for decision makers seeking to navigate the urban planning software and services sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Urban Planning Software & Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Urban Planning Software & Services Market, by Component

- Urban Planning Software & Services Market, by Deployment

- Urban Planning Software & Services Market, by End User

- Urban Planning Software & Services Market, by Organization Size

- Urban Planning Software & Services Market, by Application

- Urban Planning Software & Services Market, by Region

- Urban Planning Software & Services Market, by Group

- Urban Planning Software & Services Market, by Country

- United States Urban Planning Software & Services Market

- China Urban Planning Software & Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings and Strategic Perspectives to Reinforce Understanding of Urban Planning Software and Services

In synthesizing the insights presented, it becomes evident that the urban planning software and services market is both dynamic and interconnected, driven by technological innovation, regulatory forces, and evolving stakeholder expectations. Digital twins, AI-powered analytics, and cloud-enabled collaboration are not mere buzzwords but foundational enablers of more resilient, efficient, and sustainable urban development practices.

Tariff-induced headwinds have accelerated the maturation of domestic ecosystems, prompting greater investment in homegrown solutions and service offerings. Meanwhile, nuanced segmentation across components, deployment modalities, end-user profiles, organizational scales, and application domains underscores the importance of tailored strategies. Regional disparities further highlight the necessity for localized approaches that account for regulatory, economic, and socio-technical variables.

For industry participants, success hinges on balancing innovation with adaptability-enabling seamless integration with legacy systems while championing open standards and cloud-native architectures. By aligning service models with tangible client outcomes and actively engaging in policy formation, organizations can secure competitive advantage and play a pivotal role in shaping the cities of tomorrow.

Engage with Ketan Rohom to Secure In-Depth Urban Planning Software and Services Research Insights and Drive Informed Decisions

To delve deeper into the nuanced opportunities, competitive dynamics, and technology landscapes that define the urban planning software and services domain, engage with Ketan Rohom. As Associate Director of Sales & Marketing, he guides stakeholders through tailored discussions that align specific organizational challenges with actionable insights drawn from the comprehensive research report. Connecting with him opens access to exclusive analyses on component-level innovations, deployment strategies, end-user prioritization, and application-driven use cases, empowering decision makers to make data-backed investments and forge strategic partnerships.

Investing in this in-depth study enables organizations to stay ahead of regulatory shifts, emerging tariff impacts, and rapid technological advances reshaping the sector. Whether you aim to refine product roadmaps, optimize service offerings, or navigate regional market entry strategies, the report serves as a practical roadmap. Reach out today to secure your copy and gain a competitive edge by leveraging expert guidance, robust data, and future-proof insights that drive sustainable growth and innovation in urban planning software and services.

- How big is the Urban Planning Software & Services Market?

- What is the Urban Planning Software & Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?