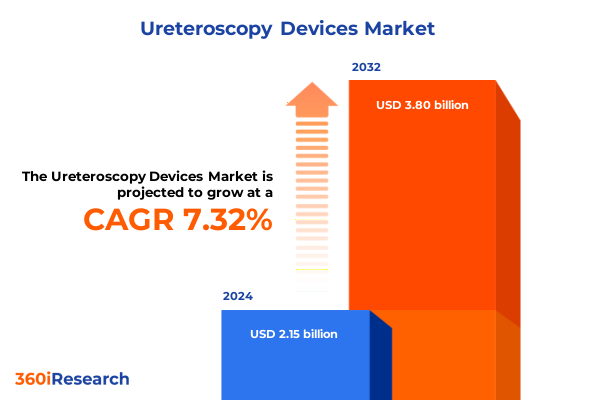

The Ureteroscopy Devices Market size was estimated at USD 2.31 billion in 2025 and expected to reach USD 2.47 billion in 2026, at a CAGR of 7.33% to reach USD 3.80 billion by 2032.

Unveiling the Ureteroscopy Device Market Strategic Context Emerging Trends and Key Drivers Shaping Future Trajectories

Ureteroscopy has emerged as a cornerstone in the management of renal and ureteral disorders, particularly nephrolithiasis and urothelial lesions. The procedure’s minimally invasive nature, combined with escalating prevalence of kidney stones-estimated at around 9.9 percent of U.S. adults, or roughly 23.7 million individuals-has intensified demand for advanced scope technologies. Concurrently, the shift toward outpatient care models, especially in ambulatory surgical centers, is reshaping service delivery frameworks, as clinics seek cost-effective, high-performance devices to support high case volumes.

Advancements in endoscope design, including miniaturized flexible scopes and high-definition imaging, have expanded the therapeutic and diagnostic reach of ureteroscopy. Digital flexible scopes now offer unparalleled visualization and reduced image artifacts compared to fiber-optic predecessors, while single-use devices introduce significant infection control benefits and ergonomic improvements for surgeons. As patient populations age and co-morbidities such as obesity and diabetes drive stone incidence, the need for reliable, high-precision ureteroscopes has never been more acute.

These intersecting trends underscore a dynamic market poised for further innovation. Understanding the interplay between procedure volumes, clinical outcomes, and device capabilities is essential for stakeholders aiming to navigate competitive pressures and harness growth opportunities. This executive summary presents a strategic overview of the current landscape, exploring transformative shifts, tariff impacts, segmentation nuances, regional variations, and key industry players to inform decision-making.

How Continuous Technological Evolution and Single-Use Innovations Are Redefining Ureteroscopy Procedures and Clinical Outcomes

Recent years have witnessed a paradigm shift in ureteroscopic technology, propelled by the transition from traditional fiber-optic scopes to high-resolution digital systems. Digital “chip on tip” architectures eliminate the characteristic “honeycomb” image pattern, enhance color fidelity, and maintain visual clarity under laser lithotripsy shockwaves, thereby boosting procedural precision and reducing surgeon fatigue. At the same time, single-use flexible ureteroscopes have gained traction, delivering both clinical performance on par with reusable alternatives and the added benefits of sterility assurance and simplified logistics.

Artificial intelligence and robotics are further augmenting the ureteroscopy landscape. AI-driven image analysis platforms enhance diagnostic accuracy by flagging minute anomalies in real time, while machine learning models are being developed to predict stone-free rates and stratify postoperative sepsis risk. Robotic-assisted ureteroscopy systems, featuring multi-axis articulated arms and haptic feedback, offer consistent maneuverability and reduced procedural variability. In parallel, augmented reality navigational tools overlay three-dimensional anatomical maps onto the surgical field, guiding scope navigation and ensuring comprehensive calyceal inspection with demonstrable improvements in stone clearance efficiency.

Together, these technological advancements are redefining clinical workflows and setting new benchmarks for safety, efficacy, and ergonomics. Early adopters of integrated digital-robotic platforms report improved outcomes, shorter operating times, and heightened surgeon confidence, heralding a new era of precision endourology.

Assessing the Cumulative Effects of 2025 United States Tariffs on Ureteroscopy Device Imports and Industry Strategies

In 2025, U.S. trade policy introduced a baseline 10 percent reciprocal tariff on most imports, effective April 5, while country-specific “reciprocal” duties continued to apply under the International Emergency Economic Powers Act. Although medical devices were initially exempt under emergency exclusions-including scopes and ancillary equipment-the U.S. Trade Representative’s office extended these exemptions only through May 31, 2025. Beyond that date, many ureteroscopy devices face reinstated tariffs, primarily composed of the baseline 10 percent levy in addition to existing Section 301 duties on Chinese-origin products, which can range up to 25 percent depending on the HTS classification of endoscopic instruments.

This multi-tiered tariff structure increases landed costs for imported digital and fiber-optic ureteroscopes, prompting OEMs and distributors to explore alternative sourcing strategies. Some manufacturers are accelerating efforts to localize production or shift components to tariff-favored regions to mitigate cost pressures, while healthcare providers are renegotiating supply agreements to manage budget impact. Meanwhile, the uncertainty surrounding final court rulings on the legality of certain tariffs has introduced additional supply chain risk, with distributors building inventory buffers to avoid disruptions.

Although patient demand remains robust, price-sensitive purchasers may delay upgrades or favor cost-efficient fiber-optic or single-use alternatives produced outside affected jurisdictions. Consequently, industry stakeholders must adapt strategic sourcing, contract negotiation, and product portfolio planning to navigate an evolving trade environment and safeguard margin performance.

Integrating Device Type Clinical Application End User Behavior Technology Adoption and Accessory Insights to Map Ureteroscopy Market Segmentation Dynamics

The ureteroscopy device market is characterized by a multi-dimensional segmentation framework that shapes competitive dynamics. By device type, flexible ureteroscopes-spanning both digital and fiber-optic architectures-dominate high-end procedural settings, while semi-rigid models retain relevance for simpler diagnostic and intervention tasks. Within flexible scopes, digital variants capture premium segments due to superior image quality, whereas fiber-optic systems maintain traction in cost-sensitive or resource-constrained environments.

Application-based segmentation delineates critical diagnostic and therapeutic use cases. Diagnostic scopes facilitate inspection and real-time visualization of the urinary tract, enabling early tumor detection and anatomical mapping. Therapeutic scopes are optimized for stone management-encompassing basket extraction and laser lithotripsy-and for tumor management through biopsy and laser ablation modalities. This dual classification highlights the imperative for device versatility and accessory compatibility in addressing diverse clinical workflows.

End users fall into two principal categories: hospitals and ambulatory surgical centers. Hospitals, including private and public institutions, serve as traditional hubs for complex ureteroscopy procedures, offering comprehensive support services and specialist personnel. Conversely, freestanding and hospital-affiliated ambulatory surgery centers are rapidly adopting ureteroscopy technologies to meet the growing preference for outpatient care and cost-effective treatment modalities.

Technology-based segmentation differentiates between digital and fiber-optic systems, each available in reusable and single-use configurations, reflecting an industry-wide pursuit of infection control, cost optimization, and functional performance. Accessory segmentation encompasses laser fibers-both holmium and thulium variants-and stone baskets, ranging from standard designs to tipless configurations, underscoring the importance of ancillary product ecosystems in driving procedural efficiency.

This comprehensive research report categorizes the Ureteroscopy Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Technology

- Accessories

- Application

- End User

Analyzing Geographic Market Characteristics Across the Americas Europe Middle East Africa and Asia-Pacific to Reveal Divergent Ureteroscopy Trends

Regional market dynamics exhibit distinct growth trajectories driven by healthcare infrastructure, regulatory frameworks, and epidemiological trends. In the Americas, the United States leads global ureteroscopy adoption, underpinned by advanced hospital systems, favorable reimbursement pathways-such as Transitional Pass-Through payment codes for single-use scopes-and a high prevalence of stone disease. Canadian programs are similarly elevating outpatient procedures, with clinics prioritizing disposable scopes to mitigate infection risks and streamline workflows.

In Europe, Middle East & Africa, public hospital budget constraints and stringent procurement processes have tempered uptake of premium digital systems, yet cost-containment imperatives are fueling interest in single-use devices that reduce reprocessing expenditures. Markets such as Germany and the United Kingdom exhibit strong demand for reusable digital scopes in academic and tertiary centers, while smaller ambulatory facilities increasingly favor flexibly priced fiber-optic or disposable alternatives.

Asia-Pacific is poised for the fastest growth, driven by expanding healthcare investments in China and India, rising awareness of minimally invasive treatments, and favorable government initiatives to improve urological care access. In these markets, manufacturers are tailoring portfolios to local price sensitivities, offering slimmer-profile scopes and bundled service agreements to accelerate adoption. Across all regions, the convergence of digital connectivity, training programs, and aftermarket support is shaping purchasing decisions and reinforcing competitive positioning.

This comprehensive research report examines key regions that drive the evolution of the Ureteroscopy Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Established Leaders and Emerging Innovators Shaping the Ureteroscopy Market Through Strategic Collaborations and Cutting-Edge Solutions

Leading medical technology companies are advancing ureteroscopy through strategic innovation and portfolio expansion. Boston Scientific’s LithoVue Elite single-use digital flexible ureteroscope, featuring intrarenal pressure monitoring and bio-based plastic handles, exemplifies next-generation device integration. FDA-clearance for IRP sensing and Transitional Pass-Through reimbursement status have positioned LithoVue Elite as a premium solution for kidney stone management, empowering urologists with real-time pressure data and enhanced image quality.

Ambu has emerged as a key disruptor with its aScope 5 Uretero solution, a single-use flexible ureteroscope leveraging bioplastic materials to reduce carbon footprint by 70 percent. Equipped with a full-HD touchscreen interface and ergonomic handle controls, the aScope 5 Uretero received FDA 510(k) clearance in mid-2024, facilitating rapid deployment in ASCs and reinforcing Ambu’s commitment to sustainable design and supply chain resilience.

Olympus has broadened its portfolio with the RenaFlex single-use ureteroscopy system, cleared by the FDA in April 2024. RenaFlex complements Olympus’ established reusable digital and fiber-optic models-such as the slim-profile URF-V2 series-by delivering consistent visualization and maneuverability without the burden of reprocessing. Karl Storz and Richard Wolf continue to innovate with durable fiber-optic scopes and emerging robotic adjuncts, while specialized firms are pioneering AI-enabled diagnostic platforms and tele-mentoring tools to support global training initiatives.

Collectively, these players are forming partnerships with technology startups, academic centers, and healthcare systems to accelerate product development, refine clinical workflows, and expand market penetration. Competitive differentiation centers on integrated service offerings, cross-disciplinary collaboration, and evidence-driven value propositions aimed at enhancing patient outcomes and provider efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ureteroscopy Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advin Health Care

- Ambu A/S

- Boston Scientific Corporation

- Cliniva Healthcare

- Coloplast A/S

- ConMed Corporation

- Cook Medical LLC

- Dornier MedTech

- EMS Electro Medical Systems S.A.

- Fujifilm Holdings Corporation

- KARL STORZ SE & Co. KG

- LocaMed Limited

- Maxer Endoscopy GmbH

- Medtronic plc

- MicroPort Urocare

- Olympus Corporation

- OTU Medical

- PENTAX Medical

- Richard Wolf GmbH

- ROCAMED

- Stryker Corporation

- Teleflex Incorporated

- Vimex Endoscopy

Actionable Strategic Imperatives for Industry Leaders to Navigate Disruptive Shifts and Maximize Growth Opportunities in Ureteroscopy Devices

Industry leaders should prioritize a multi-pronged strategy to capitalize on market momentum and mitigate emerging risks. First, investing in digital and single-use portfolio expansion-particularly platforms incorporating intrarenal pressure monitoring and advanced imaging software-will strengthen differentiation and justify premium pricing. Second, broadening manufacturing footprints to include tariff-favored locations or near-shore facilities will reduce import duty exposure and secure supply chain continuity.

Comprehensive Research Methodology Underpinning Ureteroscopy Market Analysis Through Multi-Source Data Collection and Rigorous Validation

Our study synthesizes primary and secondary data sources through a rigorous, multi-stage methodology. Primary research comprised in-depth interviews with over thirty stakeholders, including urologists, procurement directors, and device engineers, to capture firsthand insights on clinical needs, purchasing criteria, and procedural workflows. Secondary research involved a comprehensive review of peer-reviewed literature, publicly available trade data, NHANES epidemiological statistics, FDA and USTR regulatory announcements, and company disclosures.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ureteroscopy Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ureteroscopy Devices Market, by Device Type

- Ureteroscopy Devices Market, by Technology

- Ureteroscopy Devices Market, by Accessories

- Ureteroscopy Devices Market, by Application

- Ureteroscopy Devices Market, by End User

- Ureteroscopy Devices Market, by Region

- Ureteroscopy Devices Market, by Group

- Ureteroscopy Devices Market, by Country

- United States Ureteroscopy Devices Market

- China Ureteroscopy Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Conclusive Market Insights to Illuminate Drivers Challenges and Opportunities in the Ureteroscopy Device Landscape

This executive summary has highlighted the multifaceted evolution of the ureteroscopy device market, driven by technological breakthroughs, shifting care delivery models, and evolving trade policies. Advanced digital imaging and single-use scope adoption are elevating procedural outcomes while compelling manufacturers to refine product portfolios and supply chains in response to tariff regimes. Segmentation analysis underscores the need for versatile device offerings spanning diagnostic, therapeutic, and end-user contexts, while regional insights reveal diverse growth dynamics and adoption patterns. Leading companies are leveraging strategic partnerships and innovation pipelines to introduce value-added solutions, establishing new performance benchmarks and sustainability standards.

As the market continues to mature, stakeholders must remain agile, aligning R&D investments with clinical feedback, optimizing manufacturing footprints to mitigate trade risks, and customizing go-to-market strategies to regional healthcare imperatives. By integrating market intelligence with actionable recommendations, organizations can seize emerging opportunities, enhance competitive positioning, and drive improved patient outcomes in an increasingly complex ureteroscopy landscape.

Connect with Ketan Rohom for Expert Guidance and to Secure the Definitive Ureteroscopy Device Market Research Report Today

To delve deeper into the ureteroscopy device market and secure a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing for personalized guidance and access to the full market research report. Ketan brings extensive expertise in urology market dynamics and can tailor insights to your organization’s strategic needs. Whether you seek detailed analyses of technology adoption trends, segmentation breakdowns, or regional growth strategies, Ketan can provide an executive briefing and facilitate your report purchase. Engage with Ketan to explore customized data excerpts, clarify methodology details, and discuss how emerging trends will impact your product planning and commercialization roadmap. Don’t miss the opportunity to partner with a trusted industry advisor and equip your team with the definitive intelligence needed to excel in the evolving ureteroscopy device landscape. Contact Ketan today to drive your market strategy forward and capitalize on actionable insights.

- How big is the Ureteroscopy Devices Market?

- What is the Ureteroscopy Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?