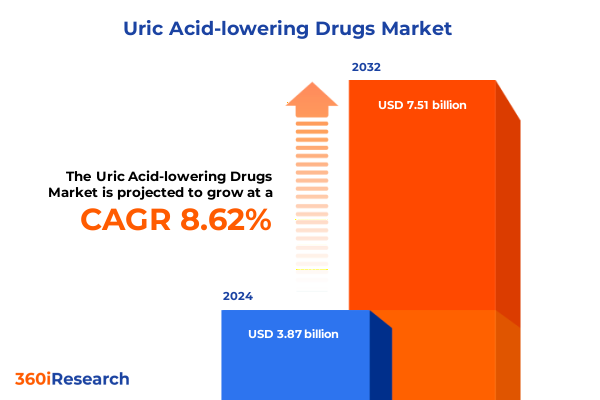

The Uric Acid-lowering Drugs Market size was estimated at USD 4.16 billion in 2025 and expected to reach USD 4.54 billion in 2026, at a CAGR of 8.79% to reach USD 7.51 billion by 2032.

Unveiling the Critical Role of Uric Acid-Lowering Therapies in Addressing the Rising Global Burden of Gout and Hyperuricemia

Uric acid accumulation and the resulting crystal deposition underlie the inflammatory joint pathology known as gout, a condition that continues to exert a substantial clinical and economic burden worldwide. In the United States, the prevalence of gout among adults reached approximately 3.9 percent in 2015 to 2016-affecting an estimated 9.2 million individuals-and subsequently climbed to 5.1 percent by 2017 to 2018, equating to around 12.1 million affected Americans. Serum urate concentrations exceeding supersaturation thresholds impact roughly 14.6 percent of the U.S. population, representing over 32 million individuals at risk for clinical hyperuricemia. These trends underscore a persistent gap in effective long-term management, as only about one-third of diagnosed patients receive ongoing uric acid-lowering therapy despite guideline recommendations for sustained serum urate control.

Given the high prevalence and associated comorbidities such as chronic kidney disease and cardiovascular events, there is an urgent need for diverse uric acid-lowering strategies. Current treatment paradigms encompass xanthine oxidase inhibitors that reduce uric acid synthesis, uricosuric agents that enhance renal excretion, and recombinant uricases that facilitate systemic urate clearance. Each class offers unique mechanistic benefits and safety considerations, driving interest in combination regimens and novel pipeline candidates. As patient populations age and comorbidity profiles evolve, the demand for individualized and efficacious therapeutic options continues to rise, highlighting the critical role of innovation and strategic diversification within the uric acid-lowering drug landscape.

Exploring Breakthrough Innovations and Emerging Pipeline Therapies That Are Redefining the Uric Acid-Lowering Drug Landscape

The uric acid-lowering therapeutics landscape is experiencing a convergence of scientific and technological breakthroughs that are reshaping clinical practice and patient outcomes. Beyond the longstanding use of allopurinol and probenecid, the advent of next-generation xanthine oxidase inhibitors is exemplified by candidates such as LC350189 and novel uricosurics like lingdolinurad, which promise superior potency and improved tolerability profiles in early-phase studies. Meanwhile, recombinant uricases such as pegloticase continue to be refined through advanced formulation technologies aimed at mitigating immunogenicity and extending infusion intervals. These innovations reflect a broader trend toward targeted molecular design and precision dosing, with several pipeline molecules demonstrating “best-in-class” urate lowering in phase 2b studies of patients unresponsive to standard-of-care therapies.

In parallel, digital health platforms and real-world evidence initiatives are facilitating more granular monitoring of serum urate dynamics and patient adherence, enabling personalized treatment adjustments. Artificial intelligence-driven analytics applied to electronic health records are uncovering predictive biomarkers for treatment response and flare risk, guiding stepwise intensification strategies. At the same time, collaborations between biotech innovators and established pharmaceutical companies are accelerating global licensing deals, particularly in emerging markets, to broaden access and diversify commercial risk. Collectively, these shifts are ushering in a new era of uric acid-lowering management characterized by precision therapeutics, real-time disease monitoring, and cross-sector partnerships.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariff Policies on Uric Acid-Lowering Drug Supply Chains and Cost Structures

The introduction of sweeping U.S. tariff measures in early 2025 has had a pronounced impact on the cost structures and supply resilience of uric acid-lowering pharmaceutical ingredients. A universal 10 percent tariff on non-Chinese imports and a punitive 145 percent levy on Chinese-origin active pharmaceutical ingredients (APIs) have disrupted traditional sourcing channels. Nearly 70 percent of APIs used in U.S. generics are sourced directly or indirectly from China, a dependency that has driven API cost increases of up to 20 percent for key molecules such as allopurinol and febuxostat. This input cost escalation is exerting pressure on profit margins across the value chain, prompting manufacturers to reevaluate supply strategies and accelerate “China+1” diversification efforts toward alternative hubs such as India and Hungary.

Amid these headwinds, branded biologics and recombinant therapies face distinct challenges as well as opportunities. While recombinant uricase formulations have thus far been exempt from the broad pharmaceutical tariffs, steep levies on upstream intermediates and reagent imports risk raising production costs and extending manufacturing timelines. Simultaneously, generics producers-operating on razor-thin margins-are particularly vulnerable to sudden tariff shifts. Without sufficient supply chain resilience, the generics sector may experience product discontinuations or shortages, undermining patient access to foundational gout treatments. As a result, both innovator and generic manufacturers are considering onshoring API production and forging strategic alliances with domestic partners to mitigate tariff exposure and secure uninterrupted drug supply.

Deriving Strategic Insights from Multifaceted Market Segmentation to Illuminate Opportunities Across Drug Classes, Administration Routes, and End Users

A nuanced understanding of market segmentation provides critical insight into therapeutic uptake and investment priorities. Within the drug class dimension, xanthine oxidase inhibitors remain the foundation of urate-lowering regimens due to their established efficacy and oral convenience, yet recombinant uricases are gaining ground in refractory and severe chronic gout subpopulations where rapid urate depletion is required. Meanwhile, uricosuric agents are being revisited through next-generation URAT1 inhibitors that may offer enhanced safety over legacy molecules.

Segmentation by branded versus generic products underscores the tension between cost-sensitive healthcare systems and the clinical imperative for innovation. Although generics dominate allopurinol and probenecid usage, branded options command value in high-antibody risk settings and specialty care contexts. Route of administration segmentation reveals sustained demand for oral therapies in outpatient settings, even as subcutaneous injection formulations are developed to extend dosing intervals for biologics. Dosage form analysis highlights the predominance of tablets and capsules for chronic management, whereas solution and powder formulations for injection are essential for inpatient or acute-care use. Distribution channel insights show hospital pharmacies remaining the primary conduit for biologics, while retail and online pharmacies facilitate broad access to oral generics. End-user segmentation indicates that clinics and home care settings are increasingly leveraging self-administered therapies to reduce hospital readmissions and support long-term adherence.

This comprehensive research report categorizes the Uric Acid-lowering Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Branded Versus Generic

- Route Of Administration

- Dosage Form

- Distribution Channel

- End User

Uncovering Regional Dynamics Shaping the Uric Acid-Lowering Drug Market Trajectory in the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics are shaping the trajectory of uric acid-lowering therapies, with the Americas leading in both volume and innovation adoption. The United States benefits from established clinical guidelines, direct-to-patient reimbursement models, and a robust biologics infrastructure, driving high uptake of advanced recombinant uricases and next-generation xanthine oxidase inhibitors. However, pricing reforms and potential policy changes continue to introduce reimbursement uncertainties that may influence formulary placements.

In Europe, the Middle East, and Africa, a heterogeneous regulatory environment demands tailored market entry strategies. While Western European countries often embrace biosimilars and regulate prices through health technology assessments, emerging markets in Eastern Europe and the Middle East present growing demand driven by rising urbanization and expanding healthcare access. Meanwhile, Asia-Pacific markets, led by China, Japan, and South Korea, are experiencing the most rapid growth. Government initiatives to expand insurance coverage and domestic manufacturing capacity-coupled with increasing awareness of gout and hyperuricemia-are creating fertile ground for both established multinational players and local innovators.

This comprehensive research report examines key regions that drive the evolution of the Uric Acid-lowering Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Evolutions and Key Strategic Moves by Leading Biopharmaceutical Companies in the Uric Acid-Lowering Therapeutics Arena

Leading biopharmaceutical companies are executing strategic maneuvers to strengthen their positions in the uric acid-lowering therapeutics space. Horizon Therapeutics, with its pegylated uricase formulation, continues to refine patient access programs and expand label indications for chronic refractory gout, underscoring the importance of specialty care channels. Sanofi’s rasburicase remains integral to tumor lysis syndrome prophylaxis, while the company explores life-cycle management through novel formulation approaches.

Established pharmaceutical firms such as Takeda and Teijin maintain their foothold in xanthine oxidase inhibitors, leveraging broad global distribution networks to support allopurinol and febuxostat uptake. At the same time, emerging biotech companies-including Shanton Pharma with its SAP-001 candidate and JW Pharmaceutical advancing epaminurad through phase 3 studies-are differentiating through targeted URAT1 inhibition strategies. Collaborations between these innovators and regional distributors are accelerating market entry in high-growth Asia-Pacific territories, reflecting a convergence of clinical innovation and strategic alliance building.

This comprehensive research report delivers an in-depth overview of the principal market players in the Uric Acid-lowering Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apotex Inc.

- Dr. Reddy's Laboratories Ltd.

- Horizon Therapeutics plc

- Lupin Limited

- Novartis AG

- Sandoz International GmbH

- Sun Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Teijin Pharma Co., Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Translating Industry Intelligence into Actionable Strategies for Pharma Executives to Capitalize on Uric Acid-Lowering Market Opportunities and Navigate Risks

To navigate the evolving landscape successfully, industry leaders must pursue supply chain diversification by establishing or strengthening domestic API production capabilities, thereby insulating operations from tariff volatility. Partnerships with regional contract manufacturing organizations can also mitigate cost pressures and enable flexible scaling in response to demand fluctuations. Concurrently, prioritizing portfolio balance across drug classes ensures exposure to both high-margin recombinant uricase therapies and high-volume oral generics.

Pharma executives should invest in digital adherence platforms and real-world evidence generation to demonstrate longitudinal outcomes and support value-based contracting discussions with payers. Expanding footprint in Asia-Pacific through joint ventures and licensing agreements allows companies to capitalize on burgeoning demand, while localized clinical trials in these regions can expedite regulatory approvals and reimbursement access. Finally, fostering cross-sector collaborations with technology providers and payers will be critical to integrating data-driven care pathways that optimize patient outcomes and differentiate therapeutic offerings.

Detailing a Rigorous Methodological Framework Employed to Ensure Data Integrity and Analytical Precision in Uric Acid-Lowering Market Research

This analytical report synthesizes insights derived from a rigorous methodology combining secondary and primary research. Secondary data sources include peer-reviewed epidemiological studies, industry publications, regulatory filings, and proprietary databases tracking drug approvals and pipeline progress. Epidemiological data were drawn from national health surveys, including the National Health and Nutrition Examination Survey, to establish prevalence and treatment patterns. Trade and tariff information were corroborated with governmental trade bulletins and expert legal analyses.

Primary research consisted of in-depth interviews with key opinion leaders, senior regulatory officials, manufacturing executives, and payers across major markets. Qualitative insights from these discussions informed scenario planning around supply chain resilience, pricing strategies, and market access hurdles. All data points were validated through triangulation across multiple sources to ensure accuracy and relevance. Analytic techniques encompassed trend analysis, competitive landscape mapping, and segmentation modeling to identify growth pockets and risk factors within the uric acid-lowering drug domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Uric Acid-lowering Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Uric Acid-lowering Drugs Market, by Drug Class

- Uric Acid-lowering Drugs Market, by Branded Versus Generic

- Uric Acid-lowering Drugs Market, by Route Of Administration

- Uric Acid-lowering Drugs Market, by Dosage Form

- Uric Acid-lowering Drugs Market, by Distribution Channel

- Uric Acid-lowering Drugs Market, by End User

- Uric Acid-lowering Drugs Market, by Region

- Uric Acid-lowering Drugs Market, by Group

- Uric Acid-lowering Drugs Market, by Country

- United States Uric Acid-lowering Drugs Market

- China Uric Acid-lowering Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Insights and Anticipating Future Directions for Uric Acid-Lowering Therapies in a Shifting Healthcare and Trade Environment

The uric acid-lowering therapeutics sector stands at an inflection point where innovation, policy dynamics, and supply chain strategies converge to define competitive advantage. From the maturation of polymer-conjugated uricases to the emergence of precision-targeting uricosurics, the pipeline offers substantial promise for addressing unmet needs in both refractory and early-stage gout populations. Regulatory incentives for onshoring critical API manufacturing underscore the importance of supply chain flexibility in the face of trade disruptions.

Looking ahead, successful navigation of this evolving ecosystem will depend on proactive partnerships, data-driven market access tactics, and portfolio diversification across drug classes and geographies. Companies that align R&D investments with localized market priorities, while leveraging digital health tools to bolster patient adherence, will be best positioned to capture growth and deliver sustainable patient value in the uric acid-lowering therapeutics arena.

Engage with Ketan Rohom to Access Comprehensive Uric Acid-Lowering Market Intelligence and Drive Strategic Growth Through Tailored Research Solutions

To explore the full depth of insights, analyses, and strategic guidance for the uric acid-lowering therapeutics market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at our firm. Ketan Rohom will provide tailored support, from customized data extracts and competitor intelligence to scenario‐based supply chain assessments. Engaging with him ensures you obtain the precise intelligence needed to inform high-impact decisions, optimize investments across drug classes, and navigate evolving trade dynamics. Contact Ketan Rohom today to secure your copy of the comprehensive market research report and gain a competitive edge in developing, positioning, and commercializing uric acid-lowering therapies

- How big is the Uric Acid-lowering Drugs Market?

- What is the Uric Acid-lowering Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?