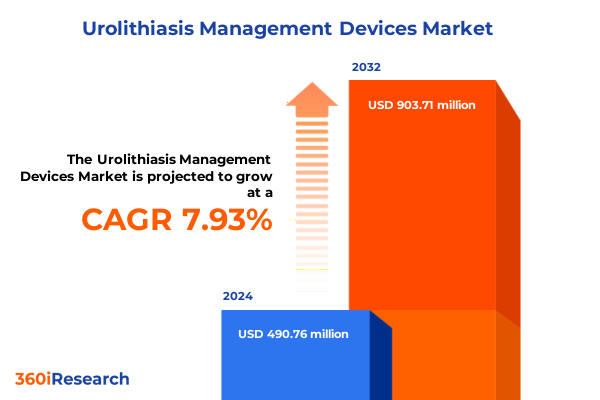

The Urolithiasis Management Devices Market size was estimated at USD 527.03 million in 2025 and expected to reach USD 569.10 million in 2026, at a CAGR of 8.00% to reach USD 903.70 million by 2032.

Setting the Stage for Groundbreaking Innovations in Urolithiasis Management Devices Driving Patient Outcomes and Shaping Clinical Practice Worldwide

Kidney stone disease, or urolithiasis, remains one of the most prevalent and burdensome conditions in urology, affecting nearly one in ten individuals during their lifetime. Advanced imaging technologies and minimally invasive treatments have transformed care pathways, yet recurrent stone formation, procedural complications, and patient quality-of-life challenges persist. As healthcare providers seek to optimize outcomes and reduce costs, the imperative to innovate in device design, technology integration, and clinical workflows has never been greater

This executive summary synthesizes the critical trends, market drivers, segmentation dynamics, regional variations, company strategies, and regulatory influences shaping the urolithiasis management devices sector. It is designed to equip decision-makers with actionable intelligence, drawing on rigorous primary interviews, secondary research from peer-reviewed literature, and industry databases. The insights herein will guide procurement, product development, and go-to-market strategies to capitalize on emerging opportunities and navigate evolving challenges.

Unprecedented Technological Advances and Emerging Treatment Modalities Revolutionizing the Urolithiasis Management Device Landscape for Improved Outcomes

Over the past year, the urolithiasis device arena has witnessed unprecedented leaps in real-time procedural feedback, energy delivery optimization, and patient-centric design. Single-use digital ureteroscopes with intrarenal pressure monitoring now allow urologists to gauge and mitigate postoperative complications such as systemic inflammatory response syndrome, marking a pivotal shift toward data-driven decision-making during endoscopic procedures. Concurrently, next-generation lithotripters leverage multimodal imaging and enhanced energy outputs to improve stone fragmentation efficiency and broaden patient eligibility, reflecting a trend toward procedural versatility and surgeon empowerment.

Emerging noninvasive modalities, such as burst wave lithotripsy using low-pressure ultrasound waves, have demonstrated high success rates in initial human trials, enabling outpatient treatments without anesthesia. Complementing these innovations, compact, portable ultrasound devices under development aim to democratize access to kidney stone therapy in ambulatory and remote settings, reducing reliance on large-scale equipment. Together, these transformative advancements are driving a paradigm shift from reactive surgery to personalized, minimally invasive stone management.

Assessing How 2025 U.S. Tariff Policies Are Reshaping Supply Chains and Cost Structures in Urolithiasis Management Devices

In 2025, U.S. tariff policies introduced a complex set of import duties on medical devices originating from key global suppliers. Tariffs of 10% on Chinese imports and up to 20% on European medical devices have elevated raw material and finished device costs, while tariffs on select components reached as high as 65% in certain categories, prompting manufacturers to reassess global sourcing strategies. Although existing long-term contracts and domestic production have tempered immediate price surges, healthcare providers anticipate downstream cost pressures that could manifest in higher procedure expenses and reduced capital budgets.

As a result, many device manufacturers are now exploring near-shoring initiatives, relocating production to Mexico and Canada under USMCA provisions or investing in U.S. facility expansions. These strategic shifts aim to mitigate tariff exposure but carry upfront capital and regulatory certification costs that may influence device pricing and time-to-market. Overall, the cumulative impact of 2025 U.S. tariffs is reshaping supply chains, compelling stakeholders to balance cost containment with uninterrupted access to critical urolithiasis management technologies.

Illuminating Comprehensive Market Dynamics Through Deep-Dive Segmentation Across Device Types, Treatment Methods, Materials, Applications, and End Users

A granular analysis of the urolithiasis management market reveals distinct performance patterns across multiple dimensions of segmentation. When considering device type, digital flexible ureteroscopes with integrated pressure sensors are outpacing guidewires in adoption due to their ability to deliver real-time intrarenal metrics that guide stone manipulation, while traditional stents maintain a stable presence driven by their role in postoperative drainage and ureteral support. Conversely, shock wave and laser-based lithotripters are demonstrating complementary strengths: extracorporeal shock wave lithotripsy remains the mainstay for outpatient stone fragmentation, whereas intracorporeal lithotripsy and percutaneous nephrolithotomy devices appeal to cases requiring direct visualization and precise energy delivery.

Material composition further differentiates market segments, with metal-based stents offering durable, long-term patency for complex obstructions but raising concerns around biofilm formation, while polymer-based stents, particularly silicone and biodegradable composites, are gaining traction due to lower encrustation rates and reduced need for secondary removal procedures. Application-based insights underscore kidney stones as the predominant clinical focus, yet growing attention to bladder and ureteral stones is driving demand for versatile, multifunctional platforms adapted across anatomical locations. Finally, end-user segmentation highlights hospital systems as centers of procedural volume, specialty clinics as hubs for ambulatory interventions, and ambulatory surgical centers as agile adopters of single-use technologies for cost-effective, high-throughput care.

This comprehensive research report categorizes the Urolithiasis Management Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Treatment Type

- Device Material

- Application

- End User

Unraveling Regional Variations and Growth Opportunities Across the Americas, EMEA, and Asia-Pacific Urolithiasis Device Markets

Geographical dynamics play a pivotal role in shaping the trajectory of urolithiasis management devices. In the Americas, advanced healthcare infrastructure and robust capital investment continue to drive early adoption of premium technologies such as disposable digital scopes and high-power laser lithotripters, supported by favorable reimbursement frameworks and large patient populations. However, tariff exposures on imported components have prompted localized production strategies and strategic partnerships to sustain supply chain resilience.

Across Europe, Middle East & Africa, regulatory harmonization under the Medical Device Regulation and emphasis on clinical evidence have fostered uptake of innovative solutions, albeit tempered by pricing pressures and varied national reimbursement policies. Manufacturers are exploring dual-market entry strategies, leveraging EU certification to streamline approvals and combining direct distribution in mature markets with distributor partnerships in emerging regions.

In Asia-Pacific, rapid expansion of urological care facilities and rising patient awareness have fueled demand for cost-efficient, portable lithotripsy devices. Localized manufacturing hubs in China and India are scaling production of consumables and reusable instruments, aiming to compete on price while gradually integrating advanced features such as real-time imaging and data connectivity. Overall, regional nuances underpin strategic considerations for market entry, pricing, and commercialization models in each territory.

This comprehensive research report examines key regions that drive the evolution of the Urolithiasis Management Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Driving the Urolithiasis Device Market with Cutting-Edge Technologies and Strategic Collaborations

Leading medical device companies are intensifying R&D investments and forging strategic alliances to secure technological leadership in the urolithiasis segment. Boston Scientific’s launch of the LithoVue Elite single-use digital flexible ureteroscope, with intrarenal pressure monitoring capabilities, exemplifies the convergence of imaging excellence and procedural safety, setting a new benchmark for scope-based interventions. Similarly, Olympus’s iTind™ system has gained U.S. Category I CPT codes and expanded its minimally invasive BPH treatment footprint, illustrating how reimbursement alignment can accelerate adoption even in adjacent urological indications.

Dornier MedTech’s Delta III lithotripter underscores the evolution of extracorporeal shock wave devices by enhancing imaging modalities and energy efficiency, while the Break Wave™ lithotripsy system from Sonomotion is pioneering portable ultrasound-based stone fragmentation that bypasses anesthesia requirements. Richard Wolf’s D-URS hybrid single-use ureteroscope, with a semi-rigid shaft and flexible distal tip, demonstrates how ergonomic design and irrigation channels can coalesce to improve stone access and pressure control. Additionally, Cook Medical’s Ascend™ single-use flexible ureteroscope and LithAssist™ PCNL accessory spotlight the strategic expansion of disposable scopes and multifunctional instruments to streamline stone removal workflows across endoscopic and percutaneous approaches.

This comprehensive research report delivers an in-depth overview of the principal market players in the Urolithiasis Management Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced MedTech Holdings

- AKSM, Ltd.

- Avvio Medical, Inc.

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Calyxo Inc.

- Coloplast A/S

- Cook Group Incorporated

- DirexGroup

- Dornier MedTech GmbH

- Dyne Medical Group Inc.

- E.M.S. Electro Medical Systems S.A.

- EDAP TMS SA

- Elmed Lithotripsy Systems

- EndoTheia, Inc.

- Karl Storz GmbH & Co. KG

- Nissha Medical Technologies

- Olympus Corporation

- Quanta System S.p.A.

- Richard Wolf GmbH

- Siemens Healthineers

- SonoMotion

- Teleflex Incorporated

Strategic Roadmap for Industry Leaders to Capitalize on Device Innovations, Navigate Tariff Challenges, and Enhance Clinical Access

To thrive in this dynamic environment, industry leaders must prioritize a three-pronged approach encompassing innovation acceleration, supply chain agility, and market access optimization. First, sustained investment in modular, data-enabled device platforms will foster scalable enhancements-such as pressure monitoring and augmented reality guidance-that address unmet clinical needs and differentiate product portfolios.

Second, companies should proactively diversify manufacturing footprints by leveraging near-shoring and dual sourcing arrangements to mitigate tariff risks and ensure continuity of component supply. Engaging in public-private partnerships to secure capital for U.S. facility expansions and participating in USMCA-backed production alliances will fortify resilience against evolving trade policies.

Third, executives must align reimbursement and commercialization strategies with regional regulatory landscapes by cultivating payer engagement and generating robust health-economics evidence. Tailoring market access programs and clinical training initiatives for hospitals, ambulatory centers, and specialty clinics will accelerate technology adoption, enhance procedural throughput, and ultimately improve patient outcomes.

Rigorous Research Methodology Combining Qualitative Insights, Primary Interviews, and Secondary Data for Robust Urolithiasis Device Analysis

The insights presented in this summary are derived from a structured research methodology integrating multiple data sources. Primary inputs included in-depth interviews with urology thought leaders, procurement specialists, and device engineers to validate emerging trends and technology performance.

Secondary research encompassed review of peer-reviewed journal articles, company press releases, FDA MAUDE reports, and industry news outlets. Government publications and trade data were analyzed to quantify the impact of 2025 tariff measures on medical device imports. Market metrics were cross-referenced with corporate financial disclosures and trade association reports to ensure data accuracy.

All findings underwent rigorous triangulation through cross-verification between independent sources, and insights were peer-reviewed by clinical advisors specializing in endourology. This methodology ensures that the strategic imperatives and market intelligence outlined herein rest upon a robust evidentiary foundation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Urolithiasis Management Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Urolithiasis Management Devices Market, by Device Type

- Urolithiasis Management Devices Market, by Treatment Type

- Urolithiasis Management Devices Market, by Device Material

- Urolithiasis Management Devices Market, by Application

- Urolithiasis Management Devices Market, by End User

- Urolithiasis Management Devices Market, by Region

- Urolithiasis Management Devices Market, by Group

- Urolithiasis Management Devices Market, by Country

- United States Urolithiasis Management Devices Market

- China Urolithiasis Management Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Bringing the Evidence Together to Highlight the Future Trajectory of Urolithiasis Management Devices and Stakeholder Impacts

In summary, the urolithiasis management devices sector is entering a transformative period characterized by real-time procedure monitoring, compact lithotripsy solutions, and an overarching shift toward personalized, minimally invasive care. While 2025 tariff policies have introduced new complexities for global supply chains, they have also galvanized strategic realignments in manufacturing and procurement practices.

Innovation-driven differentiation, combined with adaptable commercialization strategies and resilient production networks, will determine which organizations capitalize on the burgeoning demand for advanced stone management technologies. Stakeholders equipped with forward-looking intelligence and an action-oriented roadmap are best positioned to navigate disruptions, seize market opportunities, and ultimately enhance patient care in the evolving landscape of kidney stone treatment.

Take the Next Step Toward Informed Decision-Making by Engaging with Our Associate Director Ketan Rohom to Secure Your Comprehensive Market Research Report

Engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch to access the in-depth urolithiasis management devices market research report tailored to advance your strategic objectives. By collaborating with this expert, you can secure the comprehensive insights necessary to inform procurement, product development, and investment decisions. Reach out today to obtain detailed analyses of device innovations, tariff impacts, segmentation breakdowns, regional dynamics, and competitor profiles. Unlock the full potential of this authoritative resource to drive growth and maintain a competitive edge in the rapidly evolving urolithiasis management devices landscape

- How big is the Urolithiasis Management Devices Market?

- What is the Urolithiasis Management Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?