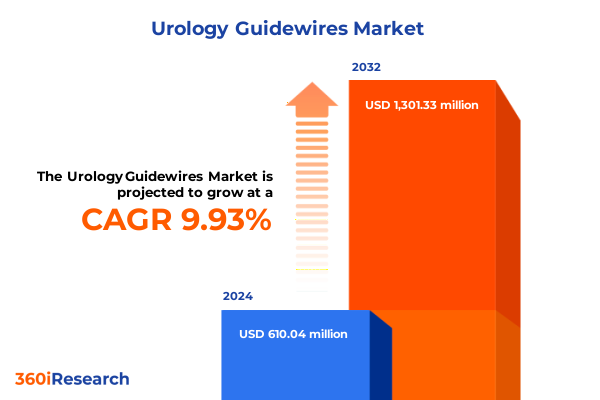

The Urology Guidewires Market size was estimated at USD 670.78 million in 2025 and expected to reach USD 728.56 million in 2026, at a CAGR of 9.92% to reach USD 1,301.33 million by 2032.

Exploring the critical role of urology guidewires in advancing minimally invasive procedures through innovative technologies and clinical adoption over the past decade

Implanted in countless minimally invasive procedures, urology guidewires serve as the silent workhorses that enable precise access, navigation, and treatment of urinary tract disorders. Emerging from humble origins as simple steel filaments, today’s guidewires integrate advanced materials and coatings to facilitate everything from complex percutaneous interventions to delicate ureteral stenting. As clinicians have embraced endourology and outpatient settings have proliferated, these slender devices have become indispensable in enhancing procedural success rates and patient comfort alike.

In recent years, the interplay between rising incidence of nephrolithiasis, an aging global population, and expanding reimbursement frameworks has further propelled the adoption of sophisticated guidewire technologies. Concurrently, regulatory harmonization initiatives in major markets have created more predictable pathways for new device approvals, stimulating innovation and intensifying competition. Against this backdrop, manufacturers are driven by the dual imperatives of improving performance characteristics-such as torque response, kink resistance, and tip flexibility-while also optimizing production efficiencies and cost structures.

Looking ahead, the convergence of digital integration, material science breakthroughs, and evolving clinical protocols promises to sustain momentum in this specialized field. By charting the evolution of urology guidewires, this executive summary provides an essential foundation for understanding the critical drivers, emerging challenges, and strategic levers that will define the next phase of growth in minimally invasive urological care.

Examining transformative shifts reshaping the urology guidewire landscape as technological innovations clinical preferences and regulatory landscapes converge to redefine procedural efficacy

Over the past five years, the urology guidewire market has undergone transformative shifts driven by relentless technological innovation and evolving clinical imperatives. Hydrophilic coatings have emerged as a hallmark advancement, dramatically lowering friction coefficients to improve device navigation through tortuous anatomy. In parallel, the integration of shape memory alloys such as nitinol has enhanced flexibility and resilience, enabling delicate maneuvering in complex endourological procedures. Such material innovations have been complemented by refinements in tip design-ranging from tapered, angled configurations to J-shaped atraumatic styles-each geared toward specific procedural challenges.

Broader shifts in healthcare delivery have also reshaped market dynamics. The migration of surgeries from traditional hospital settings to ambulatory surgical centers and specialized clinics has elevated demand for guidewires that combine reliability with cost-conscious manufacturing. Regulatory transformations-such as the implementation of unique device identification (UDI) in the United States and reinforced post-market surveillance protocols in Europe-have heightened emphasis on traceability and quality assurance, prompting manufacturers to streamline compliance workflows and invest in robust supply chain transparency.

Consequently, the competitive landscape has grown more concentrated yet dynamic, as established global players reinforce their portfolios through strategic partnerships and early-stage entrants seek to differentiate via niche coatings or digital guidance enhancements. Through these intersecting forces, the guidewire ecosystem is being recast around a new paradigm of performance, safety, and value-based care.

Assessing the cumulative impact of 2025 United States tariffs on the urology guidewire supply chain pricing dynamics and strategic sourcing considerations across manufacturers

In early 2025, the implementation of revised United States tariffs on select medical devices has reverberated across the urology guidewire supply chain. Originally imposed under broader trade policy measures targeting imported components, these tariffs-ranging between five and ten percent-have exacerbated input cost pressures for manufacturers reliant on overseas production of specialty coatings and raw materials. As a result, some producers have been compelled to adjust pricing strategies, renegotiate supplier contracts, and explore regional near-shoring options to preserve margins without compromising on quality or performance standards.

Transitioning to alternative sourcing models has, however, introduced its own complexities. Manufacturers that shifted certain production lines to neighboring markets in Latin America and Southeast Asia encountered varying regulatory regimes and logistical constraints, necessitating recalibrated quality management systems and additional validation cycles. At the same time, distributors and end users have experienced staggered lead times as suppliers recalibrated inventories and optimized cross-border logistics to mitigate tariff liabilities. Despite these adjustments, clinical adoption trends have remained robust, underscoring the essential nature of guidewire technologies within both elective and emergency urological procedures.

Looking forward, industry stakeholders are closely monitoring potential tariff escalations and trade negotiations, recognizing that supply chain resilience will be integral to sustaining long-term growth. Strategic investments in diversified manufacturing footprints, complemented by collaborative procurement initiatives, offer a pathway to balance cost imperatives with the imperative of uninterrupted device availability for patients.

Revealing key segmentation insights by application coating type material composition end user distribution and tip style to illuminate emerging opportunities and challenges

By application, urology guidewires have become critical enablers of percutaneous nephrolithotomy, ureteral stenting, and ureteroscopy procedures. The choice between these clinical uses reflects anatomical complexity and therapeutic intent: percutaneous nephrolithotomy necessitates wires with exceptional torque control to access and fragment large calculi; ureteral stenting demands atraumatic tips that safeguard delicate ureteral walls; while ureteroscopy benefits from highly flexible, kink-resistant designs that accommodate navigational challenges within narrow lumens.

Coating type further delineates market segmentation, with hydrophilic coatings leading in clinical preference due to their superior lubricity and reduced insertion forces. Polytetrafluoroethylene (PTFE) variants continue to offer durability and chemical inertness for repeatable performance, while silicone-based options address specific biocompatibility needs in long-term stent placements. Material composition adds another layer of distinction: nitinol’s shape memory properties afford seamless re-entry and recovery, whereas stainless steel’s cost efficiency maintains its relevance in high-volume, low-cost procedural bundles.

End users have also driven segmentation evolution. Ambulatory surgical centers-both freestanding and hospital-owned-have accelerated outpatient adoption, prioritizing streamlined inventory and reliable device turnover. Clinics, including dedicated outpatient centers and urology practices, favor guidewires optimized for rapid procedure throughput and minimal disposal footprint. Meanwhile, hospitals, spanning government, private, and teaching institutions, require a comprehensive range of tip styles-angled, J-shaped, and straight-to address diverse case mixes and complex referral patterns. Together, these dimensions illuminate nuanced clinical and operational demands and underscore the imperative for tailored product portfolios that resonate across user environments.

This comprehensive research report categorizes the Urology Guidewires market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Coating Type

- Material

- End User

- Tip Style

Uncovering pivotal regional insights across the Americas Europe Middle East and Africa and Asia Pacific to highlight geographical disparities in adoption investment and growth trajectories

The Americas region continues to serve as the epicenter of technological innovation and clinical adoption in urology guidewires. Within the United States, robust reimbursement frameworks and proactive regulatory pathways have incentivized the integration of advanced guidewire technologies into both hospital and ambulatory settings. Canada’s steadily expanding outpatient infrastructure further supports device uptake, while emerging Latin American markets-leveraging increasing healthcare expenditure and international funding-are gradually closing the gap on access to minimally invasive urological interventions.

In Europe, Middle East, and Africa, market dynamics are shaped by significant heterogeneity in regulatory oversight and healthcare funding. Western European nations benefit from centralized approval processes under the European Medical Device Regulation, fostering the introduction of novel materials and coatings. Conversely, in parts of the Middle East and Africa, infrastructure limitations and budgetary constraints can delay technology diffusion, even as private sector investment and medical tourism initiatives begin to stimulate demand for premium guidewire offerings.

In Asia-Pacific, rapid economic development and rising prevalence of urinary tract disorders are driving acceleration in guidewire utilization. Japan and South Korea lead with high procedural volumes and strong local R&D pipelines, while China’s domestic manufacturing prowess and India’s cost-competitive production capabilities are reshaping global supply chain patterns. Southeast Asia’s growing network of outpatient facilities and expanding insurance coverage create fertile ground for sustained market growth, underscoring the region’s strategic importance in the global competitive landscape.

This comprehensive research report examines key regions that drive the evolution of the Urology Guidewires market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategies and competitive positioning of leading urology guidewire manufacturers driving innovation partnerships and market penetration through distinctive product portfolios

Within the competitive arena of urology guidewires, a handful of global leaders distinguish themselves through sustained investment in materials science, strategic partnerships, and targeted acquisitions. These companies have expanded their portfolios to include differentiated coatings, proprietary tip configurations, and integrated delivery systems that address unique procedural challenges. Central to their strategies is the pursuit of collaborative development agreements with leading urology centers, ensuring that early-stage feedback guides iterative product enhancements and accelerates market entry.

At the same time, emerging players are seeking niche advantages by focusing on specialized coatings and regional distribution alliances. By aligning closely with ambulatory surgical centers and outpatient clinics-where cost sensitivity and procedural efficiency are paramount-these challengers have carved out footholds in select markets and increased their visibility among key opinion leaders. Consolidation through merger and acquisition activity remains an ever-present theme, as established firms acquire smaller innovators to bolster their technological breadth, expedite regulatory approvals, and secure access to new end user channels.

Looking ahead, the competitive landscape will hinge on the ability to integrate digital guidance modalities, ensure uninterrupted supply chain resilience, and adapt to evolving reimbursement paradigms. Companies that excel in these domains will solidify their leadership positions, while those that neglect these critical levers may cede ground to more agile market entrants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Urology Guidewires market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amecath Medical Devices

- Amsino International Inc.

- AngioDynamics Inc.

- Argon Medical Devices Inc.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Boston Scientific Corporation

- C. R. Bard Inc. (BD)

- Cardinal Health Inc.

- Coloplast A/S

- Cook Medical LLC

- Hollister Incorporated

- Medi-Globe GmbH

- Medtronic plc

- Merit Medical Systems Inc.

- Olympus Corporation

- Stryker Corporation

- Teleflex Incorporated

- Terumo Corporation

- Uromed Inc.

- UroViu Corporation

Formulating actionable recommendations for industry leaders to capitalize on emerging trends mitigate supply chain risks and enhance value through strategic collaborations and technology adoption

To navigate the evolving urology guidewire environment successfully, industry leaders should prioritize investment in next-generation coating technologies that enhance lubricity without sacrificing biocompatibility. Cultivating diversified supply chains-spanning North America, Europe, and key Asia-Pacific hubs-will mitigate exposure to tariff fluctuations and geopolitical disruptions while securing consistent access to specialty materials.

Moreover, forging partnerships with ambulatory surgical centers and outpatient clinics can unlock new distribution pathways, enabling value-based pricing models that align with cost containment imperatives. Concurrently, stakeholders should bolster regulatory intelligence capabilities to anticipate policy shifts in the United States and European Union, ensuring that product portfolios remain in full compliance with evolving quality and traceability requirements.

Finally, embracing digital integration-through smart guidewire prototypes featuring radiopaque markers and sensor-driven feedback loops-can differentiate offerings and create new service-based revenue streams. By aligning these strategic imperatives with robust training programs for clinicians, companies will accelerate adoption curves, optimize patient outcomes, and secure a competitive edge in a market defined by continuous innovation.

Detailing rigorous research methodology combining primary expert interviews secondary data triangulation and robust analytical frameworks to ensure validity and accuracy of findings

This analysis draws upon a rigorous mixed-methods approach to ensure the validity and reliability of findings. Primary research involved in-depth interviews with urologists, procurement executives, and clinical engineers across hospitals, ambulatory surgical centers, and specialized clinics. These expert discussions yielded nuanced perspectives on procedural preferences, device performance priorities, and evolving budgetary constraints.

Secondary research encompassed a comprehensive review of peer-reviewed journals, clinical trial databases, and regulatory filings, complemented by examinations of public policy documents related to medical device tariffs and trade measures. Quantitative data was triangulated with publicly available datasets on hospital procedure volumes, demographic trends in urolithiasis prevalence, and regional healthcare expenditure patterns.

Analytical frameworks-such as SWOT and Porter’s Five Forces-were employed to assess competitive dynamics, while cross-segmentation mapping enabled the identification of high-impact opportunity spaces. Throughout the research process, an expert advisory panel validated preliminary insights, ensuring that conclusions reflect real-world clinical requirements and market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Urology Guidewires market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Urology Guidewires Market, by Application

- Urology Guidewires Market, by Coating Type

- Urology Guidewires Market, by Material

- Urology Guidewires Market, by End User

- Urology Guidewires Market, by Tip Style

- Urology Guidewires Market, by Region

- Urology Guidewires Market, by Group

- Urology Guidewires Market, by Country

- United States Urology Guidewires Market

- China Urology Guidewires Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding insights that synthesize critical developments in urology guidewire technologies market dynamics and strategic considerations shaping the competitive landscape

The evolving landscape of urology guidewires is characterized by a convergence of material science breakthroughs, procedural migration to outpatient settings, and intensifying supply chain complexities brought on by geopolitical developments. From the widespread adoption of hydrophilic coatings to the integration of nitinol alloys for enhanced maneuverability, technological innovation remains the chief catalyst for performance improvement.

Simultaneously, segmentation insights-spanning applications, coating types, materials, end users, and tip styles-underscore the differentiated requirements of percutaneous nephrolithotomy, ureteral stenting, and ureteroscopy alike. Regional patterns reveal contrasting adoption trajectories: the Americas lead in technological uptake, EMEA shows nuanced regulatory and funding dynamics, and Asia-Pacific emerges as a high-growth frontier. Competitive analyses highlight the importance of strategic partnerships, diversified manufacturing footprints, and digital integration capabilities.

Together, these findings reinforce the imperative for manufacturers and distributors to adopt an agile, insight-driven approach. By aligning product development roadmaps with clinical feedback, anticipating tariff impacts, and leveraging regional growth opportunities, stakeholders can position themselves to meet escalating procedural demands and enhance patient outcomes in an increasingly complex market environment.

Engaging call to action with Ketan Rohom to explore comprehensive urology guidewire market intelligence and secure strategic advantage through the full research report

To learn more about the comprehensive insights and strategic analysis contained in this executive summary, interested professionals are encouraged to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing for personalized guidance on how this market intelligence can support strategic planning and decision-making. Ketan brings extensive expertise in medical device markets and can provide tailored demonstrations of the report’s key findings, detailed segmentation breakdowns, and interactive data modules to suit unique organizational requirements.

By engaging with Ketan, you can secure early access to proprietary research tools, schedule a customized briefing to address specific areas of interest-such as regional growth drivers or coating technology innovations-and explore volume licensing options for enterprise-wide distribution. Whether your goal is to refine product development roadmaps, optimize supply chain strategies in light of recent tariff shifts, or identify white-space opportunities among ambulatory surgical centers and clinics, this dialogue will equip you with actionable intelligence.

Don’t miss the opportunity to leverage this in-depth urology guidewire market report to enhance competitive positioning and accelerate time-to-insight. Contact Ketan Rohom today to obtain the full research report, unlock strategic advantages, and drive growth in an evolving landscape of endourological interventions.

- How big is the Urology Guidewires Market?

- What is the Urology Guidewires Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?