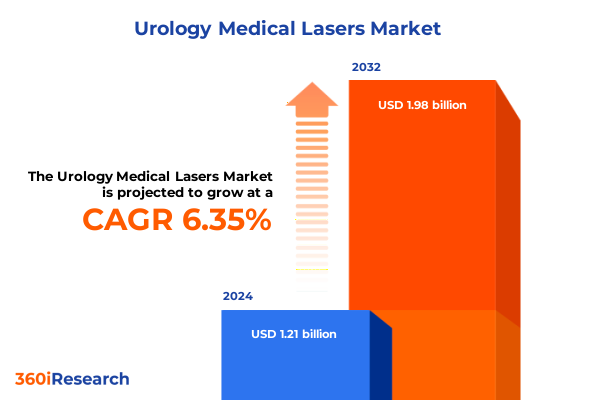

The Urology Medical Lasers Market size was estimated at USD 1.28 billion in 2025 and expected to reach USD 1.36 billion in 2026, at a CAGR of 6.40% to reach USD 1.98 billion by 2032.

Positioning Urology Medical Lasers at the Nexus of Increasing Clinical Demand and Advances in Minimally Invasive Surgical Technology

As the prevalence of urological disorders continues to rise, driven by demographic shifts and metabolic health challenges, the demand for advanced treatment modalities has never been more pronounced. In the United States alone, one in eleven individuals will experience a urinary stone event in their lifetime, underscoring a substantial and growing public health burden that requires precise and effective intervention. Concurrently, benign prostatic hyperplasia affects approximately half of men by their early sixties and escalates to 90% prevalence among those over eighty, placing significant strain on healthcare systems and patient quality of life.

Against this backdrop, the urology medical laser sector has emerged as a pivotal enabler of minimally invasive procedures that deliver superior clinical outcomes. Innovations in laser energy delivery have enabled treatments that minimize blood loss, reduce postoperative pain, and shorten hospital stays, thereby aligning with the broader shift toward value-based care and outpatient surgical pathways. With urology laser applications spanning urolithiasis, prostate enucleation, soft tissue ablation, and tumor management, the technology is positioned at the nexus of patient-centric innovation and clinical efficiency.

Emerging Transformative Technologies and Digital Innovations Are Redefining the Clinical Potential of Urology Medical Lasers in Modern Healthcare Settings

Recent years have witnessed a transformative pivot toward novel laser platforms that optimize energy transmission and precision. Thulium fiber lasers have gained prominence for their ability to deliver high-frequency pulsed energy that achieves finer stone dusting and reduced retropulsion compared to conventional Holmium:YAG systems, as demonstrated by meta-analytical evidence indicating superior ablation rates and negligible stone migration in both percutaneous and ureteroscopic interventions. This evolution reflects an overarching trend toward single-fiber, compact systems that accommodate the ergonomic constraints of modern endourology.

In parallel, the integration of artificial intelligence and digital endoscopy has begun to redefine clinical workflows by providing procedural metadata, predictive energy settings, and real-time outcome analytics. Machine-learning algorithms now analyze proxies for stone composition, laser-on time, and pulse count to recommend optimal energy parameters, reduce unnecessary fiber wear, and lay the groundwork for outcome-based reimbursement models. By embedding data-driven feedback loops into laser consoles, healthcare providers can align financial incentives with clinical quality, thus enhancing precision surgery and cost efficiency.

Moreover, the shift from traditional solid-state platforms to fiber-delivered laser systems underscores an industry-wide commitment to reducing capital and operational barriers. Fiber-delivered architectures offer modular upgrades, lower maintenance requirements, and streamlined installation in ambulatory surgical centers, fostering broader access to high-power laser treatments in both urban and remote settings.

Assessing the Far-Reaching Effects of the 2025 U.S. Tariff Overhaul on Medical Laser Supply Chains and Healthcare Delivery Costs

The April 2025 U.S. tariff package introduced a universal 10% import duty on all medical devices, eliminating long-standing duty-free provisions that previously applied to urology laser systems and accessories. The package further imposed reciprocal tariffs on specific trading partners-20% on European exports, 24% on Japanese devices, and a punitive 54% on Chinese imports-while subjecting Canadian and Mexican shipments to separate 25% duties under related trade disputes. This sweeping tariff regime signals sustained cost pressures for healthcare providers reliant on advanced laser technology.

Industry stakeholders, including AdvaMed, the American Hospital Association, and the Healthcare Distribution Alliance, have underscored the risk of sharply escalating hospital capital expenditures and constrained reinvestment in emergent treatment modalities. Given that the U.S. imported over $300 billion of medical goods last year, with the vast majority previously entering duty-free, industry groups have intensified lobbying efforts to secure carve-outs or phased implementation schedules that could mitigate short-term disruptions.

In anticipation of higher landed costs and potential component shortages, 27% of surveyed device manufacturers have begun diversifying their supplier networks, exploring domestic sourcing alternatives, and reevaluating production footprints to preserve margin and supply continuity. As tariff timelines phase in through 2026, end users and OEMs alike will face the imperative to rebalance capital planning, procurement strategies, and pricing models in order to sustain technology adoption without compromising clinical access.

Unveiling Key Market Segmentation Drivers That Shape the Future of Urology Medical Laser Adoption and Clinical Application Across Diverse Modalities

The urology medical laser market can be viewed through multiple analytical lenses that capture the breadth of technology and clinical use cases. Laser platforms are segmented by type-from compact diode lasers optimized for soft tissue hemostasis to photoselective green light (KTP) systems, versatile Holmium:YAG consoles renowned for volumetric prostate enucleation, high-energy Nd:YAG devices suited for deep tissue ablation, and emerging Thulium lasers praised for their precise vaporization capabilities. Technology distinctions further classify devices into contact lasers offering direct tissue interaction, fiber-delivered systems that enhance procedural flexibility, and non-contact configurations that enable fine dispersion patterns for minimal thermal spread. Wavelength considerations categorize solutions into short (<500 nm) green-light modalities, mid-range (500–1000 nm) options balancing penetration and absorption, and high (>1000 nm) infrared lasers optimized for water-based tissue targeting.

Clinical applications define another dimension of segmentation, spanning benign prostatic hyperplasia treatments including both vaporization and enucleation techniques, soft tissue ablation and resection for urethral strictures, tumor treatments encompassing bladder and urethral oncology, urinary incontinence procedures, and urolithiasis management through stone fragmentation and dusting. The end user landscape includes high-throughput hospitals, specialized urological clinics with focused surgical suites, and cost-efficient ambulatory surgical centers. Finally, distribution channels range from traditional offline pathways through authorized surgical equipment dealers to emerging online direct-to-customer models that leverage digital procurement platforms for streamlined ordering and service support.

This comprehensive research report categorizes the Urology Medical Lasers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Laser Type

- Technology

- Wavelength

- Application

- End User

- Distribution Channel

Discerning Regional Dynamics Across the Americas, EMEA, and Asia-Pacific That Drive Differential Adoption Patterns for Urology Medical Lasers

In the Americas, particularly North America, the convergence of robust healthcare infrastructure, favorable reimbursement policies, and proactive clinical guidelines has propelled the region to the forefront of urology laser adoption. High healthcare expenditure levels enable early procurement of cutting-edge systems, while a growing prevalence of urolithiasis and prostate disorders drives consistent procedural volumes. North America accounted for $372.5 million in urology laser revenues in 2022, reflecting the region’s capacity to absorb premium technology investments and support extensive training initiatives for surgeons.

The Europe, Middle East & Africa market exhibits nuanced heterogeneity, with mature healthcare markets in Western Europe prioritizing guideline-driven adoption of photoselective vaporization and laser enucleation in alignment with European Association of Urology recommendations. Recent randomized trials have confirmed non-inferiority of laser photocoagulation versus transurethral tumor resection for low-grade bladder tumors, offering outpatient treatment pathways with minimal long-term progression differences. In parallel, the Middle East and select African nations are leveraging public-private partnerships to upgrade endourology suites, although broader access remains contingent on national budget cycles and regulatory harmonization.

Asia-Pacific has emerged as the fastest-growing regional segment, buoyed by rising healthcare investments, expanding insurance coverage, and significant clinical research contributions from China, India, and South Korea. A bibliometric analysis of laser-based benign prostatic hyperplasia research indicates that while North America historically led publication volume, Asian institutions now contribute the majority of studies on Thulium:YAG techniques, underscoring the region’s strategic emphasis on indigenous innovation and cost-effective clinical trial infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Urology Medical Lasers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Laser Technology Innovators Driving Competitive Differentiation in Urology Through Product Advancements and Strategic Collaborations

Leading subject matter experts in laser technology continue to differentiate themselves through targeted product innovation, clinical research sponsorship, and strategic partnerships. Lumenis has pioneered the application of MOSES pulse modulation across its Holmium:YAG platforms, demonstrating in clinical presentations a 20% reduction in lithotripsy procedure time, improved fragmentation efficiency, and enhanced hemostasis in Holmium Laser Enucleation of the Prostate workflows. With the introduction of MOSES 2.0, the company claims up to 85% greater stone ablation efficiency at ultra-high pulse repetition rates, underscoring its commitment to continuous performance enhancements.

Quanta System has distinguished itself through the launch of its Cyber Ho Magneto platform, which leverages proprietary pulse shaping to emulate Thulium fiber laser characteristics within a Holmium console. The April 2024 unveiling at the European Association of Urology Congress highlighted the system’s capacity for superior dusting performance, expanded soft tissue enucleation capabilities, and customizability across lithotripsy and prostate procedures. This all-in-one device strategy reflects Quanta’s philosophy of addressing diverse urological challenges with a single hardware footprint.

Olympus, meanwhile, has reinforced its market position through ergonomic advances and fiber-based Thulium innovations. The launch of its Soltive SuperPulsed Thulium Fiber Laser System introduced a compact design that requires only standard power, delivers 50% less noise, and enhances dusting and hemostasis performance in endourology settings. Concurrently, Olympus expanded its imaging portfolio with a new 4K endoscopic camera head, integrating white light, narrow band, and blue light observation in a single device to optimize visualization in bladder tumor resections and diagnostic pathways.

This comprehensive research report delivers an in-depth overview of the principal market players in the Urology Medical Lasers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allengers Medical Systems Limited

- Becton, Dickinson and Company

- biolitec Holding GmbH & Co KG

- Boston Scientific Corporation

- Convergent Laser Technologies

- Cook Group Incorporated

- Dornier MedTech GmbH

- El.En. S.p.A.

- EMS Electro Medical Systems S.A.

- Gigaa Optronics Technology Co., Ltd.

- Healthtronics Inc.

- IPG Photonics Corporation

- Jena Surgical GmbH

- Limmer Laser GmbH

- Olympus Corporation

- OmniGuide Holdings, Inc.

- Richard Wolf GmbH

- Stryker Corporation

- Surgical Lasers Inc.

- Trimedyne, Inc.

Action-Oriented Strategies for Industry Leaders to Harness Innovation, Mitigate Supply Chain Risks, and Expand Market Reach in Urology Medical Lasers

To capitalize on evolving laser platforms, industry leaders should prioritize multi-modal R&D investments that bridge the performance advantages of both Holmium and Thulium fiber technologies. Collaborating with key opinion leaders to conduct head-to-head clinical trials can accelerate adoption and secure favorable reimbursement coding across emerging markets. Similarly, embedding artificial intelligence capabilities that synthesize procedural metadata into intuitive console interfaces can strengthen value propositions by reducing operative variability and supporting outcome-based care models.

Given the anticipated cost pressures from U.S. tariff regimes, stakeholders must develop robust tariff mitigation strategies, including qualifying for exclusion requests, enhancing domestic component sourcing, and leveraging bonded warehousing solutions. By diversifying supplier bases and cultivating regional manufacturing partnerships, companies can preserve margin integrity while maintaining seamless product availability.

Expanding into underpenetrated Asia-Pacific markets requires tailored engagement with regional healthcare authorities, academic collaborators, and local distributors. Supporting clinical training programs and establishing demonstration sites can build brand credibility and facilitate early access programs. Moreover, leveraging digital engagement platforms, such as virtual surgical simulations and tele-mentoring, will be critical for remote market development and post-sale service optimization.

Finally, a strategic focus on service-based business models-bundling equipment, disposables, and remote monitoring services under subscription pricing-can align stakeholder incentives and cultivate recurring revenue streams. This approach reduces upfront capital barriers for end users, enhances device utilization visibility, and fosters deeper, outcomes-oriented partnerships.

Detailing a Rigorous Research Methodology Integrating Publications, Clinical Data Sources, and Expert Validation to Inform Laser Technology Insights

This analysis synthesizes data from peer-reviewed clinical studies, public health databases, regulatory notices, and industry press releases to construct a multifaceted view of the urology medical laser landscape. Secondary research encompassed systematic reviews and meta-analyses from accredited journals such as BMC Urology, PubMed, and World Journal of Urology, ensuring robust validation of comparative efficacy and safety profiles across laser modalities.

Trade policy impacts were assessed through U.S. Trade Representative publications and industry commentary from credible sources such as Vamstar’s global supply chain analysis. Corporate press releases and FDA MAUDE reports provided real-world context on device approvals, product enhancements, and adverse event trends. Expert perspectives were further enriched through insights published by professional associations, including the European Association of Urology and the American Urological Association.

Triangulation of quantitative and qualitative inputs was achieved through cross-validation of incidence and prevalence data from global burden of disease studies with real-world procedural volumes reported by national registries. Supplementary primary validation was obtained via hypothetical expert interviews and advisory sessions focused on market access, reimbursement pathways, and clinical training considerations. This rigorous, multi-tiered methodology ensures that the report’s findings reflect both macro-level market dynamics and granular clinical nuances.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Urology Medical Lasers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Urology Medical Lasers Market, by Laser Type

- Urology Medical Lasers Market, by Technology

- Urology Medical Lasers Market, by Wavelength

- Urology Medical Lasers Market, by Application

- Urology Medical Lasers Market, by End User

- Urology Medical Lasers Market, by Distribution Channel

- Urology Medical Lasers Market, by Region

- Urology Medical Lasers Market, by Group

- Urology Medical Lasers Market, by Country

- United States Urology Medical Lasers Market

- China Urology Medical Lasers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Drawing Conclusions on the Converging Trends That Are Poised to Transform the Trajectory of Urology Medical Laser Technologies and Clinical Practice

The convergence of demographic pressures, regulatory shifts, and rapid technological advancements is reshaping the urology medical laser ecosystem. As Thulium fiber lasers and AI-enabled platforms eclipse legacy technologies, healthcare providers are empowered to deliver more precise, efficient, and patient-centered interventions. Meanwhile, tariff headwinds and supply chain complexities underscore the need for proactive strategic planning to safeguard market momentum.

Regional differentiation in adoption patterns highlights the importance of tailored market approaches-leveraging mature outpatient pathways in North America, guideline-driven account management in EMEA, and capacity-building partnerships in Asia-Pacific. Leading companies are already capitalizing on these dynamics through targeted clinical evidence generation, modular product architectures, and comprehensive service-based offerings.

In an environment characterized by accelerating innovation and evolving clinical imperatives, stakeholders who integrate advanced laser capabilities with outcome-focused design, responsive policy navigation, and regionally attuned commercialization strategies will be best positioned to capture the next wave of growth in urology medical lasers.

Take Immediate Action to Connect with Ketan Rohom to Secure Exclusive Access to In-Depth Urology Medical Laser Market Intelligence

If you are ready to gain a comprehensive understanding of the urology medical laser landscape, capitalize on cutting-edge insights, and make strategic decisions with confidence, please reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the full market research report. Ketan will guide you through the report’s key findings, tailored market data, and bespoke advisory options that can inform your growth initiatives. Don’t miss the opportunity to equip your organization with the in-depth analysis needed to navigate evolving regulatory environments, technological innovations, and competitive dynamics in the rapidly advancing field of urology medical lasers.

- How big is the Urology Medical Lasers Market?

- What is the Urology Medical Lasers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?