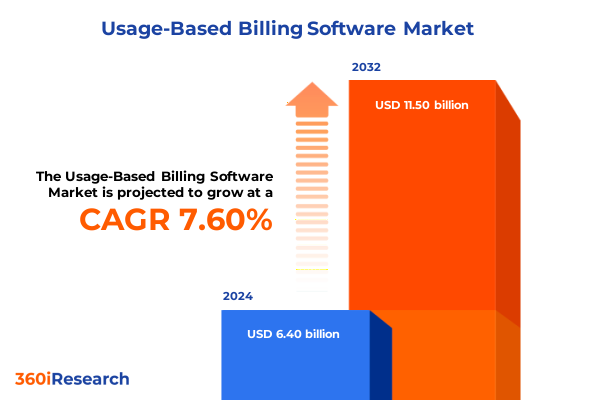

The Usage-Based Billing Software Market size was estimated at USD 6.86 billion in 2025 and expected to reach USD 7.37 billion in 2026, at a CAGR of 7.65% to reach USD 11.50 billion by 2032.

Strategic Imperatives of Usage-Based Billing Solutions in Modern Enterprises Driving Revenue Agility and Customer-Centric Monetization Approaches

Usage-based billing software has emerged as a cornerstone of modern monetization strategies, enabling organizations to align revenue generation with actual consumption. As digital transformation accelerates, companies across industries recognize the strategic value of replacing static pricing models with dynamic structures that reflect real-time usage patterns. This shift provides not only enhanced transparency for customers but also deeper visibility into product performance and service adoption. By embracing usage-based billing, enterprises can foster stronger relationships by offering tailored plans that adapt to customer needs while capturing incremental revenue opportunities.

In the wake of expanding cloud services, API-driven ecosystems, and the proliferation of connected devices, the demand for agile billing platforms has intensified. Forward-thinking organizations are leveraging usage-based billing to drive innovation, optimize cash flow, and gain a competitive edge. The introduction of consumption metrics into pricing strategies also paves the way for novel offerings-such as pay-as-you-go analytics, tiered support packages, and overage-based incentives-that were previously unfeasible. As this executive summary will reveal, the confluence of emerging technologies, shifting customer expectations, and regulatory influences has created a fertile environment for usage-based billing solutions to thrive.

Unprecedented Shifts in Usage-Based Billing Landscape Fueled by API Integration, Cloud Adoption, and Data Analytics Shaping Future Business Models

In recent years, the usage-based billing landscape has undergone transformative shifts driven by the rapid adoption of cloud-native architectures and serverless computing. Organizations increasingly deploy flexible billing engines that integrate seamlessly with microservices and containerized applications, enabling real-time consumption tracking and automated invoicing. This architectural evolution has lowered the barriers to entry for companies of all sizes, fostering a new breed of billing platforms capable of scaling horizontally to meet unpredictable spikes in demand.

Concurrently, advanced analytics and machine learning have become integral to modern billing solutions, providing actionable insights into usage trends, customer churn signals, and revenue leakage. These capabilities empower finance and product teams to optimize pricing strategies on the fly, conduct scenario planning, and personalize offers based on granular behavioral data. Moreover, self-service portals have risen to prominence, granting end users direct control over consumption monitoring, plan adjustments, and billing histories-thereby enhancing satisfaction and reducing support overhead.

As regulatory scrutiny intensifies around data privacy and financial reporting, billing platforms are also evolving to ensure compliance with global standards. Enhanced audit trails, role-based access controls, and encrypted data storage have become table stakes, particularly for industries handling sensitive information. Together, these shifts underscore a broader trend: usage-based billing is no longer a niche offering but a strategic imperative for enterprises seeking to unlock new revenue streams and cement customer loyalty.

Assessing the Cumulative Impact of 2025 United States Tariffs on Usage-Based Billing Solutions Supply Chains, Cost Structures, and Competitive Landscapes

The implementation of new tariffs by the United States government in 2025 has introduced a layer of complexity for providers and end users of usage-based billing software. Tariffs on semiconductor components, data center hardware, and network infrastructure have modestly elevated procurement costs for cloud service providers and specialized billing vendors. These cost pressures have been partially mitigated through localized hardware sourcing and renegotiated supply agreements, illustrating the sector’s resilience and adaptability.

Beyond direct cost implications, the tariffs have influenced strategic partnerships and procurement strategies. Several major billing platform vendors have diversified their manufacturing footprints to include regional data centers and hardware suppliers outside the jurisdictions affected by higher duties. This realignment has not only reduced tariff exposure but also improved latency and service availability for global customers. Meanwhile, enterprises relying on usage-based billing systems have explored multi-cloud and hybrid deployment models to balance performance objectives with tariff-induced cost variances.

Ultimately, the cumulative impact of the 2025 tariffs has reinforced the importance of robust vendor risk management processes and agile cost-pass-through mechanisms within billing frameworks. Organizations equipped with dynamic pricing engines can adjust for incremental cost changes in near real time, preserving margins without compromising competitive pricing. This adaptability stands as a testament to the strategic advantage afforded by modern usage-based billing architectures in an era of fluctuating trade policies and global economic uncertainty.

Illuminating Critical Segmentation Insights Across Billing Models, Software Modules, Enterprise Sizes, Deployment Models, User Roles, and Industry Verticals

A nuanced understanding of market segmentation reveals critical insights into customer behavior and technology adoption across varying contexts. When evaluated by billing model, companies offering overage pricing have reported improved revenue capture for spikes in usage, whereas pay-as-you-go or consumption-based schemes resonate particularly well with emerging startups seeking cost-effective scalability. Tiered pricing models continue to serve organizations with predictable usage brackets, while volume-based approaches appeal to enterprises managing high-throughput workloads.

Examining software modules provides additional clarity on functionality priorities. Analytics & Reporting capabilities have become a focal point for finance teams aiming to link usage data directly to financial forecasting, while Billing & Invoicing modules underpin core operational processes from invoice generation to automated dunning workflows. Simultaneously, Customer Self-service Portals empower end users to manage account thresholds, view consumption dashboards, and initiate plan changes without support intervention, elevating satisfaction and reducing administrative burdens.

Differences emerge when assessing enterprise size. Large enterprises often favor comprehensive deployments combining multiple modules with customized integrations and service-level guarantees. In contrast, small and medium enterprises prioritize rapid time to value and lower implementation overhead, frequently opting for cloud-based editions of billing software. Deployment model also shapes vendor selection: organizations committed to stringent data residency requirements or custom on-premise integrations continue to deploy traditional on-premise solutions, while those focused on agility lean into cloud-based offerings that deliver seamless updates and elasticity.

User role considerations further refine product expectations. Customer Support Teams demand intuitive case management and real-time usage visibility to resolve billing inquiries efficiently. Finance & Accounting Teams require reconciliation workflows, audit logs, and compliance-ready reporting. Operations & Product Teams look for deep insights into consumption patterns to inform product roadmaps and capacity planning. Sales & Marketing Teams utilize usage data to structure promotional campaigns and upsell initiatives. Finally, across end-user industries such as E-Commerce & Retail, Financial Services & Insurance, Healthcare, IT & Telecommunications, Media & Entertainment, Transportation & Mobility Services, and Utilities, the interplay between regulatory mandates, peak demand cycles, and customer experiences drives distinct requirements for usage-based billing implementations.

This comprehensive research report categorizes the Usage-Based Billing Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Billing Model

- Functional Capability

- Enterprise Size

- Deployment Model

- User Role

- End User

Strategic Regional Perspectives on Usage-Based Billing Adoption Patterns and Market Dynamics in the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics exert a profound influence on usage-based billing adoption patterns and strategic priorities. In the Americas, rapid cloud migration and a competitive landscape of SaaS providers have accelerated acceptance of flexible billing, with many organizations leveraging centralized billing hubs to serve both North and South American markets. This region’s emphasis on innovation has also fostered strong demand for real-time analytics and integration capabilities that support omnichannel monetization strategies.

Turning to Europe, Middle East & Africa, varying regulatory regimes and data sovereignty requirements have shaped deployment approaches. EMEA enterprises prioritize modular billing platforms that can accommodate localized tax structures and privacy rules. Cloud-based billing solutions that offer data partitioning and region-specific compliance features have gained traction, as organizations seek to reconcile the benefits of usage-based models with strict governance frameworks.

In Asia-Pacific, the diversity of market maturity levels has led to a spectrum of adoption. Established markets in Japan and Australia focus on advanced billing functionalities such as AI-driven consumption forecasting, while emerging economies in Southeast Asia and the Indian subcontinent are experiencing rapid uptake of pay-as-you-go models to support digital services and mobile data offerings. Across the region, investments in local data centers and joint ventures with telecommunications providers are enhancing service reliability and bringing usage-based billing within reach of new customer segments.

This comprehensive research report examines key regions that drive the evolution of the Usage-Based Billing Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-Depth Insights into Leading Usage-Based Billing Software Providers Driving Technological Innovation, Strategic Partnerships, and Competitive Differentiation

Leading providers of usage-based billing software are distinguished by their capacity to innovate, integrate, and partner effectively with broader ecosystem players. Zuora continues to refine its modular architecture, offering seamless integrations with CRM platforms and payment gateways while advancing its advanced subscription analytics offerings. Chargebee has emphasized developer-friendly APIs and extensible pricing engines that support a broad array of emerging business models, from IoT device management to digital media consumption.

Aria Systems has deepened its footprint in the enterprise segment, focusing on high-volume transaction processing and global tax compliance. Its partnerships with managed service providers and systems integrators have expanded reach into regulated industries. Oracle and SAP have also responded with usage-based modules within their broader cloud suites, catering to large enterprises seeking end-to-end financial management and resource planning solutions. Meanwhile, nimble players such as Cloudmeter and Invoiced differentiate through specialized focus on real-time usage mediation and embedded analytics.

These competitive differentiators extend beyond product features. Strategic alliances with cloud hyperscalers, telco carriers, and vertical-specific software vendors have elevated the value proposition of usage-based billing platforms, enabling clients to deploy holistic solutions that address both monetization and operational visibility. Vendor roadmaps increasingly spotlight AI-driven anomaly detection, predictive usage alerts, and automated reconciliation workflows, underscoring a collective push toward self-healing, intelligent billing infrastructures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Usage-Based Billing Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amdocs Limited

- Aria Systems, Inc.

- BillingPlatform, Inc.

- Billwerk Plus GmbH

- BluLogix, Inc.

- Cerillion Technology Ltd.

- Chargebee, Inc.

- ChargeOver, Inc.

- Cleverbridge GmbH

- Comarch SA

- CSG International, Inc.

- FastSpring, Inc.

- GoCardless Holdings Limited

- LogiSense, Inc.

- Majesco Holdings, Inc.

- MATRIXX Software, Inc.

- Maxio LLC

- NetCracker Technology Corporation

- OneBill Software, Inc.

- OpenMeter, Inc.

- Oracle Corporation

- Paddle, Inc.

- Recurly, Inc.

- Salesforce.com, Inc.

- SAP SE

- Solvimon, Inc.

- Stripe, Inc.

- Vindicia, Inc.

- Zoho Corporation

- Zuora, Inc.

Actionable Strategic Recommendations for Industry Leaders to Maximize Value from Usage-Based Billing Implementations and Achieve Sustainable Competitive Advantage

Industry leaders must prioritize the optimization of their usage-based billing strategies to capture maximum value and sustain competitive advantage. First, integrating billing platforms directly with product telemetry and usage logs ensures the accuracy and granularity of consumption data. This alignment reduces revenue leakage and enhances the customer experience by offering transparent, real-time usage visibility. Next, organizations should design pricing models that balance simplicity with flexibility, enabling customers to self-select plans that align with their growth trajectories while preserving optionality for overage and volume-based incentives.

To further deepen customer engagement, executive teams should leverage embedded analytics within billing systems to surface actionable insights for both internal stakeholders and end users. Finance and product organizations can collaboratively identify usage trends that inform promotional strategies and feature bundling. Moreover, investing in robust self-service portals will empower customers to manage thresholds, update payment methods, and forecast future spend with minimal friction, thereby reducing support costs and boosting satisfaction.

Finally, leaders must adopt a continuous improvement mindset around billing orchestration. By establishing cross-functional working groups involving finance, IT, operations, and legal teams, enterprises can rapidly respond to regulatory changes, pricing optimization opportunities, and emerging customer preferences. Piloting AI-driven anomaly detection and automated reconciliation workflows will streamline dispute resolution and reinforce trust. Altogether, these measures ensure that usage-based billing evolves in lockstep with broader digital transformation initiatives.

Comprehensive Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Expert Validation for Robust Usage-Based Billing Insights

Our research methodology combines rigorous primary and secondary data collection with expert validation to ensure robust, actionable insights. The primary phase included in-depth interviews with senior finance and product executives across multiple industries, supplemented by structured surveys of billing administrators and IT decision makers to capture firsthand experiences. These qualitative inputs provided nuanced perspectives on implementation challenges, emerging use cases, and technology requirements.

Complementing this, the secondary research phase comprised an exhaustive review of industry reports, regulatory filings, vendor whitepapers, and technical documentation to extract trends in deployment patterns, architectural innovations, and competitive positioning. Key metrics such as adoption drivers, satisfaction criteria, and integration preferences were synthesized to contextualize primary findings within broader market dynamics.

Throughout the process, a panel of independent subject matter experts validated assumptions, reviewed preliminary findings, and offered interpretive guidance on tariff implications and regional nuances. This iterative feedback loop ensured the report’s accuracy, relevance, and practical applicability. Finally, cross-case analyses distilled best practices and success factors, culminating in a holistic framework for evaluating, selecting, and optimizing usage-based billing solutions in diverse enterprise environments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Usage-Based Billing Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Usage-Based Billing Software Market, by Billing Model

- Usage-Based Billing Software Market, by Functional Capability

- Usage-Based Billing Software Market, by Enterprise Size

- Usage-Based Billing Software Market, by Deployment Model

- Usage-Based Billing Software Market, by User Role

- Usage-Based Billing Software Market, by End User

- Usage-Based Billing Software Market, by Region

- Usage-Based Billing Software Market, by Group

- Usage-Based Billing Software Market, by Country

- United States Usage-Based Billing Software Market

- China Usage-Based Billing Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesized Conclusions on the Strategic Imperatives and Transformational Impact of Usage-Based Billing Software for Forward-Looking Decision Makers

In summary, usage-based billing software has transcended its role as a mere automation tool to become a strategic enabler of revenue agility, customer satisfaction, and operational excellence. The convergence of cloud architectures, API-first design, and data-driven analytics has unlocked unprecedented opportunities for tailored monetization approaches. Moreover, evolving trade policies, such as the 2025 tariffs in the United States, have underscored the importance of flexible cost-pass-through mechanisms and supply chain diversification strategies.

Segmentation analysis reveals that no single billing model or deployment approach fits all scenarios; rather, successful implementations hinge on aligning capabilities-such as advanced analytics, self-service interfaces, and modular integrations-with organizational needs and industry-specific requirements. Regional insights further emphasize the necessity of localization, whether to comply with EMEA tax regimes or to address Asia-Pacific market maturation levels.

Leading vendors continue to differentiate through strategic partnerships, developer-centric APIs, and AI-driven innovations that streamline billing operations. For industry leaders, the path forward involves integrating billing data with broader operational systems, designing adaptive pricing frameworks, and institutionalizing continuous improvement processes. These imperatives will ensure that usage-based billing remains a catalyst for competitive advantage in an increasingly consumption-driven economy.

Engage with Ketan Rohom to Unlock Exclusive Insights and Secure Your Comprehensive Usage-Based Billing Market Research Report Today

Unlock a world of strategic growth opportunities with direct guidance from Ketan Rohom, Associate Director, Sales & Marketing. His expertise and personalized insights will empower your organization to harness the full potential of usage-based billing models. By partnering with him, you will gain access to an in-depth market research report that delivers actionable intelligence on evolving customer preferences, technological advancements, and competitive dynamics. Engage today to transform your revenue strategies, optimize operational efficiency, and secure a sustainable advantage in a market defined by continuous innovation. Don’t miss the chance to collaborate with a seasoned leader who can tailor solutions to your unique challenges and goals-reach out now to begin your journey toward superior monetization and customer loyalty.

- How big is the Usage-Based Billing Software Market?

- What is the Usage-Based Billing Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?