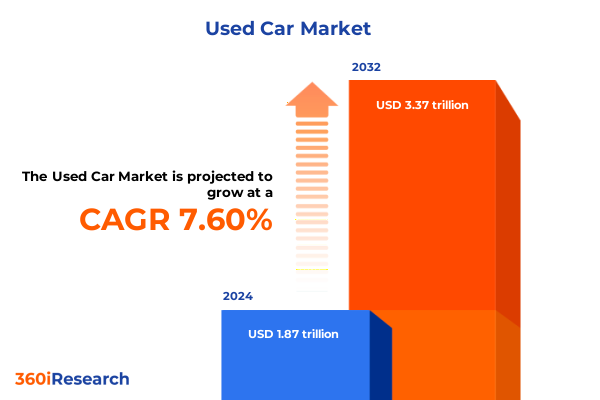

The Used Car Market size was estimated at USD 1.87 trillion in 2024 and expected to reach USD 2.01 trillion in 2025, at a CAGR of 7.60% to reach USD 3.37 trillion by 2032.

Introduction to the Evolving U.S. Used Car Landscape: Strategic Context, Stakeholder Roles, and Implications for Long-Term Decision Making

The used car market in the United States stands at a pivotal moment where affordability, reliability, and speed of transaction intersect with the benefits of digital convenience and trusted verification. This introduction sets the foundation for understanding how consumer expectations, financing dynamics, and regulatory considerations shape the choices of dealers, franchised networks, independent retailers, and digital platforms that together comprise the landscape. The purpose of this report is to present a coherent synthesis of current practice, emerging capabilities, and practical implications for governance, investment, and operational optimization without relying on speculative forecasts. By delineating the core forces at play, this section aims to orient decision makers toward actionable priorities that can withstand shifting conditions and evolving competitive pressures. The scope encompasses vehicle type preferences, channel configurations, and the evolving role of data in pricing, appraisal, and remarketing, with attention to how tariffs, trade policy, and macroeconomic signals influence strategic choices across the value chain.

Transformative Shifts Redefining the Used Car Marketplace: Digital Platforms, Supply Chain Realities, Economic Pressures, and Changing Consumer Behavior

Transformative shifts are reshaping the used car marketplace as digital platforms, data analytics, and new ways of engaging buyers redefine how vehicles move from lot to owner. Online valuations, transparent history reporting, and remote purchase experiences are lowering the friction associated with vehicle discovery, inspection, and financing. This evolution is accompanied by a reimagining of the remarketing cycle, where sellers combine online auctions, franchised and independent dealer networks, and direct consumer channels to optimize inventory velocity and risk management. For lenders and insurers, improved data quality and standardized certification protocols are enabling more confident underwriting and after-sale assurance, which in turn expands access to credit and broadens the pool of eligible buyers. The confluence of these capabilities supports a more dynamic, responsive market where pricing discipline, risk controls, and customer experience become differentiators rather than mere compliance requirements. Meanwhile, supply constraints in the broader vehicle ecosystem continue to influence model mix, inventory turnover, and the cadence of replenishment, underscoring the need for strategic allocation of capital and a robust roadmap for digital enablement across the value chain.

Cumulative Impact of United States Tariffs in 2025 on Used Car Sourcing, Pricing Flexibility, and Dealer Operational Strategies Across Channels

Tariffs and related policy developments in 2025 carry meaningful implications for used car sourcing, purchasing economics, and dealer operations, even when the immediate impact is indirect. When import costs rise or sourcing options shift due to trade measures, the downstream effects manifest as altered procurement strategies, changes in vehicle mix, and adjustments to financing and warranty offerings to preserve value for buyers. Dealers and remarketers respond by diversifying sourcing models, prioritizing domestic inventory where feasible, and strengthening relationships with certified partners that can deliver consistent quality at predictable margins. These dynamics reinforce the importance of agility in procurement, pricing discretion, and channel coordination, ensuring that each stakeholder can adapt to evolving policy landscapes while maintaining service levels. The cumulative effect is a more resilient approach to inventory planning, with an emphasis on transparency, risk management, and customer-centric solutions that sustain trust in an environment of policy volatility and market uncertainty.

Key Segmentation Insights Informing Product, Marketing, and Channel Decisions Across Vehicle Type, Fuel, Transmission, Ownership, Usage, and Sales Channel

Understanding segmentation is essential for aligning product, marketing, and channel strategies with the diverse needs of buyers. Vehicle type preferences in the market span Coupes & Convertibles, Hatchbacks, Minivans/MPVs, Sedans, SUVs, and Pickup Trucks, each driving distinct resale profiles, inspection considerations, and after-sales expectations. Fuel type variations across Diesel, Electric, Hybrid, and Petrol influence maintenance costs, availability of service, and buyer perceptions of reliability and future-proofing, which in turn shape certification programs and warranty design. Transmission type choices, including Automatic and Manual transmissions, affect maintenance practice, demand in certain regions, and the ease with which dealers can certify roadworthiness. Ownership type, captured through Multiple Owners and Single Owner segments, informs risk management, history reporting, and inventory selection, while Usage type, spanning Commercial and Personal use, guides fleet remarketing strategies and value retention expectations. Finally, Sales Channel segmentation-Auction House, Franchised Dealers, Independent Dealers, and Individual Owner-drives channel-specific service models, data sharing, and transaction pathways that determine how quickly a vehicle moves through the lifecycle. Each dimension interacts with the others to create nuanced buyer personas, enabling targeted service offerings, pricing fidelity, and trust-building initiatives that improve overall remarketing efficiency.

This comprehensive research report categorizes the Used Car market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Fuel Type

- Car Age

- Transmission Type

- Ownership Type

- Usage Type

- Sales Channel

Key Regional Insights Revealing How Americas, Europe, Middle East & Africa, and Asia-Pacific Shape Demand, Regulation, and Competitive Dynamics in the Used Car Sector

Regional dynamics shape demand, regulation, and competitive behavior in profound ways. In the Americas, the mix of urban and suburban ownership models, strong financing ecosystems, and active auction activity drive a robust used car flow that rewards efficiency, data transparency, and flexible warranty options. Europe, the Middle East & Africa present a mosaic of regulatory regimes and consumer protections that elevate the importance of vehicle history, compliant labeling, and after-sales support, while also highlighting the appeal of electrified powertrains in markets with supportive charging infrastructure. In the Asia-Pacific region, rapid digital adoption, diverse income levels, and expanding consumer credit access accelerate the pace of online discovery and transaction completion, even as supply and trade considerations punctuate demand and vehicle mix. Across these regions, policy signals, labor markets, and logistics networks shape the speed and direction of remarketing activity, creating opportunities to differentiate through reliability, speed, and value assurance. The ability to tailor pricing, certification, and financing to regional preferences becomes a critical driver of trust and loyalty among buyers and sellers alike.

This comprehensive research report examines key regions that drive the evolution of the Used Car market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Companies Insights Highlighting How Leading Players Compete Through Digital Innovation, Omnichannel Delivery, and Data‑Driven Asset Strategies

Industry leaders are leveraging a combination of digital innovations, data analytics, and omnichannel operations to stay competitive in a rapidly evolving market. Advancements in vehicle history verification, inspection protocols, and condition reporting are reducing information asymmetry and enabling more confident decision making for buyers and sellers. The most successful players integrate online experiences with physical touchpoints, combining precision valuations, convenient test drives, and swift settlement processes to deliver a seamless journey from search to ownership. Data-driven remarketing strategies, including dynamic pricing, inventory optimization, and personalized financing offers, further enhance conversion while reducing risk. Collaborative relationships with banks, lenders, and insurance providers expand access to affordable credit and protect buyers with value-added services that differentiate the offering beyond price. As platforms mature, the emphasis shifts toward compliance, security, and trust, with governance frameworks and transparent reporting underpinning sustainable growth and long-term viability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Used Car market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Group Holding Limited

- Asbury Automotive Group

- AUDI AG

- AutoNation, Inc.

- AutoScout24 GmbH

- Avis Car Sales, LLC

- Big Boy Toyz

- BMW AG

- CarGurus, Inc.

- CarMax Enterprise Services, LLC

- CARS24 Services Pvt Ltd

- CarTrade Tech Ltd.

- Carvana Operations HC LLC

- Cox Automotive, Inc.

- eBay Inc.

- Enterprise Holdings, Inc.

- Group 1 Automotive

- Hendrick Automotive Group

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Lithia Motors, Inc.

- Mahindra First Choice Wheels Limited

- Maruti Suzuki India Limited

- Morgan Auto Group

- Penske Automotive Group

- Sixt Rent a Car, LLC

- Toyota Motor Corporation

- TrueCar, Inc.

- VroomWheel

Actionable Recommendations for Industry Leaders to Navigate Tariffs, Accelerate Digital Transformation, and Align Segmented Demand Across Channels and Regions

Industry leaders should pursue practical, implementable actions that translate market dynamics into competitive advantage. First, accelerate digital capability across the full lifecycle of the vehicle, from discovery and appraisal to financing and delivery, ensuring customers experience speed, clarity, and confidence at every touchpoint. Second, invest in segmentation-driven inventory and remarketing strategies that align vehicle mix, pricing fidelity, and post-sale services with distinct buyer personas and channel preferences, while maintaining rigorous risk controls and certifiable vehicle histories. Third, strengthen regional execution by tailoring product assortments, financing solutions, and service offerings to the regulatory context, consumer expectations, and logistics realities of each market. Fourth, emphasize partnerships across the ecosystem-lawful data sharing, certified inspection networks, and insurer collaborations-to expand access to credit, improve post-sale outcomes, and build enduring trust. Finally, institutionalize scenario planning to stress-test tariffs, supply volatility, and financing conditions, ensuring contingency options are embedded in procurement, pricing, and channel strategy so leadership can respond swiftly to emerging disruptions.

Research Methodology Detailing Data Sources, Triangulation Techniques, Expert Interviews, and Analytical Frameworks Behind the Executive Summary

The methodology combines qualitative and qualitative inputs to produce a robust, decision-ready executive summary. Primary sources include in-depth conversations with senior executives, remarketing specialists, and policy experts who offer firsthand perspectives on regulatory developments, financing dynamics, and consumer behavior. Secondary sources comprise established industry datasets, publicly available regulatory materials, and market performance snapshots that provide context for the qualitative insights. The approach emphasizes triangulation, cross-checking observations against multiple sources to ensure credibility and reduce bias. Analysts translate these insights into coherent implications for strategy, with a focus on actionable actions rather than speculative projections. By documenting assumptions, limitations, and the interdependencies among segmentation, regional dynamics, and channel strategies, this methodology supports transparent decision making and ongoing refinement as new information becomes available.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Used Car market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Used Car Market, by Vehicle Type

- Used Car Market, by Fuel Type

- Used Car Market, by Car Age

- Used Car Market, by Transmission Type

- Used Car Market, by Ownership Type

- Used Car Market, by Usage Type

- Used Car Market, by Sales Channel

- Used Car Market, by Region

- Used Car Market, by Group

- Used Car Market, by Country

- United States Used Car Market

- China Used Car Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Conclusion Emphasizing Strategic Priorities, Execution Readiness, and the Imperatives for Sustained Value Creation in the Used Car Market

The executive summary underscores the practical implications of evolving industry dynamics for strategic planning, investment prioritization, and operational excellence. It highlights how the convergence of digital capability, consumer expectations, and policy considerations creates an environment where speed, transparency, and trust become critical differentiators. The analysis demonstrates that success hinges on a rigorous alignment of product strategy, channel mix, and service design with segmentation realities and regional nuances, supported by robust data governance and risk management practices. In this context, leadership should focus on building resilient operating models that can adapt to policy shifts and supply volatility while maintaining a compelling value proposition for buyers. The overarching message is that strategic clarity, disciplined execution, and continuous learning will enable stakeholders to sustain value creation and competitive advantage in a market characterized by complexity and opportunity.

Strategic Call to Action: Connect with a Senior Market Intelligence Leader to Discuss Accessing the Comprehensive Used Car Market Report and Accelerate Strategic Decision-Making

The definitive call to action invites decision makers to engage with a senior market intelligence professional to access the complete used car market report and leverage its insights for strategic planning. The objective is to accelerate informed decision making, align investment in inventory and technology with projected market dynamics, and strengthen competitive positioning across channels. Prospective buyers are encouraged to initiate a dialogue that clarifies scope, timelines, and deliverables, ensuring that stakeholders can translate qualitative insights into tangible actions. The leadership contact details are provided to facilitate a streamlined briefing process, enabling rapid scheduling of executive sessions, data demonstrations, and scenario planning tailored to specific business needs.

- How big is the Used Car Market?

- What is the Used Car Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?