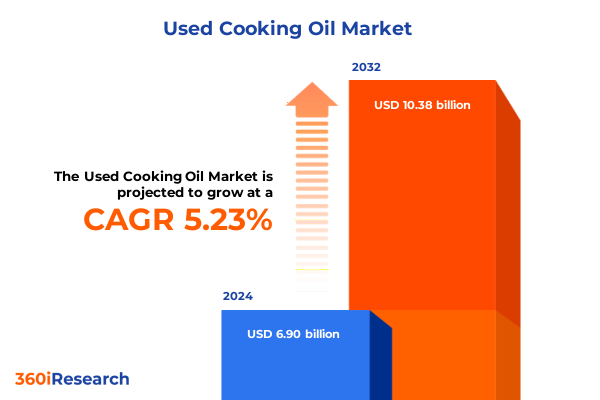

The Used Cooking Oil Market size was estimated at USD 7.22 billion in 2025 and expected to reach USD 7.55 billion in 2026, at a CAGR of 5.32% to reach USD 10.38 billion by 2032.

Navigating the Emerging Dynamics of the United States Used Cooking Oil Market Amidst Global Sustainability Imperatives and Policy Shifts

The United States used cooking oil sector stands at the crossroads of environmental sustainability, energy security, and global trade realignment. In recent years, heightened regulatory focus on carbon reduction has elevated the role of waste-based feedstocks, placing used cooking oil at the center of ambitious decarbonization agendas. Meanwhile, geopolitical tensions and shifting trade policies have compelled market stakeholders to rethink established sourcing channels and develop resilient supply chains.

As new sustainability standards emerge, refiners and biofuel producers are adapting processing technologies to optimize yields from heterogeneous oil streams ranging from household kitchen waste to industrial deep-frying residues. At the same time, collection and recycling services are innovating business models, integrating digital tracking and reverse-logistics platforms to increase recovery rates and ensure feedstock traceability. These technological leaps are accompanied by evolving consumer and corporate sustainability commitments, which are translating into greater demand for certified low-carbon fuels and increased investments in circular economy initiatives.

Against this backdrop of regulatory pressures, technological advances, and sustainability commitments, industry participants face both significant challenges and compelling opportunities. By harnessing emerging data analytics, strategic partnerships, and adaptive operational frameworks, companies can meet rising demand for renewable diesel, sustainable aviation fuel, and other low-carbon products. This introduction frames the complex interplay of market drivers and sets the stage for a deeper exploration of transformative shifts, policy impacts, segmentation, and actionable recommendations throughout the ensuing analysis.

Uncovering Key Transformative Shifts Reshaping the Global Supply Chains, Trade Flows, and Sustainability Practices in the Used Cooking Oil Landscape

Global flows of used cooking oil have undergone profound transformation as sustainability mandates and tariff actions have reshaped trade patterns and supply-chain configurations. Notably, Chinese exporters, long the primary suppliers of waste oils to the United States, have redirected volumes toward Europe and emerging Asian markets in response to steep duties on inbound shipments. This pivot has accelerated infrastructure development across the European Union, driven by new requirements for sustainable aviation fuel blending, while simultaneously widening access to feedstocks for expanding SAF facilities in South Korea, Thailand, and Malaysia.

Simultaneously, domestic collection networks in North America have scaled to capture an ever-broader range of feedstocks. Innovations in real-time route optimization and mobile collection platforms are not only enhancing operational efficiency but also improving compliance reporting under low-carbon fuel standards. Consequently, more localized supply hubs have emerged to support regional biofuel refineries, reducing logistical bottlenecks and mitigating exposure to international trade volatility.

Moreover, corporate procurement strategies now emphasize multi-feedstock flexibility, with refiners investing in modular processing units capable of handling diverse oil types, from animal fats to blended waste oils. These adaptive technologies, coupled with digital monitoring systems, enable greater yield predictability and lower lifecycle emissions. As the market continues to evolve, the interplay of regulatory frameworks, digital logistics, and decentralized processing is redefining how value is created across the used cooking oil ecosystem.

Assessing the Cumulative Impact of the United States’ 2025 Tariff Measures on Global Used Cooking Oil Trade and Domestic Feedstock Availability

The imposition of a 125% tariff on used cooking oil imports from China, effective April 2025, has sharply curtailed volumes entering the United States and prompted significant adjustments across the supply chain. Prior to the tariff, China exported nearly 3 million metric tonnes of used cooking oil annually, with U.S. imports valued at approximately $1.1 billion in 2024 being the single largest destination. With the new duty in place, American refiners have experienced a sudden gap in feedstock availability, leading to increased domestic sourcing and a surge in price volatility.

In response to the supply shock, domestic collection entities have ramped up their capacities, leveraging reverse-logistics partnerships with foodservice operators and industrial processors. This has driven greater investments in on-site aggregation tanks and mobile collection fleets, enabling near-real-time feedstock procurement to stabilize refinery throughput. At the same time, policy uncertainty around future tariff adjustments has spurred refiners to diversify import origins, seeking supplies from Southeast Asia, Latin America, and Europe to mitigate single-source risk.

However, the shift away from established Chinese channels has not been seamless. New import relationships often entail longer lead times, elevated freight costs, and varying quality profiles. As a result, refiners have accelerated process optimization efforts and quality assurance protocols to accommodate a broader range of fatty acid compositions. Collectively, these market recalibrations underscore the profound and lasting impact of 2025 tariff measures on both global trade flows and the domestic biofuel landscape.

Deriving Comprehensive Insights from Multi-Dimensional Segmentation Perspectives Illuminating Diverse Value Streams within the Used Cooking Oil Industry

A multi-dimensional examination of the used cooking oil market through the lenses of oil type, source, service type, packaging, application, and distribution channel reveals distinct value streams and performance drivers. Segmentation by oil type highlights the prominence of vegetable oil varieties-particularly palm, soybean, and sunflower-while also acknowledging the niche but critical role of animal fats in markets with specialized feedstock requirements. This nuanced perspective enables processors to tailor refining processes and quality controls to each oil’s unique fatty acid profile.

Looking at feedstock origin further clarifies competitive dynamics. Commercial, household, and industrial sources each bring differing collection challenges, oil qualities, and logistical footprints. By understanding these nuances, service providers can optimize their pickup networks and refine cost structures accordingly.

Similarly, the bifurcation between collection & pickup services and recycling & processing services underscores the importance of end-to-end coordination. Integrated operators that combine aggregation, pre-treatment, and refining capabilities often achieve higher margin capture and stronger quality assurance than firms focused solely on one service segment.

Packaging forms another strategic differentiation point, with barrels, bulk containers, and tanks each offering trade-offs in handling efficiency, storage requirements, and transport economics. Furthermore, applications ranging from animal feed and cosmetics to biofuel and industrial uses-where industrial end uses like detergents, lubricants, and paints & coatings each demand specific purity levels-shape value realizations across the chain.

Finally, the rise of online distribution channels alongside traditional offline routes reflects a broader digital transformation, with e-marketplaces increasingly facilitating price discovery, contract execution, and real-time tracking. This holistic segmentation analysis empowers stakeholders to pinpoint growth areas and optimize operational models for resilient performance.

This comprehensive research report categorizes the Used Cooking Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Oil Type

- Sources

- Service Types

- Packaging

- Application

- Distribution Channel

Elucidating Critical Regional Variations Highlighting Opportunities and Challenges across Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional dynamics in the used cooking oil market are strongly influenced by policy landscapes, infrastructure maturity, and sustainability mandates. In the Americas, advanced biofuel mandates and credit systems on both coasts have driven rapid growth in collection networks and refining capacity. State-level low-carbon fuel standards incentivize higher-value waste-based feedstocks, further propelling innovations in mobile aggregation and carbon intensity tracking.

Conversely, Europe, the Middle East, and Africa exhibit a more fragmented landscape. The European Union’s SAF blending requirements have created pockets of intense demand, particularly in Western Europe, where port-based refineries convert waste oils into sustainable aviation fuel. Meanwhile, emerging economies in the Middle East and North Africa are exploring public–private partnerships to build integrated collection and refining hubs, balancing nascent demand with infrastructure constraints.

In the Asia-Pacific, robust growth in foodservice markets and rising environmental regulations are catalyzing domestic collection ecosystems. Countries like Japan and South Korea are mandating higher waste oil recovery rates, prompting private-sector investment in advanced treatment facilities. Southeast Asian exporters, having absorbed displaced Chinese volumes, are now enhancing export logistics to meet global specifications and regulatory requirements. Across all regions, the interplay of local policy, infrastructure readiness, and global demand for low-carbon fuels shapes the unique contours of each market.

This comprehensive research report examines key regions that drive the evolution of the Used Cooking Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Demonstrating Strategic Initiatives and Competitive Positioning in the Global Used Cooking Oil Sector

Leading companies in the used cooking oil sector are deploying differentiated strategies to secure feedstock, expand processing capabilities, and strengthen customer relationships. Vertically integrated firms are investing in upstream collection assets, pre-treatment facilities, and modular refining units to improve margin capture and quality control. Meanwhile, specialized service providers are leveraging digital solutions to optimize routing, reduce idle capacity, and enhance traceability.

Strategic alliances between collectors, refiners, and end users have emerged as a key competitive lever, enabling stakeholders to share risk and co-invest in advanced processing infrastructure. Additionally, recent mergers and acquisitions have consolidated regional players, creating scale advantages in procurement and logistics. At the same time, newcomers with agile business models are entering the market, often focusing on niche applications such as cosmetic-grade waste oils or premium animal feed supplements.

Innovation in feedstock authentication and carbon accounting has also become a central differentiator, with proprietary certification schemes enabling customers to validate low-carbon claims and comply with stringent reporting standards. These concerted efforts reflect a broader industry imperative to reinforce supply security, uphold environmental integrity, and capitalize on the growing demand for sustainable end products.

This comprehensive research report delivers an in-depth overview of the principal market players in the Used Cooking Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABP Food Group

- All in Sanitation Services LLC

- Apeiron AgroCommodities Pte. Ltd.

- Argent Energy (UK) Limited

- Arrow Oils Ltd.

- Baker Commodities, Inc.

- BiomotivE (HK) Limited

- Cosmo Energy Holdings Co., Ltd.

- Darling Ingredients Inc.

- Environmental Oils Pty Ltd.

- First Mile Limited

- GrainCorp Limited

- Grand Natural Inc.

- Greasecycle

- Greasezilla

- Greenergy International Ltd. by Trafigura Group Pte Ltd

- Greenlife Oil Holdings Pty Ltd.

- GreenPlanet Bio-Fuels Inc.

- MBP Solutions Ltd.

- Muenzer Bioindustrie GmbH

- Neste Oyj

- OZ Oils Pty Ltd.

- PanOleo Energy

- Sanimax ABP Inc.

- Smart Alternative Fuels, Inc.

- Veolia Environnement S.A.

Formulating Actionable Recommendations Empowering Industry Leaders to Capitalize on Emerging Trends and Navigate Policy Shifts in the Used Cooking Oil Realm

Industry leaders should prioritize diversification of feedstock origins by establishing strategic partnerships in emerging export markets, thereby mitigating tariff exposure and securing stable supply. Equally important is the acceleration of digital transformation across collection and logistics; investing in real-time tracking and data analytics will enhance operational efficiency and ensure compliance with evolving sustainability criteria.

Further, companies are advised to develop modular processing capabilities that can adapt to varied oil qualities and seasonal supply fluctuations. Such flexibility will not only improve yield optimization but also reduce capital intensity by allowing incremental expansion. Concurrently, pursuing collaborative ventures with technology providers and end-user refiners can facilitate shared investment in next-generation pretreatment and refining technologies.

To capture premium pricing, organizations must integrate robust carbon accounting frameworks and certification schemes, ensuring transparency and trust among downstream customers. Complementing this, expanding value-added service offerings-such as on-site oil segregation, quality assurance labs, and bespoke carbon reporting-will strengthen customer loyalty and reinforce market differentiation.

Finally, proactive engagement with policymakers is critical. By contributing technical expertise and engaging in policy dialogues, industry stakeholders can help shape regulatory frameworks that balance domestic feedstock development with international trade considerations, fostering a more resilient and sustainable ecosystem.

Defining a Robust Research Methodology Ensuring Transparency, Rigor, and Credibility in the Used Cooking Oil Market Analysis

This study leverages a blended research approach, combining primary interviews with industry executives, service providers, and regulatory bodies, alongside comprehensive analysis of trade databases, public policy documents, and proprietary market intelligence. Field research encompassed site visits to collection hubs, processing facilities, and major ports, providing granular insights into operational practices and logistical constraints.

Secondary research involved an extensive review of academic publications, governmental reports, and trade journal articles, ensuring triangulation of data points and validation of key assumptions. Trade flow analyses utilized customs and import-export databases to quantify volume shifts and origin-destination matrices. Carbon intensity assessments applied established lifecycle analysis methodologies, aligned with recognized standards under federal and state low-carbon fuel programs.

Quantitative modeling incorporated sensitivity analyses around feedstock price fluctuations, tariff scenarios, and policy changes to stress-test market forecasts. Throughout the research, rigorous quality controls were maintained via internal peer reviews and expert advisory consultations, guaranteeing both the credibility and applicability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Used Cooking Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Used Cooking Oil Market, by Oil Type

- Used Cooking Oil Market, by Sources

- Used Cooking Oil Market, by Service Types

- Used Cooking Oil Market, by Packaging

- Used Cooking Oil Market, by Application

- Used Cooking Oil Market, by Distribution Channel

- Used Cooking Oil Market, by Region

- Used Cooking Oil Market, by Group

- Used Cooking Oil Market, by Country

- United States Used Cooking Oil Market

- China Used Cooking Oil Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Perspectives Synthesizing Market Dynamics, Policy Implications, and Strategic Pathways for Stakeholders in the Used Cooking Oil Sector

The evolving landscape of the used cooking oil industry presents both complex challenges and significant opportunities for sustainability-driven growth. Policy actions such as the 2025 U.S. tariff measures have catalyzed a rethink of global supply chains, spurring domestic collection expansions and diversifying import sources. Meanwhile, segmentation insights underscore the criticality of tailoring strategies across varied feedstock types, service models, and end-use applications.

Regional perspectives reveal that mature markets in the Americas leverage advanced policy frameworks and infrastructure, while EMENA and Asia-Pacific regions are dynamically scaling capabilities to meet nascent demand and regulatory requirements. Competitive analysis highlights a trend toward vertical integration, digital innovation, and strategic alliances as key success factors.

Ultimately, stakeholders that adopt flexible processing technologies, robust carbon accounting, and proactive policy engagement will be best positioned to thrive. By synthesizing market dynamics, policy implications, and strategic pathways, this report equips industry participants with the insights and recommendations necessary to navigate the complexities of the global used cooking oil sector.

Engaging with Ketan Rohom to Secure Comprehensive Insights and Acquire the Definitive Market Research Report on Used Cooking Oil Dynamics

If you’re ready to deepen your understanding of the evolving used cooking oil market, connect today with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through the comprehensive research, data-driven insights, and strategic analysis vital for informed decision-making. Reach out to secure your organization’s access to the full market research report, and empower your next move with authoritative intelligence.

- How big is the Used Cooking Oil Market?

- What is the Used Cooking Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?