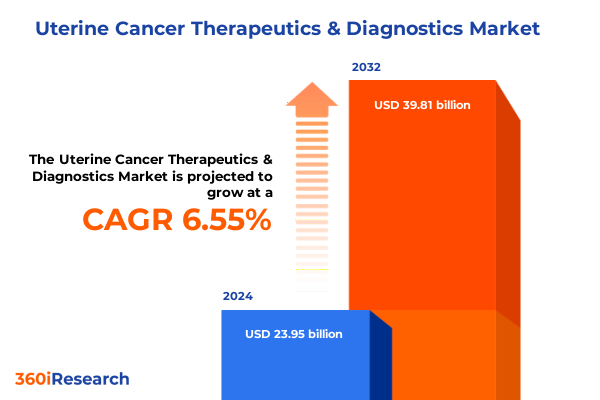

The Uterine Cancer Therapeutics & Diagnostics Market size was estimated at USD 25.43 billion in 2025 and expected to reach USD 27.00 billion in 2026, at a CAGR of 6.61% to reach USD 39.81 billion by 2032.

Unveiling the Critical Role of Advanced Therapeutic and Diagnostic Strategies in Shaping the Future of Uterine Cancer Care in the United States

The landscape of uterine cancer management requires a nuanced understanding of both therapeutic innovations and diagnostic precision. As the incidence of uterine malignancies continues to evolve, healthcare providers and industry stakeholders must collaborate to ensure that the latest advancements translate into meaningful patient outcomes. This introduction sets the stage by emphasizing the critical interplay between novel drug modalities and cutting-edge diagnostic technologies, underscoring the imperative for a cohesive approach to combat this complex disease.

Against the backdrop of increasing research investments and regulatory endorsements of targeted therapies, scientific discourse has shifted toward personalized medicine. Clinicians and researchers alike are adopting integrated strategies that combine molecular profiling with adaptive treatment regimens. Consequently, this report begins by framing the current state of uterine cancer care, highlighting how diagnostic breakthroughs-such as high-throughput sequencing and advanced immunohistochemistry-enable earlier detection and more precise therapeutic matching.

In addition, the summary outlines the thematic pillars explored throughout the comprehensive analysis: transformative technology shifts; policy-driven market forces; segmentation insights across clinical, diagnostic, and commercial dimensions; regional adoption dynamics; competitive landscapes; and strategic imperatives. By delineating these elements, readers gain clarity on the multifaceted drivers shaping the uterine cancer ecosystem, paving the way for informed decision-making and accelerated innovation.

Examining Paradigm-Shifting Innovations and Emerging Modalities Reshaping Uterine Cancer Treatment and Diagnostic Workflows Nationwide

Innovations at the crossroads of immuno-oncology, targeted therapies, and digital diagnostics are rewriting the playbook for uterine cancer management. Over recent years, the advent of checkpoint inhibitors and adoptive cell therapies has demonstrated promising clinical responses, particularly in tumors with high genomic instability. In parallel, the integration of multiplex immunohistochemistry and next-generation sequencing has empowered clinicians to stratify patients based on biomarker profiles, enabling a more precise therapeutic index.

Moreover, the rise of combination regimens-pairing PARP inhibitors with angiogenesis blockers, for example-has sparked a paradigm shift in trial design and clinical outcomes. These multi-modal approaches underscore a broader trend toward personalized treatment algorithms, wherein real-world evidence guides dosing schedules and safety monitoring. Concurrently, digital pathology platforms, augmented by artificial intelligence, accelerate histopathological review and facilitate decentralized clinical trials, thereby reducing time-to-insight and broadening patient access.

Furthermore, the diagnostic sphere is undergoing a digital metamorphosis. Automated platforms now support scalable immunohistochemistry workflows, while cloud-based genomic data repositories accelerate variant interpretation. Together, these advances foster a closed-loop system in which molecular diagnostics inform treatment selection and longitudinal monitoring in near real time. Consequently, stakeholders can anticipate a sustained trajectory of innovation as integrated solutions continue to emerge, redefining standards of care and enhancing clinical decision support.

Assessing the Impact of 2025 United States Tariff Revisions on Accessibility, Cost Dynamics, and Supply Chain Resilience in Uterine Cancer Solutions

In 2025, the United States implemented a suite of tariff revisions impacting imports across pharmaceutical ingredients, diagnostic reagents, and laboratory instrumentation. These policy adjustments have introduced new cost pressures on raw materials-such as active pharmaceutical ingredients for chemotherapy compounds and proprietary antibodies for immunohistochemistry assays. As a result, manufacturers and diagnostic developers have faced elevated procurement expenses, which in turn influence downstream pricing and reimbursement negotiations.

In response to these tariffs, organizations have reevaluated their global supply chain networks, adopting nearshoring strategies for critical intermediates while forging alternative sourcing agreements. Concurrently, some diagnostic laboratories have accelerated investments in in-house reagent production, mitigating exposure to volatile import duties. These adaptive responses have not only reshaped procurement protocols but also driven enhanced collaboration between suppliers and end users to ensure continuity of care.

Furthermore, the cumulative effect of elevated import costs has prompted stakeholders to revisit contract terms with payers, advocating for revised payment models that reflect the new cost baseline. Policymakers and industry consortia are engaging in dialogue to balance trade policy objectives with patient access imperatives. Ultimately, the tariff landscape of 2025 underscores the interconnectedness of regulatory policy, supply chain resilience, and the affordability of uterine cancer diagnostics and therapeutics.

Dissecting Patient Centric Treatment Modalities and Diverse Diagnostic Platforms Within a Multi-Dimensional Segmentation Framework for Uterine Cancer Management

The treatment landscape can be comprehensively understood by examining therapeutic modalities that span chemotherapy, immunotherapy, radiotherapy, and targeted therapy. Within chemotherapy, the focus hones in on antimetabolites, platinum compounds, and taxanes, each offering unique mechanisms of action and toxicity profiles. Meanwhile, targeted therapies are characterized by monoclonal antibodies, PARP inhibitors, and tyrosine kinase inhibitors, all of which leverage molecular vulnerabilities to optimize efficacy and minimize off-target effects. Such a segmentation framework illuminates how each modality contributes to tailored treatment pathways.

Simultaneously, diagnostic technologies facilitate precise disease characterization through diverse platforms. Flow cytometry enables rapid cellular phenotyping, while fluorescence in situ hybridization offers chromosomal aberration insights at the single-cell level. Immunohistochemistry, delivered through both automated platforms and manual assays, provides spatial protein expression data, whereas next-generation sequencing and polymerase chain reaction deliver high-resolution genomic and transcriptomic profiles. Together, these technologies underpin clinical decision support and enable iterative monitoring throughout the treatment continuum.

Route of administration further delineates therapeutic delivery into intravenous infusions and oral formulations. Intravenous approaches ensure immediate systemic exposure and controlled dosing, while oral tablets enhance patient convenience and adherence. This distinction influences regimen selection and patient quality of life, particularly in maintenance therapy settings.

End users-ranging from ambulatory care centers and diagnostic laboratories to hospitals, oncology clinics, and research institutes-form the nexuses of care delivery and data generation. Each setting presents distinct operational workflows and volume thresholds that shape technology adoption and service models. Finally, distribution channels, encompassing hospital pharmacies, retail pharmacies, and specialty pharmacies, complete the value chain by connecting manufacturers with patients. Their interplay determines logistical efficiency, inventory management, and the overall patient experience.

This comprehensive research report categorizes the Uterine Cancer Therapeutics & Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Diagnostic Technology

- Route Of Administration

- Distribution Channel

- End User

Comparative Appraisal of Region-Specific Trends Unveils Unique Adoption Patterns Regulatory Landscapes and Infrastructure Capacities Across Global Markets

Regional dynamics reveal distinct trajectories in uterine cancer management across the Americas, where established regulatory pathways and robust reimbursement frameworks have accelerated the adoption of precision diagnostics and novel therapeutics. In North America, strategic partnerships between academic centers and industry have yielded high-impact clinical trials and facilitated early access programs. Meanwhile, Latin American markets are investing in capacity-building initiatives to expand diagnostic infrastructure and enhance drug affordability through public-private collaborations.

In Europe, the Middle East, and Africa, heterogeneous regulatory landscapes present both challenges and opportunities. Western European nations benefit from centralized pricing negotiations and comprehensive screening programs, whereas emerging markets in the Middle East are prioritizing healthcare diversification and technology transfer. Across sub-Saharan Africa, diagnostic access remains constrained, driving innovative point-of-care testing models and mobile health deployments. These regional variations underscore the need for adaptable market entry strategies and customized engagement plans.

Asia-Pacific markets display a convergence of rapid technological uptake and localized manufacturing initiatives. Countries such as Japan and South Korea lead in genomic testing integration, supported by government incentives for digital pathology and AI-driven diagnostics. In Southeast Asia and Australia, efforts to scale up oral therapy access and decentralized care models have gained momentum, reflecting a broader shift toward value-based healthcare. Consequently, stakeholders must navigate diverse regulatory requirements and reimbursement policies to unlock the region’s significant potential.

This comprehensive research report examines key regions that drive the evolution of the Uterine Cancer Therapeutics & Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders Driving Breakthrough Therapeutic Pipelines Diagnostic Advancements and Strategic Collaborations in Uterine Cancer Research Arena

Major pharmaceutical innovators have prioritized pipeline diversification to address unmet needs in uterine cancer. Leading global players have announced initiatives to expand their portfolios beyond classical cytotoxic agents, integrating novel immunomodulators and targeted small molecules. Strategic collaborations with biotechnology firms have accelerated the development of first-in-class compounds that exploit synthetic lethality and tumor microenvironment modulation. As a result, the competitive landscape is increasingly defined by alliances that blend complementary expertise in drug discovery and clinical development.

Diagnostic leaders have similarly pursued growth through product differentiation and technological convergence. Firms specializing in next-generation sequencing have enhanced assay workflows to deliver tumor mutation burden and microsatellite instability metrics, supporting broader biomarker-driven treatment selection. Concurrently, immunohistochemistry suppliers have advanced automated platforms to streamline multiplex staining and image analysis. These enhancements facilitate laboratory scalability and satisfy growing demand for precision diagnostics in decentralized settings.

Moreover, integrated healthcare conglomerates are forging end-to-end solutions by combining therapeutic development, diagnostic services, and digital platforms. Such entities leverage cross-functional synergies to offer bundled care pathways, encompassing molecular profiling, real-world evidence generation, and patient support programs. This strategic orientation underscores the industry’s movement toward holistic value propositions that align clinical efficacy, cost-effectiveness, and patient experience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Uterine Cancer Therapeutics & Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AstraZeneca PLC

- Becton, Dickinson and Company

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company Ltd.

- Eisai Co., Ltd.

- F. Hoffmann-La Roche AG

- GlaxoSmithKline plc

- Hologic Inc.

- Illumina, Inc.

- Intuitive Surgical Inc.

- Karyopharm Therapeutics, Inc.

- Merck KGaA

- Myriad Genetics, Inc.

- Novartis AG

- Pfizer Inc.

- QIAGEN N.V.

- Roche Holding AG

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Implementing Forward-Looking Strategic Recommendations to Optimize Development Pathways Enhance Access Models and Accelerate Clinical Impact for Uterine Cancer Solutions

To thrive in an era of rapid innovation and policy flux, industry leaders must adopt a multifaceted approach that spans product development, market access, and stakeholder engagement. First, it is imperative to localize manufacturing footprints and diversify supply chains to mitigate tariff-related risks while enhancing production agility. This strategy not only shields operations from import duty fluctuations but also supports regional regulatory compliance and reduces lead times for critical reagents.

Furthermore, investing in precision diagnostic capabilities-especially through partnerships with digital pathology and sequencing providers-can drive differentiation and deepen clinical adoption. Organizations should prioritize co-development agreements that integrate biomarker assays with emerging therapeutics, thereby solidifying value propositions for payers and providers. In addition, engaging early with healthcare payers to explore innovative reimbursement models, such as outcomes-based contracting, will be essential to address evolving cost structures and demonstrate tangible clinical benefits.

Finally, fostering cross-sector collaboration through consortiums and advisory boards can accelerate knowledge exchange, harmonize regulatory standards, and catalyze patient-centric care pathways. By aligning development objectives with clinical, regulatory, and payer expectations, stakeholders can streamline trial designs, optimize labeling strategies, and ultimately facilitate faster patient access to life-saving interventions.

Detailing the Comprehensive Methodological Blueprint Combining Quantitative Data Analysis Qualitative Insights and Rigorous Validation to Underwrite Market Intelligence

The research methodology underpinning this analysis combines rigorous quantitative data synthesis with qualitative validation protocols to ensure comprehensive market intelligence. Data collection commenced with an extensive literature review of peer-reviewed journals, regulatory filings, and patent databases to capture technological advancements and clinical trial outcomes. This secondary research was complemented by proprietary surveys distributed to key opinion leaders across oncology clinics, diagnostic laboratories, and research institutes.

Subsequently, the study incorporated in-depth interviews with senior executives from pharmaceutical and diagnostic companies, as well as payers and regulatory experts. These engagements provided nuanced perspectives on market entry barriers, reimbursement landscapes, and supply chain dynamics. Triangulation of quantitative findings with qualitative insights enabled robust cross-verification and identification of emerging trends.

Finally, a validation workshop convened an advisory panel comprising clinicians, industry strategists, and academic researchers. Through scenario modeling and peer review sessions, the panel refined assumptions and validated thematic conclusions. This methodological blueprint ensured that the report’s insights rest on a foundation of empirical data, expert judgment, and iterative validation, delivering actionable intelligence for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Uterine Cancer Therapeutics & Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Uterine Cancer Therapeutics & Diagnostics Market, by Treatment Type

- Uterine Cancer Therapeutics & Diagnostics Market, by Diagnostic Technology

- Uterine Cancer Therapeutics & Diagnostics Market, by Route Of Administration

- Uterine Cancer Therapeutics & Diagnostics Market, by Distribution Channel

- Uterine Cancer Therapeutics & Diagnostics Market, by End User

- Uterine Cancer Therapeutics & Diagnostics Market, by Region

- Uterine Cancer Therapeutics & Diagnostics Market, by Group

- Uterine Cancer Therapeutics & Diagnostics Market, by Country

- United States Uterine Cancer Therapeutics & Diagnostics Market

- China Uterine Cancer Therapeutics & Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Reflections Highlighting Emerging Opportunities Overcoming Critical Challenges and Defining the Strategic Roadmap for Stakeholders in Uterine Cancer Ecosystem

Drawing together the diverse strands of innovation, policy shifts, and market segmentation, this analysis underscores the dynamic nature of the uterine cancer ecosystem. Therapeutic advancements-anchored by immuno-oncology breakthroughs and next-generation targeted agents-are converging with diagnostic innovations to enable truly personalized care. Simultaneously, tariff revisions have catalyzed supply chain resilience strategies, reshaping procurement and distribution paradigms.

Moreover, segmentation insights reveal the importance of tailoring approaches to specific treatment modalities, diagnostic platforms, administration routes, care settings, and distribution networks. Regional analyses highlight the need for localized strategies that address regulatory diversity and infrastructure maturity. Competitive profiling demonstrates that success hinges on strategic alliances, integrated solutions, and patient-centric value propositions.

As the industry continues to evolve, stakeholders who proactively engage in cross-sector collaboration, embrace adaptive reimbursement models, and leverage data-driven insights will be best positioned to navigate complexity and drive improved patient outcomes. The path forward demands agility, partnership, and a steadfast commitment to innovation.

Engaging with Our Associate Director for Customized Guidance and Tailored Research Support to Empower Decision-Making and Fuel Growth in Uterine Cancer Therapeutics

In a landscape defined by rapid innovation and evolving clinical paradigms, personalized engagement with leadership experts can unlock unparalleled insights. Ketan Rohom, serving as Associate Director of Sales & Marketing, offers tailored consultations to align research objectives with strategic business imperatives. By leveraging decades of industry experience and deep domain knowledge, Ketan Rohom guides stakeholders through complex decision matrices, ensuring that each organization can capitalize on emerging opportunities in uterine cancer diagnostics and therapeutics.

Engaging in a direct conversation facilitates access to proprietary frameworks and bespoke data analytics that transcend off-the-shelf reports. Through this highly interactive process, decision-makers receive actionable intelligence tailored to their product pipelines, regional focus areas, and market entry strategies. Whether refining a go-to-market plan for a novel PARP inhibitor or mapping out a distribution strategy for next-generation sequencing assays, these consultative sessions streamline stakeholder alignment and expedite critical milestones.

Stakeholders interested in securing a competitive advantage and fostering sustainable growth are encouraged to schedule a personalized briefing. In doing so, they gain exclusive visibility into untapped segments, risk mitigation pathways, and collaborative partnership models that can drive long-term success. Reach out to Ketan Rohom to explore customized research solutions and enterprise-grade intelligence designed to propel your organization to the forefront of uterine cancer innovation.

- How big is the Uterine Cancer Therapeutics & Diagnostics Market?

- What is the Uterine Cancer Therapeutics & Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?