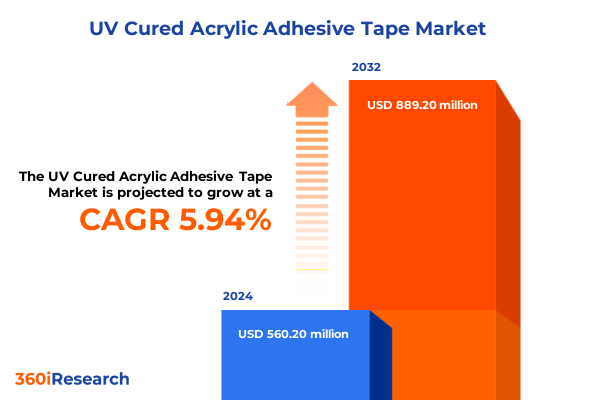

The UV Cured Acrylic Adhesive Tape Market size was estimated at USD 589.30 million in 2025 and expected to reach USD 621.43 million in 2026, at a CAGR of 6.05% to reach USD 889.20 million by 2032.

Charting the Evolution of UV Cured Acrylic Adhesive Tape Transforming Manufacturing with Unparalleled Bonding Precision across Diverse Industrial Applications

The remarkable rise of UV cured acrylic adhesive tape has redefined bonding solutions across multiple sectors, offering a synergy of rapid curing, robust adhesion, and versatile application that traditional adhesives struggle to match. From electronics manufacturers seeking precise display bonding to automotive engineers requiring durable structural connections, this adhesive category has emerged as a pivotal enabler of modern industrial innovation. Its inherent properties, such as minimal outgassing, low temperature sensitivity during curing, and compatibility with varied backing materials, have elevated design possibilities and streamlined production workflows.

Over the last decade, end users spanning aerospace and defense to healthcare devices have increasingly turned to UV cured systems to meet stringent performance and safety requirements. Innovations in photoinitiator chemistries and acrylic formulations have driven performance improvements while reducing environmental footprint compared to solvent-based alternatives. Moreover, the rapid curing times-often measured in seconds-have unlocked unprecedented throughput gains on production lines, translating into cost efficiencies and reduced lead times.

As regulatory frameworks tighten around volatile organic compounds and as sustainability goals become more pronounced across industries, UV cured acrylic adhesives stand out for their low emission profiles and energy-efficient curing processes. This combination of attributes lays the foundation for a more resilient, high-performance adhesive market, setting the stage for transformative advancements in both product capabilities and manufacturing paradigms.

Key Technological and Market Forces Redefining UV Cured Acrylic Adhesive Tape Performance and Sustainability in a Rapidly Shifting Industrial Landscape

Technological breakthroughs in UV curing equipment, alongside advances in acrylic polymer science, have catalyzed a new era for UV cured acrylic adhesive tapes. Companies are now leveraging multiwave LED curing systems that provide tunable wavelengths to initiate polymerization more precisely, resulting in cured adhesive layers with enhanced clarity, tensile strength, and long-term durability. Concurrently, the integration of smart manufacturing principles-such as in-line monitoring of cure depth and real-time adjustment of UV intensity-has elevated process control, ensuring consistent performance even in high-speed production lines.

Market dynamics are also shifting as end-user industries embrace digital transformation. In electronics, for example, the surge in flexible display applications and 5G antenna assemblies demands adhesives that can cure without damaging sensitive components, a requirement that UV cured formulations satisfy elegantly. At the same time, the building and construction sector’s drive toward modular assembly has opened new avenues for decorative and structural bonding solutions, where UV cured tapes provide both aesthetic flexibility and structural reliability.

Environmental considerations further underscore these transformative shifts. With global emphasis on reducing carbon footprints and minimizing solvent use, UV cured acrylic systems deliver an eco-friendlier alternative by eliminating solvent evaporation steps and reducing energy consumption during curing. Collectively, these technological, market, and sustainability forces are redefining performance benchmarks and reshaping the landscape in which adhesive tapes evolve.

Assessing the Cumulative Impact of Recent United States Tariff Policies on the UV Cured Acrylic Adhesive Tape Supply Chain and Cost Dynamics in 2025

In 2025, cumulative tariffs enacted by the United States government have exerted significant pressure on the UV cured acrylic adhesive tape supply chain, ultimately influencing production costs and pricing strategies. Broad import duties on raw acrylic resins and photoinitiator compounds have resulted in upward cost adjustments for manufacturers, triggering a ripple effect that has reshaped supply relationships and sourcing decisions. Many producers have sought to mitigate these impacts by diversifying their supplier base, shifting toward domestic resin producers or non-tariff jurisdictions to preserve margins.

Moreover, heightened Section 301 tariffs on certain polymer inputs from key Asian markets have increased lead times and logistics complexity. Companies have responded by optimizing inventory strategies, implementing just-in-case stocking to avoid disruptions while balancing capital tied up in warehouse space. In tandem, these tariff measures have accelerated interest in alternative chemistries produced in tariff-free regions, spurring partnerships with European and Middle Eastern specialty chemical firms to ensure stable, cost-effective raw material flows.

As these policy-driven cost dynamics persist, end users are recalibrating procurement approaches. Strategic long-term contracts with fixed-price components have become more prevalent, as have collaborative forecasting models that align volume projections with tiered pricing agreements. Ultimately, the cumulative tariff environment of 2025 underscores the critical need for agile supply chain management and informed sourcing strategies within the UV cured acrylic adhesive tape market.

Illuminating Critical Segmentation Insights Driving Material Selection and Application Performance in the UV Cured Acrylic Adhesive Tape Market

Clear differentiation emerges when examining the UV cured acrylic adhesive tape market through the lens of product segments such as double-sided tape, laminated tape, single-sided tape, transfer tape, and unsupported film tape. Each format answers unique application requirements, from the structural robustness demanded by transfer tapes to the thin-film flexibility required by unsupported options used in electronics assembly. This granularity is mirrored in the type dimension, where electron beam cured tape, pressure sensitive adhesive variants, thermal cured tapes, and UV cured tapes each present distinct curing mechanisms and performance profiles that cater to specialized manufacturing setups.

Backing material selection further refines the performance envelope. Composite backings blend material properties to optimize strength and conformability, while film-based options-particularly polyimide and PVC-are prized for their heat resistance and dielectric properties. Foam-based backings, including acrylic, polyethylene, and polyurethane foams, contribute cushioning and gap-filling functions. Meanwhile, plastic backings ranging from polyethylene to polypropylene and PET deliver varied stiffness and chemical resistance, creating a palette of options for designers.

Adhesion strength choices encompassing high, medium, and low strength grades permit precise control over removable or permanent bonding scenarios. Distribution channels bifurcate into offline wholesale and retail networks and online platforms, with brand websites and major e-commerce marketplaces becoming vital portals for product discovery and direct procurement. Finally, applications span bonding, masking, mounting, and protection, with subsegments like display and structural bonding under bonding and film laminates for surface protection enabling targeted solutions. End-user industries from aerospace and defense to therapeutic device manufacturing complete the mosaic, each demanding specific regulatory and performance certifications that UV cured acrylic tapes increasingly satisfy.

This comprehensive research report categorizes the UV Cured Acrylic Adhesive Tape market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Type

- Backing Material

- Adhesion Strength

- Distribution Channel

- Application

- End-User Industry

Uncovering Regional Trends Shaping Demand Patterns for UV Cured Acrylic Adhesive Tape across Americas, Europe, Middle East Africa, and Asia-Pacific

Regional dynamics for UV cured acrylic adhesive tape vary significantly across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions, reflecting differing industrial infrastructures, regulatory climates, and end-user priorities. In the Americas, heightened automotive and electronics manufacturing activity has sustained strong demand for high-performance bonding and display applications. Regulatory incentives encouraging local production have further reinforced the region’s adoption of UV cured systems to reduce lead times and reliance on overseas imports.

Transitioning to the Europe, Middle East & Africa region, stringent environmental regulations and energy efficiency targets have propelled uptake of low-emission adhesive technologies. European producers, in particular, have invested heavily in advanced photoinitiator research to push the boundaries of curing speed and adhesion strength, while Middle Eastern markets focus on large-scale construction and modular assembly projects that favor fast-curing, solvent-free adhesives.

The Asia-Pacific region remains the largest volume consumer, driven by electronics and automotive manufacturing hubs in East and Southeast Asia. Rapid scaling of flexible display facilities and growing penetration of electric vehicles have fueled demand for transfer tapes and thin-film unsupported tapes. Meanwhile, smaller economies in South Asia are beginning to adopt UV cured solutions in healthcare device assembly, highlighting a shift toward precision-critical applications across all major global regions.

This comprehensive research report examines key regions that drive the evolution of the UV Cured Acrylic Adhesive Tape market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Strategic Partnerships Steering Innovation in UV Cured Acrylic Adhesive Tape Development and Commercialization

Several key companies have emerged as innovation leaders in the UV cured acrylic adhesive tape market, each leveraging proprietary chemistries and strategic alliances to fortify their competitive positions. Industry giants invest consistently in research and development centers dedicated to next-generation photoinitiators and acrylic formulations optimized for rapid cure cycles and enhanced bonding strength, addressing evolving end-user requirements in electronics, automotive, and healthcare sectors.

Strategic partnerships with technology providers and manufacturing equipment suppliers have become increasingly prevalent. Leading manufacturers collaborate with UV system producers to validate adhesive and curing system compatibility, ensuring end users achieve optimal performance while minimizing process variability. At the same time, alliances with specialty chemical firms enable joint innovation on raw material sourcing and formulation refinement, enhancing supply chain resilience in the face of tariff-driven cost pressures.

In addition, a cluster of specialized players focuses on niche segments, such as ultra-thin unsupported films for flexible electronics and high-adhesion tapes for structural bonding in aerospace. These companies often partner with OEMs to co-develop custom solutions, securing long-term contracts that underpin steady revenue streams and deepen technical expertise. Collectively, these strategic maneuvers underscore a market defined by both consolidation among global leaders and targeted innovation by agile specialists.

This comprehensive research report delivers an in-depth overview of the principal market players in the UV Cured Acrylic Adhesive Tape market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Astral Adhesives

- Avery Dennison Corporation

- Bagla Group

- Berry Global, Inc.

- CHEMIPAZ CORPORATION

- Compagnie de Saint-Gobain S.A.

- Daehyun ST co., Ltd.

- Essentra PLC

- H.B. Fuller Company

- Henkel AG & Company KGaA

- Intertape Polymer Group Inc.

- Jiangyin Haoxuan Aluminum Foil Adhesive Products Co.,Ltd

- LINTEC Corporation

- Lohmann GmbH & Co. KG

- Naikos(Xiamen) Adhesive Tape Co., Ltd

- Nitto Denko Corporation

- Parker Hannifin Corporation

- Scapa Group PLC

- Shanghai Toptape, Inc.

- Shin-Etsu Chemical Co. Ltd.

- Shurtape Technologies, LLC

- TECHSiL Ltd.

- Tesa SE

- Toyochem Co. Ltd.

Deliberating Actionable Strategic Recommendations for Industry Leaders to Enhance Competitive Edge in the UV Cured Acrylic Adhesive Tape Sector

Industry leaders seeking to secure competitive advantage in the UV cured acrylic adhesive tape sector should prioritize integrated supply chain strategies that balance cost efficiency with raw material security. Establishing multi-sourcing arrangements for key acrylic resins and photoinitiators across tariff-compliant regions can mitigate price volatility and reduce the risk of supply disruptions. Complementing this approach with collaborative forecasting agreements strengthens alignment between producers and end users, fostering stable pricing structures and more predictable production planning.

Technological investment is equally critical. Organizations should assess upgrades to advanced LED or multiwave UV curing systems that enable precise control over cure profiles, enhancing consistency across different tape formats and backing materials. In parallel, allocating resources to formulation innovation-particularly to reduce cure energy requirements and expand adhesion performance under extreme environmental conditions-will distinguish offerings in competitive markets.

Finally, companies should expand direct-to-consumer and digital engagement channels, leveraging e-commerce platforms and brand-operated portals. Providing interactive application guides, technical data sheets, and virtual support tools will enhance customer experience and facilitate rapid adoption of novel tape solutions. By combining strategic sourcing, technological refinement, and enhanced customer engagement, industry leaders can navigate evolving tariff environments and accelerate growth in high-value application segments.

Detailing Rigorous Research Methodology Employed to Analyze Market Dynamics, Technological Advancements, and Competitive Landscape of Adhesive Tapes

The methodology underpinning this analysis integrated a rigorous, multi-pronged approach to ensure comprehensive coverage of market dynamics and technological developments. Primary research involved in-depth interviews with senior executives, R&D specialists, and procurement leads across end-user industries, providing firsthand insights into performance requirements, supply chain challenges, and innovation priorities. These qualitative findings were supplemented by secondary research from technical papers, industry consortium reports, and regulatory filings to validate emerging trends and standardization efforts.

Furthermore, data triangulation was applied to cross-reference information from publicly available patent databases, trade journals, and customs data, ensuring robust verification of raw material flows and tariff impacts. Case studies highlighting successful implementations of UV cured acrylic tapes in electronics and automotive manufacturing provided contextual understanding of process enhancements and return on investment considerations.

Finally, competitive landscape profiling drew upon company financial disclosures, partnership announcements, and patent activity metrics to map strategic initiatives and R&D pipelines. This blend of qualitative and quantitative techniques delivers a holistic perspective on the UV cured acrylic adhesive tape market, empowering stakeholders to make informed, data-driven decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our UV Cured Acrylic Adhesive Tape market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- UV Cured Acrylic Adhesive Tape Market, by Product

- UV Cured Acrylic Adhesive Tape Market, by Type

- UV Cured Acrylic Adhesive Tape Market, by Backing Material

- UV Cured Acrylic Adhesive Tape Market, by Adhesion Strength

- UV Cured Acrylic Adhesive Tape Market, by Distribution Channel

- UV Cured Acrylic Adhesive Tape Market, by Application

- UV Cured Acrylic Adhesive Tape Market, by End-User Industry

- UV Cured Acrylic Adhesive Tape Market, by Region

- UV Cured Acrylic Adhesive Tape Market, by Group

- UV Cured Acrylic Adhesive Tape Market, by Country

- United States UV Cured Acrylic Adhesive Tape Market

- China UV Cured Acrylic Adhesive Tape Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Concluding Insights Highlighting the Strategic Significance of UV Cured Acrylic Adhesive Tape in Modern Industrial Processes and Value Creation

As modern manufacturing environments demand ever-greater precision, speed, and sustainability, UV cured acrylic adhesive tapes have emerged as a cornerstone technology driving innovation across sectors. Their ability to deliver rapid cure cycles, robust adhesion under diverse conditions, and compatibility with a multitude of backing materials positions them as preferred solutions for applications ranging from flexible electronics to structural bonding in aerospace.

The evolving tariff landscape and regional regulatory differences emphasize the necessity for agile sourcing models and adaptive procurement strategies. Organizations that proactively diversify their raw material networks and invest in advanced curing technologies will be best positioned to harness the full potential of UV cured systems while maintaining cost competitiveness.

Looking ahead, anticipated advancements in photoinitiator chemistries, coupled with digital integration of curing processes, promise to further refine performance and throughput. Strategic partnerships and targeted R&D in emerging end-use applications will catalyze new growth opportunities, reinforcing the strategic significance of UV cured acrylic adhesive tapes within global manufacturing ecosystems.

Engage with Ketan Rohom to Access the Comprehensive Market Research Report and Unlock Strategic Opportunities in the UV Cured Acrylic Adhesive Tape Domain

For organizations poised to capitalize on the unique advantages of UV cured acrylic adhesive tapes, direct engagement with Ketan Rohom, Associate Director of Sales & Marketing, presents the most efficient path to strategic market insights. By connecting with Ketan Rohom, you unlock personalized consultations tailored to your specific industry challenges and can secure immediate access to the comprehensive report that delves into critical trends, tariff impacts, segmentation intelligence, and regional dynamics.

This report has been meticulously crafted to empower decision-makers with actionable data, robust competitive analyses, and forward-looking recommendations. Reaching out ensures your organization remains at the forefront of adhesive technology advancements, optimizing product development cycles and supply chain strategies while navigating evolving regulatory landscapes. Ketan Rohom’s expertise will guide you through the report’s key findings and highlight bespoke opportunities aligned with your growth objectives.

Don’t delay in transforming these insights into market leadership. Engage today to obtain your copy of the full UV cured acrylic adhesive tape market research report and fortify your strategic roadmap with in-depth analysis and expert guidance.

- How big is the UV Cured Acrylic Adhesive Tape Market?

- What is the UV Cured Acrylic Adhesive Tape Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?