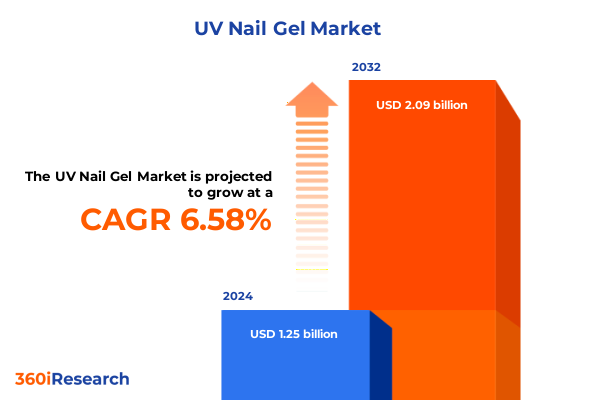

The UV Nail Gel Market size was estimated at USD 1.33 billion in 2025 and expected to reach USD 1.42 billion in 2026, at a CAGR of 6.64% to reach USD 2.09 billion by 2032.

Navigating the Vivid World of UV Nail Gel as Consumer Preferences and Professional Standards Drive Unprecedented Growth and Innovation

The global UV nail gel industry has evolved from a niche salon offering into a mainstream beauty staple embraced by both consumers and professionals alike. Rising consumer awareness of long-lasting finish, health-friendly formulations, and at-home convenience has converged with salon-driven innovation to create unparalleled momentum in product development and adoption. As advanced LED and curing technologies proliferate, manufacturers are racing to optimize product performance, durability, and aesthetic variety to meet the escalating expectations of discerning end users.

Amid this dynamic environment, strategic decision makers face a complex matrix of shifting consumer tastes, regulatory landscapes, and supply-chain variables. Navigating this complexity requires an authoritative synthesis of market drivers, distribution evolutions, and competitive benchmarks. This executive summary distils the most salient trends, regulatory implications, and strategic imperatives shaping the UV nail gel domain, equipping stakeholders with the insights needed to capitalize on emerging opportunities and mitigate risks. By understanding the underlying forces propelling demand-from premium salon experiences to DIY home treatments-leaders can chart a clear course toward robust growth and sustainable innovation.

Emerging Innovations and Disruptive Trends Reshaping the UV Nail Gel Landscape From Sustainable Formulations to Digital Retail Experiences

Over the last two years, the UV nail gel segment has experienced several transformative shifts that redefine the competitive landscape. Formulation science has advanced significantly, with bio-derived monomers and plant-based photoinitiators reducing reliance on petrochemicals and addressing rising consumer demands for sustainability. Concurrently, hybrid gel systems blending the best attributes of traditional lacquer and UV gel formats have emerged, offering faster curing times and enhanced chip resistance for both salon professionals and home users.

Digital disruption has further accelerated market evolution. Direct-to-consumer brand launches with integrated AR try-on features have reconfigured the traditional distribution model, empowering consumers to experiment virtually with finishes before purchase. Meanwhile, salon management tools powered by artificial intelligence are optimizing appointment scheduling, mixology precision, and customer retention strategies, underscoring the importance of seamless tech integration for service providers.

Emerging regulatory scrutiny of potential allergenic compounds has prompted proactive product reformulation among market leaders, ensuring compliance with tightening safety standards. In parallel, the convergence of beauty and wellness has spurred multi-functional offerings infused with nail-care actives such as keratin, vitamins, and biotin. As a result, stakeholders must stay attuned to evolving consumer health priorities and digital engagement trends to maintain competitive advantage.

Assessing the Combined Implications of 2025 United States Import Tariffs on Raw Materials and Finished UV Nail Gel Supply Chains

With the imposition of new United States tariffs in early 2025 targeting key chemical precursors and packaging components used in UV nail gel production, supply chains have encountered heightened cost pressures. Import duties on specialized methacrylate oligomers and photoinitiators have increased landed costs for gel manufacturers, triggering a ripple effect throughout the industry. Domestic producers have responded by exploring alternative feedstock partnerships, while several international suppliers have relocated portions of their operations to reduce tariff exposure.

In response, some firms have accelerated investments in in-house compounding capabilities, shifting portions of raw material sourcing from high-tariff jurisdictions to regions benefiting from preferential trade agreements. These tactical adjustments have mitigated margin erosion, yet the cost burden remains visible in the final retail price, potentially influencing consumer adoption patterns and channel mix decisions. Salon service providers, particularly price-sensitive independents, are reevaluating menu offerings and throughput targets to preserve profitability.

Conversely, tariff-induced supply chain realignments have unlocked opportunities for emerging domestic contract manufacturers. Proximity to demand centers in North America now offers lead-time advantages, bolstering the case for nearshoring in an era defined by cost volatility and regulatory complexity. As industry players adapt to this new tariff regime, agility in production planning and sourcing diversification will be paramount to sustaining growth trajectories.

Decoding Market Segmentation Dynamics Across Product Types Finishes End Users and Distribution Channels to Unlock Growth Opportunities

Product type segmentation reveals that UV Builder Gel continues to command attention for its structural benefits, particularly among professional salons focused on enhanced nail architecture. Meanwhile, UV Gel Base Coats remain indispensable as foundational layers supporting long-wear performance, driving consistent repeat consumption. UV Gel Polish has expanded its appeal with vibrant color portfolios and rapid-cure formulas, effectively blurring the lines between traditional nail lacquer and gel technology. Top Coats, valued for imparting high-gloss shine and scratch resistance, round out the product suite and often serve as an entry point for new users seeking visible performance improvements.

Finish type segmentation has spotlighted shifting consumer preferences. Glossy finishes retain popularity for their classic aesthetic and salon-grade sheen, yet the past year has seen a surge in demand for matte top coats, positioning them as a fashionable alternative for consumers seeking understated elegance. Glitter-infused gels have also enjoyed renewed interest, particularly among younger cohorts embracing bold self-expression through nail art. These finish preferences inform targeted R&D efforts and marketing narratives aimed at capturing diverse style segments.

In examining end-user segmentation, home and DIY users have demonstrated growing confidence in at-home gel kits, propelled by user-friendly LED lamps and online tutorials. Professional salons, however, remain the primary growth engine for premium offerings, leveraging skilled application techniques and customized color blending. Spa and wellness centers represent a niche yet expanding channel, integrating UV gel services into holistic beauty menus that emphasize relaxation and pampering.

Distribution channel segmentation underscores the duality of offline and online pathways. Brick-and-mortar retailers and salon-exclusive distributors continue to command significant share through personalized service and immediate availability. Concurrently, online sales via brand websites and e-commerce platforms have accelerated, offering convenience and access to exclusive limited-edition collections. This dual-channel dynamic compels manufacturers to balance traditional retail partnerships with robust digital strategies.

This comprehensive research report categorizes the UV Nail Gel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Ingredient Type

- Curing Technology

- Application

- End User

- Distribution Channel

Unearthing Regional Nuances in UV Nail Gel Adoption Spanning Americas Europe Middle East Africa and Asia Pacific Markets

Regional analysis illustrates distinct trajectories across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, the United States leads in premiumization, with salon operators investing in advanced LED systems and premium gel formulations to satisfy a style-conscious clientele. Canada’s market shows steady uptake in home gel kits, supported by cross-border e-commerce and social media-driven tutorials. Latin American markets, though price-sensitive, are benefiting from rising beauty influencer culture and expanding payment solutions, driving incremental adoption of mid-tier gel products.

Within Europe Middle East & Africa, Western European nations adhere to stringent product safety regulations, prompting manufacturers to emphasize hypoallergenic and cruelty-free formulations. The Middle East’s luxury beauty scene fosters demand for bespoke color matches and high-end finishing services, while select African markets are emerging as growth frontiers through digital distribution channels and micro-influencer partnerships.

Asia Pacific remains the largest and most dynamic regional market. In Northeast Asia, especially South Korea and Japan, high-precision nail art techniques and advanced formulations set global trends. China’s massive online ecosystem continues to fuel rapid product innovation and distribution efficiency, leveraging livestream commerce and domestic manufacturing scale. Southeast Asian consumers, attracted to global beauty trends, represent a fast-growing audience for affordable yet premium-perceived UV nail gel offerings. Overall regional diversity underscores the need for tailored product and channel strategies to capture local nuances.

This comprehensive research report examines key regions that drive the evolution of the UV Nail Gel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Moves and Competitive Positioning of Leading UV Nail Gel Manufacturers and Emerging Innovators in 2025

Leading players in the UV nail gel space have pursued divergent strategies to fortify market positioning. Established brands with deep salon relationships have doubled down on professional training programs, enhancing application proficiency and brand loyalty. These leaders have introduced color-system extensions and curated seasonal collections to maintain premium brand equity and recurring purchase cycles.

Emerging innovators have focused on niche differentiation. Some have launched eco-certified gel lines emphasizing biodegradable packaging and naturally derived ingredients to appeal to environmentally conscious consumers. Others have harnessed digital-first approaches, offering subscription models and AI-driven shade-matching tools. Strategic partnerships with salon management software providers have also enabled seamless integration of product ordering into daily operations, reinforcing value for professional clientele.

Contract manufacturers have capitalized on tariff-induced sourcing realignments to attract white-label business from both domestic and international brands. Their ability to scale production rapidly and support custom formulation requests has elevated their status as indispensable supply chain partners. Collectively, these varied corporate strategies reflect a market in which both legacy incumbents and agile newcomers vie for consumer attention and distribution access.

This comprehensive research report delivers an in-depth overview of the principal market players in the UV Nail Gel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alessandro International GmbH

- Armbruster Associates Inc.

- BORN PRETTY

- Chemence, Inc.

- CNC International B.V.

- Cosbeauty Co Ltd

- CosFab GmbH

- Crystal Nails USA

- Divage Fashion Srl

- Faces Canada

- GLAM Nails

- Izabelle Hammon Limited

- Keystone Industries

- Light Elegance

- L’OREAL S.A.

- McConnell Labs, Inc.

- Modelones

- MOROVAN

- Nail Alliance - North America, Inc.

- Nykaa E-Retail Private Limited

- ORLY International, Inc.

- P&D UNITED COSMETICS CO., LTD

- Plum Goodness

- Revlon, Inc.

- Semilac UK

- Sheba Nails

- Swiss Beauty

- United Beauty Products Limited

- Wella International Operations Switzerland Sàrl

Strategic Imperatives for Industry Leaders to Capitalize on Market Shifts and Strengthen Competitive Advantage in UV Nail Gel

To thrive amid accelerating innovation and regulatory complexity, industry leaders should prioritize investments in sustainable formulation research that align with global health and safety standards. Positioning eco-certified and allergen-free gels as mainstream offerings will address evolving consumer expectations while differentiating brands in a crowded landscape. Simultaneously, brands must fortify their digital ecosystems by integrating virtual shade-try-on features and personalized product recommendations into e-commerce platforms, enhancing conversion and customer retention.

Diversifying supply chains through regional manufacturing partnerships and nearshoring agreements will reduce exposure to tariff volatility and ensure responsiveness to local market fluctuations. Engaging closely with salon partners via education initiatives and exclusive product co-development can strengthen professional endorsement and bolster high-margin channel performance. Leaders should also explore subscription-based service models that provide curated gel collections, driving predictable revenue streams and fostering direct customer relationships.

Finally, maintaining vigilance on regulatory developments and fostering collaboration with industry associations will help anticipate compliance requirements and streamline time-to-market. By balancing product innovation, channel optimization, and regulatory foresight, companies can secure sustainable growth and resilient competitive advantage in the UV nail gel arena.

Comprehensive Research Framework and Methodological Rigor Underpinning the UV Nail Gel Market Analysis Ensuring Reliability and Validity

This research employs a hybrid methodology combining quantitative and qualitative approaches to ensure comprehensive market insights. Primary data was collected through structured interviews with salon professionals, supply-chain executives, and end-users spanning key geographic markets. Additionally, consumer surveys administered across multiple digital channels gauged preferences for product attributes, finish types, and purchase motivations.

Secondary research incorporated analysis of industry reports, academic journals, regulatory filings, and trade association publications to contextualize market trends and regulatory frameworks. Competitive intelligence on product portfolios and strategic initiatives was gathered from corporate disclosures, patent databases, and retail audits. Data triangulation techniques were applied to reconcile variations between disparate sources and enhance the reliability of findings.

The research framework integrates thematic analysis of qualitative inputs with statistical trend modeling, uncovering correlations between consumer behavior shifts and technology adoption rates. Validation of insights was achieved through advisory workshops with domain experts, including chemists, digital marketing specialists, and logistics consultants. This rigorous methodological approach underpins the accuracy and depth of the market analysis presented in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our UV Nail Gel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- UV Nail Gel Market, by Product Type

- UV Nail Gel Market, by Packaging Type

- UV Nail Gel Market, by Ingredient Type

- UV Nail Gel Market, by Curing Technology

- UV Nail Gel Market, by Application

- UV Nail Gel Market, by End User

- UV Nail Gel Market, by Distribution Channel

- UV Nail Gel Market, by Region

- UV Nail Gel Market, by Group

- UV Nail Gel Market, by Country

- United States UV Nail Gel Market

- China UV Nail Gel Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Synthesis of Market Trends Strategic Considerations and Growth Drivers Defining the Future Trajectory of the UV Nail Gel Industry

The UV nail gel industry stands at the intersection of creative expression, technological advancement, and evolving regulatory landscapes. Integral drivers such as formulation innovation, digital channel proliferation, and shifting consumer health priorities converge to define a market characterized by rapid change and opportunity. Segment-specific insights reveal that product, finish, end-user, and distribution variations offer multiple pathways for targeted growth and differentiation.

Tariff-induced supply chain realignments in the United States underscore the importance of proactive sourcing strategies and production agility. Regional analyses highlight diverse adoption patterns, from premium salon investments in North America to digital commerce-driven expansion in Asia Pacific. Competitive intelligence shows that both established incumbents and agile newcomers are deploying distinct tactics-ranging from eco-focused formulations to subscription models-to capture market share.

As industry stakeholders contemplate strategic next steps, a holistic understanding of these multifaceted trends will be essential. By leveraging a blend of sustainable product development, robust digital engagement, supply chain resilience, and regulatory foresight, market participants can harness the transformative potential of UV nail gel technology and secure long-term competitive advantage.

Empower Your Strategic Vision and Drive Market Leadership by Securing the Comprehensive UV Nail Gel Market Research Report with Expert Guidance from Ketan Rohom

To delve deeper into the dynamics transforming the UV nail gel market and harness actionable intelligence for strategic decision making, secure your copy of the comprehensive market research report by reaching out to Ketan Rohom, Associate Director of Sales & Marketing. Engage directly with an expert who can guide you through tailored data insights, in-depth analysis, and bespoke solutions designed to drive growth and competitive advantage in the evolving beauty landscape. Take the next step toward empowering your business with authoritative research on consumer behaviour, supply chain developments, regulatory impacts, and technological innovations shaping the UV nail gel industry in 2025 and beyond.

- How big is the UV Nail Gel Market?

- What is the UV Nail Gel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?