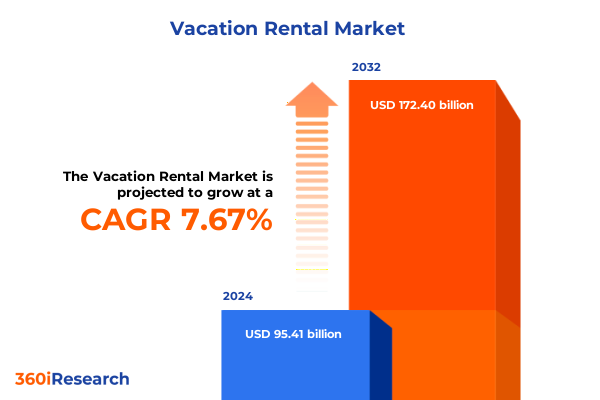

The Vacation Rental Market size was estimated at USD 102.12 billion in 2025 and expected to reach USD 109.39 billion in 2026, at a CAGR of 7.76% to reach USD 172.40 billion by 2032.

Navigating the Modern Vacation Rental Ecosystem: Unveiling Key Drivers, Emerging Dynamics, and Competitive Imperatives Shaping Market Evolution

The vacation rental industry is undergoing a profound transformation driven by shifting consumer expectations, emerging technologies, and evolving regulatory landscapes. Decision-makers require a concise yet comprehensive overview of the sector’s key dynamics to inform strategic planning and operational execution. This executive summary distills critical insights spanning market disruptions, regulatory impacts, and segmentation analyses, delivering actionable intelligence to stakeholders across the value chain.

In this document, we present a structured examination of the most influential trends reshaping vacation rentals-from digital platform innovations and consumer behavior shifts to the cumulative effects of U.S. tariffs enacted in 2025. We further delve into granular segmentation and regional patterns that uncover distinct demand drivers, followed by detailed profiles of leading market participants. Finally, we propose targeted recommendations for industry leaders and outline our robust research methodology. Throughout, the content maintains clarity and depth, catering to both seasoned executives and emerging strategists seeking an authoritative perspective on this dynamic market.

Identifying Pivotal Industry Disruptions and Technology Advancements Reshaping Vacation Rentals Through Consumer Behaviors and Market Dynamics

Over the past few years, technology adoption and consumer preferences have catalyzed transformative shifts in the vacation rental landscape. The rise of AI-driven personalization has enabled platforms to tailor offerings based on guest profiles, influencing booking patterns and length of stay. Contactless check-in and smart home integrations have transitioned from novelty features to standard expectations, enhancing operational efficiency while elevating guest satisfaction.

Simultaneously, the proliferation of remote work has blurred traditional distinctions between business and leisure travel, driving demand for medium-term accommodations that blend productivity with leisure amenities. Sustainability considerations have also gained prominence, prompting property managers to incorporate eco-friendly practices and energy-efficient upgrades to meet the values of environmentally conscious travelers. These developments, supported by data analytics and mobile engagement strategies, underscore a new paradigm where adaptability and customer centricity define competitive advantage.

Analyzing the Aggregate Effects of Newly Enacted United States Tariffs in 2025 on Cost Structures, Supply Chains, and Operational Efficiencies in Vacation Rentals

In 2025, the United States implemented a series of tariffs on imported home furnishings, electronics, and building materials, directly affecting rental property outfitting and maintenance. These levies increased costs for appliances and furniture components, compelling operators to reexamine sourcing strategies and renegotiate supplier contracts. Supply-chain bottlenecks further amplified price pressures as shipping delays and higher freight rates became commonplace.

As a result, property owners and management companies have recalibrated pricing models to preserve margin integrity while maintaining guest satisfaction. Many adopted lean inventory practices and sought regional suppliers to mitigate tariff exposure, leading to diversified procurement portfolios. The ripple effects also influenced ancillary service providers, from housekeeping to landscaping, who adjusted service fees to compensate for higher input costs. Overall, the tariffs have driven an industry-wide reassessment of cost structures and supply-chain resilience.

Uncovering Deep Insights Across Property Types, Booking Channels, Rental Durations, Guest Categories, and Age Cohorts Driving Demand Patterns

The vacation rental market exhibits nuanced differences when examined through the lens of property type, booking channel, rental duration, guest profile, and age demographics. Apartment, bungalow, condominium, cottage and cabin, townhouse, and villa accommodations each present unique operational considerations and guest expectations. Apartments and condominiums serve urban professionals seeking convenient, amenity-rich stays, whereas cottages, cabins, and bungalows appeal to travelers prioritizing seclusion and local authenticity. Townhouses bridge these preferences, offering suburban comfort with proximity to urban attractions, while villas cater to premium, large-party experiences.

Booking channel dynamics reveal that online reservations have surged ahead, driven by OTA platforms offering seamless discovery and transparent reviews, yet offline channels remain relevant for repeat corporate bookings and niche travel agencies. Rental duration segmentation highlights a growing appetite for medium-term stays among digital nomads and hybrid workers, although short-term vacation bookings continue to dominate leisure travel. Long-term rentals maintain significance in markets with extended repositioning needs or relocation scenarios.

Guest type segmentation spans corporate travelers, couples, families, groups, and solo adventurers. Corporate guests value integrated workspaces and reliable internet, couples seek romantic and experiential stays, while families and groups prioritize safety features, space, and recreational offerings. Solo travelers often lean into community-driven platforms and budget-focused accommodations. When age cohorts are considered-18-35, 36-55, 56-75, 76 and above, and under 18-preferences diverge further: younger guests favor tech-enabled, social lodgings, middle-aged travelers emphasize comfort and service consistency, and mature guests prioritize accessibility and tranquility. Integrating these multi-dimensional segments enables operators to tailor amenities, pricing frameworks, and marketing messages, thereby optimizing guest satisfaction and revenue outcomes.

This comprehensive research report categorizes the Vacation Rental market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Property Type

- Booking Channel

- Rental Duration

- Guest Type

Examining Regional Demand Variations Across the Americas, Europe Middle East Africa and Asia Pacific to Reveal Distinct Market Trajectories and Growth Catalysts

Regional analysis reveals that the Americas continue to exhibit robust demand growth, fueled by domestic travel resurgence and cross-border road trips. In the United States and Canada, flexible work arrangements remain a key driver for extended stays, while Latin American markets benefit from cost-competitive offerings and proximity-based tourism. The region’s emphasis on experiential travel has led operators to enhance local partnerships and curated activity bundles to differentiate their portfolios.

In Europe, Middle East, and Africa, regulatory frameworks and high inbound tourism volumes drive a diverse competitive environment. Urban centers in Western Europe maintain strong occupancy rates, supported by efficient public transport and cultural heritage. Gulf markets are leveraging luxury villa offerings to capture high-net-worth travelers, whereas parts of Africa are emerging as eco-tourism hotspots, with bush lodges and coastal cottages gaining traction. Host communities and property managers are increasingly collaborating on sustainable development initiatives to align with regional conservation priorities.

Asia-Pacific presents a dynamic mix of established and emerging markets. Australia and New Zealand showcase mature short-term segments balanced by rural and coastal retreats. Southeast Asian destinations are experiencing rapid growth, driven by rising middle-class incomes and improving infrastructure, while Japan and South Korea are innovating with smart lodging solutions and blended hospitality models. Across the region, diversified cultural experiences and tailored local services are pivotal for capturing heterogeneous visitor segments.

This comprehensive research report examines key regions that drive the evolution of the Vacation Rental market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Vacation Rental Platforms and Service Providers to Highlight Strategic Initiatives, Competitive Positioning, and Innovation Trends

Leading companies in the vacation rental ecosystem are advancing differentiated strategies to secure market positioning. Major platform operators are investing heavily in AI-driven search algorithms and personalized recommendation engines, seeking to reduce customer acquisition costs while enhancing conversion rates. Some are extending loyalty programs and subscription offerings to foster repeat bookings and brand affinity.

On the property management front, established firms are forging partnerships with real estate developers to expand turnkey portfolio offerings, integrating co-investment models to underpin growth. Technology service providers, meanwhile, are launching comprehensive property operations suites that unify pricing optimization, dynamic housekeeping scheduling, and guest communication tools within a single dashboard. Several enterprises are also piloting blockchain-based identity verification and secure payment platforms to streamline trust mechanisms between hosts and guests.

Innovators in smart home applications have introduced modular devices enabling real-time monitoring of energy consumption and contactless entry, which not only enhance the guest experience but also support sustainability reporting. Additionally, a new cohort of local boutique operators is emerging, focusing on themed stays and personalized on-ground services to differentiate from global generic offerings. Collectively, these initiatives underscore an increasingly competitive landscape where technological prowess, strategic partnerships, and guest-centric design converge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vacation Rental market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 9flats.com Pte Ltd.

- Accor SA

- Airbnb, Inc.

- Arizona Vacation Getaway LLC

- Avantstay, Inc.

- Benchmark Management

- Bluefish Vacation Rentals

- Booking Holdings Inc.

- Clickstay Ltd.

- English Cottage Vacation

- Evolve Vacation Rental Network, Inc.

- Expedia Group, Inc.

- Guesty Inc.

- HomeToGo GmbH

- Hotelplan Group

- iTrip LLC

- Ivy Lettings

- Luxury Cotswold Rentals

- MakeMyTrip (India) Private Limited

- Novasol AS

- Oravel Stays Private Limited

- Seashore Vacations, Inc.

- SkyRun Vacation Rentals, LLC

- Southern Vacation Rentals

- The Plum Guide

- Thrillophilia

- Travel + Leisure Co.

- Tripadvisor LLC

- Tybee Vacation Rentals

- Utah's Best Vacation Rentals

- Vacasa LLC

- Vacation Rental Pros Property Management LLC

- Yatra Online Private Limited

Delivering Targeted Strategic and Operational Recommendations to Help Industry Leaders Capitalize on Emerging Opportunities and Overcome Key Challenges

Industry leaders seeking to thrive in this evolving environment should prioritize agility, technology integration, and strategic collaboration. First, investing in advanced analytics and AI solutions will empower more precise demand forecasting, dynamic pricing, and personalized marketing, enabling companies to respond swiftly to fluctuating booking patterns and cost pressures. Second, diversifying supply-chain networks by cultivating relationships with regional suppliers can mitigate tariff impacts and enhance operational resilience.

Furthermore, designing differentiated guest experiences based on segmentation insights-such as developing dedicated work-from-stay packages for medium-term corporate guests or wellness-focused retreats for mature travelers-will deepen market penetration. Partnerships with local tour operators, sustainable product suppliers, and technology innovators can create value-added bundles that increase ancillary revenue. Simultaneously, cultivating loyalty through tiered membership programs and seamless omnichannel engagement will drive retention and lifetime value.

Finally, embracing sustainability as a core corporate strategy, from energy management to waste reduction, will resonate with environmentally conscious travelers and support regulatory compliance. By aligning business models with ESG principles, organizations can foster brand trust and unlock investment opportunities tied to green financing. These combined tactics offer a roadmap for industry stakeholders to navigate volatility and maintain competitive leadership.

Outlining Robust Primary and Secondary Research Frameworks Employed to Generate Comprehensive Vacation Rental Market Intelligence and Derive Actionable Insights

This analysis is underpinned by a multi-stage research framework combining primary and secondary data sources. The primary investigation involved in-depth interviews with senior executives from leading rental platforms, property management companies, and technology vendors, capturing qualitative insights on strategic priorities and operational challenges. In parallel, surveys of end-users spanning various demographics and travel motivations provided quantitative validation of emerging preferences and pain points.

Secondary research encompassed examination of regulatory filings, industry consortium reports, and academic white papers to contextualize macroeconomic and policy influences. Proprietary databases were leveraged to analyze platform performance metrics, user reviews, and pricing trends. Data triangulation methods ensured consistency across diverse inputs, while gap analysis highlighted areas requiring further validation. Rigorous cross-referencing and peer review by sector specialists reinforced the integrity of the findings.

Limitations include variations in regional data availability and the rapidly evolving nature of technology adoption, which may necessitate periodic updates. Nonetheless, the methodology’s breadth and depth establish a robust foundation for actionable strategic and operational recommendations designed to support stakeholders in making informed decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vacation Rental market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vacation Rental Market, by Property Type

- Vacation Rental Market, by Booking Channel

- Vacation Rental Market, by Rental Duration

- Vacation Rental Market, by Guest Type

- Vacation Rental Market, by Region

- Vacation Rental Market, by Group

- Vacation Rental Market, by Country

- United States Vacation Rental Market

- China Vacation Rental Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Core Findings and Strategic Implications to Provide a Cohesive Perspective on the Future Trajectory of the Vacation Rental Market

Overall, the vacation rental industry is at a pivotal juncture characterized by rapid technological evolution, shifting traveler demographics, and external cost pressures from regulatory actions. The intersection of AI personalization, remote work trends, and sustainability aspirations is redefining how properties are marketed, managed, and experienced. Meanwhile, geopolitical factors such as U.S. tariffs are prompting operational recalibrations and supply-chain diversification.

Segment and regional analyses reveal that targeted approaches-tailoring offerings by property type, booking channel, and guest profile within specific geographic markets-are essential for competitive differentiation. Leading companies are embracing digital innovation, strategic partnerships, and ESG commitments to secure long-term resilience. By synthesizing these insights, organizations can craft strategies that balance short-term performance with sustainable growth, ultimately delivering exceptional guest experiences and robust financial returns.

As the market continues to mature, staying attuned to emerging consumer preferences and policy shifts will be vital. This executive summary provides the foundational intelligence necessary for industry participants to navigate uncertainty, capitalize on evolving demand patterns, and chart a course toward sustained leadership in the dynamic vacation rental ecosystem.

Engage with Ketan Rohom to Access In-Depth Vacation Rental Market Analysis and Empower Your Organization with Data-Driven Strategic Insights Today

To explore comprehensive strategic insights, customized competitive analysis, and in-depth market breakdowns tailored to the vacation rental sector, connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise can guide you through the report’s methodologies and key takeaways, ensuring you derive maximum value from the intelligence provided. Reach out to engage on how this research will inform your next strategic move, strengthen partnerships, and identify lucrative growth opportunities across diverse markets.

- How big is the Vacation Rental Market?

- What is the Vacation Rental Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?