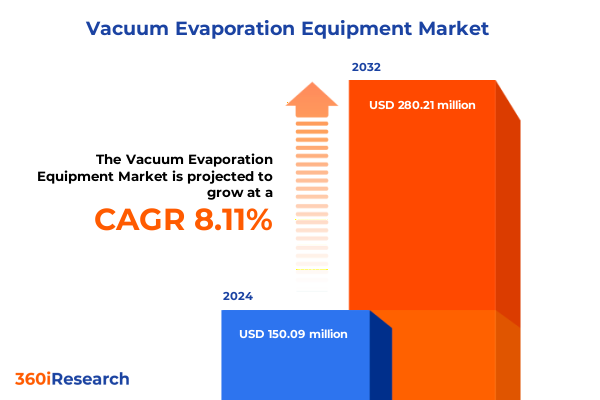

The Vacuum Evaporation Equipment Market size was estimated at USD 160.12 million in 2025 and expected to reach USD 173.75 million in 2026, at a CAGR of 8.32% to reach USD 280.21 million by 2032.

Understanding the Key Fundamentals and Industrial Applications of Vacuum Evaporation Equipment in Modern Process Industries

Vacuum evaporation operates on a fundamental thermodynamic principle where lowering the pressure within a liquid-filled chamber reduces the liquid’s boiling point, enabling evaporation at significantly lower temperatures. This process minimizes thermal stress on heat-sensitive materials, broadening its applicability across diverse chemical and biological processes. By precisely controlling vacuum levels and heating profiles, practitioners achieve high-purity separation without excessive energy input, underscoring its role as a cornerstone in modern separation technology.

In industrial settings, vacuum evaporators serve as versatile workhorses for concentrating solutions, recovering solvents, and minimizing waste volumes. Their modular design integrates critical components such as vacuum pumps, condensers, and heat exchangers to support applications ranging from wastewater treatment and desalination to fine chemical synthesis and thin-film deposition in electronics manufacturing. Advanced control systems ensure consistent performance and compliance with stringent environmental regulations, making vacuum evaporation indispensable for process intensification and sustainable manufacturing workflows.

Exploring the Transformative Technological and Sustainability-Driven Shifts Reshaping the Vacuum Evaporation Equipment Landscape

Recent years have witnessed a surge in technological innovations that have redefined the vacuum evaporation landscape. Integrated digital control platforms now enable real-time monitoring of pressure, temperature, and flow rates, while Industry 4.0-driven analytics facilitate predictive maintenance and remote diagnostics. These advancements not only reduce unplanned downtime but also allow dynamic adjustment of operating parameters to maximize throughput and minimize energy consumption. Moreover, the adoption of multi-effect configurations and hybrid systems has expanded the envelope of achievable separation efficiencies, supporting complex streams with varying volatility profiles.

Parallel to the digital revolution, sustainability has emerged as a primary design driver. Mechanical vapor recompression (MVR) technologies harness latent heat from vapor streams to preheat incoming feed, slashing overall steam demand and associated carbon emissions. Low-temperature vacuum systems paired with thermal fluid loops further curtail energy use, while solvent recovery loops enable circular processing of high-value chemicals. These eco-centric enhancements not only align with corporate net-zero commitments but also deliver tangible operating cost reductions and bolster environmental compliance.

To meet evolving customer needs, equipment manufacturers are embracing modular and compact architectures that simplify installation, reduce footprint, and accelerate time to operation. Standardized skid-mounted units support plug-and-play deployment, while scalable designs allow seamless capacity expansion. Complemented by advanced materials of construction and automated cleaning-in-place systems, these solutions enhance adaptability across batch and continuous processes, empowering plants to pivot quickly in response to shifting product specifications and regulatory requirements.

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Vacuum Evaporation Equipment Supply Chains and Costs

In April 2025, the United States introduced a universal 10% tariff on most imported goods, while China-derived equipment faced rates escalating from 20% to as high as 145% under cumulative measures. Imports from Canada and Mexico were subjected to a 25% levy on non-USMCA goods, alongside a 10% tariff on select categories. These actions, aimed at addressing perceived trade imbalances and supply chain resilience, have directly impacted the cost structure and availability of vacuum evaporation systems and components imported into the U.S. market.

The steep hikes on Chinese-origin equipment have led manufacturers and end users to reevaluate sourcing strategies. Elevated duties have applied pressure on original equipment manufacturers to either absorb added costs or pass them to customers, potentially raising capital expenditures and total cost of ownership for new installations. In parallel, extended customs clearance times and administrative reviews have contributed to project delays, challenging schedules for plant upgrades and greenfield expansions. Supply chain teams are increasingly prioritizing tariff-free procurement corridors and nearshore production to mitigate these disruptions.

Despite these headwinds, stakeholders are exploring cooperative frameworks such as bonded zones, trade-compliant assembly operations, and bilateral negotiations to secure preferential treatment. Domestic manufacturing of critical components remains limited by specialized fabrication capabilities and stringent quality requirements. As a result, many players are pursuing dual-track approaches that blend localized assembly with diversified international sourcing, aiming to balance supply assurance with cost efficiency.

Revealing Critical Segmentation Insights Across Equipment Types End-Use Industries System Configurations Heating Methods Materials and Capacity Ranges

Equipment type segmentation reveals a spectrum of designs tailored to process requirements. Falling film evaporators-available in horizontal and vertical tube configurations-offer gentle handling of shear-sensitive liquids, while forced circulation systems excel at high foulant feeds given their enhanced fluid recirculation. Molecular and short path units are optimized for low-temperature distillation of thermally unstable compounds, and rising film and wiped film evaporators address high-viscosity streams through thin-film formation and continuous material renewal.

End-use segmentation underscores the cross-industry demand for vacuum evaporation equipment. Chemical processors leverage these systems for concentration and solvent recovery, whereas petrochemical complexes integrate them into zero liquid discharge loops. In the pharmaceutical domain, precise temperature control supports active pharmaceutical ingredient purification. Desalination plants incorporate vacuum stages to reduce energy consumption, and wastewater treatment facilities deploy evaporators for volume reduction. Within the food & beverage sector, breweries and distilleries concentrate distillates, dairy processors utilize units for cream separation, milk powder production, and whey protein concentration, and juice producers enhance flavor retention while minimizing thermal degradation.

System type analysis distinguishes batch and continuous operations. Batch evaporators-available in multi-effect and single-effect variations-provide flexibility for small-batch or multi-product environments, enabling changeovers with minimal cross-contamination. Continuous systems, offered with horizontal or vertical arrangements, deliver steady throughput for large-scale production, emphasizing consistency and operational efficiency over extended runs.

Heating medium segmentation covers electric, steam, and thermal oil options. Electric heating affords fast ramp-up times and precise temperature regulation, steam remains a cost-effective choice in steam-rich facilities, and thermal oil enables high-temperature operation while isolating the process from direct steam contact. Material selection further refines system capability, with alloy steel and carbon steel providing robustness for general applications, stainless steel (SS304 and SS316) delivering corrosion resistance for aggressive fluids, and titanium suited to extreme corrosive or high-purity contexts.

Capacity range segmentation ensures solutions align with plant scale. Large units-categorized as industrial and ultra capacities-support high-volume treatment and production. Medium configurations-offered in high and standard throughput options-balance performance with manageable capital investment. Small-scale units-ranging from micro to mini designs-serve pilot plants, research labs, and niche applications requiring compact footprints and rapid deployment.

This comprehensive research report categorizes the Vacuum Evaporation Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- System Type

- Heating Type

- Material

- Capacity Range

- End Use Industry

Uncovering Key Regional Trends and Opportunities in the Vacuum Evaporation Equipment Market Across Americas EMEA and Asia-Pacific

In the Americas, stringent environmental regulations and a growing emphasis on water reuse have catalyzed investments in vacuum evaporation solutions. North American operators benefit from a mature service infrastructure and established OEM presence, enabling rapid deployment of both retrofit and greenfield systems. Latin American markets are also increasingly adopting zero liquid discharge strategies to address water scarcity and regulatory compliance, driving interest in compact evaporator designs and remote monitoring capabilities.

Europe, the Middle East, and Africa region is shaped by aggressive emissions reduction targets and energy transition policies. Western European facilities are upgrading legacy thermal evaporation systems to incorporate mechanical vapor recompression and multi-effect configurations, reducing carbon footprints and operational expenses. In the Middle East, desalination-driven water productivity mandates have spurred the integration of vacuum stages within evaporative crystallizers, while North African and Sub-Saharan markets are exploring public-private partnerships to fund sustainable wastewater management infrastructure.

Asia-Pacific stands as a major growth engine for vacuum evaporation equipment, buoyed by rapid industrialization in China, India, and Southeast Asia. Expansion of chemical, pharmaceutical, and food processing sectors is matched by intensifying environmental regulations and government incentives for circular water economies. Local OEMs are scaling production of cost-competitive evaporator units, and global players are establishing regional hubs to deliver integrated service offerings and digital support platforms to a diverse array of end users.

This comprehensive research report examines key regions that drive the evolution of the Vacuum Evaporation Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Leaders Innovations and Strategic Moves Shaping the Vacuum Evaporation Equipment Sector Amid Emerging Technologies

Alfa Laval’s strategic commitment to sustainability and technological leadership is exemplified by its accelerated net-zero roadmap and targeted acquisitions. In late 2024, the company announced plans to achieve scope 1 and 2 net-zero emissions by 2027, three years ahead of its initial timeline. Investments in mechanical vapor recompression and enhanced heat exchanger capacity, coupled with the acquisition of Fives Cryogenics, have strengthened the portfolio for low-temperature and cryogenic heat transfer applications, positioning the company at the nexus of energy-efficient process solutions.

Veolia and SUEZ continue to reinforce their market positions through integrated water management offerings that couple vacuum evaporators with reverse osmosis and crystallization technologies. These partnerships enable end users to achieve true zero liquid discharge across chemical, pharmaceutical, and industrial sectors. Emphasis on modular, skid-mounted evaporator packages facilitates rapid site integration and streamlined maintenance, enhancing lifecycle value.

GEA has advanced its product lineup with modular plate evaporators and digital twin platforms, enabling predictive analytics and remote performance optimization. By embedding sensors and AI-driven control algorithms, GEA systems autonomously adjust operational setpoints to maintain target concentrations and energy efficiency.

SPX Flow and Sumitomo bring specialized expertise in mechanical vapor recompression licensing and wiped film evaporation technologies. Their global service networks and focus on high-throughput designs for specialty chemical applications underscore a commitment to robust, energy-efficient solutions that meet stringent purity and throughput requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vacuum Evaporation Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- ANDRITZ AG

- Belmar Technologies Ltd.

- Bucher Unipektin AG

- Condorchem Enviro Solutions S.L.

- De Dietrich Process Systems GmbH

- ECO-TECHNO S.r.l.

- Evoqua Water Technologies LLC

- GEA Group Aktiengesellschaft

- Hering AG

- JEOL Ltd.

- Praj Industries Limited

- Saltworks Technologies Inc.

- SPX FLOW, Inc.

- SUEZ S.A.

- Sumitomo Heavy Industries, Ltd.

- Thermax Limited

- Unitop Aquacare Limited

- Veolia Water Technologies & Solutions

- Zhejiang Taikang Evaporator Co., Ltd.

Actionable Recommendations for Industry Leaders to Drive Innovation Resilience and Sustainable Growth in Vacuum Evaporation Equipment Operations

Industry leaders are encouraged to intensify investments in digitalization and data analytics to unlock process efficiencies and reliability improvements. Deploying advanced sensors in critical system zones and integrating cloud-based monitoring platforms can transform maintenance strategies from reactive to predictive, reducing downtime and optimizing energy usage.

Diversification of the supply chain is paramount in an era of evolving trade policies and tariff regimes. By establishing alternate manufacturing locations and leveraging nearshore assembly partnerships, companies can insulate their operations from import levies and customs delays, ensuring continuity of customer service and project delivery.

Accelerating R&D efforts on next-generation vacuum evaporation technologies-such as hybrid thermal–electric systems, advanced materials for high corrosive streams, and adaptive control frameworks-will be critical to sustaining performance advantages. Collaborations with academic institutions and specialized research centers can expedite development cycles and foster breakthroughs in energy recovery and process intensification.

Finally, cultivating end-user engagement through collaborative pilot projects and application engineering support will reinforce customer confidence and facilitate technology adoption. Demonstrating total cost of ownership benefits and sustainability contributions through transparent case studies can drive wider acceptance and long-term partnerships.

Comprehensive Research Methodology Leveraging Secondary and Primary Data Collection Expert Validation and Rigorous Analytical Framework

This analysis synthesizes insights from comprehensive secondary research and targeted primary validation. Secondary data sources included industry publications, patent filings, OEM technical bulletins, regulatory frameworks, and peer-reviewed literature. Market dynamics and competitive landscapes were examined through press releases, investor presentations, and expert commentary.

Primary research involved structured interviews with engineering leaders, project managers, and procurement specialists across key end-use industries. These qualitative engagements provided real-world perspectives on functional requirements, performance expectations, and procurement challenges, informing segmentation and regional analyses.

A robust analytical framework was applied to map technology trends against application requirements, tariff impacts, and regional regulatory drivers. Cross-validation workshops with subject matter experts ensured consistency of findings and refined strategic recommendations. The methodology’s iterative approach balanced quantitative rigor with qualitative nuance, delivering a holistic view of the vacuum evaporation equipment ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vacuum Evaporation Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vacuum Evaporation Equipment Market, by Equipment Type

- Vacuum Evaporation Equipment Market, by System Type

- Vacuum Evaporation Equipment Market, by Heating Type

- Vacuum Evaporation Equipment Market, by Material

- Vacuum Evaporation Equipment Market, by Capacity Range

- Vacuum Evaporation Equipment Market, by End Use Industry

- Vacuum Evaporation Equipment Market, by Region

- Vacuum Evaporation Equipment Market, by Group

- Vacuum Evaporation Equipment Market, by Country

- United States Vacuum Evaporation Equipment Market

- China Vacuum Evaporation Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesis of Strategic Insights and Industry Trends Guiding the Future of Vacuum Evaporation Equipment Technologies and Market Dynamics

The evolving vacuum evaporation equipment market is defined by a confluence of technological innovation, sustainability imperatives, and geopolitical factors. Advanced digital controls and mechanical vapor recompression solutions are delivering unprecedented energy efficiencies, while modular and hybrid system architectures are redefining flexibility and scalability.

Tariff adjustments have prompted a strategic realignment of supply chains and procurement models, fueling interest in nearshore manufacturing and bonded assembly operations. Concurrently, stringent environmental regulations and corporate decarbonization targets are intensifying demand for zero liquid discharge and solvent recovery technologies, particularly within chemical, pharmaceutical, and food & beverage sectors.

Segmentation analysis underscores the importance of a tailored approach to equipment selection, informed by specific process requirements across diverse fluid chemistries, operating modes, and capacity needs. Regional market dynamics reveal differentiated growth patterns, driven by local regulatory environments, infrastructure maturity, and investment incentives.

As major OEMs and service providers pursue strategic acquisitions, net-zero commitments, and digitalization roadmaps, the landscape for vacuum evaporation equipment is poised for continued evolution. Organizations that embrace innovation, operational resilience, and sustainability will be best positioned to capitalize on emerging opportunities and navigate the complexities of global trade and regulatory landscapes.

Engage with Ketan Rohom Associate Director Sales Marketing to Explore and Acquire the Comprehensive Vacuum Evaporation Equipment Market Research Report

To delve deeper into the comprehensive analysis of vacuum evaporation equipment and gain actionable intelligence for strategic decision-making, we encourage you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the detailed findings, provide tailored insights for your organization’s unique needs, and facilitate your acquisition of the full market research report. Connect with Ketan Rohom today to secure a competitive edge in the evolving vacuum evaporation equipment landscape and empower your team with expert-driven data and recommendations.

- How big is the Vacuum Evaporation Equipment Market?

- What is the Vacuum Evaporation Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?