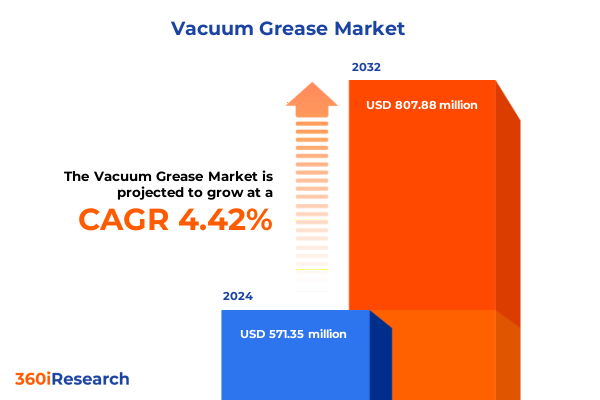

The Vacuum Grease Market size was estimated at USD 159.33 million in 2025 and expected to reach USD 184.88 million in 2026, at a CAGR of 13.70% to reach USD 391.44 million by 2032.

Unveiling the Essential Functions and Growing Significance of Vacuum Grease Across High-Precision Industrial and Laboratory Environments

Vacuum grease stands as a cornerstone material in technologies that demand rigorous sealing, lubrication, and protection under extreme vacuum and temperature conditions. Its unique physicochemical properties, including low vapor pressure, thermal stability, and chemical inertness, enable seamless integration into high-performance equipment ranging from ultra-high vacuum chambers to precision laboratory instrumentation. As industries continue to push the boundaries of miniaturization, performance, and sustainability, vacuum grease’s reliability has never been more critical to maintaining operational integrity and preventing contamination.

From aerospace applications requiring robust environmental resistance to semiconductor manufacturing where even trace contamination can compromise yield, vacuum grease underpins a multitude of advanced processes. Recent advances in polymer science have unlocked new formulations that extend service life, reduce maintenance cycles, and enhance compatibility with sensitive materials. Consequently, understanding the fundamental role and evolving capabilities of vacuum grease provides essential context for stakeholders aiming to optimize performance and mitigate risks across diverse use cases.

Exploring How Technological Innovations and Regulatory Demands Are Reshaping the Vacuum Grease Market Landscape Worldwide

Over the past decade, the vacuum grease landscape has undergone transformative shifts driven by breakthroughs in material chemistry and an accelerating pace of digital integration. Next-generation fluorinated and perfluoropolyether-based greases now deliver unmatched thermal performance and chemical resilience, facilitating their adoption in harsh environments such as cryogenic chambers and high-vacuum electron microscopes. Simultaneously, silicone-based formulations have evolved to offer enhanced oxidative stability and compatibility with organic solvents, expanding their utility in emerging fields like biotechnology and clean energy research.

Concurrently, industry 4.0 initiatives have stimulated the deployment of smart manufacturing systems where real-time condition monitoring and predictive maintenance rely on the stability of sealing and lubrication components. Digital twin technologies and embedded sensors now enable proactive grease replacement schedules, minimizing downtime and extending equipment lifespan. These innovations have prompted greasing solutions that incorporate traceable RFID tags or color-changing indicators, reinforcing quality assurance protocols across complex production lines.

Environmental regulations and sustainability commitments have further reshaped product development priorities. Manufacturers are investing in solvent-free, low-toxicity grease matrices and biodegradable carriers to align with global emissions targets and corporate responsibility goals. As a result, the market has witnessed a pronounced shift toward greener vacuum grease alternatives that maintain uncompromised performance while reducing ecological footprints.

Analyzing the Cumulative Effects of Recent United States Tariffs on Raw Materials and Supply Chains Within the Vacuum Grease Industry

The introduction of new United States tariffs in early 2025 has exerted significant pressure on the vacuum grease supply chain, particularly affecting imports of specialized raw materials such as perfluorinated polymers and high-purity silicones. Suppliers have faced increased input costs, prompting a reconsideration of sourcing strategies and a turn toward domestic production or duty-exempt regions. This shift has required companies to reassess long-standing procurement relationships and invest in qualification processes for alternate material vendors to ensure uninterrupted operations.

Moreover, the tariffs have catalyzed local innovation, as regional manufacturers strive to develop equivalent high-performance formulations using domestically available feedstocks. While this trend enhances supply chain resilience, it introduces transitional challenges related to formulation compatibility, certification, and quality assurance. Equipment operators in sectors like aerospace and semiconductor manufacturing have collaborated with grease producers to co-develop batch-specific grades that comply with stringent industry standards and mitigate any potential impact on product reliability.

Longer-term implications of the tariff framework include strategic stockpiling of critical greases and intensified partnerships between manufacturers and end users. By coordinating production schedules and inventory buffers, stakeholders aim to minimize exposure to further trade policy volatility. These collective efforts have underscored the importance of agile supply chain management and robust risk mitigation frameworks in preserving operational continuity.

Revealing Critical Segmentation Insights That Illuminate Diverse Product Types Applications End Users Distribution Channels and Packaging Trends

Deep analysis across product typologies reveals that fluorinated vacuum grease maintains dominance where extreme chemical resistance and temperature tolerance are prerequisites, while hydrocarbon-based greases continue to serve cost-sensitive applications with moderate performance requirements. Perfluoropolyether formulations have gained traction for their low vapor pressures and extended lifespan, particularly in high-end research facilities, and silicone variants maintain relevance in laboratory settings due to their broad compatibility and ease of application.

Application-focused segmentation highlights that the aerospace sector demands ultra-reliable sealing compounds to withstand vibrations, pressure fluctuations, and thermal cycling. The automotive industry exploits specialized greases in electric vehicle manufacturing and battery assembly for their insulating properties. Critical industrial machinery operations, from vacuum pumps to compressors, rely on grease grades tailored for longevity under continuous operation. Laboratory equipment manufacturers prioritize non-reactive, analytical-grade options that minimize background noise in sensitive assays, while semiconductor manufacturing calls for trace-free, high-purity greases to avert contamination.

End users in chemicals and petrochemicals leverage robust greases to maintain catalytic reactor seals, whereas electronics producers implement ultra-clean formulations to ensure pristine conditions during assembly. Metal processing plants require lubricants that resist metal galling at elevated pressures, and oil & gas operations count on durable sealing solutions for drilling and pumping apparatus. Power generation facilities depend on high-performance greases to preserve turbine integrity and thermal control. Across distribution channels, direct sales models foster customized technical support, distributors provide localized inventory and rapid fulfillment, and online retailers cater to low-volume or emergency replenishment needs. Packaging preferences range from bulk deliveries for large-scale operations to cartridge, drum, and tube formats for targeted maintenance tasks, while purity-grade distinctions separate analytical-grade formulations for laboratory precision from industrial-grade compositions optimized for heavy-duty performance.

This comprehensive research report categorizes the Vacuum Grease market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Packaging

- Purity Grade

- Application

- End User

- Distribution Channel

Examining Distinct Regional Dynamics Driving Adoption Challenges and Growth Opportunities for Vacuum Grease in Key Global Markets

In the Americas, established manufacturing hubs in the United States and Canada drive robust demand for high-purity vacuum greases across semiconductor fabs and research institutions, with Mexico emerging as a cost-competitive production base for industrial-grade grades. Latin American countries demonstrate growing interest in energy sector applications, with oil & gas expansions in Brazil and Argentina presenting new sealing challenges for exploration equipment.

Europe, the Middle East, and Africa exhibit a balanced mix of legacy market stability and rapid growth pockets. Western Europe’s mature semiconductor cluster continues to push for lower outgassing materials, while oil-rich Middle Eastern economies invest in cutting-edge petrochemical plants that require resilient greases under harsh desert conditions. Africa’s industrialization initiatives create nascent opportunities for maintenance-focused applications, particularly in mining and metal processing sectors.

The Asia-Pacific region stands as the fastest-growing market, propelled by aggressive investments in electronics manufacturing in China, semiconductor production ramp-ups in Taiwan and South Korea, and aviation expansions across India. Local producers in Japan and Southeast Asia lead in premium fluorinated grease innovations, while emerging economies adopt cost-effective solutions to support burgeoning industrial machinery sectors. Robust distribution networks and competitive pricing strategies further reinforce the region’s dynamic growth trajectory.

This comprehensive research report examines key regions that drive the evolution of the Vacuum Grease market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Innovation Trends and Competitive Advantages of Leading Companies Shaping the Vacuum Grease Industry

Leading stakeholders in the vacuum grease domain have emphasized differentiated innovation pathways to reinforce competitive positioning. Major chemical conglomerates leverage extensive R&D facilities to pioneer next-generation perfluoropolyether and hybrid polymer blends that deliver tailored viscosity and surface tension profiles. These efforts aim to capture high-end aerospace, semiconductor, and research laboratory segments seeking bespoke sealing solutions.

Mid-tier specialty chemical companies have carved out niches by offering rapid technical support, agile custom formulation services, and flexible packaging options to address unique end user requirements. These players often partner with academic institutions and industry consortia to validate performance under extreme conditions, thereby enhancing their credibility in demanding applications. Simultaneously, forward-thinking distributors have begun integrating digital platforms that streamline order tracking, inventory management, and technical consultation, elevating service levels and fostering closer customer relationships.

Strategic alliances and licensing agreements have also emerged as critical avenues for growth. Joint ventures between grease manufacturers and equipment OEMs facilitate co-developed products engineered to specific machine tolerances, reducing integration risks. In parallel, selective acquisitions bolster portfolios with complementary technologies or expand geographic reach, enabling companies to respond swiftly to regional tariff impacts and local sourcing imperatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vacuum Grease market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apiezon by M&I Materials Ltd.

- Balmer Lawrie

- Castrol Ltd. by BP PLC

- DuPont de Nemours, Inc.

- Harrison Manufacturing Company

- Klüber Lubrication

- MPT Industries

- Shin-Etsu Chemical Co., Ltd.

- Sinopec Corp.

- Supervac Industries LLP

- The Chemours Company

- ULVAC, Inc.

Delivering Actionable Strategic Recommendations to Optimize Innovation Supply Chain Resilience and Sustainability in the Vacuum Grease Sector

Industry leaders should prioritize accelerated R&D investment in sustainable grease chemistries that align with increasingly stringent environmental regulations and corporate ESG commitments. By adopting green polymer backbones and eliminating hazardous additives, companies can differentiate their offerings and preempt potential regulatory disruptions. Furthermore, embedding condition monitoring capabilities such as colorimetric indicators or IoT-based sensors will enable proactive maintenance strategies, enhancing customer value.

To fortify supply chain resilience, organizations must diversify raw material sources across multiple geographies and establish strategic inventory buffers for critical components. Engaging in collaborative development agreements with domestic and international suppliers will mitigate the impact of future trade policy shifts. In tandem, adopting advanced analytics and digital procurement platforms can optimize lead times and predict potential bottlenecks before they escalate.

Finally, firms should tailor their go-to-market strategies by focusing on high-growth applications and end user segments. Targeted marketing campaigns emphasizing specialized performance credentials-such as vacuum compatibility certifications or cryogenic stability test results-will resonate with discerning buyers in aerospace, semiconductor, and laboratories. Strategic partnerships with key equipment OEMs and distributors can further unlock new channels and reinforce technical credibility.

Outlining a Rigorous Multi-Source Research Methodology Combining Expert Interviews Secondary Data Analysis and Proprietary Data Modeling Techniques

This analysis integrates a multi-faceted research framework combining in-depth expert interviews, rigorous secondary source reviews, and proprietary data modeling. Senior scientists, application engineers, and procurement specialists contributed firsthand insights into performance requirements, emerging trends, and supply chain dynamics. Their perspectives were systematically triangulated with regulatory databases, patent filings, and industry publications to ensure comprehensive coverage and validate key assumptions.

Secondary intelligence was sourced from reputable technical journals, engineering white papers, and government trade databases to map tariff developments, material cost trajectories, and regional production volumes. Proprietary modeling tools then synthesized these inputs to identify structural relationships between formulation innovations, end user demands, and geopolitical factors. This robust methodology underpins the strategic recommendations and insights presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vacuum Grease market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vacuum Grease Market, by Type

- Vacuum Grease Market, by Packaging

- Vacuum Grease Market, by Purity Grade

- Vacuum Grease Market, by Application

- Vacuum Grease Market, by End User

- Vacuum Grease Market, by Distribution Channel

- Vacuum Grease Market, by Region

- Vacuum Grease Market, by Group

- Vacuum Grease Market, by Country

- United States Vacuum Grease Market

- China Vacuum Grease Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Key Takeaways Reinforcing the Strategic Imperatives and Emerging Opportunities That Will Shape the Future of Vacuum Grease Markets

In summary, the vacuum grease market is navigating a period of significant transformation driven by advanced material formulations, digitalization of maintenance practices, and evolving trade policies. Stakeholders must remain attuned to shifting performance requirements in high-precision industries while adapting to geopolitical dynamics that influence raw material availability and pricing. Embracing sustainable chemistries and digital condition monitoring will position organizations to capitalize on new opportunities and sustain long-term growth.

As the industry advances, continuous collaboration between manufacturers, end users, and research institutions will be essential to address technical challenges and accelerate innovation. Companies that integrate strategic supply chain diversification, targeted segmentation strategies, and proactive regulatory compliance will secure competitive advantages in this demanding marketplace.

Secure Comprehensive Market Intelligence by Connecting with Ketan Rohom Associate Director Sales Marketing to Unlock the Full Vacuum Grease Industry Report Now

The vacuum grease market research report represents a critical asset for industry stakeholders seeking in-depth competitive intelligence and strategic clarity through 2025 and beyond. To secure unrestricted access to the full suite of analysis, proprietary data models, and expert commentary, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His team stands ready to provide tailored solutions, flexible licensing options, and guided walkthroughs of key findings to ensure your organization capitalizes on emerging opportunities and navigates sector challenges with confidence. Unlock the complete report today to gain a definitive edge in the evolving vacuum grease landscape

- How big is the Vacuum Grease Market?

- What is the Vacuum Grease Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?