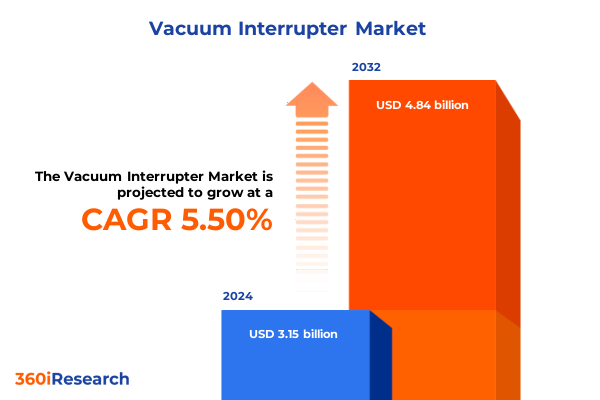

The Vacuum Interrupter Market size was estimated at USD 3.32 billion in 2025 and expected to reach USD 3.49 billion in 2026, at a CAGR of 5.55% to reach USD 4.84 billion by 2032.

Unveiling the Critical Role and Emerging Opportunities Driving Vacuum Interrupter Technologies Across Power and Industrial Sectors

Vacuum interrupter technology stands at the forefront of modern electrical innovation, offering unparalleled reliability and resilience in high-voltage switching applications. These devices play a pivotal role in safeguarding power systems, controlling load flows, and ensuring safe operations across diverse industrial environments. As power grids evolve to integrate renewable generation and digital control systems, the demand for vacuum interrupters is intensifying due to their rapid arc quenching capabilities and minimal maintenance requirements.

Amid growing pressures to enhance grid stability and reduce operational downtime, stakeholders are increasingly turning to vacuum interrupters as a transformative solution. Recent material science advancements have improved contact wear resistance and thermal performance, further extending device lifetimes and reducing total cost of ownership. Consequently, energy utilities, heavy industries, and infrastructure developers are prioritizing vacuum interrupters in upgrade projects and new installations, acknowledging their integral contribution to system optimization and safety.

Identifying Disruptive Trends and Technological Advancements Reshaping the Vacuum Interrupter Landscape in a Rapidly Evolving Energy Ecosystem

In recent years, the vacuum interrupter landscape has undergone profound shifts driven by technological breakthroughs and evolving regulatory frameworks. The integration of digital diagnostics and condition-based monitoring tools has transformed conventional maintenance paradigms, enabling real-time performance insights. These innovations are fostering proactive asset management strategies that reduce unplanned outages and extend operational lifespans.

Simultaneously, the push toward decarbonization and the proliferation of distributed energy resources have introduced new performance requirements, prompting manufacturers to develop next-generation interrupters with enhanced voltage ratings and faster response times. Moreover, sustainability mandates and stringent environmental compliance have accelerated the adoption of eco-friendly manufacturing processes, compelling industry participants to reevaluate materials and production techniques. Taken together, these disruptive trends are redefining competitive boundaries and stimulating fresh collaborations across the value chain.

Assessing How Escalating United States Tariffs in 2025 Are Influencing Supply Chains Cost Structures and Competitive Dynamics for Vacuum Interrupters

The implementation of elevated United States tariffs on electrical components in 2025 has introduced significant cost pressures and strategic recalibrations across the vacuum interrupter supply chain. Manufacturers active in high-voltage equipment have experienced shifts in procurement strategies, exploring alternative sourcing destinations and localizing assembly operations to mitigate tariff impacts. Consequently, production cost structures are increasingly influenced by import duties, prompting value chain participants to reevaluate supplier contracts and optimize inventory management.

In response to these financial headwinds, many firms are intensifying efforts to secure tariff-exempt certifications and leverage free trade agreements. Furthermore, distributors and end users are demanding greater transparency around landed costs, driving collaboration between procurement, logistics, and engineering teams to align technical requirements with budgetary constraints. Moving forward, agility in navigating evolving trade policies will remain a critical differentiator in maintaining supply continuity and preserving competitive margins.

Deciphering Core Market Segmentation Based on Voltage Thresholds Distribution Channels Application Types and End-User Verticals to Uncover Hidden Value Drivers

Understanding the intricate layers of market segmentation is crucial for identifying targeted opportunities and crafting precise go-to-market strategies. When examining voltage thresholds, the market divides into below 15 kV, the mid-range segment ranging from 15 kV to 30 kV, and the high-voltage category above 30 kV. The below 15 kV domain remains fundamental to distribution networks and light industrial installations, whereas the mid-range and high-voltage brackets are increasingly vital for utility transmission upgrades and renewable integration projects.

Distribution channels reveal divergent purchasing behaviors, with offline interactions dominating legacy infrastructure projects and long-term service agreements, while online platforms are stimulating direct procurement for smaller-scale deployments and aftermarket replacements. Application-wise, circuit breakers still represent the core use case, yet contactors, load break switches, reclosers, and tap changers are gaining traction as grid modernization accelerates. Each of these applications imposes unique performance and durability requirements, compelling suppliers to refine product portfolios accordingly.

End-user verticals span automotive manufacturing lines requiring robust interruption solutions, construction and infrastructure firms upgrading smart buildings, heavy industries seeking reliable switching under extreme load conditions, oil and gas operators focused on explosion-proof designs, transportation networks demanding high-frequency switching cycles, and utility transmission entities prioritizing minimal maintenance in remote locations. By decoding these segmentation parameters, market leaders can tailor value propositions and service models to align precisely with end-user priorities.

This comprehensive research report categorizes the Vacuum Interrupter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Contact Structure Type

- Voltage Rating

- Enclosure Type

- Distribution Channel

- Application

- End-User

Exploring Regional Demand Variations and Strategic Imperatives Across the Americas Europe Middle East Africa and Asia-Pacific Vacuum Interrupter Markets

Regional dynamics exert a profound influence on investment flows and technological adoption within the vacuum interrupter market. Across the Americas, infrastructure renewal initiatives in North America are fueling demand for mid-range and high-voltage interrupters, while Latin American markets are gradually embracing digital diagnostics to optimize aging networks. The regulatory emphasis on grid resilience and disaster recovery in North America is accelerating the deployment of advanced interrupters with integrated condition monitoring.

Europe, the Middle East, and Africa present a mosaic of matured markets and burgeoning growth corridors. In Western Europe, decarbonization goals and aging grid assets are driving upgrades to vacuum-based switching solutions, complemented by robust standards for thermal performance and environmental impact. In the Middle East, large-scale utility expansions and smart city projects are creating pockets of significant opportunity, whereas sub-Saharan Africa’s electrification push underscores the need for cost-effective, low-maintenance devices.

Within Asia-Pacific, rapid industrialization across Southeast Asia and infrastructure investments in India are generating rising consumption of interrupters in the below 15 kV category. Meanwhile, power utilities in China, Japan, and South Korea are allocating capital toward next-generation mid-range and high-voltage interrupters to support renewable integration and strengthen network reliability. Understanding these regional imperatives enables stakeholders to align market entry and product development strategies with localized requirements.

This comprehensive research report examines key regions that drive the evolution of the Vacuum Interrupter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players Technological Collaborations and Strategic Moves That Are Defining Leadership in the Vacuum Interrupter Industry

Prominent industry players are engaging in strategic alliances and technology licensing agreements to fortify their competitive positions in the vacuum interrupter domain. Leading electrical conglomerates are expanding research collaborations with material science firms to enhance contact metallurgy and arc extinguishing chambers. Such partnerships are accelerating the prototyping of compact interrupters that deliver high-voltage performance in smaller form factors.

Mergers and acquisitions are reshaping the competitive landscape, with several regional specialists integrating vertically to secure raw material supplies and streamline production workflows. Concurrently, joint ventures are emerging in high-growth regions to localize manufacturing, reduce tariff burdens, and expedite time-to-market. Beyond corporate restructurings, top vendors are investing in digital twin technologies that simulate device performance under various load conditions, enabling faster validation cycles and continuous improvement.

In addition, forward-looking companies are establishing dedicated centers of excellence for power switchgear innovations, aggregating multidisciplinary expertise in engineering, software development, and quality assurance. These centers serve as incubators for advanced diagnostic tools, artificial intelligence-based failure prediction models, and modular design platforms. Such endeavors are setting new benchmarks for operational reliability and lifecycle management in vacuum interrupter solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vacuum Interrupter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A R Power Electricals Engineering Works

- ABB Ltd.

- ACTOM Pty Ltd

- Bharat Heavy Electricals Limited (BHEL)

- CG Power and Industrial Solutions Limited

- Chengdu Xuguang Electronics Co., Ltd.

- Chint Group Corporation

- Crompton Greaves Ltd.

- Eaton Corporation PLC

- General Electric Company

- GREENSTONE USA Inc.

- Hitachi, Ltd.

- Hyundai Electric & Energy Systems Co., Ltd.

- Jiangsu Liyuan Electric Co., Ltd.

- Jiangsu Sifang Electric Co., Ltd.

- Kirloskar Electric Company Limited

- Kunshan GuoLi Electronic Technology Co., Ltd.

- LS ELECTRIC Co., Ltd.

- Meidensha Corporation

- METTZ Group

- Minghua Electric Co., Ltd.

- Mitsubishi Electric Corporation

- S&P Electric Co., Ltd.

- Schneider Electric SE

- Shaanxi Baogong Electrical Co., Ltd.

- Shaanxi Baoguang Vacuum Electric Device Co., Ltd.

- Shaanxi Joyelectric International Co.,Ltd

- Shanghai Delixi Electric Co., Ltd.

- Shanghai Kaysen Electric Co., Ltd.

- Siemens AG

- Sungrow Power Supply Co., Ltd.

- Tianjin Keyuan Electric Co., Ltd.

- Tianjin Sine Electric Co., Ltd.

- Toshiba Corporation

- Vacuum Interrupters Inc. by Group CBS, Inc.

- Westinghouse Electric Company LLC

- Wuhan Feite Electric Co.,Ltd

- Xiamen Hongfa Electroacoustic Co.,Ltd.

- Yueqing Liyond Electric Co., Ltd.

- Zhejiang Tiansheng Electric Co., Ltd.

- Zhejiang Volcano Electrical Technology Co.,Ltd

Providing Actionable Strategic Recommendations for Industry Leaders to Enhance Innovation Operational Efficiency and Market Competitiveness in Vacuum Interruption

To strengthen market standing and accelerate innovation, industry leaders should prioritize the integration of predictive maintenance capabilities into their vacuum interrupter portfolios. By embedding sensors and leveraging cloud-based analytics, manufacturers can offer outcome-driven service models that shift from reactive to condition-based maintenance regimes. This approach not only enhances equipment uptime but also fosters long-term customer partnerships through performance-based contracts.

Furthermore, investing in flexible manufacturing cells that accommodate rapid retooling can deliver significant cost advantages, particularly when navigating tariff fluctuations and evolving regulatory demands. Agile production facilities enable scalable output adjustments, ensuring that both standard and customized interrupter variants can be delivered with minimal lead times. In tandem, establishing collaborative frameworks with utility operators and industrial end users will facilitate co-creation of next-generation solutions tailored to specific operational challenges.

Finally, leaders are advised to harness digital marketing channels and interactive training platforms to educate customers on the technical and economic benefits of vacuum interrupters. Elevating customer awareness through immersive webinars, virtual reality demonstrations, and simulation-based training will drive informed decision-making and accelerate adoption cycles. Collectively, these strategic initiatives will position forward-thinking firms at the vanguard of the vacuum interrupter market.

Elucidating Rigorous Research Methodology Combining Secondary Data Exploration Expert Interviews and Quantitative Analysis to Ensure Robust Insights

The research methodology underpinning this analysis combined extensive secondary data exploration with targeted primary interviews and rigorous quantitative validation. Secondary sources included peer-reviewed journals, industry white papers, and regulatory filings that provided foundational insights into technological progress and policy drivers. These materials were systematically reviewed to map historical trends and identify emerging themes across key application segments.

Primary research encompassed structured interviews with C-level executives, design engineers, procurement managers, and utility stakeholders to capture firsthand perspectives on market dynamics, purchasing criteria, and future deployment plans. Interview findings were synthesized to refine segmentation frameworks and validate the relative importance of performance attributes such as dielectric strength, contact erosion resistance, and mechanical endurance.

To ensure robustness, data triangulation techniques were applied, cross-referencing quantitative shipment statistics with qualitative feedback from industry experts. Analytical models were stress-tested under various tariff and regulatory scenarios to assess supply chain resilience. The methodology prioritized transparency, reproducibility, and the elimination of bias through multiple rounds of peer review and consistency checks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vacuum Interrupter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vacuum Interrupter Market, by Contact Structure Type

- Vacuum Interrupter Market, by Voltage Rating

- Vacuum Interrupter Market, by Enclosure Type

- Vacuum Interrupter Market, by Distribution Channel

- Vacuum Interrupter Market, by Application

- Vacuum Interrupter Market, by End-User

- Vacuum Interrupter Market, by Region

- Vacuum Interrupter Market, by Group

- Vacuum Interrupter Market, by Country

- United States Vacuum Interrupter Market

- China Vacuum Interrupter Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Critical Findings and Forward-Looking Perspectives to Guide Decision Makers in Navigating the Future Trajectory of Vacuum Interrupter Innovations

This comprehensive examination of vacuum interrupter technologies has surfaced critical findings that will shape strategic decisions and investment priorities. The convergence of digital diagnostics, material innovations, and tariff dynamics underscores the importance of agility and collaborative innovation in maintaining competitive advantage. Furthermore, the segmentation analysis highlights distinct value pools across voltage ranges, distribution channels, applications, and end-user verticals, offering a clear roadmap for targeted market penetration.

Regional insights reveal nuanced demand drivers, from infrastructure renewal in the Americas to smart city deployments in EMEA and electrification efforts in Asia-Pacific. Leading companies are responding with strategic partnerships, localized manufacturing strategies, and advanced R&D initiatives. Moving forward, success will hinge on the capacity to integrate predictive maintenance capabilities, optimize supply chains amid trade uncertainties, and articulate compelling value propositions through digital engagement.

In conclusion, stakeholders who align innovation roadmaps with evolving market requirements and forge deep collaborations across the value chain will be best positioned to harness the full potential of vacuum interrupter technologies. This analysis provides the actionable intelligence needed to navigate the rapidly changing landscape and sustain long-term growth.

Engage with Our Associate Director of Sales and Marketing to Acquire In-Depth Vacuum Interrupter Market Intelligence and Propel Your Strategic Agenda

To explore the full breadth of market insights and tailor a strategic approach for your organization’s needs, reach out to Associate Director of Sales & Marketing Ketan Rohom. He is prepared to guide you through the comprehensive details and answer any questions you may have about acquiring the full vacuum interrupter market research report. Engaging with his expertise will empower your team to act swiftly on emerging opportunities, mitigate risks associated with market shifts, and align your strategic priorities with the latest industry benchmarks. He looks forward to partnering with you to elevate your competitive edge through this in-depth analysis and bespoke recommendations.

- How big is the Vacuum Interrupter Market?

- What is the Vacuum Interrupter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?