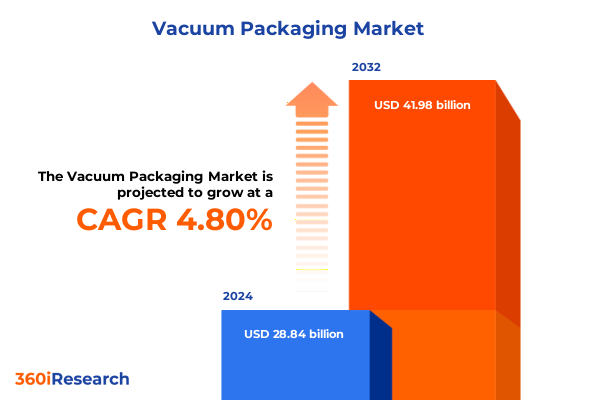

The Vacuum Packaging Market size was estimated at USD 30.22 billion in 2025 and expected to reach USD 31.56 billion in 2026, at a CAGR of 4.80% to reach USD 41.98 billion by 2032.

Unlocking the Strategic Importance of Vacuum Packaging Technologies Across Supply Chains to Enhance Shelf Life Safety and Consumer Appeal

Vacuum packaging has emerged as a pivotal technology for preserving product integrity and extending shelf life by removing air and creating an impermeable barrier around goods. This method not only inhibits microbial growth and oxidation but also enhances the visual and structural quality of packaged products, making it indispensable for modern supply chains. As consumers increasingly demand fresher, safer, and longer-lasting products, vacuum packaging’s role in reducing waste and maintaining quality has become more pronounced, driving its adoption across diverse industries.

Regulatory mandates and consumer preferences for transparency and sustainability have further propelled vacuum packaging beyond traditional food applications. Pharmaceutical and medical device manufacturers leverage its contamination-free sealing capabilities to ensure sterility and product safety, while electronics companies utilize specialized vacuum techniques to protect sensitive components. As a result, vacuum packaging has transitioned from a niche solution to a mainstream strategy that aligns with stringent quality standards and evolving market expectations.

Navigating the Convergence of Automation, Sustainability, and Digital Innovations That Are Redefining Vacuum Packaging Practices Globally

The vacuum packaging sector is experiencing a significant transformation driven by automation, digital integration, and a heightened focus on sustainability. Manufacturers are adopting advanced robotics and Industry 4.0 platforms to streamline operations, reduce human error, and enhance throughput. Simultaneously, sustainable innovations in packaging materials-from recyclable polyolefin films to compostable bio-based laminates-are gaining traction as companies seek to meet stringent environmental regulations and consumer demands for greener solutions.

In parallel, the integration of smart packaging technologies-such as embedded sensors that monitor temperature, freshness, and package integrity-is redefining vacuum packaging applications. These advancements not only provide real-time data for cold chain management but also enhance transparency and build consumer trust. Modified atmosphere packaging hybrids and steam flushing techniques are further extending product lifecycles and opening new opportunities in sectors like ready-to-eat meals, pharmaceuticals, and luxury goods.

Assessing the Far-Reaching Effects of 2025 United States Tariff Measures on Vacuum Packaging Supply Chains and Cost Structures

In early 2025, sweeping tariff measures reshaped the landscape for vacuum packaging supply chains. Under the International Emergency Economic Powers Act, the U.S. imposed tariffs of up to 20% on Chinese imports alongside 25% duties on Canadian and Mexican goods, with reciprocal 10% baseline tariffs introduced for all trading partners. Concurrently, Section 232 levies reinstated a 25% tariff on steel and aluminum inputs critical to packaging machinery production, while reciprocal tariffs on vehicles, electronics, and raw materials escalated costs across the board.

The cumulative effect of these tariff policies has been a notable increase in input costs and lead times for packaging equipment and materials. Domestic manufacturers have faced higher prices for steel and aluminum substrates, while global suppliers have navigated complex duty structures and compliance requirements. These dynamics have prompted industry players to reassess sourcing strategies, invest in nearshoring, and explore tariff-engineering solutions to mitigate cost pressures and maintain competitive delivery timelines.

Leveraging Application, Equipment Type, and Material-Based Segmentation to Reveal Unmatched Insights in the Vacuum Packaging Market Landscape

The vacuum packaging market’s multidimensional segmentation offers critical insights into its diverse applications and growth vectors. Within the application domain, food packaging remains the dominant driver, leveraging vacuum sealing to preserve bakery items, dairy products, produce, meat and seafood, as well as ready meals. Electronic packaging, particularly for consumer electronics and semiconductors, is gaining momentum due to heightened demand for moisture and dust protection during transit and storage. Industrial packaging applications encompass automotive parts, chemical products, and construction materials, reflecting this method’s versatility in safeguarding bulk and high-value components, while medical packaging solutions, spanning medical devices and pharmaceutical vials, prioritize sterility and contamination control.

Analyzing packaging machine types reveals distinct operational advantages: belt vacuum packaging systems excel in high-throughput environments such as e-commerce fulfillment centers by providing continuous in-line sealing, chamber vacuum machines offer cost-effective flexibility for small to medium batches across food and medical sectors, and thermoforming vacuum systems cater to complex bespoke packaging shapes with precision and consistency. Understanding these distinctions allows stakeholders to match equipment capabilities with production requirements and efficiency goals.

Material segmentation underscores performance trade-offs among aluminum foil laminates, polyamide/polyethylene films, polypropylene films, and polyvinylidene chloride films. Polyethylene-based films dominate through their balanced durability and cost-effectiveness, while foil laminates deliver superior barrier properties for oxygen-sensitive products. Polypropylene variants are preferred where stiffness and clarity are critical, and PVDC films provide exceptional moisture resistance in high-humidity environments. Insights into these materials inform procurement strategies that optimize barrier performance against sustainability and regulatory demands.

This comprehensive research report categorizes the Vacuum Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Packaging Material

- Application

Uncovering Regional Dynamics and Growth Drivers Shaping Vacuum Packaging Adoption Across the Americas, EMEA, and Asia-Pacific Market Segments

In the Americas, North America leads the vacuum packaging segment driven by robust food and beverage consumption patterns, stringent safety regulations, and advanced manufacturing infrastructure. The U.S. market benefits from high automation levels in packaging lines, extensive e-commerce networks, and consumer preferences for fresh-prepared and convenience foods. Regulatory frameworks such as the Food Safety Modernization Act and state-level sustainability mandates further incentivize investment in eco-friendly vacuum solutions.

Europe, the Middle East, and Africa exhibit diverse dynamics underpinned by the European Union’s Packaging and Packaging Waste Regulation, which mandates the use of recyclable or compostable materials. Countries like Germany are integrating oxygen-scavenging films in meat packaging, while France’s premium cosmetics brands adopt biodegradable vacuum-formed containers. In emerging EMEA markets, growth is more gradual, constrained by infrastructure gaps and varied regulatory landscapes, yet the shift toward circular economy principles drives long-term prospects.

Asia-Pacific stands out with the fastest growth trajectory, propelled by rising per capita incomes, urbanization, and a burgeoning e-commerce sector in China, India, and Southeast Asia. Regional policymakers are introducing incentives for high-barrier sustainable materials to address food safety and waste reduction. Combined with increasing local manufacturing capabilities and global supply chain integration, Asia-Pacific offers significant expansion opportunities for vacuum packaging machinery and material suppliers.

This comprehensive research report examines key regions that drive the evolution of the Vacuum Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Competitive Innovations of Leading Manufacturers Fueling Growth in the Vacuum Packaging Industry

Competitive dynamics in the vacuum packaging space are shaped by a handful of global leaders that command significant market presence. Companies such as Sealed Air, Amcor, and Berry Global collectively account for nearly half of North America’s vacuum packaging solutions, leveraging strong distribution networks, continuous innovation in high-barrier films, and expansive R&D investments to maintain their leadership positions.

Innovation-driven players are introducing breakthrough systems that combine functionality with energy efficiency. MULTIVAC’s steam flushing vacuum packaging technology exemplifies this trend by enabling immediate sealing of hot foods without pre-cooling, thereby reducing energy consumption and extending shelf life through in-package steam sterilization. These product enhancements underscore the growing emphasis on process efficiency and product quality.

Material specialists like Sonoco and Berry Global are accelerating the adoption of recycled polyethylene terephthalate and PET-G materials in thermoformed trays and flexible films. Year-over-year increases in post-consumer recycled content reflect a broader industry commitment to circular economy objectives, as major retailers mandate sustainability targets within their packaging supplier networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vacuum Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Berry Global Group, Inc.

- Busch SE

- Coveris Holdings S.A.

- Henkelman B.V.

- Henkovac International B.V.

- Huhtamäki Oyj

- Klöckner Pentaplast GmbH & Co. KG

- Mondi plc

- MULTIVAC Sepp Haggenmüller SE & Co. KG

- Nichrome India Limited

- Packmech Engineers Private Limited

- ProAmpac Holdings, Inc.

- Promarks Vac Corporation

- Sealed Air Corporation

- Sevana Electrical Appliances Private Limited

- Syntegon Technology GmbH

- Südpack Verpackungen SE & Co. KG

- ULMA Packaging, S. Coop.

- Winpak Ltd.

Implementing Forward-Thinking Strategies to Enhance Sustainability, Efficiency, and Resilience in Vacuum Packaging Operations and Supply Chains

Industry leaders should prioritize investments in advanced barrier materials that balance product protection with recyclability to navigate tightening environmental regulations. Collaborative partnerships with material scientists and technology providers can accelerate the development of next-generation bio-based films and coatings, differentiating offerings in a competitive market.

Digital transformation remains a cornerstone of operational excellence. Adopting smart manufacturing platforms with real-time monitoring, predictive maintenance, and data analytics will optimize packaging line performance and reduce downtime. Additionally, integrating Internet of Things (IoT) sensors into packaging can enhance supply chain transparency and consumer engagement by providing actionable freshness and quality data.

Supply chain resilience is critical amid tariff volatility and raw material fluctuations. Companies should diversify sourcing strategies, exploring regional manufacturing hubs and nearshoring options that minimize duty exposure and streamline logistics. Scenario planning and tariff-engineering expertise will further mitigate cost pressures and safeguard continuity.

Finally, a customer-centric approach that blends product innovation with service differentiation can unlock new value streams. Offering turnkey packaging-as-a-service solutions, customizable packaging formats, and end-to-end sustainability consulting positions organizations to meet evolving client demands.

Detailing the Rigorous Research Framework Employed to Deliver Comprehensive and Credible Insights into the Global Vacuum Packaging Sector

This research was conducted using a rigorous framework that blends comprehensive secondary research with targeted primary interviews. Secondary sources included industry white papers, trade publications, regulatory documents, and technical journals, each critically evaluated for relevance and credibility. Excluded were commercial pay-for-download market reports to ensure impartiality.

Primary research efforts involved in-depth discussions with packaging engineers, procurement specialists, supply chain executives, and materials scientists. These stakeholder interviews provided nuanced perspectives on technology adoption, regulatory impacts, and sustainability challenges. Data points were triangulated across sources and validated through feedback loops to guarantee accuracy.

Quantitative analysis employed a combination of scenario simulation and trend extrapolation techniques, focusing on historical performance and recent market shifts. Qualitative insights were synthesized into thematic frameworks, enabling a holistic understanding of growth drivers, barriers, and emerging opportunities. The methodology ensures robustness, reliability, and actionable relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vacuum Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vacuum Packaging Market, by Packaging Type

- Vacuum Packaging Market, by Packaging Material

- Vacuum Packaging Market, by Application

- Vacuum Packaging Market, by Region

- Vacuum Packaging Market, by Group

- Vacuum Packaging Market, by Country

- United States Vacuum Packaging Market

- China Vacuum Packaging Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Summarizing Key Findings and Imperatives from Our In-Depth Examination of Emerging Trends and Opportunities in Vacuum Packaging

This executive summary underscores the critical importance of vacuum packaging as a preservation and protection strategy across multiple industries. Transformative shifts in automation, material science, and digital integration are reshaping production paradigms, while evolving trade policies introduce both challenges and opportunities. Segmentation analyses reveal distinct growth pockets, from food and medical applications to thermoformed packaging types and advanced barrier materials. Regional insights highlight North America’s regulatory-driven leadership, Europe’s circular economy initiatives, and Asia-Pacific’s rapid expansion.

The competitive landscape is marked by innovation-driven incumbents and material specialists who are pushing technological boundaries to meet stringent performance and sustainability criteria. Actionable recommendations emphasize a holistic approach that balances product development, digitalization, supply chain agility, and customer-centric services. Together, these imperatives offer a roadmap for organizations to navigate a complex terrain and capture emerging value in the evolving vacuum packaging market.

Connect with Ketan Rohom to Secure Your Definitive Market Intelligence Report on the Evolution and Opportunities in Vacuum Packaging Today

If you are ready to gain a decisive edge in the rapidly evolving vacuum packaging arena, connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your definitive market intelligence report. Uncover tailored insights that will empower your strategic decision-making, guide your investment priorities, and position your organization to capitalize on emerging growth opportunities. Engage today and ensure you have the actionable data and expert analysis to stay ahead in a competitive market landscape.

- How big is the Vacuum Packaging Market?

- What is the Vacuum Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?