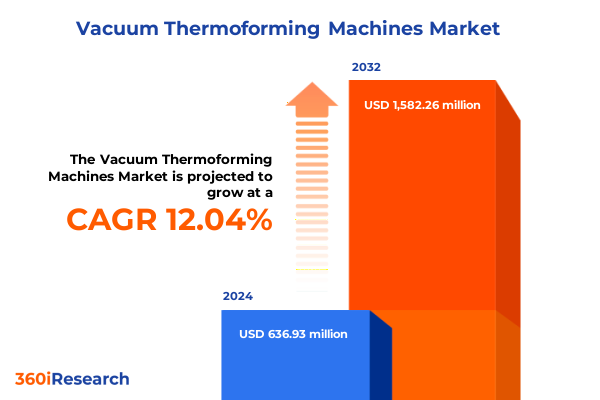

The Vacuum Thermoforming Machines Market size was estimated at USD 713.85 million in 2025 and expected to reach USD 787.66 million in 2026, at a CAGR of 12.04% to reach USD 1,582.26 million by 2032.

Discovering how vacuum thermoforming technology is redefining prototyping, customization, and production efficiency across diverse industries globally

Vacuum thermoforming machines have emerged as a linchpin in contemporary manufacturing, offering unparalleled versatility for shaping polymer sheets into complex, high-precision forms. As industries demand lighter, stronger, and more customized components, this technology bridges the gap between rapid prototyping and large-scale production, delivering consistent quality with minimal tooling lead times.

Transitioning from traditional molding methods, vacuum thermoforming integrates advanced heating, vacuum application, and trimming processes to accommodate an extensive array of thermoplastics such as Acrylonitrile Butadiene Styrene, Polyethylene Terephthalate, Polystyrene, and Polyvinyl Chloride. This adaptability enhances efficiency across sectors, from automotive interior panels to medical device packaging, while enabling manufacturers to innovate at speed without compromising on dimensional accuracy.

Moreover, the expanding adoption of digital controls, integrated robotics, and real-time monitoring is elevating machine uptime and yield. As organizational priorities shift toward agile production lines and lean operations, vacuum thermoforming stands out for its cost-effectiveness and sustainable material utilization. In this executive summary, we delve into the strategic forces driving this market and outline actionable insights to navigate its evolving landscape.

Highlighting the pivotal technological and sustainability-driven transformations reshaping vacuum thermoforming capabilities and operational supply chains

Over the past few years, the vacuum thermoforming landscape has undergone seismic transformations, driven by the twin imperatives of digital innovation and environmental stewardship. Machinery now incorporates Industry 4.0 features such as predictive maintenance analytics, digital twin simulations, and augmented reality-assisted setup procedures. These capabilities streamline changeovers, reduce scrap rates, and enable remote diagnostics, fundamentally altering how manufacturers approach both capital investment and daily operations.

Concurrently, sustainability has emerged as a critical determinant of competitive advantage. Advanced machine designs now emphasize reduced energy consumption, eco-friendly heating systems, and compatibility with recycled or bio-based resins. Such shifts not only align with tightening regulatory mandates but also respond to end-customer preferences for greener packaging and components. As a result, suppliers and OEMs are collaborating on closed-loop recycling initiatives, leveraging form-and-fill automation cells that reclaim and reprocess scrap directly on site.

Furthermore, supply chain disruptions have accelerated the move toward localized production footprints. By deploying compact vacuum thermoforming cells closer to end markets, manufacturers can mitigate logistics risks, shorten lead times, and capitalize on just-in-time inventory models. This strategic localization, combined with modular machine architectures, now enables rapid scalability and resilience in the face of global uncertainties.

Assessing how the imposition of United States import tariffs in 2025 is altering supply dynamics, cost structures, and positioning in vacuum thermoforming

In early 2025, the United States enacted targeted import tariffs on select polymer resins and thermoforming equipment components, aiming to incentivize domestic production and reduce reliance on foreign suppliers. These measures have led to immediate cost pressures for companies sourcing materials such as PVC sheets and precision heating elements from tariff-affected regions.

As a direct consequence, procurement teams have re-evaluated supplier portfolios, shifting orders to domestic resin producers where possible and renegotiating long-term agreements to absorb incremental duties. This recalibration has also catalyzed investment in alternative feedstocks and collaborative R&D efforts focused on domestically manufactured thermoplastics. Concurrently, OEMs are redesigning machine configurations to accommodate a broader range of resin grades, mitigating the financial impact of tariff differentials.

Notably, smaller contract manufacturers have faced acute margin compression, prompting consolidation among regional suppliers and increased demand for shared-service thermoforming facilities. Amid these adaptations, companies that have proactively diversified their intake strategies and optimized machine utilization report improved resilience and a faster return on investment. Looking ahead, tariff-driven restructuring is likely to continue shaping sourcing strategies and competitive positioning throughout the vacuum thermoforming sector.

Unveiling critical segmentation insights revealing how material, machine type, operation mode, sheet thickness, and application industries drive demand dynamics

Examining how vacuum thermoforming platforms cater to a spectrum of plastic materials reveals distinct performance and processing considerations. For instance, Acrylonitrile Butadiene Styrene excels in structural applications requiring impact resistance, whereas Polyethylene Terephthalate caters to transparent packaging with stringent barrier properties. Polystyrene remains prevalent for economical trays and hinged clamshells, and specialized Polyvinyl Chloride formulations support medical-grade blister packs.

When evaluating machine configurations, differentiation emerges between roll fed and sheet fed systems. Roll fed machines offer continuous throughput for high-volume packaging runs, while sheet fed options deliver precision and flexibility ideal for prototyping and low-to-medium batch production. Further, the choice of operation mode-ranging from fully automatic cells with integrated robotic pick-and-place arms to semi-automatic and manual setups-directly influences floor space utilization, staffing requirements, and changeover agility.

Sheet thickness capabilities further segment the market, with machinery optimized for ultra-thin materials up to 3 millimeters excelling in consumer electronics housings, mid-range 3 to 6 millimeter equipment balancing rigidity and process speed for automotive interiors, and heavy-gauge systems above 6 millimeters producing durable trays and lids. Finally, application industry distinctions underscore targeted design variations. Automotive uses benefit from multi-station cells for dashboard inserts, consumer electronics demand cleanroom-compatible thermoforming lines, food packaging segments incorporate precision trimming for clamshells, lids, and trays, and the medical domain features validated processes for blister packs and surgical trays.

This comprehensive research report categorizes the Vacuum Thermoforming Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Plastic Material

- Machine Type

- Operation Mode

- Sheet Thickness

- Application Industry

Exploring unique regional dynamics and growth enablers across the Americas, Europe Middle East Africa, and Asia Pacific vacuum thermoforming landscapes

Regional characteristics have a profound influence on vacuum thermoforming adoption and innovation. In the Americas, strong automotive and consumer packaged goods sectors drive demand for mid-gauge thermoforming cells, while localized sheet extrusion supports just-in-time supply models. Investment incentives and reshoring initiatives in this region are accelerating equipment upgrades, especially for energy-efficient platforms.

Across Europe, the Middle East, and Africa, sustainability directives and stringent food safety regulations stimulate growth in cleanroom-compatible machines and solvent-free process technologies. High labor costs in Western European markets have further spurred automation adoption, whereas emerging economies within EMEA prioritize cost-effective entry-level systems to establish foundational manufacturing capabilities.

In the Asia Pacific, rapid urbanization and expanding medical device markets underpin increasing volumes of food and healthcare packaging applications. Market entrants in this region leverage vertically integrated value chains, from resin compounding to forming and finishing, to secure competitive cost structures. Additionally, government-backed smart manufacturing programs in key markets are driving the integration of IoT-enabled thermoforming cells that support predictive maintenance and real-time quality monitoring.

This comprehensive research report examines key regions that drive the evolution of the Vacuum Thermoforming Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading innovators and market drivers shaping technological advancement and competitive dynamics in vacuum thermoforming machinery sector

Key industry participants are advancing thermoforming technology through targeted R&D investments and strategic partnerships. European-based machine builders have focused on modular architectures that accommodate rapid tooling changes and multi-cavity forming, while North American firms emphasize turnkey solutions combining forming, trimming, and robotic part handling.

Collaborations between resin suppliers and equipment OEMs have given rise to co-engineered materials systems, pairing proprietary sheet formulations with optimized heating and vacuum profiles. Simultaneously, machinery manufacturers are forging alliances with automation integrators to deliver holistic form-and-fill packaging cells, particularly for the food and pharmaceutical sectors.

Meanwhile, emerging entrants from Asia are introducing competitively priced lines featuring digital controllers and energy-recovery heat systems, pressuring incumbent players to enhance value through lifecycle service offerings and software-enabled productivity tools. Across the board, the competitive landscape is characterized by continuous innovation in machine speed, throughput flexibility, and energy efficiency, underscoring the strategic importance of R&D and aftermarket support in sustaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vacuum Thermoforming Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMUT SpA

- Asano Laboratories Co. Ltd.

- BMB s.r.l.

- Brown Machine LLC

- Cannon SpA

- Comi SpA

- Formech Inc.

- GABLER Thermoform

- Gabler Thermoform GmbH & Co. KG

- GEISS Thermoforming USA

- GN Thermoforming Equipment

- Honghua Machinery Co. Ltd.

- Kiefel GmbH

- MAAC Machinery

- MULTIVAC Sepp Haggenmüller SE & Co. KG

- Plastiform Inc.

- Polivac International

- QS Group

- ROLAND MACHINERY

- Thermoforming Systems LLC

- ZED Industries Inc.

Delivering actionable strategic recommendations to empower industry leaders in optimizing operations, innovation pipelines, and global supply strategies

Industry leaders should prioritize the integration of digital monitoring and analytics to transform maintenance schedules from reactive to predictive, thereby maximizing uptime and extending machine lifespan. Investing in energy-efficient heating technologies and recycled-grade resin compatibility will not only reduce operational costs but also align product portfolios with emerging sustainability mandates.

Moreover, diversifying supply chains through regional sourcing agreements and strategic inventory buffers can mitigate the impact of tariff fluctuations and logistical bottlenecks. Establishing collaborative R&D consortia with material suppliers and end users will accelerate the development of next-generation thermoforming processes, enabling early access to high-value applications in medical and electronics packaging.

Finally, building robust training programs that upskill operators on advanced controls and quality assurance protocols will drive consistent output and empower continuous improvement initiatives. By adopting these recommendations, companies can enhance operational resilience, reinforce their technology roadmaps, and capitalize on evolving market opportunities.

Outlining rigorous research methodology combining expert interviews, technical assessments, and comprehensive data validation protocols

Our research framework combines in-depth interviews with senior executives from leading machine OEMs, resin producers, and contract manufacturers to capture firsthand market perspectives. These qualitative insights are augmented by technical consultations with process engineers and quality assurance specialists, ensuring comprehensive coverage of emerging machine architectures and material formulations.

Secondary research includes a systematic review of policy documents, regulatory standards, and environmental guidelines, providing context on tariff structures, sustainability directives, and safety requirements shaping equipment design. In parallel, we conducted a detailed analysis of patent filings and industry consortium publications to identify technology trends and proprietary advancements in heating systems, vacuum modules, and integrated automation.

Data validation protocols involve cross-referencing multiple information sources, reconciling divergent viewpoints through expert panels, and applying rigorous data triangulation techniques. This methodological rigor guarantees that our executive summary reflects the most current and credible insights available, equipping stakeholders with a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vacuum Thermoforming Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vacuum Thermoforming Machines Market, by Plastic Material

- Vacuum Thermoforming Machines Market, by Machine Type

- Vacuum Thermoforming Machines Market, by Operation Mode

- Vacuum Thermoforming Machines Market, by Sheet Thickness

- Vacuum Thermoforming Machines Market, by Application Industry

- Vacuum Thermoforming Machines Market, by Region

- Vacuum Thermoforming Machines Market, by Group

- Vacuum Thermoforming Machines Market, by Country

- United States Vacuum Thermoforming Machines Market

- China Vacuum Thermoforming Machines Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing key takeaways and emphasizing strategic imperatives for stakeholders navigating the evolving vacuum thermoforming industry landscape

In summary, vacuum thermoforming machines are at an inflection point, driven by digitalization, sustainability imperatives, and evolving regulatory landscapes. The introduction of United States tariffs in 2025 has prompted strategic realignments in sourcing and machine configurations, underscoring the need for supply chain agility. Segmentation insights highlight material-specific processing nuances, the impact of machine type, and targeted application requirements across diverse end-use industries.

Regional analysis reveals differentiated growth trajectories, with reshoring initiatives in the Americas, regulatory-driven upgrades in EMEA, and integrated value chains propelling Asia Pacific expansion. Key companies are advancing innovation through collaborative R&D and value-added service models, while actionable recommendations emphasize digital maintenance, energy efficiency, and workforce development as cornerstones of competitive advantage.

By leveraging this knowledge base, stakeholders can navigate the complexities of the vacuum thermoforming market with confidence, aligning strategies with technological trends, regulatory developments, and regional dynamics to secure long-term growth.

Encouraging strategic engagement with Ketan Rohom to explore tailored market research insights and secure informed decision-making pathways

To explore how insightful market intelligence can fuel your strategic planning and propel operational excellence in vacuum thermoforming, reach out to Ketan Rohom (Associate Director, Sales & Marketing). Collaborating with Ketan provides direct access to tailored insights that align research findings with your specific business objectives, ensuring your investments and initiatives are grounded in authoritative analysis.

Engaging with Ketan Rohom opens a dialogue to shape a research solution that addresses your most pressing challenges, from cost optimization and supply chain resilience to emerging technology roadmaps. By partnering at this early stage, you can leverage in-depth discussions that refine report deliverables, unlocking actionable recommendations that drive sustainable competitive advantage.

Don’t miss the opportunity to gain a comprehensive understanding of market drivers, regulatory impacts, and regional dynamics affecting vacuum thermoforming machines. Contact Ketan Rohom today to secure a customized research package that empowers your decision-making and accelerates your growth trajectory.

- How big is the Vacuum Thermoforming Machines Market?

- What is the Vacuum Thermoforming Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?