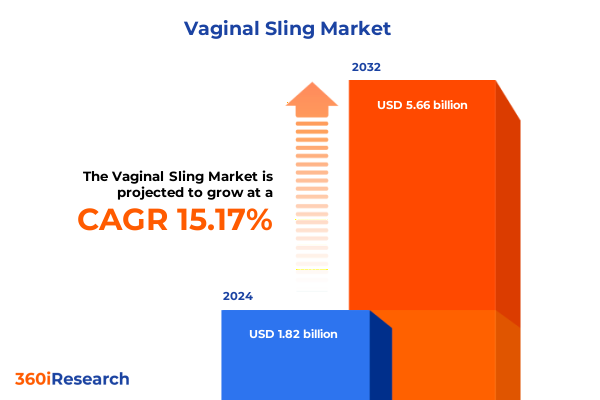

The Vaginal Sling Market size was estimated at USD 2.10 billion in 2025 and expected to reach USD 2.40 billion in 2026, at a CAGR of 15.18% to reach USD 5.66 billion by 2032.

Emerging Dynamics in Pelvic Floor Health and the Critical Role of Vaginal Slings in Addressing Growing Stress Urinary Incontinence Challenges

The pelvic floor health arena is experiencing a period of unprecedented attention as clinical research and patient advocacy converge to address the high prevalence of urinary incontinence. Recent national survey data reveal that over 60% of adult U.S. women report some degree of urinary incontinence, with more than one–third experiencing symptoms at least monthly. Of those affected, 37.5% suffer from stress urinary incontinence, underscoring the need for durable and effective therapeutic interventions. Increasing life expectancy and rising rates of obesity and tobacco use have compounded the burden of pelvic floor disorders, positioning vaginal sling procedures at the forefront of surgical management when conservative measures fail. Within this evolving context, the vaginal sling market has crystallized around two core product categories: mid urethral slings, subdivided into retropubic, single incision, and transobturator techniques, and traditional slings comprising allograft and autologous tissue constructs. This bifurcated framework has enabled surgeons to tailor interventions based on patient anatomy and clinical need while fostering innovation in device design and material science. Transitional pathways from conservative therapies to sling placement have been streamlined by enhanced training programs, multidisciplinary care models, and a robust body of evidence validating long-term efficacy and patient satisfaction.

Revolutionizing Vaginal Sling Therapies with Advanced Materials, Minimally Invasive Techniques, and Regulatory and Reimbursement Innovations Driving Market Adoption

The vaginal sling landscape has been reshaped by a convergence of material innovations, minimally invasive surgical approaches, and evolving reimbursement frameworks. Over the last five years, surgeons have widely adopted single–incision mini–slings, supported by peer–reviewed clinical evaluations demonstrating equivalent safety and efficacy compared to traditional retropubic and transobturator systems. Simultaneously, the integration of polyvinylidene fluoride (PVDF) meshes has expanded beyond pelvic organ prolapse repair into stress urinary incontinence applications, with midterm follow-up data highlighting exceptional anatomical success rates exceeding 95% and acceptable complication profiles. These advances have been catalyzed by targeted regulatory guidance that clarifies device classification and labeling requirements, as well as by the introduction of new procedure codes that strengthen reimbursement for outpatient sling placement. Consequently, hospitals, ambulatory surgical centers, and specialty clinics have accelerated capital investments in training and infrastructure to accommodate high–volume, same–day procedures. Collectively, these shifts are not merely incremental but transformative in enabling broader access to sling therapies, optimizing patient throughput, and fostering cross–disciplinary collaboration between urogynecology and urology specialists.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Vaginal Sling Supply Chains, Cost Structures, and Strategic Sourcing Approaches

The imposition of augmented Section 301 tariffs in 2025 has introduced novel complexities into the supply chain for vaginal sling components, particularly meshes and consumables sourced from China and other Asian markets. Under the revised regime, tariffs on raw materials such as titanium and polymers have increased by 15%, while duties on medical gloves and surgical instruments climbed to 50%, and those on select surgical respirators rose to 25%. These escalations in import costs have exerted upward pressure on input pricing, compelling device manufacturers to renegotiate supplier contracts and, in some cases, relocate portions of their production to domestic facilities. Industry stakeholders caution that prolonged trade tensions risk depleting inventory buffers and magnifying cost pass-through to healthcare providers, with attendant challenges for facility budgets and patient affordability. In response, leading original equipment manufacturers have diversified sourcing strategies, secured longer-term price guarantees, and accelerated investments in local manufacturing hubs to fortify supply resilience. This strategic recalibration underscores the critical interplay between trade policy and medical device availability, mandating agile procurement practices and proactive supplier engagement to mitigate disruptions.

Uncovering Critical Insights Across Product Types, Clinical Applications, Material Choices, and End User Channels in the Vaginal Sling Landscape

A granular view of market segmentation reveals distinct growth trajectories and clinical imperatives across product types, therapeutic applications, material compositions, and end user environments. Mid urethral slings, encompassing retropubic, single incision, and transobturator approaches, continue to dominate procedural volumes due to streamlined techniques and robust long-term outcomes, whereas traditional allograft and autologous tissue slings persist as critical options for complex anatomies or cases contraindicated for synthetic implants. Stress urinary incontinence remains the primary indication for sling placement, though pelvic organ prolapse repairs increasingly integrate combined sling approaches to address coexisting pelvic floor defects. Material type is pivotal in device selection: while polypropylene retains a leading role for its tensile strength and surgical familiarity, polyester and PVDF alternatives gain traction for enhanced biocompatibility and lower rates of de novo urgency incontinence. Channel dynamics further shape uptake, with hospitals provisioning most high-complexity cases, ambulatory surgical centers driving efficiency for routine procedures, and specialized gynecology and urology clinics delivering targeted care in outpatient settings. The interplay among these vectors dictates both competitive positioning and technology adoption, underscoring the need for tailored strategies aligned with evolving clinical and economic imperatives.

This comprehensive research report categorizes the Vaginal Sling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Application

- End User

Evaluating Regional Dynamics Shaping Vaginal Sling Adoption across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional nuances exert profound influence on vaginal sling adoption, underpinned by diverse healthcare infrastructures, regulatory regimes, and demographic trends. In the Americas, advanced reimbursement pathways and a high prevalence of stress urinary incontinence have fostered early adoption of next-generation sling systems, while a robust network of ambulatory surgical centers enables efficient ambulatory care workflows. Conversely, the Europe, Middle East & Africa region contends with stringent mesh regulations that have prompted manufacturers to invest in alternative biocompatible materials and comprehensive post-market surveillance to reassure clinicians and patients. Emerging economies within EMEA are simultaneously witnessing heightened investment in urogynecological training and facility upgrades, narrowing the gap with established markets. The Asia-Pacific theater exhibits the most rapid procedural expansion, fueled by aging populations, burgeoning medical tourism hubs, and government-led initiatives to elevate women’s health services. Across these territories, localized reimbursement policies, device registration processes, and clinical guideline updates create a tapestry of opportunity and complexity that demands region-specific market entry and growth strategies.

This comprehensive research report examines key regions that drive the evolution of the Vaginal Sling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Innovations, Mergers, and Competitive Positioning among Leading Global Vaginal Sling Manufacturers and Emerging Market Entrants

The competitive landscape for vaginal sling devices features major medical device conglomerates alongside nimble challengers specializing in advanced materials and next-generation technologies. Boston Scientific’s strategic acquisition of Axonics in 2024 exemplifies a broader trend toward consolidating urology and urogynecology portfolios to deliver integrated solutions across pelvic floor and bladder dysfunction modalities. Coloplast continues to emphasize patient-centric product design and robust clinical data to differentiate its mid urethral and autologous tissue offerings, while emerging players such as Caldera Medical have secured regulatory clearances for absorbable sling systems that aim to address mesh safety concerns. Ancillary service providers, including specialized contract manufacturers and sterilization experts, have also become critical partners, offering scalable solutions that expedite time to market and ensure quality compliance. Collectively, these moves underscore an environment where innovation pipelines, strategic alliances, and regulatory acumen are key determinants of market positioning and long-term growth potential.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vaginal Sling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.M.I. GmbH

- ABISS

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Betatech Medical Ltd. Şti.

- Boston Scientific Corporation

- Caldera Medical, Inc.

- CL Medical S.A.S.

- Coloplast A/S

- Cook Medical LLC

- Cousin Biotech

- Ethicon, Inc.

- Herniamesh S.r.l.

- LiNA Medical ApS

- Lotus Surgicals Pvt. Ltd.

- MedGyn Products, Inc.

- Medtronic plc

- Neomedic International Ltd.

- Promedon S.A.

- UroCure LLC

Strategic Roadmap for Industry Leaders to Drive Growth, Navigate Regulatory Landscapes, and Mitigate Supply Chain Risks in Vaginal Sling Market

To capitalize on the evolving vaginal sling landscape, industry leaders should pursue several strategic imperatives. First, prioritizing R&D investments in next-generation biocompatible materials, including hybrid and absorbable mesh technologies, can address growing clinician and patient concerns about mesh-related complications. Second, diversifying supply chains by forging partnerships with domestic and near-shore manufacturers will mitigate tariff exposure and enhance operational resilience. Third, engaging proactively with payers and regulatory bodies to shape favorable reimbursement frameworks and streamline device approvals is essential for maintaining market access and cost efficiency. Fourth, expanding outpatient capabilities through targeted support for ambulatory surgical centers and specialized clinics can optimize procedural throughput and patient experience. Finally, amplifying educational initiatives with key opinion leaders and multidisciplinary care teams will drive greater awareness of sling options, procedural best practices, and patient selection criteria, fostering broader adoption and improved clinical outcomes.

Comprehensive Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Rigorous Data Triangulation for Vaginal Sling Market Insights

This research leverages a hybrid methodology that integrates primary and secondary sources to deliver actionable market insights. Primary research comprised in-depth interviews with urogynecology and urology surgeons, procurement executives, and key opinion leaders to capture firsthand perspectives on device preferences, procedural workflows, and emerging clinical needs. Secondary research entailed a systematic review of peer-reviewed medical literature, regulatory filings, trade association reports, and tariff documentation to establish context and validate market trends. Quantitative data were derived from proprietary databases, customs import records, and healthcare utilization statistics, while qualitative analysis employed thematic coding and triangulation techniques to identify convergent insights. Rigorous data validation protocols, including cross-referencing sources and reconciling discrepancies, ensure the robustness of findings. The resulting framework combines market segmentation, regional dynamics, and competitive mapping to furnish stakeholders with a comprehensive, evidence-based foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vaginal Sling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vaginal Sling Market, by Product Type

- Vaginal Sling Market, by Material Type

- Vaginal Sling Market, by Application

- Vaginal Sling Market, by End User

- Vaginal Sling Market, by Region

- Vaginal Sling Market, by Group

- Vaginal Sling Market, by Country

- United States Vaginal Sling Market

- China Vaginal Sling Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Capturing Evolving Market Realities in Vaginal Sling Therapies to Guide Strategic Decisions, Investment Priorities, and Future Research Directions

The vaginal sling ecosystem is at a pivotal juncture, shaped by demographic imperatives, technological breakthroughs, and complex policy environments. Minimally invasive procedures and advanced materials such as polyvinylidene fluoride are redefining clinical standards and patient expectations, while tariff fluctuations and regulatory scrutiny continue to test supply chain resiliency. A nuanced appreciation of segmentation dynamics-from mid urethral versus traditional slings to specialized end user channels-enables targeted strategies that align product offerings with evolving clinical protocols. Regional variations in reimbursement, regulatory pathways, and infrastructure investments underscore the need for tailored go-to-market approaches. Against this backdrop, competitive differentiation hinges on integrated value propositions that address efficacy, safety, and health economics in equal measure. By synthesizing these multifaceted trends, stakeholders can prioritize R&D, optimize commercial execution, and forge partnerships that drive sustainable growth and improved patient outcomes.

Contact Ketan Rohom to Unlock In-Depth Vaginal Sling Market Intelligence, Tailored Insights, and Customized Research Packages for Informed Decision Making

To explore comprehensive data on emerging trends, competitive strategies, and regional market dynamics within the vaginal sling landscape, contact Ketan Rohom, Associate Director of Sales & Marketing. He can arrange a personalized briefing to walk you through a detailed discussion of our findings, customization options, and exclusive add-on modules. Engage with an expert who can tailor insights to your organization’s unique objectives, ensuring you leverage the full depth of our research to drive informed strategies and maximize competitive advantage.

- How big is the Vaginal Sling Market?

- What is the Vaginal Sling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?