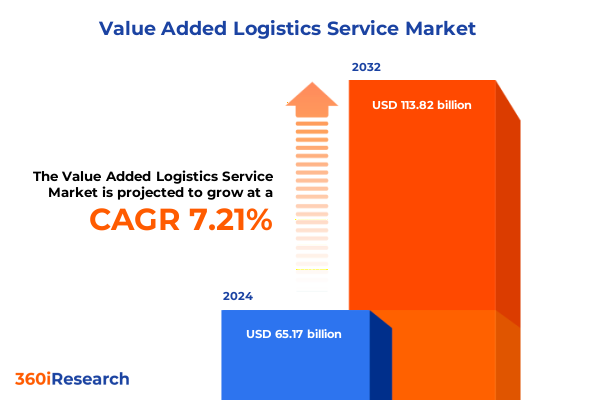

The Value Added Logistics Service Market size was estimated at USD 69.64 billion in 2025 and expected to reach USD 74.47 billion in 2026, at a CAGR of 7.27% to reach USD 113.82 billion by 2032.

Unlocking the Strategic Role of Value Added Logistics Services in Enhancing Supply Chain Competitiveness Across Global Market Dynamics

Value added logistics services have emerged as a pivotal component in modern supply chains, bridging the gap between traditional transportation and comprehensive end-to-end fulfillment. As companies grapple with rising customer expectations and complex distribution networks, the ability to tailor logistics activities-from customized packaging and precise kitting to temperature-sensitive storage-has become a clear differentiator. This evolution underscores a shift away from commoditized freight movement toward integrated service offerings that enhance product visibility, improve speed to market, and foster stronger customer loyalty. Moreover, the rise of digital platforms and data-driven decision making has amplified the strategic importance of value added logistics, enabling real-time insights and predictive analytics that inform operational agility and cost optimization. With global trade volumes rebounding and e-commerce channels accelerating growth, businesses are recognizing that traditional logistics alone no longer suffices. Consequently, organizations across sectors are seeking partners capable of orchestrating complex supply chain functions, from automated warehousing to dynamic route planning and reverse logistics. This introduction sets the stage for an in-depth exploration of transformative trends, regulatory headwinds, segmentation dynamics, and strategic imperatives shaping the value added logistics landscape in 2025 and beyond.

Embracing Disruption Through Digital Transformation Automation and Sustainable Practices Shaping the Next Generation of Value Added Logistics Excellence

The value added logistics landscape is undergoing a paradigm shift driven by digital transformation, sustainability mandates, and advanced automation technologies. Intelligent systems powered by AI and machine learning are redefining how warehouses allocate space, manage inventory levels, and forecast demand, allowing providers to execute dynamic order fulfillment with precision. Simultaneously, the emergence of robotic process automation and autonomous guided vehicles is streamlining repetitive tasks, reducing human error, and increasing throughput without compromising quality. In parallel, customers and regulators alike are demanding greener supply chains, prompting logistics operators to integrate low-emission vehicles and renewable energy sources into their networks. This focus on environmental stewardship not only aligns with corporate social responsibility goals but also safeguards operations against tightening emissions regulations and carbon pricing schemes. Furthermore, the convergence of blockchain and Internet of Things platforms is enhancing transparency, enabling secure end-to-end traceability from origin to delivery and invigorating trust among stakeholders. Taken together, these disruptive forces are reshaping value added logistics into a more agile, sustainable, and technologically advanced function. Organizations that embrace these transformative shifts will secure a powerful competitive edge, unlocking new possibilities for customer experience and operational resilience.

Assessing the Complex Cumulative Impact of 2025 United States Tariffs on International Value Added Logistics Operations and Cost Management Strategies

In 2025, United States tariffs continue to exert profound effects on the cost structures and strategic configurations of value added logistics operations. The extension of Section 301 duties on certain imported components has elevated landed costs, compelling companies to reassess sourcing strategies and reconsider nearshoring options to mitigate tariff burdens. Additionally, Section 232 tariffs on metals and derivatives have reverberated throughout packaging and equipment markets, increasing expenses for automated storage systems and metal-based infrastructure. These policy measures have incentivized logistics providers to forge closer partnerships with domestic suppliers and invest in local assembly facilities, thereby preserving service levels while controlling expenditures. Concurrently, importers are diversifying their transportation routes, shifting shipments via intermodal corridors and expanding capacity in less congested seaports to circumvent high-tariff trade lanes. As a result, network design has evolved toward more flexible, regionalized footprints that can adapt swiftly to policy shifts and tariff escalations. While the short-term impact involves heightened operational complexity and elevated costs, these adaptations are fostering greater supply chain robustness. Stakeholders who proactively align their logistics strategies with the evolving tariff landscape will be better positioned to navigate uncertainty and maintain competitive pricing structures in a protectionist trade environment.

Deep Dive into Service Delivery Industry Vertical Logistics Mode and Customer Type Segmentation Delivering Tailored Value Added Logistics Solutions

A granular understanding of market segmentation is essential for designing value added logistics solutions that align with distinct customer requirements and industry dynamics. Across service types, Inventory Management is redefining how companies track and replenish stock, while Order Fulfillment specialists are deploying both Kitting and Assembly operations alongside Pick and Pack processes to deliver tailored orders at speed. Packaging and Labeling functions are evolving to accommodate compliance standards and e-commerce branding needs, and Reverse Logistics expertise is increasingly critical for handling returns, repairs, and recycling. Transportation Management now encompasses Carrier Selection, Freight Forwarding, and Route Optimization, ensuring that shipments transit via Air, Road, or Sea freight forwarding channels-each divided into Air Freight Forwarding, Road Freight Forwarding, and Sea Freight Forwarding-to balance cost, speed, and reliability. Meanwhile, Warehousing and Storage providers operate Automated Warehouses for high-volume throughput, Bonded Warehouses for customs efficiency, and Temperature Controlled Storage facilities that include both Cold Chain Storage and Controlled Ambient Storage for sensitive products. Industry vertical considerations further refine service offerings, as automotive supply chains demand just-in-time sequencing, consumer packaged goods companies prioritize rapid shelf replenishment, and healthcare and pharmaceuticals firms require stringent temperature and traceability controls. Logistics mode selection-whether Air, Intermodal, Rail, Road, or Sea-impacts lead times and environmental footprints, and customer type distinctions among e-commerce marketplaces, large enterprises, and small and medium enterprises dictate varying service level agreements and volume commitments. By synthesizing these segmentation layers, service providers can craft highly customized portfolios that optimize efficiency and drive value across diverse market contexts.

This comprehensive research report categorizes the Value Added Logistics Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Mode of Transportation

- End Use Industry

- Customer Size

Navigating Regional Nuances in the Americas Europe Middle East Africa and Asia Pacific Markets to Drive Value Added Logistics Service Differentiation

Regional market characteristics profoundly influence how value added logistics services are structured and delivered. In the Americas, expansive geography and cross-border trade between North America and Latin America demand robust multimodal networks and streamlined customs procedures. Providers in this region are investing in digital platforms that unify freight forwarding across land and maritime corridors, enabling shippers to leverage intermodal efficiencies while maintaining full visibility. Europe, the Middle East, and Africa (EMEA) present a tapestry of regulatory frameworks and infrastructural maturity levels. Established economies in Western Europe focus on integrating sustainability targets into logistics operations, adopting electric vehicles and carbon tracking systems, whereas emerging markets in Africa invest in bonded warehousing and temperature controlled solutions to support agricultural exports. Meanwhile, the Middle East is positioning itself as a logistics hub through free trade zones and smart port initiatives. Across Asia-Pacific, high-growth economies and e-commerce penetration are driving demand for rapid fulfillment services and advanced cold chain storage, particularly for food and pharmaceutical products. Regional hubs in Southeast Asia leverage automated warehouses to address labor constraints, while established markets in Japan and South Korea emphasize precision and quality through controlled ambient storage solutions. Recognizing these regional nuances enables logistics leaders to tailor value added services that resonate with local requirements and capitalize on emerging growth corridors.

This comprehensive research report examines key regions that drive the evolution of the Value Added Logistics Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Players in Value Added Logistics Services Highlighting Competitive Strategies Partnerships and Innovation Initiatives

Leading providers in the value added logistics arena are defining the competitive landscape through innovation, strategic partnerships, and targeted investments. Global integrators have prioritized expansion of automated warehousing footprints and introduction of AI-driven inventory optimization tools to support high-velocity e-commerce clients. At the same time, specialized carriers have forged alliances with technology startups to embed real-time shipment tracking and predictive maintenance capabilities into transportation offerings. Collaboration with packaging innovators has also emerged as a key differentiator, as companies develop sustainable materials and modular designs to streamline assembly and reduce waste. Furthermore, several market leaders are exploring co-development models with customers to engineer customized reverse logistics flows, enhancing service recovery rates and driving circular economy objectives. In parallel, regional logistics firms are leveraging deep local expertise and niche capabilities, such as cold chain management for perishable goods or bonded warehouse operations for complex customs regimes. These diverse approaches underscore a broader trend toward ecosystem building, where integrated networks of carriers, warehouse operators, technology providers, and compliance specialists come together to deliver seamless value added experiences. As competition intensifies, sustained investment in digital platforms, sustainability frameworks, and strategic partnerships will remain central to maintaining market leadership and unlocking new service frontiers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Value Added Logistics Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.P. Møller - Mærsk A/S

- Americold Realty Trust, Inc.

- Bolloré Logistics

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics AG

- CJ Logistics

- DACHSER

- Deutsche Bahn AG

- Deutsche Post AG

- DP World Limited

- DP World Logistics

- DSV Panalpina A/S

- Expeditors International of Washington

- FedEx Corporation

- Geodis SA

- GXO Logistics, Inc.

- Hellmann Worldwide Logistics SE & Co. KG

- Hub Group, Inc.

- J.B. Hunt Transport Services

- Japan Post Group

- Kintetsu World Express, Inc.

- KLN Logistics Group Limited

- Kuehne + Nagel International AG

- Lineage Logistics, LLC.

- LOGISTEED, Ltd.

- LX Pantos Co., Ltd.

- Neovia Logistics Services, LLC

- Nippon Express Co., Ltd.

- Penske Logistics

- Ryder System, Inc.

- Schenker AG

- Sinotrans Limited

- Toll Group

- Total Quality Logistics

- Uber Freight Holding Corporation

- United Parcel Service, Inc.

- XPO Logistics, Inc.

- Yusen Logistics

Actionable Strategies for Industry Leaders to Drive Growth Innovation and Resilience in Value Added Logistics Across Evolving Market Landscapes

To thrive in a rapidly evolving value added logistics sector, industry leaders should prioritize the integration of advanced digital technologies across all service touchpoints. By adopting AI-powered demand forecasting and automated workflow orchestration, organizations can achieve higher accuracy in order processing and reduce operational overhead. Equally important is the development of sustainable logistics practices, from electrifying fleets to optimizing packaging materials, which not only meets regulatory requirements but also resonates with environmentally conscious customers. Building flexible, regionalized networks through strategic nearshoring and diversified carrier partnerships will enhance resilience against trade policy fluctuations and capacity constraints. Additionally, fostering cross-functional collaboration with supply chain stakeholders-spanning procurement, production, and last-mile delivery-enables a more cohesive value chain and accelerates response to market shifts. Investment in talent development is similarly vital; upskilling teams with data analytics, e-commerce fulfillment expertise, and sustainability know-how will ensure organizations can capitalize on emerging service opportunities. Finally, deploying scalable technology platforms that integrate seamlessly with customer systems fosters real-time visibility and enables proactive issue resolution. By aligning these actionable strategies, leaders can secure operational excellence, mitigate risk, and drive sustainable growth in the competitive world of value added logistics.

Comprehensive Multi-Method Research Approach Integrating Primary and Secondary Data Ensuring Rigorous Insights into Value Added Logistics Services

Our research methodology for analyzing value added logistics services employs a comprehensive, multi-stage approach designed to ensure depth, validity, and relevance of insights. We began with extensive secondary research, reviewing industry publications, regulatory filings, and white papers to establish foundational context and identify emerging trends. This effort was complemented by primary interviews with senior executives across leading logistics providers, shippers, and technology enablers, gathering qualitative perspectives on strategic priorities, operational challenges, and innovation roadmaps. Quantitative data was obtained via structured surveys deployed to a diverse panel of supply chain professionals, enabling us to quantify service adoption rates, technology penetration, and customer satisfaction metrics. To validate findings and uncover nuanced regional or industry-specific dynamics, we conducted in-depth case studies focused on target sectors such as healthcare cold chain and automotive sequencing operations. Finally, we synthesized these inputs through rigorous triangulation, cross-referencing qualitative insights with quantitative results and market intelligence. This robust methodological framework ensures that our analysis reflects the most current industry realities and equips decision-makers with actionable recommendations grounded in empirical evidence and expert insight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Value Added Logistics Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Value Added Logistics Service Market, by Service Type

- Value Added Logistics Service Market, by Mode of Transportation

- Value Added Logistics Service Market, by End Use Industry

- Value Added Logistics Service Market, by Customer Size

- Value Added Logistics Service Market, by Region

- Value Added Logistics Service Market, by Group

- Value Added Logistics Service Market, by Country

- United States Value Added Logistics Service Market

- China Value Added Logistics Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings and Strategic Imperatives Demonstrating the Criticality of Value Added Logistics Services in Today’s Competitive Environment

The evolving landscape of value added logistics services represents both challenges and opportunities for organizations seeking to differentiate their supply chain capabilities. Our analysis highlights that technological integration, sustainability commitments, and strategic network design are no longer optional but essential pillars for success. Companies that incorporate AI-enabled forecasting and automated operations into their service offerings will realize significant gains in efficiency and responsiveness. At the same time, embracing environmental standards through low-carbon transport and eco-friendly packaging will become a key source of competitive advantage as regulatory scrutiny intensifies and customer expectations shift. The segmentation insights demonstrate that a one-size-fits-all approach is untenable; instead, service providers must tailor offerings to specific industry verticals, logistics modes, and customer profiles to maximize value. Regional considerations further underscore the importance of local expertise and infrastructure adaptability. In this context, leading players are distinguished by their ability to forge collaborative ecosystems, leverage data-driven decision making, and maintain operational agility. As businesses navigate tariff complexities and global trade fluctuations, the imperative to innovate within value added logistics services will only grow stronger. Ultimately, organizations that deploy a holistic strategy-integrating technology, sustainability, and customer-centric design-will secure resilient, future-proof supply chains.

Take Decisive Action Today Engage with Our Experts to Acquire In-Depth Value Added Logistics Market Research Insights and Drive Your Competitive Advantage

To explore how specialized insights into value added logistics services can transform your supply chain strategies and deliver measurable competitive advantages, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with our team will provide you with exclusive access to in-depth market intelligence, expert analysis, and strategic recommendations tailored to your organizational needs. By partnering with Ketan, you can ensure that your logistics initiatives are informed by the latest trends and backed by rigorous research methodologies. Take this opportunity to secure the full market research report and gain a comprehensive roadmap for optimizing value added logistics services within your operations. Elevate your decision-making process and drive sustainable growth by connecting directly with our experts today.

- How big is the Value Added Logistics Service Market?

- What is the Value Added Logistics Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?