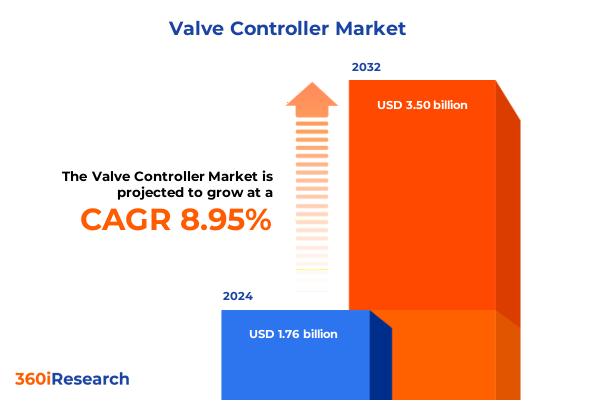

The Valve Controller Market size was estimated at USD 1.92 billion in 2025 and expected to reach USD 2.09 billion in 2026, at a CAGR of 8.96% to reach USD 3.50 billion by 2032.

Evolution of Valve’s Game Controllers Demonstrates Pioneering Haptic, Motion and Customization Capabilities Redefining Player Interaction

In recent years, the landscape of gaming peripherals has evolved from a simple, one-size-fits-all design approach to a highly specialized domain where player immersion and ergonomic precision are paramount. Valve’s controller innovations, beginning with the Steam Controller and progressing to the Valve Index Knuckles controllers, have continually pushed the boundaries of haptic feedback and user-customization. The high adoption rate of haptic-enabled controllers in premium VR systems underscores the central role of tactile responsiveness in modern gaming hardware. According to industry observations, these advanced controllers, characterized by nuanced vibration motors and adaptive triggers, are now standard in nearly every high-end virtual reality setup, reflecting a mature ecosystem that prioritizes touch and resistance feedback for enhanced realism.

Moreover, the broader virtual reality market itself has experienced significant expansion, transitioning from niche experimentation to mainstream entertainment. By 2025, global consumer engagement with VR gaming is supported by a robust user base and diversified content offerings. This widespread adoption has spurred hardware manufacturers to refine controller ergonomics, integrate motion-sensing technologies, and enhance tactile elements. As immersive technologies continue to blur the line between digital and physical experiences, Valve’s controllers exemplify this convergence, demonstrating how innovation in form factor and feedback mechanisms can redefine player interaction and elevate gaming experiences across platforms.

Emerging Digital Commerce Models And Advanced Wireless Haptic Technologies Are Transforming The Distribution And Design Of Gaming Controllers

The gaming controller landscape has witnessed transformative shifts driven by both technological advancements and evolving retail paradigms. Wireless connectivity, once a novelty, has become the baseline expectation among enthusiasts and professionals alike. As Bluetooth and proprietary RF solutions mature, manufacturers are transitioning from wired USB connections to fully untethered experiences, enabling gamers to move freely without compromising responsiveness. This migration toward wireless adoption has been propelled by improvements in battery life and signal stability, ensuring that latency concerns no longer impede the sense of immersion. Data from the gaming accessories sector indicates a pronounced pivot to wireless solutions as market leaders recognize the growing demand for clutter-free, high-performance peripherals.

Simultaneously, distribution channels are undergoing a paradigm shift as brands leverage direct-to-consumer platforms to foster deeper relationships with end users. Official storefronts now offer subscription-based services that bundle hardware, software updates, and exclusive content, creating recurring revenue models and personalized engagement. Moreover, online gaming-focused marketplaces and general e-commerce platforms are facilitating rapid product discovery, while specialty electronics retailers and dedicated gaming shops continue to serve as experiential touchpoints where users can trial new devices. The rise of live commerce on streaming platforms further exemplifies this dynamic, as real-time demonstrations by influencers on channels like Twitch are reshaping how gamers evaluate and purchase peripherals. This convergence of digital retail strategies and influencer-driven promotions is redefining the competitive playing field for controller manufacturers.

Mounting Tariff Pressures And Regulatory Shifts In 2025 Have Significantly Disrupted Valve Controller Supply Chains And Pricing Dynamics

Throughout 2025, the imposition of heightened tariffs by the United States government has exerted mounting pressure on the supply chains and pricing structures of imported gaming hardware, including valve controllers. In early spring, the removal of the de minimis exemption for low-value shipments rendered packages valued under $800 subject to ad valorem duties of up to 90 percent or a per-item charge beginning at $75, set to rise to $150 after June 1, 2025. As a result, third-party manufacturers that previously relied on cost-efficient cross-border logistics have been compelled to reassess their sourcing strategies and absorb incremental duties, disrupting standard delivery timelines and inflating landed costs for U.S. distributors and end users.

In parallel, video game consoles and accessories, classified under the broader category of “toys” by the U.S. International Trade Commission, faced punitive tariffs of up to 145 percent on imports from China. This dramatic increase has led to significant operational adjustments among peripheral producers. Notably, 8BitDo paused direct shipments from its Chinese facilities to U.S. consumers, electing to fulfill orders solely from domestically stocked inventory to mitigate exposure to punitive duties. Though this maneuver preserved partial market access, it also underscored the vulnerability of lean supply models to rapid policy shifts and the strategic necessity of geographic inventory diversification.

The cumulative effect of these regulatory changes has manifested in cascading delays, elevated wholesale pricing, and reduced promotional flexibility. Tier-one console manufacturers have responded variably: some have delayed new product preorders in the U.S. to reassess final retail prices, while others have quietly absorbed duties to maintain launch schedules. However, the elimination of tariff exemptions for critical components and peripherals continues to exert a destabilizing influence on both established players and emerging challengers, making supply chain resilience a central concern for industry stakeholders across the valve controller segment.

In-Depth Segmentation Analysis Highlights How Distribution Channels Controller Types Price Tiers End Users And Technologies Drive Market Dynamics

An in-depth segmentation of the valve controller market reveals a complex interplay of channels, device configurations, pricing strategies, consumer profiles, and core technologies that collectively drive purchasing decisions. Within distribution networks, direct-to-consumer engagements span official storefronts and subscription-based experiences, fostering loyalty and direct data collection, while online retail encompasses both specialist gaming platforms and broad-spectrum e-commerce sites that optimize reach. Likewise, specialty outlets, including electronics superstores and niche gaming shops, offer hands-on trials that influence high-consideration purchases.

Examining hardware classifications, wired controllers bifurcate into proprietary interfaces with custom docking solutions and USB-based models that emphasize cross-platform compatibility. In contrast, wireless alternatives leverage either standardized Bluetooth connectivity or dedicated RF protocols to balance universality with minimal latency. When assessing the market through a price-tier lens, consumers encounter distinct value propositions across budget-friendly options that emphasize affordability, mid-range devices that blend performance with cost-effectiveness, and premium offerings that integrate advanced materials, customization, and exclusive features.

User segmentation underscores divergent use cases: the casual gamer demographic engages in home-based leisure or social gaming, often prioritizing ergonomics and ease of setup; professional gamers pursue competitive ladders and esports circuits, demanding ultra-responsive inputs and robust build quality; and content creators-both large and small streamers-seek visually striking peripherals that reinforce their personal brand while delivering reliable performance on broadcasted gameplay. Underpinning all segments are emergent technologies: advanced haptic feedback solutions differentiate user experiences through nuanced tactile responses, motion controls harness accelerometers and gyroscopes for intuitive input, and touchpad integration spans multi-touch capabilities to precise gesture recognition. These layered segmentation criteria illuminate the multifaceted considerations that define controller adoption and usage patterns.

This comprehensive research report categorizes the Valve Controller market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Controller Type

- Price Tier

- Technology

- Distribution Channel

- End User

Geographical Performance Insights Reveal Distinct Trends Across Americas Europe Middle East Africa And Asia Pacific Gaming Controller Markets

Across the Americas, the convergence of advanced manufacturing in select North American facilities with robust consumer demand has created a battleground for cost optimization and service excellence. While the U.S. market grapples with the impacts of new import duties, regional producers are exploring nearshoring opportunities and leveraging free-trade agreements to alleviate fiscal burdens. Latin America, meanwhile, exhibits growing interest in mobile gaming adapters and mid-range wireless controllers, with affordability and localized support shaping purchasing trends.

In Europe, Middle East, and Africa, the landscape is fragmented by varying regulatory environments and distribution infrastructures. Western European markets demonstrate a preference for premium controllers that integrate touchpad and haptic innovations, supported by mature retail networks and strong e-commerce adoption. Conversely, emerging EMEA regions are seeing incremental growth in entry-level and mid-range segments, driven by expanding internet penetration and the proliferation of online gaming communities. Import tariffs and value-added tax differentials further influence pricing strategies and channel selection within the region.

The Asia-Pacific arena remains a production powerhouse while simultaneously evolving into one of the fastest-growing consumer markets. China, Japan, and South Korea continue to command technological leadership in motion-sensing and advanced haptics, supplying both local and global demand. Southeast Asia and Oceania report surges in specialist gaming retail and direct import of niche accessories, with a burgeoning professional gaming infrastructure fostering demand for high-intensity competitive-grade controllers. Manufacturers in this region increasingly emphasize rapid innovation cycles to capture both domestic enthusiasts and international distributors.

This comprehensive research report examines key regions that drive the evolution of the Valve Controller market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Evaluation Presents Strategic Innovations And Market Movements From Key Valve Controller Manufacturers And Emerging Brands

Leading industry participants have leveraged distinct strategies to navigate market complexities and reinforce their competitive positions. Valve’s proprietary controllers stand out for their integration with its digital ecosystem, offering seamless Steam platform compatibility and software-driven customization. Sony’s DualSense technology, characterized by adaptive triggers and refined haptic actuators, has raised user expectations for tactile immersion beyond traditional rumble motors. Microsoft’s recent price adjustments for its Xbox console family, which extended to first-party controllers, reflect efforts to absorb broader market pressures while maintaining consumer accessibility across product tiers.

Third-party innovators, such as 8BitDo, are capitalizing on nimble manufacturing partnerships and open-source firmware to deliver versatile, cross-platform controllers. However, supply chain disruptions and tariff escalations have prompted these brands to reconfigure logistics pipelines, prioritize U.S.-based inventory, and explore alternative assembly locales to mitigate duty exposure, as evidenced by the temporary suspension of shipments from Chinese warehouses to American consumers.

Emerging contenders are focusing on niche differentiators, including modular component swaps, ergonomic research-driven form factors, and specialized software suites that facilitate macro programming and performance analytics. By aligning product roadmaps with consumer feedback loops and forging strategic retail alliances, these companies aim to establish footholds in both the casual streamer segment and the high-octane esports arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Valve Controller market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Baker Hughes Company

- Curtiss-Wright Corporation

- Emerson Electric Co.

- Flowserve Corporation

- IMI plc

- Metso Corporation

- Rotork plc

- SAMSON AG

- Schneider Electric SE

- Yokogawa Electric Corporation

Actionable Strategic Recommendations Outline Tactical Supply Chain Optimization And Innovation Pathways For Industry Leaders In Valve Controller Market

To sustain growth amid evolving trade policies and intensifying competition, industry leaders should institute a dual-pronged supply chain diversification strategy that balances localized assembly hubs with resilient global partnerships, thereby buffering against sudden tariff escalations. Concurrently, investment in next-generation haptic systems-leveraging advances in voice coil motors and piezoelectric actuators-can unlock premium price points, as half of current headset owners have indicated a willingness to pay more for advanced tactile feedback in immersive environments.

Furthermore, embracing direct-to-consumer subscription models can generate predictable revenue streams and facilitate continuous engagement through firmware updates and exclusive content drops. In parallel, deepening collaborations with leading e-commerce platforms and influential live-commerce practitioners on gaming streaming services will amplify product visibility and streamline the buyer journey. On the product front, prioritizing modular architecture and cross-platform interoperability will appeal to both casual and professional demographics, enabling rapid iteration and personalization.

Finally, fortifying brand authenticity through co-development with top-tier esports teams and high-profile streamers can drive aspirational appeal. By aligning technical enhancements-such as adaptive triggers and motion-sensing capabilities-with real-world competitive use cases, manufacturers can substantiate performance claims and engender community trust. These targeted actions will position stakeholders to navigate regulatory headwinds, capture rising consumer expectations, and drive sustained market differentiation.

Comprehensive Research Methodology Explains Primary And Secondary Data Collection Techniques And Analytical Frameworks Used In This Valve Controller Study

This analysis combines rigorous primary and secondary research methodologies to ensure comprehensive coverage of the valve controller market. The secondary phase involved systematic reviews of industry publications, trade journals, regulatory filings, company annual reports, and reputable news outlets to capture the latest technological developments and tariff policy changes. Simultaneously, primary research comprised structured interviews with C-level executives, product managers, and procurement specialists across major controller manufacturers, distributors, and retail partners.

Quantitative data collection included detailed surveys administered to gaming communities, esports professionals, and content creators, supplemented by proprietary usage analytics from digital platforms. This multidisciplinary approach allowed for triangulation of insights, reconciliation of disparate data points, and validation of emerging trends. Analytical frameworks such as SWOT and Porter’s Five Forces were applied to delineate competitive dynamics, while scenario modeling assessed the potential implications of evolving trade regulations. The resulting data set has been synthesized to deliver actionable conclusions and strategic imperatives tailored to stakeholder objectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Valve Controller market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Valve Controller Market, by Controller Type

- Valve Controller Market, by Price Tier

- Valve Controller Market, by Technology

- Valve Controller Market, by Distribution Channel

- Valve Controller Market, by End User

- Valve Controller Market, by Region

- Valve Controller Market, by Group

- Valve Controller Market, by Country

- United States Valve Controller Market

- China Valve Controller Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Final Executive Summary Emphasizes Market Drivers Key Insights And Strategic Considerations Shaping The Future Of Valve Controllers In The Gaming Industry

In summary, the valve controller segment is characterized by rapid technological evolution, multifaceted distribution channels, and heightened regulatory complexities. Key market drivers include the proliferation of immersive gaming experiences, the maturation of wireless communication protocols, and the growing consumer appetite for advanced haptic feedback. Supply chain resiliency has emerged as a critical determinant of operational continuity amid fluctuating tariff landscapes, while strategic segmentation-from casual home gaming to high-stakes esports-underscores the necessity for tailored product offerings.

Leading players have demonstrated resilience through dynamic pricing adjustments, strategic inventory management, and collaborative co-development with professional teams and influencers. At the same time, emerging manufacturers are carving out niches by emphasizing modular design, seamless interoperability, and subscription-based engagement models. Looking ahead, continued investment in research and development, coupled with agile distribution strategies, will be fundamental to maintaining competitive advantage. As the valve controller market continues to mature, stakeholders who adeptly balance innovation with channel diversification and regulatory navigation will be best positioned to capitalize on growth opportunities and shape the future of interactive gaming technologies.

Reach Out To Ketan Rohom Associate Director Sales And Marketing For A Custom Valve Controller Market Research Report Purchase Today

To explore the comprehensive analysis, strategic insights, and market opportunities detailed in this study, please contact Ketan Rohom, Associate Director, Sales & Marketing, at 360iResearch. Ketan will guide you through the tailored benefits of this in-depth report and arrange immediate access to unlock the data-driven strategies that will empower your business to capitalize on emerging trends and navigate complex market dynamics in the valve controller segment. Secure your copy today and position your organization at the forefront of innovation and competitive advantage.

- How big is the Valve Controller Market?

- What is the Valve Controller Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?