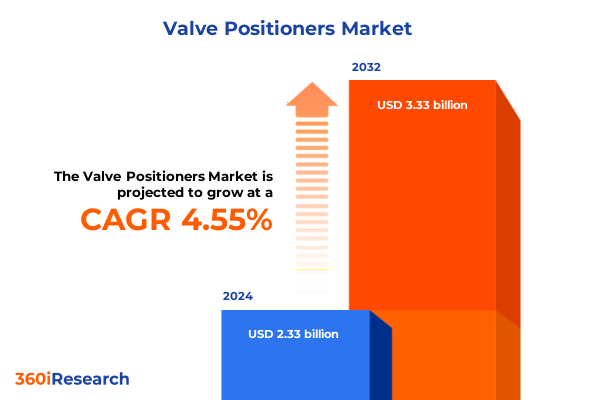

The Valve Positioners Market size was estimated at USD 2.43 billion in 2025 and expected to reach USD 2.54 billion in 2026, at a CAGR of 4.57% to reach USD 3.33 billion by 2032.

Setting the Stage for Valve Positioners Market Dynamics in an Era of Technological Innovation and Evolving Regulatory Landscapes

The valve positioner market is evolving in response to a convergence of technological innovation, stringent regulatory demands, and shifting economic imperatives. As global industry landscapes undergo digital transformation, process automation has become central to optimizing plant performance, reducing downtime, and enhancing safety. Valve positioners serve as critical components in these automated systems, ensuring precise flow, level, pressure, and temperature control. By calibrating actuator responses, these devices not only improve process stability but also drive energy efficiency and lower emissions in an era where sustainability targets are non-negotiable.

Within this dynamic environment, end users-from petrochemical refineries to pharmaceutical manufacturing facilities-are prioritizing smarter instrumentation with integrated diagnostics and remote connectivity. Simultaneously, manufacturers are accelerating development of digital platforms that offer predictive maintenance capabilities and analytics-driven performance optimization. These shifts are reshaping competitive boundaries, compelling suppliers to invest heavily in R&D while forging strategic partnerships to deliver turnkey solutions. Against this backdrop, it is essential for stakeholders to understand the interplay between emerging technologies, evolving application requirements, and macroeconomic factors such as trade policies and raw material costs.

Uncovering Key Transformative Shifts Shaping the Valve Positioners Ecosystem Amid Digitalization Sustainability and Industry 4.0 Advancements

Recent years have witnessed transformative shifts that are redefining the valve positioners landscape, fueled by the rapid proliferation of Industry 4.0 technologies and escalating demands for sustainability. Smart factories equipped with the Industrial Internet of Things now rely on valve positioners featuring embedded sensors that continuously transmit real-time performance data. This seamless connectivity enables operators to pivot from reactive to predictive maintenance models, thereby reducing unplanned shutdowns and extending asset lifecycles. Importantly, the integration of artificial intelligence algorithms has begun to automate calibration routines, enhancing accuracy while freeing up technical personnel for higher-value tasks.

Moreover, the industry is embracing green initiatives that call for energy-efficient actuation systems and eco-friendly materials. Manufacturers are exploring low-power designs and eco-certifications to comply with tightening environmental regulations. Concurrently, digital twin technology has emerged as a critical tool, allowing engineers to simulate valve positioner behavior under diverse operating conditions before deploying physical hardware. These innovations are not isolated developments; rather, they form a cohesive ecosystem that is pushing the boundaries of what valve positioners can achieve. As a result, suppliers and end users alike are recalibrating strategies to align with these multifaceted shifts, recognizing that adaptability and digital fluency will be paramount in capturing future value.

Examining the Cumulative Impact of United States Tariffs Implemented in 2025 on Valve Positioner Supply Chains Production and Cost Structures

In 2025, the implementation of new United States tariffs has exerted significant pressure on valve positioner supply chains and cost structures. These measures, targeted at specific imported components, have compelled global manufacturers to reassess sourcing strategies and localize production closer to end-user markets. Consequently, lead times for critical actuator assemblies have lengthened, prompting operators to maintain higher safety stocks and renegotiate contracts to buffer against price volatility. This heightened complexity has underscored the importance of supply chain resilience as a core competitive differentiator.

Furthermore, the cumulative impact of these tariffs has accelerated investment in domestic manufacturing capabilities. By relocating assembly operations and forging partnerships with local suppliers, companies aim to mitigate tariff exposure and reduce exposure to foreign exchange fluctuations. At the same time, some firms are exploring nearshoring options in neighboring countries to preserve cost efficiencies while maintaining regional proximity. In parallel, end users are increasingly demanding transparency on origin and traceability, aligning with broader corporate governance and environmental, social, and governance mandates. Taken together, these developments highlight a paradigm shift: tariff management and supply chain agility are now integral to the long-term viability of valve positioner portfolios.

Delivering Deep Insights into Market Segmentation Trends Driven by Product Technology Valve Type Application and Industry Alignments

An in-depth look at valve positioner segmentation reveals nuanced trends driven by product architecture, underlying technology, valve type, application requirements, and industry end use. On the product front, electric valve positioners are gaining traction in sectors where precision control and digital integration are paramount, while electro-pneumatic models continue to serve as a bridge for facilities transitioning from purely pneumatic systems. Within the pneumatic category, double-acting positioners are preferred in heavy industrial applications requiring bidirectional actuator control, whereas single-acting variants maintain relevance in cost-sensitive installations with simpler fail-safe requirements.

Delving into technology segmentation, the shift from analog to digital positioners is evident, with digital units offering enhanced diagnostics, remote calibration, and seamless integration into advanced process control systems. Meanwhile, valve type distinctions persist, as linear valve positioners dominate flow control loops in chemical processing, and rotary valve positioners underpin precise throttling in oil and gas pipelines. Application segmentation further unpacks market drivers, showing robust adoption of flow control positioners across midstream infrastructure, complemented by growing implementation of specialized units for level, pressure, and temperature control in water treatment and power generation.

Industry segmentation underscores diverging growth vectors: automotive manufacturing plants are investing in compact, ruggedized positioners for paint lines and assembly processes, whereas pharmaceuticals demand hygienic designs with traceable calibration for compliance. The chemicals sector gravitates toward high-accuracy instruments to manage corrosive media, and pulp and paper operations prioritize durability under fluctuating load conditions. Across all segments, the ability to customize positioner offerings to meet specific process dynamics remains a key determinant of supplier success.

This comprehensive research report categorizes the Valve Positioners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Valve Type

- Application

- Industry

Revealing Strategic Regional Dynamics Influencing Valve Positioner Deployment and Growth in the Americas Europe Middle East Africa and Asia Pacific

Geographic dynamics play a pivotal role in shaping valve positioner deployment patterns and growth opportunities. In the Americas, North America leads with robust capital expenditure in petrochemical and power generation sectors, underpinned by incentives for infrastructure modernization and renewable energy projects. Latin American markets, while more price-sensitive, present pockets of growth tied to expanding oil and gas production and rising municipal water treatment investments. The imbalance between regional capacity and local demand has spurred cross-border partnerships aimed at balancing supply with project timelines.

Europe, the Middle East, and Africa (EMEA) exhibit diverse drivers: Western Europe continues to prioritize energy efficiency and stringent emissions standards, fostering demand for advanced digital positioners. The Middle East is characterized by large-scale refinery upgrades and petrochemical complex expansions, which require heavy-duty devices capable of operating in extreme environments. In Africa, infrastructure development in mining and water sanitation is catalyzing uptake of pneumatic and electro-pneumatic positioners, albeit at mid-market price points due to budget constraints.

In the Asia-Pacific region, China and India dominate demand with large-scale manufacturing and refining capacity, while Southeast Asian economies are ramping up investments in power generation and wastewater management. Asia-Pacific’s emphasis on cost optimization has led to a rise in localized production hubs and joint ventures, enabling faster delivery and tailored engineering support. Collectively, these regional narratives illuminate the importance of adaptive go-to-market strategies and localized value propositions.

This comprehensive research report examines key regions that drive the evolution of the Valve Positioners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Innovations from Leading Valve Positioner Manufacturers Driving Market Differentiation and Technological Excellence

Leading valve positioner manufacturers are pursuing differentiated strategies to secure competitive advantage in an increasingly complex market. Technology pioneers are focusing on the rapid launch of digital positioner platforms that bundle advanced diagnostics, cloud connectivity, and machine learning-driven predictive maintenance modules. In parallel, several incumbents have established centers of excellence dedicated to research on low-power electronics and environmentally robust materials, aimed at addressing both energy efficiency mandates and harsh operating conditions.

Mergers and acquisitions have also emerged as a strategic lever for market consolidation and capability expansion. By integrating specialized niche players, global corporations are enhancing their product portfolios with highly tailored solutions, including high-precision single-acting pneumatic units and modular digital retrofit kits. Strategic alliances with systems integrators and independent service organizations further extend their aftermarket reach, ensuring lifecycle support and recurring revenue streams.

At the same time, agile new entrants are capitalizing on flexible manufacturing practices and direct-to-customer digital sales channels, targeting small-to-medium enterprises with cost-effective, scalable positioner offerings. This growing competitive intensity is compelling established players to refine their value propositions, shifting from product-centric to solution-oriented models that emphasize performance guarantees, uptime commitments, and total cost of ownership analyses.

This comprehensive research report delivers an in-depth overview of the principal market players in the Valve Positioners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- ALFA HI-FLOW Co., Ltd

- Azbil Corporation

- Badger Meter, Inc.

- Baker Hughes Company

- Christian Bürkert GmbH & Co. KG

- CIRCOR International, Inc.

- ControlAir

- CRANE Engineering

- Donjoy Technology Co., Ltd.

- Emerson Electric Co.

- Festo SE & Co. KG

- Flowserve Corporation

- Hamilton Company

- IMI Process Automation Group

- Mengchuan Instrument Co,Ltd.

- Nihon KOSO Co., Ltd.

- Nova Smar S/A

- Rotex Automation Limited

- Rotork PLC

- SAMSON AG

- Schneider Electric SE

- Siemens AG

- SMC Corporation

- Spirax Sarco Limited

- Tissin Co.,Ltd.

- Valmet Oyj

- W. Baelz & Sohn GmbH & Co.

- Wenzhou EAA Electric Co.,Ltd by Snda Industry Co., Ltd.

- Yokogawa Electric Corporation

- Zhejiang KGSY Intelligent Technology Co., Ltd.

Presenting Actionable Recommendations for Industry Leaders to Capitalize on Emerging Valve Positioner Trends and Navigate Operational Complexities

To thrive in the current landscape, industry leaders should pursue a multifaceted strategy that aligns technological investment with operational agility. First, accelerating adoption of digital positioners with built-in analytics will unlock new avenues for predictive maintenance and remote troubleshooting, thereby minimizing unplanned downtime. Concurrently, establishing modular and scalable product lines can address a broader spectrum of application requirements, from automotive paint booths to hydrocarbon processing loops.

Given the evolving tariff landscape, organizations must also consider localized manufacturing and assembly footprints. Partnering with regional suppliers or forming joint ventures can reduce trade friction, shorten delivery cycles, and foster stronger customer relationships. In parallel, enhancing supply chain visibility through digital tracking platforms will enable proactive risk management and more accurate demand forecasting, safeguarding against sudden policy shifts.

Finally, embedding sustainability into product roadmaps-through low-power designs, eco-friendly materials, and extended service agreements-will resonate with stakeholders across process industries and meet tightening environmental regulations. By combining these initiatives with targeted workforce training on digital calibration techniques and IIoT best practices, executives can position their operations for enduring resilience and market leadership.

Outlining Rigorous Research Methodology Integrating Primary Interviews Secondary Data Triangulation and Qualitative Quantitative Analyses

The research underpinning this report integrates both primary and secondary methodologies to deliver robust, unbiased insights. Primary data was collected through in-depth interviews with senior executives, process engineers, and procurement officers across leading end-user industries, ensuring firsthand perspectives on technology adoption, supply chain challenges, and investment priorities. Additionally, structured surveys were conducted with instrumentation specialists to quantify adoption rates of analog and digital valve positioners across diverse applications.

Secondary research involved comprehensive analysis of industry white papers, regulatory filings, technical standards, and corporate disclosures to validate market drivers and technological advancements. This data was systematically triangulated with primary findings to reconcile any discrepancies and enhance reliability. Qualitative insights were augmented by case studies of key deployment scenarios, while quantitative analyses employed cross-segment comparisons to identify statistically significant trends.

An iterative validation process, involving peer review by domain experts and cross-functional stakeholders, ensured methodological rigor and minimized bias. The result is a cohesive research framework that blends empirical evidence with strategic interpretation, equipping decision-makers with actionable intelligence tailored to the valve positioner domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Valve Positioners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Valve Positioners Market, by Product

- Valve Positioners Market, by Technology

- Valve Positioners Market, by Valve Type

- Valve Positioners Market, by Application

- Valve Positioners Market, by Industry

- Valve Positioners Market, by Region

- Valve Positioners Market, by Group

- Valve Positioners Market, by Country

- United States Valve Positioners Market

- China Valve Positioners Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Drawing Insightful Conclusions Highlighting Critical Success Factors Future Outlook and Strategic Imperatives in the Evolving Valve Positioner Market

In synthesizing these findings, several critical success factors emerge for the valve positioner market. Technological agility-especially the ability to integrate digital diagnostics and predictive analytics-will dictate leadership in high-growth segments. Supply chain resilience, underpinned by strategic localization and diversified sourcing, is essential to navigate geopolitical and tariff uncertainties. Meanwhile, sustainability credentials and alignment with industry-specific compliance standards will become increasingly influential in purchasing decisions.

Looking ahead, the convergence of digital twin simulations, edge computing, and artificial intelligence promises to unlock unprecedented performance optimization and remote service capabilities. These advances will not only reduce total cost of ownership but also enable new business models centered on outcome-based service agreements. To capitalize on these opportunities, organizations must invest in talent development, cross-disciplinary collaboration, and adaptive product architectures.

Ultimately, the ability to balance innovation with operational discipline, and to translate data insights into tangible performance improvements, will define market leaders. As the valve positioner ecosystem continues to evolve, those who proactively embrace emerging technologies and refine their strategic playbooks will capture the greatest value and shape the future of process control.

Take the Next Step Toward Operational Efficiency and Competitive Advantage by Connecting with Ketan Rohom to Access the In-Depth Market Report

Unlock unparalleled insights into operational efficiency advancements and strategic differentiators by engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the in-depth market research report. This comprehensive document consolidates proprietary analyses, expert interviews, and cross-industry benchmarks into an actionable resource designed to guide executive decision-making. By connecting with Ketan Rohom, you’ll gain tailored advice on integrating digital calibration protocols, mitigating tariff induced disruptions, and leveraging emerging technologies for sustainable growth. The report’s granular deep dive into product innovations, segmentation drivers, and regional dynamics equips you to navigate competitive complexities with confidence. Reach out today to transform your strategic roadmap and position your organization at the forefront of valve positioner excellence.

- How big is the Valve Positioners Market?

- What is the Valve Positioners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?