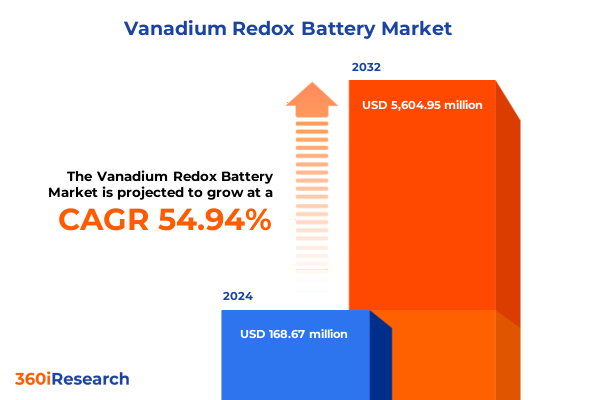

The Vanadium Redox Battery Market size was estimated at USD 260.45 million in 2025 and expected to reach USD 408.76 million in 2026, at a CAGR of 55.02% to reach USD 5,604.95 million by 2032.

Discover How Vanadium Redox Flow Batteries Are Poised to Revolutionize Grid-Scale Energy Storage with Unmatched Durability, Scalability, and Environmental Benefits

Vanadium redox flow batteries (VRFBs) represent a paradigm shift in grid-scale energy storage, leveraging an all-vanadium electrolyte that remains stable over millions of cycles with virtually no capacity fade. The liquid electrolyte design decouples power and energy components, allowing system architects to tailor storage duration independently from power output. This modularity not only simplifies maintenance and end-of-life recycling but also ensures safety through a water-based, nonflammable chemistry. In contrast to lithium-ion solutions, VRFBs can endure deep discharge cycles without degradation, offering guaranteed operational lifespans that exceed two decades while maintaining consistent performance under diverse environmental conditions. Ⓒcite

Explore the Transformative Policy, Technological, and Market Shifts Redefining the Vanadium Redox Flow Battery Landscape for Tomorrow’s Energy Systems

Global energy markets are undergoing transformative shifts driven by expansive policy mandates and targeted funding initiatives that recognize long-duration storage as a linchpin of decarbonization strategies. The U.S. Department of Energy’s Long Duration Storage Shot and Office of Clean Energy Demonstrations have allocated grant funding to projects ranging from community microgrid deployments using VRFB technology to co-operative utility initiatives, underscoring federal commitment to domestic storage innovation and resilient supply chains. Federal grants supporting tribal sovereignty microgrids and cooperative utility installations illustrate a strategic emphasis on leveraging VRFBs for grid reliability and clean energy access in remote or underserved regions, amplifying demand signals for scalable flow battery deployments. Ⓒcite

Analyze the Multidimensional Impact of Newly Instituted 2025 US Reciprocal Tariffs on the Global Vanadium Supply Chain and Domestic Battery Production Economics

The reciprocal tariff framework unveiled in early 2025 introduced a 25% duty on ferro-vanadium imports from non-USMCA countries, directly impacting supply chains for vanadium electrochemistry. Market participants have responded by accelerating purchase commitments, with spot offers for 80% grade ferro-vanadium surging near $20 per pound following the imposition of reciprocal tariffs on European and Indian origins. This shift has prompted buyers to reconsider stockpiling strategies and to explore alternative origins, notably Canadian imports which remain exempt under the US-Canada-Mexico Agreement. As a result, domestic electrolyte producers and flow battery integrators face increased raw material costs, potentially deferring project timelines absent strategic procurement adjustments. Ⓒcite

Unveil the Critical Segmentation Landscape Highlighting Type, Component, Application, End User, Deployment, and Capacity Insights Driving Vanadium Battery Market Strategies

An in-depth segmentation analysis underscores that the VRFB market is bifurcated by electrolyte chemistry into established all-vanadium systems and emerging vanadium-bromine variants, each offering distinct trade-offs between cost structure and energy density. Component segmentation further reveals that advanced electrolyte formulations, combined with high-efficiency power control systems and modular stack architectures, serve as primary performance levers. Application-level insights highlight that commercial deployments in office buildings and retail centers are focusing on demand-charge management, while industrial users in manufacturing and mining missions require uninterrupted backup. Residential uptake, spanning multi-family and single-family properties, is gradually emerging for critical load support. Utility stakeholders are testing VRFBs for both front-of-meter and behind-the-meter installations across distribution and transmission grids to facilitate renewable integration. End-user segmentation indicates that data center operators, both colocation and hyperscale, are adopting VRFB solutions to meet stringent uptime requirements. Oil and gas platforms value their modularity for remote operations, while telecom assets in broadband and cellular towers leverage flow batteries to reduce diesel reliance. Deployment vectors ranging from standalone backup to microgrid islanding and time-of-use shifting demonstrate the technology’s adaptability, and capacity band analysis identifies below 500 kW systems for localized resilience, 500–2000 kW for distributed energy storage, and above 2000 kW for utility-scale long-duration projects.

This comprehensive research report categorizes the Vanadium Redox Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Deployment

- Capacity Range

- Application

- End User

Gain Strategic Regional Perspectives on Vanadium Redox Flow Battery Adoption Across the Americas, EMEA, and Asia-Pacific Energy Ecosystems

Regional dynamics in the Americas reflect strong policy alignment, where state and federal incentives underpin VRFB adoption for grid resilience and renewable integration. California’s pilot initiatives with Sumitomo Electric highlight how VRFBs mitigate curtailment and firm solar output, showcasing replicable models for other U.S. states. Across Europe, Spain and Germany are forging ahead with landmark installations such as the H2 Inc. 8.8 MWh EnerFLOW 640 project under Spain’s 20 GW storage target and Germany’s 2 MW/20 MWh Fraunhofer ICT pilot, evidencing continent-wide momentum under the EU’s renewable expansion plans. In Asia-Pacific, Japan’s Hokkaido demonstrator and China’s expanding electrolyser capacity underscore the region’s dual role as both a leading vanadium producer and an aggressive end-market for long-duration storage, driven by national decarbonization mandates and rapid renewable capacity additions. These tailored regional strategies illustrate how local policy frameworks, resource endowments, and grid priorities shape diverging yet complementary VRFB growth trajectories. Ⓒcite

This comprehensive research report examines key regions that drive the evolution of the Vanadium Redox Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine Leading Vanadium Flow Battery Innovators and Their Strategic Initiatives Driving Technological Advancements and Market Expansion Globally

Leading innovators are scaling VRFB platforms through both product innovation and value-chain integration. Invinity Energy Systems’ launch of the ENDURIUM™ series represents a leap in module energy density and stack response times, backed by DNV certification and global deployments extending from the U.S. to the UK’s LODES project. Their strategic partnerships and reserved manufacturing capacity signal readiness for gigawatt-hour scale roll-outs. Largo Inc. has vertically integrated vanadium supply and electrolyte production via the Storion Energy joint venture with Stryten Energy, ensuring domestic access to high-quality electrolyte under a cost-efficient leasing model, while advancing their patented VCHARGE± stack design. Sumitomo Electric’s collaboration with San Diego Gas & Electric for utility-scale demonstration adds further validation to VRFB reliability. H2 Inc.’s EnerFLOW 640 deployment in Spain, driven by modular design and HyperBOOST stack enhancements, exemplifies how tailored technology solutions are meeting Europe’s long-duration storage mandates. Collectively, these firms are establishing robust project pipelines, supply assurances, and technological roadmaps to cement leadership in the VRFB domain. Ⓒcite

This comprehensive research report delivers an in-depth overview of the principal market players in the Vanadium Redox Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Australian Vanadium Limited

- Big Pawer Electrical Technology Xiangyang Co., Ltd.

- Bushveld Energy Limited

- Dalian Rongke Power Source Co., Ltd.

- Delectrik Systems Pvt. Ltd.

- Enerox GmbH

- GILDEMEISTER energy solutions GmbH

- Golden Energy Fuel Cell Co., Ltd.

- H2, Inc.

- Invinity Energy Systems plc

- Largo Inc.

- Shanghai Electric Group Company Limited

- StorEn Technologies Inc.

- Stryten Energy LLC

- Sumitomo Electric Industries, Ltd.

- UniEnergy Technologies, Inc.

- V-Flow Tech Ltd.

- VanadiumCorp Resource Inc.

- Vecco Group Pty Ltd

- Versano Energy Ltd.

- VionX Energy, LLC

- VRB Energy Pte. Ltd.

Implement Actionable Strategies for Industry Leaders to Navigate Supply Chain Challenges, Regulatory Dynamics, and Technological Innovation in Vanadium Battery Markets

Industry leaders should prioritize securing vertically integrated supply chains for vanadium electrolyte, either through partnerships or joint ventures, to hedge against tariff-induced price volatility and critical mineral shortages. Collaborative R&D initiatives-particularly those funded by government grants-can accelerate advancements in membrane technology and stack design, reducing system costs and improving energy efficiency. Engagement with regulators to advocate for long-duration storage targets and infrastructure incentives will help establish stable demand signals, while diversification across commercial, industrial, and utility segments can mitigate market concentration risk. Establishing pilot programs in under-served regions and leveraging microgrid projects can generate demonstrable case studies, bolstering stakeholder confidence. Finally, adopting circular economy principles by implementing robust electrolyte recycling frameworks will not only reduce raw material dependency but also strengthen sustainability credentials, appealing to ESG-focused investors.

Understand the Rigorous Research Methodology Underpinning This Comprehensive Analysis of Vanadium Redox Flow Battery Market Dynamics and Trends

This research synthesizes insights from extensive secondary sources, including peer-reviewed scientific studies, industry publications, trade press, and government reports. Primary data were collected through expert interviews with VRFB manufacturers, system integrators, and end-users, ensuring real-world perspectives informed segmentation and regional assessments. Supply chain analyses incorporated customs and trade data, while company profiles were validated against press releases and financial disclosures. Tariff impact findings derive from governmental trade notices and Argus Metals price assessments, triangulated against market reactions. Methodological rigor was maintained through cross-validation of data points, transparency in analytical frameworks, and adherence to ethical guidelines in data collection. This multi-method approach underpins the reliability and relevance of our conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vanadium Redox Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vanadium Redox Battery Market, by Component

- Vanadium Redox Battery Market, by Type

- Vanadium Redox Battery Market, by Deployment

- Vanadium Redox Battery Market, by Capacity Range

- Vanadium Redox Battery Market, by Application

- Vanadium Redox Battery Market, by End User

- Vanadium Redox Battery Market, by Region

- Vanadium Redox Battery Market, by Group

- Vanadium Redox Battery Market, by Country

- United States Vanadium Redox Battery Market

- China Vanadium Redox Battery Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesize Key Insights on Vanadium Redox Flow Batteries to Empower Decision-Makers in Driving Long-Duration Energy Storage Adoption and Sustainability Goals

Vanadium redox flow batteries are uniquely positioned to address the exigent need for long-duration energy storage, offering unparalleled durability, safety, and lifecycle sustainability. While U.S. tariffs have introduced short-term supply pressures, domestic production initiatives and strategic partnerships are realigning the value chain. Segmentation insights underscore VRFB adaptability across applications, from data center resiliency to grid-scale renewable firming. Regional contrasts reveal that policy frameworks and resource endowments are defining divergent growth pathways, yet global momentum remains intact. Leading companies are capitalizing on technological innovations and collaborative ventures, signaling that VRFBs will become integral to decarbonization roadmaps. As the energy landscape evolves, stakeholders who act on these insights will be best positioned to navigate market complexities, drive cost efficiencies, and secure sustainable growth in the vanadium flow battery arena.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to Secure the Definitive Vanadium Redox Flow Battery Market Research Report and Propel Your Strategic Planning Forward

Secure your competitive edge by partnering with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the definitive market research report on vanadium redox flow batteries. This comprehensive analysis equips you with actionable insights into evolving regulatory landscapes, supply chain dynamics, and the latest technological breakthroughs across the global VRFB ecosystem.

By engaging directly with Ketan, you gain tailored guidance on how the intelligence within this report aligns with your strategic objectives, whether you seek to optimize investment decisions, refine product roadmaps, or benchmark against key industry players. Don’t miss the opportunity to leverage an in-depth evaluation of segment-specific drivers, regional trends, and the evolving impact of U.S. tariffs on vanadium supply chains.

Contact Ketan today to secure immediate access to the market research report that will empower your organization to navigate the complexities of the long-duration energy storage market, drive sustainable growth, and solidify your leadership in the vanadium redox flow battery sector.

- How big is the Vanadium Redox Battery Market?

- What is the Vanadium Redox Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?