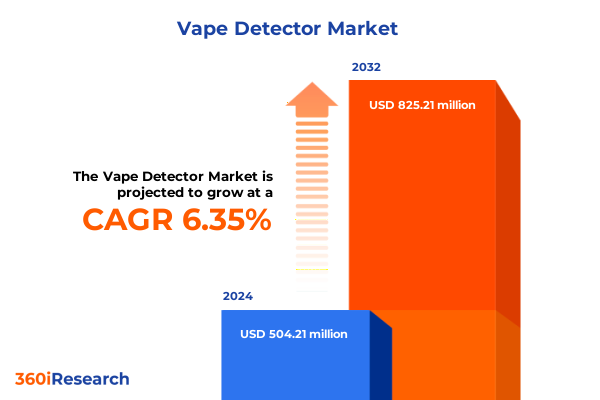

The Vape Detector Market size was estimated at USD 326.63 million in 2025 and expected to reach USD 353.81 million in 2026, at a CAGR of 8.58% to reach USD 581.44 million by 2032.

Unveiling the Critical Role of Advanced Vape Detection Technologies in Ensuring Safer Indoor Environments Across Commercial, Industrial, and Residential Spaces

As the prevalence of vaping continues to rise across a spectrum of environments, from bustling shopping malls to high-density office complexes and family homes alike, the imperative to monitor and control indoor air quality has never been more pronounced. Traditional smoke and fire detection systems, while effective for combustion byproducts, often lack the sensitivity and specificity required to identify volatile organic compounds and aerosol particulates characteristic of electronic nicotine delivery systems. This gap in detection capability not only exposes property stakeholders to potential compliance liabilities but also places occupants at risk of prolonged exposure to aerosolized contaminants that can undermine overall well-being.

In response, a new generation of vape detection solutions is emerging, harnessing advanced sensing materials, real-time analytics, and networked architectures to deliver precise, rapid identification of vaping events. These systems are designed to seamlessly integrate with existing building management and security platforms, enabling facility managers and property owners to enforce no-vaping policies, maintain regulatory compliance, and protect indoor air quality without compromising occupant comfort or operational efficiency. By adopting these technologies, decision makers can proactively safeguard environments against misuse of vaping devices, demonstrating a commitment to health and safety that aligns with modern regulatory expectations and corporate responsibility standards.

Examining the Technological, Regulatory, and Behavioral Transformations Shaping the Evolution of Vape Detection Solutions Across Diverse Sectors

Over the past few years, the vape detection market has undergone profound transformations driven by concurrent advancements in sensor technology, evolving regulatory frameworks, and shifting behavioral patterns among end users. Breakthroughs in microelectromechanical systems have yielded sensors with heightened sensitivity to aerosol particle size distributions, while novel machine learning algorithms enable context-aware detection that minimizes false positives triggered by benign vapors from cleaning agents or cooking activities. Consequently, these technological strides have elevated the reliability and robustness of vape detectors, positioning them as indispensable components of comprehensive indoor air quality strategies.

Regulatory bodies across North America, Europe, and select Asia-Pacific nations have progressively extended smoke-free legislation to encompass areas afflicted by vaping. This trajectory has prompted property managers and educational institutions to prioritize installation of specialized detectors that comply with newer standards. Simultaneously, increased public awareness around the health implications of secondhand aerosol exposure has spurred demand for transparent air quality monitoring, thereby elevating detector deployments in restaurants, hospitality venues, and residential complexes.

Behavioral shifts are also reshaping the landscape. As remote work and hybrid learning models gain traction, the need for portable, handheld detection solutions has grown, enabling rapid spot checks in home offices, temporary workspaces, and shared accommodations. At the same time, facility operators are gravitating toward integrated data platforms that aggregate environmental metrics across HVAC, fire safety, and security systems. This convergence of sensor fusion and cloud-based analytics is redefining the possibilities for proactive facility management, ensuring that vape detection rapidly evolves from a standalone function into a core pillar of comprehensive building intelligence infrastructures.

Assessing the Cumulative Impact of United States Tariff Policies in 2025 on the Vape Detector Supply Chain and Component Cost Structures

In 2025, the United States implemented a series of tariff adjustments targeting electronic components imported from key manufacturing hubs overseas. These measures, designed to incentivize domestic production and reduce reliance on international supply chains, have had a cascading effect on the vape detector industry. Core sensor elements and microcontrollers, predominantly sourced from markets subject to heightened duties, experienced cost escalations that reverberated throughout manufacturing and distribution channels.

Producers responded by intensifying efforts to localize component sourcing, forging partnerships with domestic semiconductor fabricators and printed circuit board assemblers. While this strategic pivot reduced exposure to cross-border tariffs, it also necessitated reengineering of certain detector modules to accommodate alternative suppliers’ specifications. As a result, product development cycles extended marginally to validate performance consistency and reliability under newly adopted parts pipelines.

Beyond direct cost implications, the tariff landscape has driven a more holistic reevaluation of supply chain risk management. Industry participants are embracing dual-source strategies and cultivating regional manufacturing footprints, thereby bolstering resilience against future policy fluctuations. Concurrently, greater collaboration with industry associations and trade negotiators has emerged as a key tactic for influencing tariff determinations and securing exemptions for critical sensor technologies. Through these collective responses, the vape detection sector is navigating the complex interplay between trade policy imperatives and the continuous drive for innovation.

Deriving Key Insights from Segmentation Analysis to Navigate Product Types, Detection Ranges, Connectivity Options, Distribution Channels, and End Users

Analyses reveal that product type distinctions wield significant influence over deployment strategies and value propositions. Fixed detectors, designed for permanent integration within ductwork and ceiling grids, appeal to large-scale commercial and industrial facilities requiring uninterrupted monitoring, whereas handheld detectors enable quick verification in transient environments or sensitive spaces where networked connectivity may be impractical. Detection range capabilities similarly guide application selection; long-range sensors support wide-area surveillance in manufacturing warehouses and research laboratories, while short-range technologies find favor in confined offices, classrooms, and residential units that demand pinpoint accuracy and minimal spatial footprint.

Connectivity options further differentiate device offerings, with wired systems providing robust, low-latency links to building control networks and wireless variants offering installation flexibility and rapid mobilization. Channel dynamics influence procurement pathways, as traditional offline retailers maintain strong footholds in retrofitting legacy infrastructures, while online platforms accelerate access to the latest portable models for residential end users and small-to-medium enterprises. End-user segmentation underscores the multifaceted utility of vape detection solutions: commercial managers deploy integrated ceiling-mounted units in malls, offices, restaurants, and schools to uphold policy compliance; industrial operators rely on specialized sensors within healthcare institutions, manufacturing units, research laboratories, and warehouse complexes to safeguard critical processes; and homeowners increasingly adopt plug-and-play detectors to ensure safe indoor air quality in living spaces affected by unauthorized vaping.

This comprehensive research report categorizes the Vape Detector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Detection Range

- Connectivity

- Distribution Channel

- End User

Uncovering Distinct Regional Dynamics Influencing the Vape Detector Market Across the Americas, Europe Middle East and Africa, and Asia Pacific

Regional dynamics exhibit distinct characteristics driven by regulatory frameworks, infrastructure maturity, and end-user priorities. In the Americas, strict enforcement of smoke-free regulations at state and municipal levels has accelerated adoption of specialized vape detection technologies in educational institutions, corporate workplaces, and hospitality venues. Collaborative efforts between private sector adopters and local health authorities foster best practices for installation and calibration, reinforcing a culture of proactive air quality management.

Across Europe, the Middle East, and Africa, varying degrees of building code standardization and data privacy considerations influence technology integration. Western Europe’s emphasis on environmental sustainability and smart building certifications has enhanced receptivity to networked detectors that deliver real-time analytics, whereas emerging markets in the Middle East and Africa prioritize cost-effective, standalone solutions that can be deployed with minimal infrastructure prerequisites.

In the Asia-Pacific region, rapid urbanization and accelerating construction of mixed-use developments underscore the importance of scalable vape detection systems. While mature markets such as Japan and Australia emphasize adherence to stringent regulatory guidelines, growth trajectories in Southeast Asia and South Asia are propelled by rising awareness of indoor pollution hazards. Consequently, manufacturers are tailoring offerings to align with region-specific building typologies and variable connectivity landscapes, delivering a range of fixed, handheld, wired, and wireless detectors suited to the diverse needs of commercial, industrial, and residential end users.

This comprehensive research report examines key regions that drive the evolution of the Vape Detector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Product Advancements and Competitive Differentiation in the Global Vape Detection Industry

Key market participants are distinguishing their offerings through targeted innovations and strategic collaborations. Industry stalwarts have invested heavily in the refinement of electrochemical and optical sensing elements, achieving lower detection thresholds and enhanced selectivity for aerosolized nicotine compounds. At the same time, select technology firms have forged partnerships with building management system providers, embedding vape detection modules within broader environmental monitoring suites that track temperature, humidity, and volatile organic compounds.

Lean start-ups are also making inroads by focusing on niche applications such as student safety in educational settings and asset protection in industrial cooling chambers. These agile companies leverage modular hardware architectures and open-source software frameworks to deliver customizable solutions that can be rapidly configured to client specifications. Strategic alliances with telecommunications providers have facilitated the rollout of wireless detectors utilizing narrowband IoT protocols, enabling long-range, low-power communication in locations where traditional Wi-Fi or Ethernet connectivity is unavailable.

In parallel, a number of leading equipment manufacturers are extending their footprints through joint ventures with regional distributors, ensuring localized support for installation, maintenance, and calibration services. Through these multifaceted approaches-ranging from core sensor innovations to integration partnerships and regional distribution alliances-companies are solidifying their competitive positions while advancing the collective capabilities of the vape detection ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vape Detector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ark Systems Inc

- CM3 Building Solutions by Daikin Group

- Forensics Detectors, LLC

- Hochiki Corporation

- ICASCorp

- Johnson Controls International plc

- Ningbo SENTEK Electronics CO., LTD.

- Pelco by Motorola Solutions, Inc.

- Piera Systems Inc

- SAFETECH TECHNOLOGIES PRIVATE LIMITED

- SafetyFirst Monitoring Solutions Inc

- SensorTech Innovations Inc

- SMF Systems Ltd.

- Soter Technologies, LLC

- SwabTek Inc

- Swift Sensors, Inc.

- TAKEX EUROPE LTD.

- Tel Group

- Triton Sensors LLC

- Vape Detectors UK

- Verkada Inc.

- Zeptive Inc.

Presenting Actionable Strategic Recommendations for Industry Leaders to Enhance Product Innovation Supply Chain Resilience and Market Penetration of Vape Detectors

Industry leaders should prioritize diversification of their component supply chains by establishing relationships with multiple qualified vendors and evaluating nearshore manufacturing options to reduce exposure to future tariff changes. Embracing modular hardware designs that facilitate swift integration of alternative sensor modules will further enhance resilience and accelerate time to market in response to supply disruptions.

To capitalize on growing demand for wireless solutions, organizations ought to expand investments in IoT-enabled detector platforms, exploring partnerships with telecom providers to offer seamless connectivity in challenging network environments. Concurrently, developing user-centric interfaces and analytics dashboards will amplify the value proposition, empowering facility operators to derive actionable insights and streamline incident response procedures.

Given the evolving landscape of health and safety regulations, companies are advised to engage proactively with standards bodies and regulatory agencies to shape emerging detection criteria and secure early conformity pathways. Cultivating end-user training programs and certification workshops can foster adoption and minimize installation errors, reinforcing brand credibility.

Finally, pursuing R&D collaborations with academic institutions and research laboratories will accelerate the advancement of next-generation sensing technologies, such as nanomaterial-based detectors and predictive analytics algorithms. By orchestrating cross-functional initiatives that span supply chain optimization, technological innovation, regulatory engagement, and end-user enablement, industry participants can achieve sustainable growth and maintain a leadership position in the vape detection market.

Outlining a Robust Research Methodology Employing Comprehensive Secondary Sources Expert Interviews and Data Triangulation for Reliable Market Insights

This research is grounded in an extensive secondary data collection process that encompassed technical publications, patent databases, regulatory frameworks, corporate filings, and industry association reports. Complementing this foundation, in-depth interviews were conducted with a diverse array of stakeholders, including facility managers, regulatory officials, sensor manufacturers, system integrators, and end-user representatives. The qualitative insights derived from these dialogues informed the identification of key drivers, barriers, and adoption patterns.

Quantitative validation was achieved through systematic triangulation, cross-referencing shipment data, procurement records, and historical deployment case studies. To ensure analytical rigor, findings were subjected to peer review by a panel of domain experts, who assessed methodological soundness and challenged assumptions related to technological performance, regulatory impacts, and supply chain dynamics.

The research scope spans global deployment contexts, with specific emphasis on the Americas, Europe Middle East and Africa, and Asia Pacific. While efforts were made to include emerging market participants, certain constraints in publicly available data necessitate cautious extrapolation for under-represented regions. Nonetheless, the combined methodological approaches provide a robust conceptual framework capable of guiding strategic planning and investment decisions in the rapidly evolving vape detection industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vape Detector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vape Detector Market, by Product Type

- Vape Detector Market, by Detection Range

- Vape Detector Market, by Connectivity

- Vape Detector Market, by Distribution Channel

- Vape Detector Market, by End User

- Vape Detector Market, by Region

- Vape Detector Market, by Group

- Vape Detector Market, by Country

- United States Vape Detector Market

- China Vape Detector Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Highlight the Strategic Imperatives and Future Outlook for Vape Detection Technologies in Emerging Global Contexts

The confluence of advanced sensing technologies, evolving regulatory landscapes, and shifting end-user behaviors has elevated vape detection from a niche security measure to a critical component of holistic indoor air quality management. Across global markets, the drive toward integrated building intelligence, underpinned by real-time analytics and networked sensor platforms, signals an irreversible shift in how commercial, industrial, and residential stakeholders safeguard their environments.

Trade policy developments, particularly the 2025 tariff revisions, have underscored the importance of supply chain diversification and strategic collaboration. By localizing component sourcing and embracing modular design philosophies, manufacturers can navigate policy uncertainties while maintaining the pace of innovation. Segment-specific insights affirm that success will hinge on aligning product capabilities-such as detection range, connectivity, and form factor-with the unique demands of each end-user category, from mall operators and educational institutions to research facilities and private residences.

Regionally, the Americas lead in regulatory enforcement and advanced deployments, EMEA exhibits varied adoption based on infrastructural maturity and privacy considerations, and Asia Pacific presents a dynamic growth frontier shaped by urbanization trends. Leading companies are differentiating through sensor precision, seamless integration, and strategic partnerships, collectively advancing the capability envelope of vape detectors.

Looking ahead, the industry is poised to embrace emerging opportunities in predictive maintenance, AI-driven anomaly detection, and cross-platform interoperability. Success will depend on an ecosystem approach that integrates technological innovation with regulatory advocacy and end-user education, ensuring that vape detection solutions not only detect unauthorized vaping events but also contribute meaningfully to healthier, safer indoor environments.

Engaging with Ketan Rohom to Secure the Comprehensive Market Research Report Offering Unmatched Strategic Insights and Competitive Intelligence

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to access a comprehensive compilation of market intelligence and actionable strategic recommendations tailored to your organizational objectives. Engaging with Ketan will ensure you receive bespoke insights that address your specific challenges in product development, regulatory compliance, and supply chain optimization. By securing this definitive resource, you will obtain clarity on emerging trends, competitive landscapes, and innovation pathways that can elevate your decision-making processes.

This report consolidates expert analyses, regional deep dives, and segmentation insights across product types, detection ranges, connectivity solutions, distribution channels, and end-user requirements, delivering a granular understanding of market dynamics. Partnering with Ketan enables your team to expedite time-to-market for next-generation vape detectors while mitigating risks associated with tariffs and supply chain disruptions. Don’t miss the opportunity to gain a competitive edge through data-driven strategies and tailored recommendations that respond to the evolving demands of commercial, industrial, and residential stakeholders.

- How big is the Vape Detector Market?

- What is the Vape Detector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?