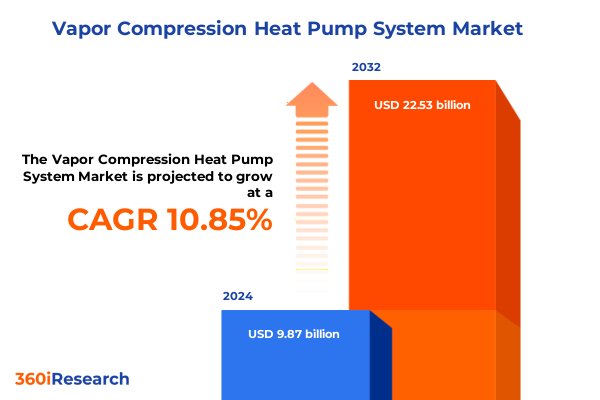

The Vapor Compression Heat Pump System Market size was estimated at USD 10.91 billion in 2025 and expected to reach USD 12.13 billion in 2026, at a CAGR of 10.91% to reach USD 22.53 billion by 2032.

Exploring the Evolution and Strategic Importance of Vapor Compression Heat Pump Systems in Modern Thermal Management Solutions Worldwide

Vapor compression heat pump systems have emerged as a cornerstone in global efforts to enhance energy efficiency and reduce greenhouse gas emissions across diverse end markets. By utilizing a closed‐loop refrigeration cycle, these systems transfer heat from low‐temperature sources to higher‐temperature sinks, ensuring reliable heating or cooling with minimal electrical input. In recent years, advancements in compressor design, refrigerant chemistry, and system integration have propelled performance metrics to new heights, positioning vapor compression technology as a pivotal enabler of sustainable climate control strategies. As governments and industries accelerate decarbonization initiatives, demand for scalable, high‐efficiency heat pump solutions has surged, underscoring their strategic importance in residential, commercial, and industrial applications.

At the core of this evolution is a growing ecosystem of stakeholders-equipment manufacturers, component suppliers, engineering service firms, and technology innovators-collaborating to address market complexities. Regulatory drivers, including stricter efficiency standards and incentives for clean heating solutions, have further catalyzed product development cycles. Meanwhile, end users are seeking systems that balance upfront investment with long-term operational savings. This dynamic environment continues to foster innovation in controls, integration with renewable energy sources, and predictive maintenance capabilities. Together, these forces are reshaping the thermal management landscape and setting the stage for the next generation of vapor compression heat pump deployments.

Unveiling Key Forces and Emerging Trends Reshaping the Vapor Compression Heat Pump Sector Across Global Energy Landscapes

The vapor compression heat pump sector is undergoing transformative shifts driven by a confluence of technological progress, policy realignment, and evolving customer expectations. Digital integration into system control architectures has unlocked unprecedented opportunities for optimizing performance in real time. Internet-of-Things connectivity, coupled with advanced analytics, empowers operators to fine-tune capacity modulation, refrigerant flow, and defrost cycles, enhancing energy utilization while minimizing downtime. Concurrently, the transition toward low-global-warming-potential refrigerants is reshaping compressor and component design to ensure compatibility with new working fluids. These material and engineering innovations are paving the way for truly sustainable heating and cooling solutions, aligned with international climate goals.

In parallel, a stronger emphasis on lifecycle analysis and total cost of ownership is prompting end users to prioritize systems offering both high coefficient of performance and minimal environmental impact. Energy storage integration, leveraging thermal buffers or phase-change materials, is gaining traction as a means to smooth demand peaks and integrate intermittent renewable generation. As a result, manufacturers are broadening their portfolios to include hybrid configurations that blend vapor compression loops with auxiliary heat sources such as solar thermal collectors or waste‐heat recovery units. These emergent architectures illustrate the industry’s adaptive response to decarbonization imperatives and signal a new era of system interoperability and resilience.

Analyzing the Far Reaching Effects of 2025 United States Tariffs on the Vapor Compression Heat Pump Industry Supply Chains and Competitiveness

The introduction of new United States tariffs in 2025 has exerted a pronounced influence on the vapor compression heat pump supply chain, compelling manufacturers and distributors to recalibrate their sourcing and pricing strategies. Originally aimed at bolstering domestic production of critical components, these measures have increased import expenses for compressors, valves, and heat exchangers sourced from select regions. The consequent rise in input costs has reverberated throughout the value chain, placing pressure on OEMs to absorb or pass along price adjustments while preserving unit economics and end user affordability.

In response, many industry participants are exploring localization strategies to mitigate tariff exposure. Joint ventures with domestic component fabricators and strategic alliances with North American suppliers are gaining momentum, enabling companies to secure preferential duty treatment and shorten lead times. Meanwhile, some manufacturers are consolidating production footprints, migrating assembly lines closer to key markets to minimize cross‐border movements. These adaptations, while essential for maintaining competitiveness, require significant capital investment and complex project management. Nevertheless, the drive to circumvent tariff impacts has accelerated the adoption of advanced manufacturing techniques-such as modular assembly and digital twins-to enhance agility and cost control in the newly tariff-constrained landscape.

Decoding Essential Segmentation Perspectives to Illuminate Application Diversity and Technology Preferences in the Vapor Compression Heat Pump Market

Dissecting the vapor compression heat pump market through multiple segmentation lenses reveals nuanced insights that inform product strategy and go-to-market tactics. When examining usage contexts, commercial applications-spanning hospitality, workplace environments, and retail precincts-demand capacity scalability and seamless integration with building automation systems. Industrial settings, notably chemical and food processing plants, prioritize robustness and precision control to maintain stringent temperature tolerances. Residential deployments range from high-density multifamily units to standalone single-family homes, each requiring tailored solutions that balance aesthetics, footprint, and ease of maintenance.

Turning to system architecture, air-source variants dominate entry-level markets with both air-to-air and air-to-water configurations proving popular in temperate zones. Ground-source installations, employing horizontal loop or vertical loop arrays, offer superior seasonal performance in regions with stable subsurface temperatures. Water-source setups are favored near abundant aquatic resources, capitalizing on consistent thermal baselines. Capacity segmentation further differentiates offerings: modules under five kilowatts cater to compact residential and light commercial uses, five to thirty kilowatt units serve mid-range installations, and larger configurations exceed thirty kilowatts to address heavy commercial and industrial demands. End-use orientation segments the market into cooling-only units, dual heating and cooling systems, and dedicated space heating products. Lastly, compressor technology-whether centrifugal, reciprocating, screw, or scroll-drives fundamental performance trade-offs in efficiency, noise, and part-load behavior, underscoring the importance of matching component topology to application requirements.

This comprehensive research report categorizes the Vapor Compression Heat Pump System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Capacity

- Technology

- Application

- End Use

Mapping Regional Dynamics and Growth Drivers Shaping the Vapor Compression Heat Pump Market Across the Americas, EMEA, and Asia Pacific Territories

Regional dynamics shape the competitive contours of the vapor compression heat pump industry, with distinct growth drivers and regulatory frameworks across the Americas, the combined Europe, Middle East & Africa region, and the Asia-Pacific sphere. In the Americas, policy incentives at federal and state levels are catalyzing adoption of high-efficiency heating and cooling systems, particularly within the residential sector. Retrofit initiatives targeting aging infrastructure in North American cities have created demand for innovative air-source and hybrid heat pump systems that harmonize with existing HVAC networks.

Over in Europe, Middle East & Africa, stringent eco-design mandates and phased refrigerant restrictions are prompting accelerated modernization of commercial and industrial installations. European Union directives on energy performance in buildings are complemented by Middle Eastern demand for advanced cooling solutions in arid climates, creating a diverse palette of application requirements. Africa’s emerging markets are still in nascent stages, but utility-scale district cooling projects are beginning to illustrate the potential for large-scale heat pump deployments.

In Asia-Pacific, rapid urbanization and industrial expansion are the primary growth levers. China’s commitment to peak carbon emissions by 2030 has spurred extensive rollouts of ground-source and water-source systems, while Japan’s established presence in scroll compressor innovation continues to influence product roadmaps. Southeast Asian markets are showing heightened interest in modular, containerized heat pump units for food processing and hospitality sectors, reflecting both infrastructure constraints and evolving environmental regulations.

This comprehensive research report examines key regions that drive the evolution of the Vapor Compression Heat Pump System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pioneering Companies Driving Innovation and Strategic Collaborations in the Vapor Compression Heat Pump Industry Ecosystem

A cohort of leading equipment manufacturers and technology providers is shaping the competitive landscape through product differentiation and collaborative ventures. These enterprises invest heavily in research and development to refine compressor efficiencies, enhance refrigerant compatibility, and integrate intelligent controls that anticipate maintenance requirements. Strategic partnerships between component suppliers and system integrators are yielding next-generation platforms that streamline installation and commissioning, reducing total cost of ownership for end users.

Mergers and acquisitions have also played a pivotal role in consolidating expertise and expanding geographic reach. By absorbing specialized engineering firms and controls startups, established players are accelerating time-to-market for novel heat pump configurations and digital services. Concurrently, emerging challengers are leveraging open-source hardware and agile manufacturing to offer niche solutions that target underserved market segments, prompting incumbents to reexamine their product roadmaps.

Beyond product development, alliances between heat pump manufacturers and energy service companies are forging new business models around performance contracting and shared-savings schemes. These collaborations align incentives across the value chain, ensuring that system performance directly translates into cost avoidance for facility operators. As this ecosystem continues to mature, the interplay of technological innovation and strategic cooperation will define the pace of market expansion.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vapor Compression Heat Pump System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AltaRock Energy, Inc.

- Baker Hughes Company

- Bostech Mechanical Ltd.

- Carrier Global Corporation

- ClimateMaster, Inc. by NIBE Industrier AB

- Daikin Industries, Ltd.

- Daikin Industries, Ltd.

- Dandelion Energy, Inc.

- De Dietrich by BDR Thermea France S.A.S.

- EnergySmart Alternatives, LLC

- Fujitsu General Limited

- Geo-Flo Corporation

- GeoComfort by Enertech Global, LLC

- Geoflex Systems Inc.

- GeoSmart Energy

- GeoStar

- Hitachi, Ltd.

- Hydro-Temp Corporation

- Johnson Controls International plc

- LG Electronics Inc.

- Miami Heat Pump

- Mitsubishi Electric Corporation

- OCHSNER Wärmepumpen GmbH

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Shuangliang Eco-energy Systems Co., Ltd.

- Siemens AG

- Toyesi Pty Ltd

- Trane Technologies plc

- Trane Technologies plc

Providing Actionable Recommendations to Enhance Competitiveness and Sustainable Growth for Industry Leaders in the Heat Pump Sector

Industry leaders can capitalize on current market opportunities by adopting a multi-pronged strategy that emphasizes portfolio optimization, supply chain resilience, and customer-centric service models. Prioritizing research into modular architectures will enable faster customization and flexible scaling of heat pump systems to meet diverse application demands. In parallel, forging strategic alliances with local component producers can mitigate tariff exposure, reduce logistics costs, and reinforce responsiveness to regional regulatory shifts.

Organizations should also invest in digital platforms that deliver predictive maintenance, remote diagnostics, and performance benchmarking. By transitioning from product sales to outcome-based contracts, companies can deepen customer relationships while unlocking recurring revenue streams. Training dealer networks and field technicians on these advanced service offerings will ensure high levels of operational uptime and customer satisfaction.

Finally, maintaining a vigilant eye on evolving energy policies and refrigerant legislation is critical. Engaging proactively in industry working groups and standards committees will allow firms to shape emerging regulations and anticipate compliance requirements. This forward-looking posture, combined with disciplined capital allocation to high-impact innovation, will position companies to capture value in a rapidly morphing heat pump marketplace.

Outlining Rigorous Methodological Approaches and Data Collection Protocols Underpinning the Vapor Compression Heat Pump Market Analysis

The underlying analysis is grounded in a rigorous multi-stage research framework that integrates both qualitative and quantitative methodologies. Initially, a comprehensive review of secondary literature-including policy white papers, engineering journals, and publicly available financial disclosures-helped construct a baseline understanding of technology trajectories and regulatory drivers. This desk research was complemented by a broad sweep of patent filings and supplier catalogs to map emerging component innovations and product launches.

To validate and enrich these insights, a structured primary research program was conducted, comprising in-depth interviews with senior executives, R&D directors, and procurement specialists across equipment manufacturers, component vendors, and end-user organizations. These conversations provided granular perspectives on decision criteria, investment priorities, and operational challenges, enabling triangulation of secondary data points. Market sizing and segmentation were cross-checked through proprietary shipment data analysis and distribution channel surveys, ensuring accuracy in relative performance metrics.

Data triangulation procedures were applied throughout to reconcile discrepancies and refine key conclusions. Advanced analytics tools facilitated scenario modeling under varying tariff regimes and refrigerant phase-down schedules. The final report underwent internal peer review by subject-matter experts to guarantee that findings reflect both strategic imperatives and practical considerations shaping the vapor compression heat pump market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vapor Compression Heat Pump System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vapor Compression Heat Pump System Market, by Type

- Vapor Compression Heat Pump System Market, by Capacity

- Vapor Compression Heat Pump System Market, by Technology

- Vapor Compression Heat Pump System Market, by Application

- Vapor Compression Heat Pump System Market, by End Use

- Vapor Compression Heat Pump System Market, by Region

- Vapor Compression Heat Pump System Market, by Group

- Vapor Compression Heat Pump System Market, by Country

- United States Vapor Compression Heat Pump System Market

- China Vapor Compression Heat Pump System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights to Illuminate the Future Trajectory of Vapor Compression Heat Pump System Adoption and Innovation Pathways

The converging forces of technological innovation, regulatory evolution, and supply chain adaptation are collectively charting a transformative path for vapor compression heat pump systems. Advances in compressor topologies and digital controls are unlocking new levels of efficiency, while the transition to environmentally benign refrigerants is reinforcing the industry’s commitment to sustainability. Regional policy landscapes-from incentives in the Americas to eco-design requirements in EMEA and decarbonization targets across Asia-Pacific-are actively shaping deployment patterns and investment priorities.

Segment-specific insights underscore the vital importance of customizing solutions to match end use, capacity requirements, and end-market dynamics. Whether serving the precise needs of food processing in industrial campuses or delivering reliable comfort in multifamily residences, system design must align with application nuances and installation constraints. The 2025 United States tariff adjustments have spurred a strategic shift toward supply chain localization and advanced manufacturing techniques, highlighting the sector’s resilience and adaptability.

Looking forward, companies that integrate cross-functional expertise-from thermal engineering to software analytics-and cultivate collaborative relationships across the ecosystem will be best positioned to navigate emergent challenges. By harnessing rigorous research insights and embracing outcome-oriented business models, stakeholders can accelerate adoption, drive operational excellence, and secure a sustainable growth trajectory for vapor compression heat pump technologies.

Driving Strategic Decision Making through Comprehensive Market Insights and Inviting Collaboration to Acquire the Full Research Report

For organizations seeking to secure a competitive edge through access to comprehensive analysis, Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, stands ready to guide you through the full market research report. Leveraging deep industry expertise, Ketan can tailor a package that aligns with your strategic objectives and provides actionable intelligence on vapor compression heat pump systems. Engage today to obtain detailed insights, customized data sets, and exclusive foresight into technological advancements, regulatory developments, and competitive positioning. Unlock the full potential of this market with a strategic partnership designed to inform your investment decisions and operational roadmaps. Connect directly with Ketan to arrange your report purchase and begin driving informed growth.

- How big is the Vapor Compression Heat Pump System Market?

- What is the Vapor Compression Heat Pump System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?