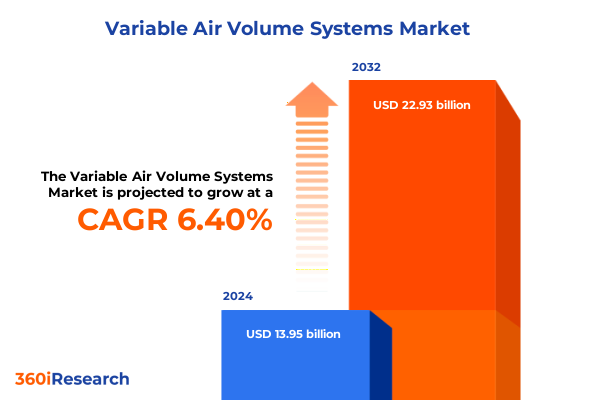

The Variable Air Volume Systems Market size was estimated at USD 14.86 billion in 2025 and expected to reach USD 15.84 billion in 2026, at a CAGR of 7.03% to reach USD 23.93 billion by 2032.

Unveiling the Strategic Imperatives and Market Drivers Shaping the Future of Variable Air Volume Systems in Commercial and Industrial Environments

In the evolving landscape of commercial and industrial HVAC solutions, variable air volume systems have emerged as a cornerstone of energy optimization and occupant comfort. These systems dynamically modulate airflow in response to fluctuating thermal loads, thereby reducing overall energy consumption and aligning with stringent sustainability mandates imposed by regulatory bodies worldwide. As organizations increasingly pursue net-zero carbon targets, the strategic adoption of variable air volume configurations offers a direct pathway to achieve significant operational savings while enhancing indoor environmental quality. Furthermore, municipal and federal incentives for energy-efficient retrofits have heightened the appeal of advanced airflow management solutions, positioning variable air volume systems as a critical lever for cost containment and environmental compliance.

Exploring the Technological, Regulatory, and Sustainability Disruptions Catalyzing a Paradigm Shift in the Variable Air Volume Systems Landscape

The variable air volume market is undergoing a profound transformation driven by converging technological, regulatory, and sustainability forces. The first catalyst is digital transformation, wherein smart building management systems and IoT-enabled controllers deliver real-time performance analytics and predictive maintenance capabilities. Integration with cloud-based analytics platforms enables facility managers to adjust zone airflow with precise granularity, reducing energy waste by up to 45% compared to legacy constant-volume approaches. Moreover, wireless VAV controllers are diminishing installation complexity and labor costs, fostering rapid deployment of modern airflow solutions across diverse property portfolios.

Simultaneously, regulatory stringency is reshaping market dynamics. In North America, amendments to ASHRAE Standard 62.1 now incentivize demand-controlled ventilation, compelling new and existing buildings to integrate advanced VAV configurations. Across Europe, the revised Energy Performance of Buildings Directive mandates a minimum 15% reduction in HVAC energy consumption for public structures by 2025, catalyzing demand for modular, high-efficiency airflow systems.

Lastly, corporate net-zero commitments and green building certifications such as LEED and BREEAM are accelerating the adoption of VAV solutions. As organizations prioritize carbon footprint reduction, the ability of variable air volume systems to deliver localized control and measurable energy savings has shifted these offerings from ancillary upgrades to baseline requirements in sustainable building design strategies.

Assessing the Repercussions of 2025 Trade Measures and Steel and Aluminum Tariffs on the Variable Air Volume Systems Supply Chain and Cost Structures

In early 2025, the U.S. government imposed a sweeping 25% tariff on all imported steel and aluminum products, effective March 12, under Section 232 of the Trade Expansion Act. This policy applied uniformly to traditional import partners and previously exempt nations, escalating raw material costs overnight for multiple manufacturing sectors, including HVACR. By June 4, the tariff rate doubled to 50%, intensifying concerns among equipment producers over persistent price volatility and margin erosion.

The immediate downstream impact on variable air volume system manufacturers has been a marked increase in production expenditures. Core components such as sheet steel casings, aluminum coils, and metal actuators are now subject to surcharges that have elevated per-unit costs by 20% to 40% in some scenarios. Manufacturers have begun passing selected surcharges to customers, with Siemens announcing a 3.2% tariff surcharge across its building automation and HVAC product lines to preserve quality standards and supply continuity.

Furthermore, complex global supply chains have witnessed disruptions as procurement teams seek alternative steel and aluminum sources to mitigate financial exposure. The Air Conditioning Contractors of America highlighted that contractors now face intermittent shortages and extended lead times, compelling them to explore domestic production options and adjust project timelines accordingly.

Ultimately, these trade measures are projected to cascade through the value chain, resulting in incremental end-user pricing pressures. Several distributors and contractors have advised clients to secure equipment orders before further tariff escalations materialize, underscoring the urgency for strategic procurement planning in the face of sustained trade uncertainty.

Illuminating Critical Market Segments Through Analysis of System Types, Zone Variations, Control Technologies, Airflow Ranges, End Users, and Component Architectures

The variable air volume market is delineated by distinct system types that address varying performance and application requirements. Single duct configurations remain prevalent due to their cost-effectiveness and precise temperature control in commercial office environments. By contrast, dual duct units offer simultaneous heating and cooling streams, making them well suited for facilities with heterogeneous thermal loads. Fan-powered systems bridge the gap by augmenting airflow in perimeter zones where heating demands fluctuate, illustrating how system type segmentation informs equipment selection and operational strategy.

Zone type segmentation further refines application planning by distinguishing core and perimeter requirements. Core zones, characterized by relatively stable internal heat gains, benefit from simpler single duct systems that deliver consistent airflow. Perimeter zones, exposed to external temperature variances, often require fan-powered VAV boxes or dual duct arrangements to maintain comfort under dynamic weather conditions, highlighting the critical interplay between architectural design and airflow management.

Control type segmentation underscores the evolution from analog thermostats to fully digital and smart systems. Analog controls, once ubiquitous, have given way to digital thermostats that offer programmable schedules and basic data logging. The advent of smart controls, featuring cloud connectivity, machine learning algorithms, and occupancy-based adjustments, has elevated comfort precision while reducing energy waste. This progression exemplifies the accelerating pace of innovation in VAV control technologies.

Airflow range segmentation categorizes units into low, medium, and high capacity to align with application intensity. Low-range VAV boxes serve small-scale offices and hospitality suites, medium-range systems cater to retail and educational facilities, while high-range units support expansive data centers and healthcare complexes. Matching airflow capacity to end-use parameters remains essential for optimizing energy performance and occupant well-being.

End-user segmentation spans diverse verticals including commercial office, data center, education, healthcare, hospitality, and retail. Each sector imposes unique performance criteria-data centers demand precise thermal control and redundancy, educational institutions prioritize quiet operation for learning environments, and healthcare facilities require stringent indoor air quality monitoring. These nuanced distinctions drive tailored product development and market positioning efforts.

Component segmentation reflects the modular architecture of VAV offerings. Actuators, divided into electric and pneumatic types, enable damper modulation with varying speed and torque characteristics. Controllers, whether building automation modules or standalone units, dictate system logic and integration capabilities. Dampers appear in opposed blade or parallel blade designs to optimize airflow linearity and sealing performance. Sensors, encompassing flow, pressure, and temperature measurement, deliver the critical data that underpins advanced control strategies. Together, these component subsegments create a rich ecosystem of interoperable parts, fostering incremental innovation and customization within the VAV marketplace.

This comprehensive research report categorizes the Variable Air Volume Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Zone Type

- Control Type

- Airflow Range

- Component

- End User

Unraveling Regional Dynamics and Growth Catalysts in the Americas, EMEA, and Asia-Pacific Variable Air Volume Systems Ecosystem

In the Americas, particularly the United States and Canada, federal and state energy codes have pushed variable air volume adoption through retrofit rebate programs and updated building standards. California’s Title 24 now mandates demand-controlled ventilation in commercial developments, driving widespread integration of VAV solutions. Moreover, the retrofitting of thousands of government facilities with smart airflow controls underscores the region’s emphasis on operational cost reduction and environmental stewardship.

Across Europe, Middle East, and Africa, the revised Energy Performance of Buildings Directive has compelled public and private stakeholders to achieve defined energy intensity reductions, elevating VAV systems as a core compliance technology. Germany, the United Kingdom, and France lead the charge by incentivizing green building certifications, which frequently require sophisticated airflow modulation capabilities. Additionally, rapid urbanization in the Gulf Cooperation Council nations has spurred new commercial projects that incorporate VAV systems to balance extreme climate demands with sustainability objectives.

In Asia-Pacific, the convergence of commercial real estate expansion and robust sustainability targets has fueled remarkable VAV growth. Metropolitan hubs such as Shanghai, Tokyo, and Bangalore have integrated millions of square meters of office and retail space with VAV-based climate control in recent years. Incentives for green loans and government mandates for energy-efficient design in Australia, South Korea, and Japan have further entrenched VAV technology as a standard specification. As emerging economies accelerate infrastructure development, the Asia-Pacific region is positioned to sustain the highest compound adoption rates globally.

This comprehensive research report examines key regions that drive the evolution of the Variable Air Volume Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Deciphering Strategic Moves and Innovation Roadmaps of Leading Variable Air Volume Systems Manufacturers Driving Competitive Advantage

Leading industry participants have each carved distinct strategic paths to capture growth in the variable air volume landscape. Honeywell has strengthened its position by embedding advanced thermostatic and CO₂ detection features into its controllers, enabling schools, hospitals, and office towers to optimize airflow based on real-time occupancy and air quality metrics. This integration of sensing intelligence into VAV terminal units has bolstered Honeywell’s digital building solutions portfolio.

Carrier Corporation has responded to tariff-induced cost pressures by expanding its domestic manufacturing footprint and offering turnkey retrofit packages that integrate VAV terminal units with cloud-based building management platforms. By emphasizing localized production and end-to-end service agreements, Carrier aims to mitigate supply chain risks while delivering comprehensive value to clients focused on lifecycle performance.

Johnson Controls has invested heavily in artificial intelligence and machine learning, rolling out adaptive-learning VAV modules that continuously calibrate airflow parameters based on historical usage patterns and external weather data. This AI-driven approach has demonstrated up to 12% additional energy savings on top of conventional demand-controlled ventilation measures, reinforcing the company’s reputation in predictive maintenance and energy management.

Siemens Smart Infrastructure has navigated tariff headwinds by implementing a temporary surcharge while simultaneously launching a cloud-enabled VAV monitoring platform. This dual strategy preserves manufacturing margins and complements the company’s digital portfolio, which now covers over 9,500 properties across Europe with remote diagnostics and performance benchmarking capabilities.

Schneider Electric has advanced its competitive edge through the development of eco-friendly VAV dampers and actuators built from recyclable materials, targeting government and corporate clients with stringent sustainability mandates. By aligning product innovation with circular economy principles, Schneider Electric appeals to customers seeking both high performance and reduced environmental impact.

Belimo Holding AG has deepened its specialization in VAV sensor technology, launching next-generation pressure and flow sensors that deliver sub-1% measurement accuracy. These enhancements enable VAV controllers to achieve tighter airflow tolerances, making Belimo a preferred partner for mission-critical environments such as cleanrooms and data centers where precision is paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Variable Air Volume Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Carrier Global Corporation

- Daikin Industries Ltd

- Halton Group

- Honeywell International Inc.

- Johnson Controls International plc

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

- Trane Technologies plc

Actionable Strategies for Industry Leaders to Navigate Market Volatility, Capitalize on Technology Trends, and Optimize Variable Air Volume System Deployments

Industry leaders should prioritize supply chain diversification to buffer against ongoing tariff volatility. By qualifying additional steel and aluminum suppliers in low-risk jurisdictions and securing long-term contracts with domestic mills, organizations can stabilize material costs and maintain production continuity in the face of sudden trade disruptions. Furthermore, scenario planning exercises should incorporate potential tariff escalations and regulatory shifts to ensure procurement teams are prepared with alternative sourcing strategies.

In parallel, investment in smart control platforms and IoT integration is essential for future-proofing VAV deployments. Companies must allocate resources toward retrofitting legacy analog systems with digital thermostats, wireless actuators, and cloud-based management software to unlock real-time analytics, predictive maintenance, and occupant-responsive adjustments. Collaboration with BMS providers and software vendors will expedite these upgrades while enhancing data-driven decision-making across facility portfolios.

Finally, a concerted focus on retrofit programs and sustainability certification alignment will differentiate market offerings. Organizations should develop turnkey retrofit solutions packaged with LEED, BREEAM, or WELL compliance roadmaps, leveraging rebate programs and green financing opportunities to reduce upfront costs for customers. By coupling technical expertise with financial incentives, companies can expand their addressable market and reinforce their role as trusted partners in decarbonization initiatives.

Rigorous Research Framework and Methodological Approach Underpinning the Comprehensive Analysis of the Variable Air Volume Systems Market

The research approach underpinning this analysis combined extensive primary interviews with HVAC engineers, facility managers, and procurement specialists, alongside rigorous secondary research encompassing industry reports, regulatory publications, and company disclosures. Data triangulation ensured consistency across multiple sources, enabling the validation of trend observations and strategic imperatives. Market segmentation was informed by bottom-up analysis of sales data and region-specific regulatory frameworks, while expert workshops facilitated scenario planning for tariff impacts and technology adoption trajectories.

Competitive profiling involved the systematic examination of product portfolios, patent filings, and partnership announcements to assess each leading manufacturer’s strategic positioning. Regional performance insights leveraged publicly available construction and retrofit statistics, complemented by government incentive program databases. Methodologies adhered to established market research best practices, including transparent documentation of assumptions, data sources, and analytical techniques, to deliver a robust and unbiased view of the variable air volume systems landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Variable Air Volume Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Variable Air Volume Systems Market, by System Type

- Variable Air Volume Systems Market, by Zone Type

- Variable Air Volume Systems Market, by Control Type

- Variable Air Volume Systems Market, by Airflow Range

- Variable Air Volume Systems Market, by Component

- Variable Air Volume Systems Market, by End User

- Variable Air Volume Systems Market, by Region

- Variable Air Volume Systems Market, by Group

- Variable Air Volume Systems Market, by Country

- United States Variable Air Volume Systems Market

- China Variable Air Volume Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesis of Key Findings and Strategic Implications Guiding Future Investments in the Variable Air Volume Systems Sector

Throughout this executive summary, variable air volume systems have been highlighted as pivotal enablers of energy efficiency, regulatory compliance, and occupant comfort in commercial and industrial settings. Technological innovations, particularly in smart controls and IoT integration, are driving a shift toward data-centric building management, while sustainability mandates and tariff dynamics are reshaping supply chain and cost structures. The market’s nuanced segmentation-spanning system types, zone requirements, control technologies, airflow capacities, end-user verticals, and component architectures-reveals diverse pathways for tailored solutions. Regionally, the Americas, EMEA, and Asia-Pacific each present unique growth catalysts, from retrofit incentives to green building directives and rapid urban expansion. Leading companies are responding with strategic investments in AI-driven modules, domestic manufacturing resilience, and eco-friendly product lines. Industry leaders must focus on supply chain agility, digital transformation strategies, and sustainability-aligned offerings to capture emerging opportunities and mitigate risks. By synthesizing these insights, stakeholders are equipped to make informed decisions and drive the next generation of variable air volume system deployments.

Engage with Ketan Rohom to Access In-Depth Variable Air Volume Systems Analysis and Secure Your Comprehensive Market Research Intelligence

To obtain unparalleled insights into the variable air volume systems market and equip your organization with actionable intelligence, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise and guidance will ensure you access the most comprehensive, up-to-date analysis tailored to your strategic objectives. Engage now to secure your copy of the definitive market research report.

- How big is the Variable Air Volume Systems Market?

- What is the Variable Air Volume Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?