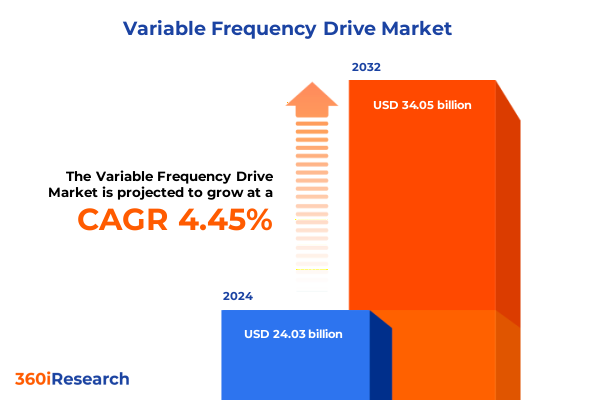

The Variable Frequency Drive Market size was estimated at USD 25.01 billion in 2025 and expected to reach USD 26.04 billion in 2026, at a CAGR of 4.50% to reach USD 34.05 billion by 2032.

Charting the Evolution of Variable Frequency Drives: Uncovering the Critical Role of VFD Technology in Modern Industrial Efficiency and Sustainability

Variable Frequency Drives have emerged as pivotal components in modern industrial operations, offering precise motor speed control and significant energy savings. As the global push for operational efficiency intensifies, organizations are increasingly turning to these devices to optimize processes across manufacturing, infrastructure, and utilities. By adjusting the frequency and voltage supplied to an electric motor, these systems enable smoother start-up, reduced mechanical stress, and lower power consumption compared to traditional fixed-speed controls.

The role of Variable Frequency Drives in supporting sustainability objectives cannot be overstated, as they directly contribute to carbon footprint reduction by minimizing energy waste. Furthermore, regulatory frameworks in key markets are reinforcing the adoption of energy-efficient equipment, positioning these drives at the forefront of industrial modernization efforts. Consequently, understanding the technological evolution, market dynamics, and strategic considerations surrounding these drives is essential for executives seeking to maintain competitive advantage and drive long-term value creation.

Identifying the Transformative Technological and Market Shifts Reshaping the Variable Frequency Drive Landscape in the Wake of Digitalization and Energy Imperatives

The Variable Frequency Drive landscape has undergone a profound transformation driven by digitalization and heightened energy imperatives. Software defined architectures now allow for seamless integration with supervisory control and data acquisition systems, enabling real-time diagnostics and predictive maintenance strategies. This shift toward intelligent drives empowers maintenance teams to anticipate failures, reduce downtime, and optimize asset utilization, thereby increasing overall equipment effectiveness.

Simultaneously, the proliferation of cloud-enabled platforms has facilitated remote monitoring and firmware updates, further enhancing operational resilience. These developments parallel rising demand for drives that support regenerative energy capabilities, capturing kinetic energy during braking and feeding it back into the grid. As end users prioritize decarbonization and operational agility, original equipment manufacturers are embedding advanced power electronics, sophisticated control algorithms, and user-friendly human-machine interfaces into their next-generation offerings.

Assessing the Far-Reaching Cumulative Impact of 2025 United States Tariff Policies on Variable Frequency Drive Supply Chains, Cost Structures, and Competitive Dynamics

The introduction of new United States tariff measures in 2025 has created a cumulative effect on the Variable Frequency Drive ecosystem, influencing procurement costs, supply chain resilience, and end-user pricing. Manufacturers reliant on imported components have faced elevated input costs, prompting strategic sourcing adjustments and a gradual shift toward regional suppliers. These adaptations have culminated in reconfigured logistics networks and revised inventory strategies to mitigate the impact of sustained tariff pressure.

Moreover, the tariff environment has accelerated discussions around nearshoring and vertical integration, as companies seek greater control over critical components such as power modules, control boards, and semiconductors. As a result, investments in domestic manufacturing capacity and collaborative agreements with local foundries have gained prominence. Although these changes have introduced short-term cost volatility, they are reshaping competitive dynamics by rewarding agile manufacturers that can optimize landed costs and maintain robust service levels under shifting trade policies.

Delving into Comprehensive Segmentation Insights Revealing the Diverse Product, Voltage, Power Rating and Application Requirements Driving Variable Frequency Drive Adoption

Insight into product type segmentation reveals distinct performance and application trends among AC Drives, DC Drives, and Servo Drives, with AC Drives dominating general industrial applications due to their versatility and cost efficiency while DC Drives retain niche roles in specialized settings demanding precise torque control. Servo Drives, on the other hand, are gaining traction in high-precision processes such as robotics and automated assembly lines, where rapid response times and positional accuracy are critical.

Voltage segmentation indicates that Low Voltage variants remain prevalent in commercial and small-scale industrial environments, whereas Medium Voltage solutions are increasingly favored in power-intensive sectors such as mining and large process plants. Within power rating categories, High Power drives above 200 kW serve heavy industries requiring continuous high-torque performance, while Medium Power units balance flexibility and capacity in mid-range applications. Low Power drives under 0.75 kW support auxiliary systems and small machinery, reflecting the growing emphasis on distributed automation.

Application analysis underscores that Compressors, Conveyors, Extruders, Fans and Blowers, and Pumps each have tailored drive requirements. Reciprocating and Screw Compressors benefit from torque-ramping features to manage load variability. Belt and Roller Conveyors rely on drives with adjustable speed profiles for material handling efficiency. Metal and Plastic Extruders demand robust thermal management and precise speed control to ensure product consistency. HVAC and Industrial Fans depend on aerodynamic optimization modes that minimize noise while maximizing airflow. Centrifugal and Diaphragm Pumps require corrosion-resistant components and adaptive control routines for variable fluid dynamics.

Across end users, sectors such as Agriculture, Chemical & Petrochemical, Energy & Power, Food & Beverage, Marine & Shipbuilding, and Oil & Gas present unique operational demands and regulatory considerations, steering drive manufacturers to deliver sector-specific features that address environmental conditions, safety standards, and maintenance protocols.

This comprehensive research report categorizes the Variable Frequency Drive market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Voltage

- Power Rating

- Application

- End User

Uncovering Critical Regional Insights Highlighting the Growth Drivers and Infrastructure Dynamics Shaping Variable Frequency Drive Demand across Americas, EMEA and Asia-Pacific

The Americas region is characterized by regulatory incentives promoting energy-efficient equipment and a mature maintenance services ecosystem that prioritizes predictive analytics. North American facilities are rapidly adopting intelligent drive solutions to meet stringent emissions targets and improve operational uptime. Meanwhile, Latin American markets are witnessing gradual modernization as infrastructure projects incorporate Variable Frequency Drives for water treatment, mining, and renewable energy integration.

Europe, the Middle East and Africa showcase a heterogeneous landscape driven by Europe’s aggressive decarbonization goals and government mandates for smart grid compatibility. In the Middle East, investments in megaprojects have elevated demand for medium and high voltage drives that support petrochemical processing and utilities. Africa remains at an earlier stage of adoption, although renewable energy installations and urbanization initiatives are creating new opportunities for drive deployment in pumping and ventilation systems.

Asia-Pacific stands out as the fastest innovating region, propelled by extensive manufacturing expansions in China and India. The rapid electrification of rail networks, smart factory rollouts, and robust infrastructure spending across Southeast Asia have all fueled demand for a full spectrum of drive technologies. Collaboration between drive suppliers and local integrators is enhancing the customization of solutions to meet diverse grid conditions, environmental factors, and end-user requirements across the region.

This comprehensive research report examines key regions that drive the evolution of the Variable Frequency Drive market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Profiles and Innovation Strategies of Leading Variable Frequency Drive Manufacturers Shaping Market Competitiveness and Technological Advancements

Leading companies in the Variable Frequency Drive sector are differentiating through targeted innovation, strategic partnerships, and digital service offerings. One major player has integrated advanced artificial intelligence into its drive platforms, enabling autonomous load balancing and real-time energy optimization that bolster industrial sustainability goals. Another manufacturer has established a broad network of certified service centers, delivering rapid local support and modular upgrade pathways that extend product lifecycles and strengthen customer loyalty.

Collaborative ventures between drive specialists and electronics suppliers have accelerated the development of next-generation power modules characterized by higher switching frequencies and reduced harmonic distortion. At the same time, select firms are piloting subscription-based models that bundle hardware, cloud analytics, and maintenance services into flexible agreements, aligning capital expenditures with operational budgets. Investment in research partnerships with universities and standards bodies is underpinning advancements in silicon carbide semiconductors and integrated safety functions, setting the stage for the next wave of drive capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Variable Frequency Drive market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Anaheim Automation, Inc.

- Carlo Gavazzi Holding AG

- CG Power and Industrial Solutions Limited

- Danfoss A/S

- Delta Electronics, Inc.

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- General Electric Company

- Getriebebau NORD GmbH & Co KG

- Hitachi Ltd.

- Honeywell International Inc.

- Inovance Technology Europe GmbH

- Johnson Controls International plc

- Larsen & Toubro Limited

- Mitsubishi Electric Corporation

- Nidec Corporation

- Parker-Hannifin Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- SEW-EURODRIVE GmbH & Co KG

- Shenzhen Gozuk Co., Ltd

- Shenzhen INVT Electric Co., Ltd.

- Siemens AG

- Sprint Electric Limited

- Sumitomo Heavy Industries, Ltd.

- WEG S.A.

- Yaskawa Electric Corporation

Presenting Strategic and Actionable Recommendations to Empower Industry Leaders in Capitalizing on Emerging Variable Frequency Drive Opportunities and Mitigating Key Market Risks

To capitalize on emerging digitalization trends and mitigate supply chain volatility, industry leaders should prioritize the development of modular drive architectures that support plug-and-play upgrades and scalable functionality. By investing in edge-computing capabilities within the drive itself, organizations can reduce latency for critical control loops and unlock new levels of process automation.

Furthermore, establishing strategic partnerships with component suppliers and local integrators will enhance supply chain transparency and foster resilience against regional trade disruptions. Executives are encouraged to explore collaborative R&D initiatives focused on low-loss semiconductor materials, leveraging co-investment models to share development costs and accelerate time-to-market. Complementing these efforts, expanding aftermarket service portfolios-especially in predictive maintenance and performance benchmarking-will drive recurring revenue streams and deepen customer relationships.

Finally, aligning product development roadmaps with decarbonization targets by embedding energy recovery features and compliance tracking tools will resonate with end users facing tightening environmental regulations. Leaders who integrate sustainability as a core design principle will not only differentiate in competitive tenders but also contribute meaningfully to broader corporate ESG commitments.

Detailing a Rigorous Multimethod Research Methodology Combining Primary Interviews, Secondary Data Analysis and Quantitative Validation for Reliable Variable Frequency Drive Insights

This study employs a robust blend of primary and secondary research methods to ensure comprehensive and reliable insights. Primary data was collected through in-depth interviews with motor manufacturers, drive integrators, end-user maintenance managers, and industry consultants, providing firsthand perspectives on technology adoption and operational challenges.

Secondary research included thorough examination of technical papers, trade association reports, white papers published by standards bodies, and publicly available company disclosures. Market participant databases and product catalogs were analyzed to map out competitive landscapes and identify emerging technology trends.

Quantitative validation was achieved by correlating shipment and installation volume data from industry registries with supply chain intelligence reports. Data triangulation techniques were applied to reconcile any discrepancies between sources. Throughout the research process, validation workshops with subject matter experts ensured that interpretations aligned with practical industry experience and current best practices.

Ethical considerations were maintained by anonymizing sensitive insights and respecting confidentiality agreements. The multi-method approach established a balanced framework that combines qualitative depth with quantitative rigor, underpinning the credibility of the study’s findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Variable Frequency Drive market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Variable Frequency Drive Market, by Product Type

- Variable Frequency Drive Market, by Voltage

- Variable Frequency Drive Market, by Power Rating

- Variable Frequency Drive Market, by Application

- Variable Frequency Drive Market, by End User

- Variable Frequency Drive Market, by Region

- Variable Frequency Drive Market, by Group

- Variable Frequency Drive Market, by Country

- United States Variable Frequency Drive Market

- China Variable Frequency Drive Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights and Forward-Looking Perspectives to Conclude the Executive Summary on Variable Frequency Drives with a Focus on Strategic Implications

In synthesizing the core findings of this executive summary, it is clear that Variable Frequency Drives occupy a critical nexus between digital transformation, energy efficiency, and supply chain resilience. The evolution of intelligent drive platforms, bolstered by cloud connectivity and advanced power electronics, is redefining maintenance paradigms and enabling unprecedented levels of process optimization.

At the same time, the cumulative effects of 2025 United States tariff policies have stimulated strategic shifts toward regional sourcing and vertical integration, underscoring the importance of agile procurement practices. Segmentation analysis demonstrates the nuanced requirements across product types, voltage classes, power ratings, applications, and end-user sectors, guiding targeted solution development and sales strategies.

Regional insights reveal that while mature markets emphasize sustainability and predictive services, emerging economies are rapidly advancing in infrastructure and manufacturing modernizations. Leading manufacturers are responding through innovation partnerships, service network expansion, and subscription models that align with evolving customer preferences.

By following the actionable recommendations provided-centered on modular design, supply chain partnerships, R&D collaboration, and sustainable features-industry leaders can position themselves to harness growth opportunities and navigate market uncertainties. The methodological rigor of this study ensures that stakeholders can confidently leverage these insights to inform strategic decisions and drive operational excellence.

Engaging with Ketan Rohom Associate Director Sales Marketing to Secure Your Comprehensive Variable Frequency Drive Market Research Report for Informed Decision Making

To obtain the in-depth analysis and actionable insights outlined in this executive summary, reach out to Ketan Rohom Associate Director Sales & Marketing to secure your comprehensive Variable Frequency Drive market research report. His expertise in articulating technical nuances and strategic recommendations ensures that your organization gains clarity on market dynamics, segmentation opportunities, tariff impacts, and regional growth drivers. By engaging directly with Ketan Rohom, decision-makers can customize briefing sessions, request tailored data extracts, and access exclusive appendices that delve deeper into company profiles and methodology details. This report not only synthesizes current trends but also delivers a structured framework for investment evaluation, technology adoption strategies, and supply chain optimization. Contacting Ketan Rohom today will align your strategic planning with the latest intelligence and ensure your teams are equipped to leverage emerging opportunities in the Variable Frequency Drive market.

- How big is the Variable Frequency Drive Market?

- What is the Variable Frequency Drive Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?