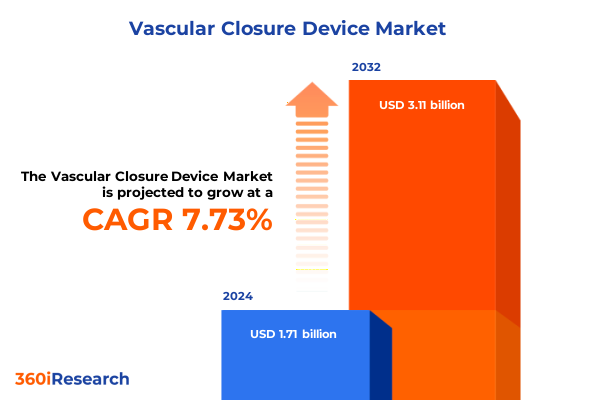

The Vascular Closure Device Market size was estimated at USD 1.85 billion in 2025 and expected to reach USD 2.00 billion in 2026, at a CAGR of 7.71% to reach USD 3.11 billion by 2032.

Unveiling the Future of Vascular Closure Devices Through Precision Innovation and Unmatched Excellence in Minimally Invasive Care

Vascular closure devices have evolved from rudimentary manual compression setups to advanced systems that enhance procedural efficiency and patient comfort. The introduction of minimally invasive interventions has amplified the significance of reliable closure techniques, positioning these devices as critical enablers of rapid hemostasis and early ambulation. With pressures on healthcare providers to optimize patient throughput and reduce hospital stays, the demand for sophisticated solutions that minimize complications while streamlining clinical workflows has never been greater.

In recent years, technological breakthroughs in biomaterials and deployment mechanisms have expanded the scope of applications for vascular closure devices. These innovations have intersected with the rise of transradial access procedures, which demand devices that accommodate smaller access sites without sacrificing closure integrity. Simultaneously, an aging population and the rising prevalence of chronic vascular conditions have driven demand across a variety of clinical settings, from high-volume cath labs to outpatient surgical centers. Consequently, market participants are challenged to deliver solutions that balance safety, ease of use, and cost effectiveness.

With these dynamics in play, stakeholders across the ecosystem are investing in research, portfolio diversification, and strategic partnerships. As hospitals and ambulatory centers integrate advanced hemostasis techniques into their procedural protocols, understanding the evolving technological landscape and clinical imperatives is paramount for informed strategy development.

Identifying the Major Transformative Shifts That Are Redefining Vascular Closure Device Development, Adoption, and Market Dynamics Globally

The landscape of vascular closure devices is being redefined by several interlocking shifts that transcend point innovations and reflect a broader transformation in how healthcare is delivered. First, the convergence of digital health and device engineering has introduced intelligent deployment platforms that can provide real-time feedback on tissue apposition and closure efficacy, elevating procedural accuracy and reducing reliance on operator experience.

In parallel, the increasing adoption of radial access in cardiovascular interventions is reshaping device design imperatives. Radial approaches reduce bleeding risk and improve patient satisfaction, prompting developers to optimize device profiles for smaller access sites and variable vessel anatomies. Moreover, sustainability considerations have gained prominence, with a trend toward biodegradable materials and environmentally conscious packaging that align with institutional goals for waste reduction.

Another critical shift lies in the growing emphasis on integrated care pathways. As healthcare systems pursue value-based reimbursement models, the ability of closure devices to contribute to faster recovery and lower complication rates has become a key differentiator. This shift has encouraged cross-functional collaboration among device manufacturers, contract research organizations, and clinical stakeholders to validate outcomes in real-world settings. Together, these transformative forces are driving a new era of device design and market evolution that favors adaptability, data-driven insights, and holistic patient care.

Assessing the Comprehensive Consequences of United States Tariff Measures on Vascular Closure Device Supply Chains, Costs, and Strategic Planning in 2025

In 2025, a suite of ad valorem duties and reciprocal measures imposed by the United States has generated ripple effects across global supply chains serving the vascular closure device sector. The administration’s broad tariffs introduced a baseline duty on imported medical equipment and raw materials, with higher rates targeting specific manufacturing hubs in China and the European Union. This framework has resulted in elevated production costs for devices whose components-such as collagen plugs, sealant polymers, and stainless steel delivery systems-are sourced internationally.

Healthcare providers have reported incremental price pressures as distributors and original equipment manufacturers adjust pricing structures to mitigate margin erosion. Analysis by industry observers suggests that these cost increases have been partially transferred to end users, leading to longer procurement cycles and tighter capital allocations for capital equipment in cath labs and outpatient centers. Consequently, some market participants have accelerated their evaluation of dual-sourcing strategies and nearshoring initiatives to stabilize supply chain resilience.

Moreover, smaller innovative firms have encountered disproportionate challenges due to their limited scale and reliance on specialized components. The need to navigate complex tariff classifications and compliance protocols has contributed to delays in regulatory submissions and extended product life cycle timelines. As a countermeasure, select companies are engaging domestic contract manufacturers and leveraging federal incentives aimed at reshoring critical medical device operations. Collectively, these developments underscore the pressing need for strategic agility and supply chain diversification in maintaining device availability and fostering continuous innovation.

Deriving Critical Insights from Multifaceted Segmentation of the Vascular Closure Device Market by Product, Procedure, Access Route, End User, and Distribution Channel

Critical insights emerge when the vascular closure device landscape is examined through the lens of product type, procedure categorization, access route, end user, and distribution framework. Clip based devices and suture based closure systems continue to command attention in high-volume interventional suites, while collagen plug variants-both bovine derived and synthetic formulations-have gained traction for their predictable resorption profiles. Sealant based products, which include both chitosan and polyethylene glycol sealants, are being embraced in settings where rapid tissue integration is prioritized, and external compression solutions maintain their role where simplicity and cost containment are key.

Differentiation also follows the nature of interventional versus diagnostic procedures. During angiographic and hemodynamic monitoring applications, closure devices emphasize minimal vascular trauma and ease of deployment to preserve vessel integrity. In contrast, cardiovascular and peripheral vascular interventions demand robust closure systems that can withstand higher sheath sizes and anticoagulated patient profiles. Access routes further inform device selection, as femoral access often favors plug and suture techniques, whereas radial approaches are ideally matched with low-profile sealants and compression adjuncts.

End users such as hospitals, ambulatory surgical centers, and clinics exhibit unique adoption patterns driven by procedural volumes, staffing capabilities, and cost structures. Larger medical centers may invest in advanced hemostasis platforms with integrated imaging guidance, while outpatient facilities prioritize devices that align with streamlined workflows and room-turn efficiency. Finally, distribution channels-whether direct sales led by device innovation teams or partnerships with third party distributors-shape the go-to-market cadence and the service level expectations across diverse clinical environments.

This comprehensive research report categorizes the Vascular Closure Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Procedure Type

- Access Site

- End User

- Distribution Channel

Exploring Regional Differentiators and Growth Drivers for Vascular Closure Devices Across Americas, Europe Middle East Africa and Asia Pacific Markets

Geographic dynamics play a defining role in the competitive and regulatory dimensions of vascular closure devices. In the Americas, sustained investment in advanced cardiovascular care infrastructure and the rising prevalence of percutaneous interventions have spurred interest in both next generation sealants and suture based closure platforms. Payers in the region are actively calibrating reimbursement pathways to reflect the long term patient benefits of reduced complication rates and shorter hospital stays, thereby incentivizing adoption.

Within Europe, the Middle East, and Africa, diverse healthcare delivery models coexist alongside varying regulatory landscapes. Western European markets emphasize clinical evidence and cost effectiveness, prompting robust clinical trials and health technology assessments. Conversely, several Middle Eastern nations are rapidly expanding catheterization capacities, creating demand for user friendly devices that can integrate into developing procedural environments. In parts of Africa, where resource constraints persist, external compression remains prevalent, but pilot programs exploring biodegradable collagen plugs mark a shift toward scalable innovation.

Asia-Pacific stands out as a dynamic growth zone, propelled by a widening base of interventional cardiology centers in China, India, and Southeast Asian economies. Local manufacturing capabilities are evolving to produce competitively priced plug and sealant based technologies, often in collaboration with global medtech leaders. Furthermore, novel distribution alliances are emerging to navigate complex import regulations and enhance after-sales support, underscoring the region’s strategic importance for long term portfolio expansion.

This comprehensive research report examines key regions that drive the evolution of the Vascular Closure Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Positioning and Innovation Profiles of Leading Companies Dominating the Vascular Closure Device Market Landscape

Leading medical technology companies have established distinct strategic footholds in the vascular closure device sector through targeted investments, merger activity, and focused R&D. Medtronic and Abbott have advanced plug based systems that leverage refined deployment mechanisms and biomaterial innovations, while Boston Scientific has concentrated on sealant based offerings designed for streamlined workflow integration in high throughput labs. Teleflex and B. Braun have each broadened their portfolios to include a spectrum of clip based and suture based technologies, catering to both elective and emergency hemostasis needs.

Mid sized specialized firms are also carving niches through next generation polymer research and enhanced delivery profiles. By collaborating with academic centers and clinical thought leaders, these innovators are demonstrating improved hemostatic performance and reduced time to hemostasis in comparative studies. Contract manufacturers have become instrumental in scaling these advances, offering modular production services that accelerate time to market and flexibility in component sourcing.

Strategic partnerships continue to redefine the landscape, as device developers collaborate with imaging companies, digital health providers, and logistics platforms to enhance device utilization tracking and outcome analytics. Together, these alliances are laying the groundwork for personalized closure strategies that factor in patient-specific risk scores, procedural complexity, and longitudinal care pathways.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vascular Closure Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Advanced Vascular Dynamics, LLC

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- BIOTRONIK SE & Co. KG

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Medical LLC

- Essential Medical, Inc.

- Forge Medical AB

- Haemonetics Corporation

- InSeal Medical Ltd.

- Lake Region Medical, Inc.

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- Merit Medical Systems, Inc.

- Morris Innovative, Inc.

- Rex Medical, L.P.

- Teleflex Incorporated

- Terumo Corporation

- Tricol Biomedical, Inc.

- TZ Medical, Inc.

- Vasorum Ltd.

- Vivasure Medical Ltd.

Delivering Actionable Recommendations to Empower Industry Leaders in Vascular Closure Device Development, Market Entry, and Competitive Strategy Execution

To maintain leadership in the vascular closure device domain, industry participants should prioritize the integration of data driven insights into their product development roadmaps. By harnessing procedural analytics and real world evidence, companies can refine device features and validate clinical benefits that resonate with value based care objectives. Concurrently, deepening engagements with interventional cardiology networks and outpatient surgical centers will facilitate iterative feedback on usability and outcomes, ensuring that next generation solutions address frontline clinical pain points.

Supply chain resilience must be reinforced through diversified sourcing strategies that mitigate tariff exposure and geopolitical risk. Nearshoring select production processes and qualifying alternate suppliers for key biomaterials can stabilize input costs while safeguarding quality standards. In concert with these efforts, pursuing regulatory harmonization across major markets will accelerate approvals and optimize global launch sequencing. Collaboration with regulatory authorities to establish unified standards for absorbable materials and deployment mechanisms can reduce redundant testing and expedite market entry.

Finally, forging alliances with digital health companies to integrate closure device data into broader patient management platforms offers a powerful avenue to demonstrate long term value. By capturing metrics on hemostasis times, complication rates, and patient satisfaction, device manufacturers can substantiate compelling value propositions for payers and providers alike. This holistic approach will position organizations to capitalize on the shift toward outcome oriented reimbursement models and sustain growth amid intensifying competition.

Outlining the Rigorous Research Methodology Underpinning the Vascular Closure Device Market Analysis Incorporating Primary and Secondary Data Sources

This report is grounded in a blended research methodology that synthesizes qualitative and quantitative insights to deliver a robust analysis of vascular closure device dynamics. The foundation was built upon comprehensive secondary research, including peer reviewed medical journals, regulatory filings, and white papers from leading healthcare associations. These sources provided historical context on device approvals, material innovations, and clinical outcome benchmarks.

Primary research was conducted through structured interviews with key opinion leaders in interventional cardiology, vascular surgery, and cath lab management. Supplementing expert perspectives, in depth discussions with device engineers and regulatory specialists offered practical insights into manufacturing complexities and compliance considerations. Furthermore, proprietary procedural data sets from major hospital systems were analyzed to discern closure technique preferences and time to hemostasis metrics in diverse procedural environments.

The confluence of these research streams was triangulated through comparative analysis, ensuring validation of findings across multiple vantage points. Market participants and process experts were engaged in iterative feedback cycles to refine thematic insights and strategic imperatives. Collectively, this meticulous approach underpins the credibility of the report’s conclusions and reinforces its utility for decision makers seeking to navigate the vascular closure device landscape with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vascular Closure Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vascular Closure Device Market, by Product Type

- Vascular Closure Device Market, by Procedure Type

- Vascular Closure Device Market, by Access Site

- Vascular Closure Device Market, by End User

- Vascular Closure Device Market, by Distribution Channel

- Vascular Closure Device Market, by Region

- Vascular Closure Device Market, by Group

- Vascular Closure Device Market, by Country

- United States Vascular Closure Device Market

- China Vascular Closure Device Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesis and Strategic Implications Drawn from the Vascular Closure Device Market Findings to Guide Decision Makers in Medical Device Innovation

The synthesis of technological innovations, regulatory pressures, and macroeconomic forces reveals a market at an inflection point, where the confluence of data driven device design and patient centric care models will dictate future trajectories. Stakeholders who invest in adaptive strategies-whether through modular product architectures, diversified supply networks, or strategic partnerships-are poised to lead the next wave of growth in vascular closure.

Key strategic implications include the need for a balanced portfolio that spans low profile sealant systems for radial access, robust plug based solutions for high volume cath labs, and versatile suture and clip technologies for a broad spectrum of procedures. Moreover, companies must remain vigilant in monitoring policy shifts that affect cross border trade and reimbursement frameworks, as these variables directly influence procurement and adoption patterns.

Ultimately, the success of industry participants will hinge on their ability to orchestrate innovation, operational excellence, and stakeholder collaboration. By aligning clinical efficacy with streamlined procedural workflows and demonstrable economic value, organizations can secure competitive advantage and support improved patient outcomes. This integrated perspective serves as a blueprint for guiding investment priorities and shaping sustainable growth strategies in the evolving vascular closure device arena.

Engage with Ketan Rohom to Secure Deep Insights from Our Vascular Closure Device Market Report and Accelerate Your Strategic Growth Decisions Today

To gain unparalleled clarity on the strategic forces shaping the future of vascular closure devices, reach out to Ketan Rohom, Associate Director of Sales & Marketing, for a direct discussion on how this report can deepen your understanding and empower informed decision making. Engage with an expert who can guide you through the intricate landscape of product innovation, procedural adoption, and regulatory considerations so you can translate insights into immediate action for your organization. Secure a customized briefing or full report access tailored to your specific priorities and accelerate your growth initiatives with confidence.

- How big is the Vascular Closure Device Market?

- What is the Vascular Closure Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?