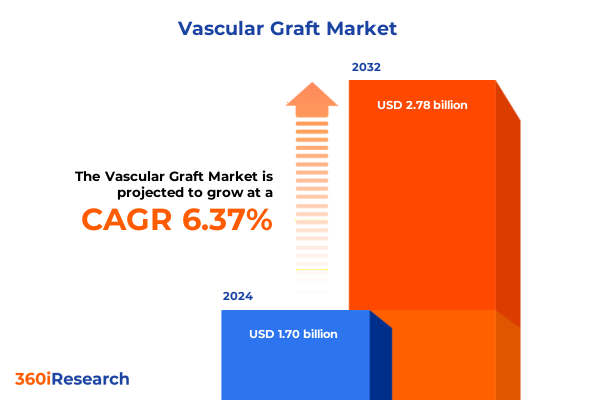

The Vascular Graft Market size was estimated at USD 1.80 billion in 2025 and expected to reach USD 1.90 billion in 2026, at a CAGR of 6.44% to reach USD 2.78 billion by 2032.

Setting the Stage for the Indispensable Role of Advanced Vascular Grafts in Redefining Modern Cardiovascular Treatment Paradigms

Vascular grafts have emerged as cornerstone solutions in modern cardiovascular interventions, enabling clinicians to bypass occluded or diseased vessels and restore vital blood flow to critical organs and tissues. Their development represents a confluence of surgical ingenuity, materials science breakthroughs, and rigorous clinical validation, all aimed at improving long-term patency rates and reducing postoperative complications. From coronary artery bypass applications to peripheral and renal artery reconstructions, graft selection and performance directly influence patient outcomes and healthcare economics. Advancements in both biological and synthetic graft formats have significantly expanded the therapeutic toolkit, offering physicians a versatile array of options tailored to specific anatomical and pathological scenarios.

As demographic shifts continue to elevate the global burden of cardiovascular disease, the need for robust vascular graft solutions has never been more pronounced. Aging populations combined with rising incidences of comorbidities such as diabetes and hypertension underscore the urgency of durable, biocompatible conduits. Meanwhile, evolving surgical techniques and minimally invasive approaches are redefining procedural paradigms, creating new demands for graft designs that optimize deliverability, reduce operative trauma, and accelerate patient recovery. Against this dynamic backdrop, understanding the technological, clinical, and regulatory forces at play is paramount for stakeholders aiming to shape the future of vascular graft therapy.

Unveiling the Transformative Technological and Clinical Shifts Shaping the Future of Vascular Graft Development and Application

Over recent years, transformative technological innovations have reshaped the vascular graft landscape, leading to materials and manufacturing processes that were once beyond imagination. Breakthroughs in polymer chemistry have yielded synthetic grafts with enhanced hemocompatibility and mechanical resilience, while tissue engineering and decellularization techniques have ushered in next-generation biologic conduits that harness the regenerative potential of allografts, autografts, and xenografts. Within this evolving ecosystem, surgical practitioners are increasingly leveraging hybrid graft constructs that combine the structural integrity of synthetic scaffolds with the bioactivity of cellular matrices, bridging the gap between synthetic resilience and biologic integration.

Simultaneously, the miniaturization of delivery systems and the proliferation of endovascular techniques are driving demand for smaller-diameter grafts engineered with precision tolerances. Three-dimensional printing and additive manufacturing approaches have facilitated bespoke graft geometries tailored to patient-specific vascular anatomies, deepening the personalization of care. These combined shifts are not merely incremental; they represent a fundamental redefinition of what vascular grafts can achieve, opening the door to reduced thrombogenic risk, enhanced endothelialization, and ultimately, improved long-term success rates across diverse clinical indications.

Assessing the Cumulative Impact of Recent 2025 United States Tariff Policies on Supply Chains and Cost Structures for Vascular Graft Manufacturing

In early 2025, the introduction of targeted tariff measures by United States authorities introduced new complexities for material suppliers and graft manufacturers alike. Additional duties on imported polymeric feedstocks such as polyester and polytetrafluoroethylene have elevated production costs, prompting manufacturers to reevaluate sourcing strategies and secure alternative supply channels to mitigate margin erosion. Concurrently, duties applied to certain biologic raw materials imported from key regions have pressured the cost structure for allograft and xenograft processing, leading some tissue banks to repatriate parts of their value chain or negotiate long-term agreements to stabilize input pricing.

These cumulative tariff impacts extend beyond pure cost considerations, influencing inventory management and product lifecycle planning. Manufacturers managing just-in-time delivery frameworks have encountered inventory build-up as they front-load raw material orders to preempt further duty escalations. At the same time, distributors and end-users such as hospitals and surgical centers face higher procurement expenses that may ultimately affect procedure affordability or reimbursement negotiations. Thus, the 2025 tariff regime has underscored the strategic importance of diversified supply networks, proactive policy monitoring, and agile procurement protocols to maintain both competitive pricing and uninterrupted clinical availability.

Deriving Strategic Intelligence from Comprehensive Segmentation Insights to Guide Decision Making across Diverse Vascular Graft Categories and Channels

A multi-angle segmentation framework reveals nuanced opportunities across product modalities, demographic needs, clinical indications, care settings, and distribution models. Within the product type dimension, biological grafts encompass allografts that offer natural extracellular matrices, autografts providing patient-derived compatibility, and xenografts leveraging porcine or bovine scaffolds, each presenting distinct integration and immune response profiles. In contrast, synthetic materials such as polyester deliver high tensile strength, polytetrafluoroethylene offers superior biostability, and polyurethane enables flexible conformability, catering to divergent anatomic and procedural requirements.

Exploring blood vessel diameter further differentiates strategic imperatives, where large-diameter conduits address high-flow applications such as aortoiliac and coronary bypasses, while small-diameter grafts are critical for cerebral, renal, and peripheral artery reconstructions, demanding exceptional hemocompatibility and anti-thrombogenic performance. Indication-based segmentation spans aortoiliac bypass surgery through lower extremity and cerebral artery bypass interventions, with each clinical use case imposing unique surgical handling, patency, and regulatory demands. End-user analysis underscores the growing role of ambulatory surgical centers in delivering outpatient bypass procedures, complementing the longstanding dominance of hospitals and clinics, whereas distribution channels bifurcate into traditional offline procurement networks and rising online platforms that offer procurement agility and cost transparency. Through this integrated lens, market participants can identify white spaces and align innovation efforts with evolving care delivery models.

This comprehensive research report categorizes the Vascular Graft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Blood Vessel Diameter

- Indication

- End User

- Distribution Channel

Illuminating Regional Market Variations and Growth Catalysts Influencing Vascular Graft Adoption across Americas, EMEA, and Asia-Pacific Territories

Regional dynamics play a pivotal role in shaping vascular graft adoption, reflecting varied healthcare infrastructures, regulatory frameworks, and economic priorities. In the Americas, strong reimbursement pathways and advanced cardiovascular care systems drive widespread use of both biologic and synthetic grafts, with the U.S. market leading investment in next-generation grafts for coronary and peripheral applications. Conversely, emerging markets in Latin America are gradually expanding vascular intervention capacity, supported by government initiatives to upgrade hospital networks and broaden access to surgical solutions.

Across Europe, the Middle East & Africa, the landscape is fragmented by divergent regulatory processes and healthcare funding models. Western European nations demonstrate robust clinical trial ecosystems and rapid uptake of innovative graft formats, while certain economies in the Middle East prioritize infrastructure expansion through public-private partnerships, fostering demand for cost-effective, off-the-shelf synthetic grafts. In select African countries, constrained budgets and limited specialist availability have tempered market growth, although targeted international collaborations aim to build local tissue banking and training capabilities.

The Asia-Pacific region is characterized by accelerating cardiovascular disease prevalence and expanding healthcare investments. Developed markets such as Japan and Australia have established graft registries and reimbursement pathways that incentivize long-term outcome studies, whereas fast-growing economies in Southeast Asia and India are scaling manufacturing capacity and distribution networks to meet soaring clinical demand. This region’s combination of innovation hubs and large patient populations positions it as a crucial arena for both global suppliers and emerging local players.

This comprehensive research report examines key regions that drive the evolution of the Vascular Graft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Key Industry Players and Their Innovative Strategies Driving Technological Leadership and Competitive Advantage in Vascular Grafts

Leading companies in the vascular graft arena are leveraging targeted R&D investments, strategic partnerships, and advanced manufacturing techniques to secure competitive differentiation. Established medical device firms are fortifying their product portfolios through the integration of bioactive coatings and antimicrobial technologies, aiming to reduce infection risks and improve endothelialization. Concurrently, specialist tissue organizations are refining decellularization protocols to preserve extracellular matrix integrity, fostering superior cellular repopulation and reducing immunogenicity.

In parallel, nimble innovators are harnessing additive manufacturing to produce patient-specific grafts, collaborating with academic institutions to validate custom geometries under real-world hemodynamic conditions. Strategic alliances between polymer suppliers and clinical research centers have yielded preclinical data that support regulatory filings for next-generation synthetic conduits, while select startups are exploring cell-seeded tissue constructs that bridge the divide between off-the-shelf and autologous graft solutions. Market leaders are also expanding geographically, establishing regional centers of excellence and forging distribution agreements that optimize market penetration across developed and emerging territories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vascular Graft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Affluent Medical

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- BIOVIC Sdn. Bhd.

- Boston Scientific Corporation

- Cardinal Health Inc.

- Cook Medical, Inc.

- Corcym S.r.l.

- CryoLife, Inc.

- Endologix Inc.

- Getinge AB

- Heart Medical Europe B.V.

- Japan Lifeline Co., Ltd.

- Lemaitre Vascular, Inc.

- Medtronic PLC

- Merit Medical Systems, Inc.

- Perouse Medical SAS by Vygon SAS

- Rua Life Sciences PLC

- Shanghai Suokang Medical Implants Co. Ltd.

- Terumo Corporation

- Vascular Graft Solutions Ltd.

- VUP Medical

- W. L. Gore & Associates, Inc.

- Xeltis B.V.

Outlining Actionable Strategic Imperatives to Enable Industry Leaders to Navigate Vascular Graft Market Complexities and Maximize Growth Potential

To thrive in the rapidly evolving vascular graft landscape, industry leaders must embrace a multifaceted strategic approach. Prioritizing research investments in hemocompatible coatings and bioreactor-based tissue conditioning will differentiate product offerings and address unmet clinical demands for small-diameter and complex anatomical applications. Similarly, establishing collaborative partnerships with raw material suppliers can mitigate future tariff risks and secure preferential pricing arrangements for critical polymer and biologic inputs.

In parallel, deploying advanced digital platforms that enhance supply chain transparency and forecast demand patterns will strengthen resilience against regulatory and logistic disruptions. Engaging with key opinion leaders and participating in standardized graft registries can accelerate clinical acceptance, inform iterative design improvements, and support reimbursement dossiers. Finally, optimizing distribution networks by blending established offline channels with agile e-procurement solutions will streamline access for ambulatory surgical centers and hospitals alike, ensuring broad market coverage and faster time to treatment.

Detailing the Rigorous Multi-Stage Research Methodology Employed to Ensure Accuracy, Objectivity, and Actionability of Vascular Graft Market Insights

The research underpinning these insights follows a rigorous, multi-stage methodology designed to ensure both credibility and practical relevance. Initial secondary research entailed a comprehensive review of peer-reviewed journals, regulatory filings, and patent databases to map material innovations and clinical evidence. This was complemented by in-depth primary interviews with cardiovascular surgeons, procurement officers, and regulatory specialists, capturing frontline perspectives on performance criteria and adoption barriers.

Subsequently, quantitative surveys of suppliers, distributors, and end-users validated core hypotheses regarding segmentation priorities and regional dynamics. Advanced data triangulation techniques were applied to reconcile disparities between public data sources and proprietary interviews, while expert advisory panels provided iterative feedback to refine assumptions and interpret emerging trends. Finally, all findings underwent stringent internal peer review to deliver a robust, objective, and actionable view of the vascular graft market, empowering stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vascular Graft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vascular Graft Market, by Product Type

- Vascular Graft Market, by Blood Vessel Diameter

- Vascular Graft Market, by Indication

- Vascular Graft Market, by End User

- Vascular Graft Market, by Distribution Channel

- Vascular Graft Market, by Region

- Vascular Graft Market, by Group

- Vascular Graft Market, by Country

- United States Vascular Graft Market

- China Vascular Graft Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Forward-Looking Perspectives to Chart the Future Course of Innovation in Vascular Graft Technologies

Bringing together technological, regulatory, and market dynamics, the analysis reveals a field on the cusp of significant transformation. Innovative materials and personalized graft designs promise to elevate clinical outcomes, while new tariff landscapes and supply chain complexities necessitate agile procurement strategies. Regional insights underscore the divergent pathways through which cardiovascular care is delivered and financed, highlighting both established centers of excellence and high-growth emerging markets.

As key players refine their R&D roadmaps and forge strategic alliances, the ability to anticipate shifts in segmentation demands and cross-regional adoption curves will define competitive leadership. By synthesizing these core findings, industry stakeholders can chart a clear path forward-one that balances innovation with operational resilience, aligns product advancements with evolving clinical workflows, and capitalizes on the most compelling growth opportunities across the global vascular graft ecosystem.

Secure Exclusive Access to Comprehensive Vascular Graft Market Intelligence by Connecting with Associate Director Ketan Rohom for Personalized Support

To gain unparalleled clarity on the competitive environment, technological breakthroughs, and emerging clinical practices within the vascular graft sector, it is essential to secure complete market intelligence. Ketan Rohom, serving as Associate Director of Sales & Marketing, stands ready to provide a tailored consultation that addresses your organization’s specific priorities, whether focused on product innovation, supply chain resilience, or regulatory readiness. By engaging with this expert guidance, stakeholders will not only access the most in-depth research report but also unlock strategic recommendations designed to accelerate growth and strengthen market positioning. Reach out today to initiate a customized discussion, confirm the report scope, and embark on a data-driven journey toward sustained success in vascular graft innovation.

- How big is the Vascular Graft Market?

- What is the Vascular Graft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?