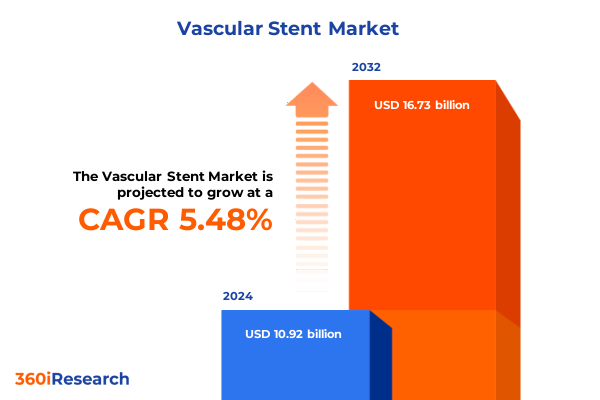

The Vascular Stent Market size was estimated at USD 11.49 billion in 2025 and expected to reach USD 12.09 billion in 2026, at a CAGR of 5.51% to reach USD 16.73 billion by 2032.

Unveiling the Pivotal Role of Advanced Vascular Stents in Contemporary Healthcare and the Emerging Dynamics Shaping Their Evolution

Vascular stents have emerged as a cornerstone of interventional therapy, transforming the management of occlusive and aneurysmal vascular disease through minimally invasive techniques. Over the past three decades, the evolution of stent design has reduced procedural complications, improved patient outcomes, and broadened indications beyond coronary interventions into peripheral and gastrointestinal applications. As clinicians and device innovators strive to elevate the standard of care, stents have become more than simple scaffolds-they now incorporate drug therapies, novel materials, and advanced delivery platforms that respond dynamically to the vascular environment.

In this complex ecosystem, stakeholders across the value chain-manufacturers, healthcare providers, payers, and patients-must navigate a rapidly shifting landscape. Regulatory scrutiny has intensified, prompting companies to invest heavily in clinical evidence and post‐market surveillance. Simultaneously, emerging economies are building out advanced catheterisation laboratories and expanding reimbursement schemes to accommodate state‐of‐the‐art therapies. Taken together, these developments underscore the critical importance of understanding the technical advances, market drivers, and cross‐border influences that will define the next chapter of vascular stent innovation.

Exploring the Transformative Shifts Revolutionizing Vascular Stent Technology Delivery Systems and Clinical Applications Worldwide

The vascular stent sector is undergoing profound transformation, driven by converging technological innovations and evolving clinical requirements. Drug‐eluting stents, once a niche offering, have become the standard of care for coronary interventions, prompting parallel research into polymer coatings and next‐generation drug formulations that mitigate restenosis without compromising healing. At the same time, self‐expanding stents have gained traction in peripheral artery disease, thanks to refined nitinol alloys and geometric designs that optimise flexibility and reduce vessel trauma.

Beyond core stent technologies, novel delivery systems are redefining procedural precision. Enhanced imaging integration, including intravascular ultrasound and optical coherence tomography, guides real‐time deployment and facilitates personalised sizing. Meanwhile, the advent of bioresorbable scaffold platforms, powered by biodegradable polymers, promises a temporary support structure that dissolves after vessel remodelling, potentially reducing long‐term complications. Integration of digital health tools and artificial intelligence into procedural workflows is further enabling predictive analytics for patient selection and long‐term monitoring. These transformative shifts are converging to create a more adaptable, data‐driven vascular stent landscape that addresses the full spectrum of clinician and patient needs.

Assessing the Cumulative Impact of 2025 United States Tariffs on the Global Vascular Stent Ecosystem and Supply Chain Dynamics

In early 2025, the United States government implemented a series of targeted tariffs on imported medical device components, including specialty metal alloys and high‐performance polymers integral to vascular stent manufacturing. The policy, designed to encourage domestic supply chain resilience, has exerted multifaceted pressures across the ecosystem. Manufacturers have faced immediate increases in raw material costs, prompting renegotiation of supplier contracts and strategic stockpiling to hedge against further tariff escalations.

The ripple effects of these measures extend to pricing dynamics and procurement practices within healthcare delivery systems. As device makers adjust list prices to absorb higher input expenses, hospitals and ambulatory surgical centres are under pressure to optimise procedural efficiency and negotiate value‐based pricing agreements. Concurrently, some leading innovators have accelerated investments in local production facilities to mitigate tariff exposure, while others are exploring joint ventures with North American alloy producers and polymer specialists. Ultimately, the 2025 tariff regime is reshaping procurement strategies, supply chain geographies, and cost structures, compelling stakeholders to balance short‐term operational impacts with long‐term resilience objectives.

Uncovering Key Segmentation Insights Across Product Types Materials Delivery Systems Applications and End Users in the Vascular Stent Market

In examining the vascular stent industry through the lens of its core segments, the dichotomy between balloon‐expandable stents and self‐expanding stents reveals distinct clinical and commercial trajectories. Balloon‐expandable options continue to dominate coronary interventions, offering precise radial force that mimics vessel architecture, whereas self‐expanding designs are increasingly preferred in tortuous peripheral anatomy due to their conformability and chronic outward force.

Material innovation further differentiates market offerings, as metallic stents maintain leadership with cobalt‐chromium and platinum‐chromium alloys prized for durability. However, the maturation of polymeric stents-particularly those leveraging biodegradable polymers-has introduced a paradigm shift, with bioresorbable scaffolds aiming to minimise long‐term implant residue and reduce the risk of late complications. Non‐biodegradable polymeric platforms are also evolving, focusing on enhanced biocompatibility and controlled drug elution.

Delivery systems span bare metal constructs for cost‐sensitive environments, covered stents that reinforce vessel walls against aneurysmal dilation, and drug‐eluting stents that combine mechanical support with antiproliferative therapy to prevent restenosis. Application areas range from established use in coronary artery disease to expanding roles in gastrointestinal disease and peripheral artery disease, where lower extremity interventions are accelerating research into stent design while upper extremity procedures are carving out specialized niches. Finally, the complexity of adoption among ambulatory surgical centres, cardiac centres, and hospitals underscores the need for tailored value propositions, as each end user type navigates unique reimbursement pathways, procedural volumes, and capital expenditure constraints.

This comprehensive research report categorizes the Vascular Stent market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Delivery System

- Application

- End User

Revealing Key Regional Insights Highlighting Distinctive Trends and Market Drivers in the Americas Europe Middle East Africa and Asia Pacific

Geographic dynamics in the vascular stent industry offer a window into how regional healthcare infrastructures, regulatory frameworks, and patient demographics drive innovation and adoption. In the Americas, established reimbursement mechanisms and high procedural volumes create an environment where incremental product enhancements and evidence‐based differentiation fuel competitive advantage. The United States in particular remains a global bellwether, with premium pricing models sustaining investments in next‐generation drug coatings and scaffold materials.

Moving to Europe Middle East & Africa, regulatory harmonisation efforts within the European Union coexist with nuanced national approval pathways, which together form a complex mosaic that manufacturers must navigate. Innovation hubs in Western Europe emphasise clinical trial excellence, while emerging markets in the Middle East and North Africa seek cost‐effective solutions that align with public health priorities and expanding vascular care networks.

In Asia‐Pacific, surging incidence of cardiovascular disease is paralleled by aggressive infrastructure development, especially in China and India, where catheterisation lab rollouts and local manufacturing incentives accelerate adoption. Price sensitivity and varying reimbursement landscapes underscore the need for adaptable product portfolios and tiered pricing models. Across these three regions, companies must leverage region‐specific insights to align their commercial strategies, balancing standardised global offerings with tailored local approaches.

This comprehensive research report examines key regions that drive the evolution of the Vascular Stent market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Landscape of Leading Companies Innovating Vascular Stent Solutions Through Partnerships Product Development and Market Expansion

At the forefront of the global vascular stent arena are companies differentiating through integrated portfolios that span core scaffold technologies, advanced coatings, and complementary procedural tools. Major players have harnessed strategic partnerships to strengthen their presence in critical segments: some have acquired specialised polymer developers to fast‐track biodegradable scaffold programmes, while others have formed alliances with imaging and digital health firms to enhance deployment precision.

Innovation pipelines are being bolstered by targeted R&D investments, particularly in drug‐eluting bioresorbable stents and next‐generation covered platforms designed for complex aneurysmal conditions. Competitive dynamics have also spurred joint ventures aimed at capturing high‐growth emerging markets; these collaborations blend global technology leadership with local manufacturing expertise to meet price and regulatory requirements. Additionally, several leading vendors are expanding shared‐services networks that support real‐time clinical data collection, enabling post‐market surveillance and differentiated value propositions. Collectively, these strategic moves reveal a landscape defined by collaborative innovation, cross‐segment diversification, and a relentless focus on elevating clinical outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vascular Stent market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Amaranth Medical, Inc.

- Artivion Inc.

- B. Braun SE

- Becton, Dickinson and Company

- Biotronik SE & Co. KG

- Blue Sail Medical Co., Ltd

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Group Incorporated

- Elixir Medical Corporation

- Endologix LLC

- iVascular, S.L.U

- Kaneka Corporation

- Kyoto Medical Planning Co., Ltd.

- Lepu Medical Technology(Beijing)Co.,Ltd.

- Lombard Medical Ltd.

- Medtronic PLC

- Meril Life Sciences Pvt. Ltd

- Microport Scientific Corporation

- Otsuka Medical Devices Co., Ltd.

- Purple MicroPort Cardiovascular Pvt. Ltd

- Sahajanand Medical Technologies Limited

- Stryker Corporation

- Terumo Corporation

- Translumina GmbH

- W. L. Gore & Associates, Inc.

Actionable Recommendations for Industry Leaders to Address Regulatory Shifts Technological Advances and Competitive Pressures in Vascular Stents

To thrive in the evolving vascular stent ecosystem, industry leaders must adopt a multifaceted approach that addresses regulatory, technological, and competitive imperatives. First, diversifying the supply chain through strategic alliances and regional manufacturing hubs will mitigate tariff exposure and ensure continuity of critical material supplies. In parallel, deepening engagement with regulatory bodies by participating in harmonisation initiatives can streamline approval processes and reduce time‐to‐market.

Second, accelerating innovation in biodegradable polymers and drug‐eluting coatings requires collaborative research agreements with material science experts and academic institutions. Such partnerships can expedite translational research and enhance the efficacy and safety profiles of next‐generation stents. Third, forging value‐based contracting models with payers and health systems will align product pricing with demonstrated clinical benefits, fostering long‐term adoption despite cost pressures. Finally, establishing a robust digital infrastructure for procedural guidance and patient follow‐up-leveraging artificial intelligence and cloud‐based analytics-will enhance real‐world data capture and differentiate product offerings in an increasingly outcomes‐driven marketplace.

Detailing Rigorous Research Methodology Incorporating Data Collection Analytical Frameworks and Validation Procedures for Vascular Stent Insights

This study synthesises insights through a rigorous, mixed‐methods research framework designed to maximise validity and relevance. Extensive secondary research formed the foundation, encompassing peer‐reviewed journals, regulatory filings, patent databases, and clinical trial repositories. Complementing this, primary research was conducted via in‐depth interviews with a c‐suite executives, interventional cardiologists, vascular surgeons, procurement officers, and payers across key markets. These expert dialogues enriched our understanding of real‐world challenges, adoption dynamics, and emerging unmet needs.

Quantitative data was triangulated across multiple sources to ensure consistency, while qualitative findings underwent thematic analysis to identify recurring trends and strategic imperatives. The research team applied a structured validation process, cross‐referencing stakeholder feedback with historical market movements and supply chain developments. Furthermore, a peer review mechanism ensured methodological rigor and reduced potential bias. This comprehensive approach delivers a multidimensional perspective on the vascular stent market, empowering decision‐makers with both breadth and depth of insight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vascular Stent market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vascular Stent Market, by Product Type

- Vascular Stent Market, by Material

- Vascular Stent Market, by Delivery System

- Vascular Stent Market, by Application

- Vascular Stent Market, by End User

- Vascular Stent Market, by Region

- Vascular Stent Market, by Group

- Vascular Stent Market, by Country

- United States Vascular Stent Market

- China Vascular Stent Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Critical Findings and Strategic Perspectives to Illuminate the Future Trajectory of Vascular Stent Innovations and Market Dynamics

The confluence of material innovations, regulatory shifts, and regional market dynamics underscores the transformative trajectory of the vascular stent industry. Examining segmentation layers reaffirmed the strategic importance of customised product offerings-from drug‐eluting scaffolds to bioresorbable alternatives-tailored to diverse clinical applications across coronary, peripheral, and gastrointestinal interventions. Regional assessments highlighted the critical interplay between reimbursement models, manufacturing capabilities, and market readiness, informing strategic priorities for global and local players alike.

As leading companies navigate competitive pressures and emerging tariff regimes, the value of a deliberate, data‐driven strategy becomes clear. Prioritising collaborative R&D, supply chain resilience, and value‐based contracting will be essential to capturing growth opportunities and sustaining clinical excellence. Ultimately, stakeholders equipped with nuanced insights and actionable recommendations can confidently chart a course that balances innovation with operational agility, positioning their organisations to excel in the next phase of vascular stent evolution.

Connect with Ketan Rohom to Unlock Comprehensive Vascular Stent Market Insights and Secure the Definitive Market Research Report for Strategic Advancement

For more personalised insights and to gain immediate access to the definitive market research report on vascular stents, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan will provide you with tailored guidance on how the comprehensive analysis can support your strategic initiatives and investment decisions. Discover how this in-depth research can inform your competitive positioning, guide your innovation roadmap, and fortify your market entry strategies. Connect with Ketan to secure the report, unlock exclusive data visualisations, and tap into expert commentary that will empower your organisation to stay ahead in the evolving vascular stent landscape

- How big is the Vascular Stent Market?

- What is the Vascular Stent Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?