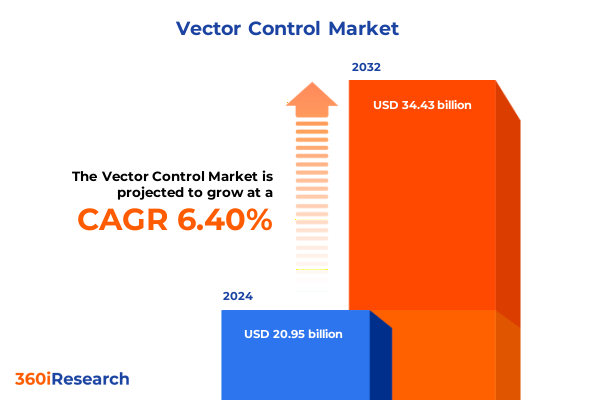

The Vector Control Market size was estimated at USD 22.22 billion in 2025 and expected to reach USD 23.58 billion in 2026, at a CAGR of 6.45% to reach USD 34.43 billion by 2032.

Uncovering the Critical Role of Innovative Vector Control Strategies in Safeguarding Public Health, Agricultural Resilience, and Community Well-Being Worldwide

The accelerating complexity of global vector control challenges demands a thorough appreciation of the interwoven factors shaping public health, agricultural resilience, and environmental stewardship. As vector-borne diseases persist in resurfacing across urban and rural landscapes alike, stakeholders must navigate an intricate web of biological, chemical, physical, and regulatory considerations to protect populations and crops. In this context, a robust executive summary serves as a compass, distilling critical trends and inflection points that are redefining the contours of the vector control sector and framing the priorities for strategic investment.

Transitioning from the era of one-size-fits-all insecticidal approaches, the industry now witnesses a paradigm shift towards integrated vector management that harmonizes advanced biocontrol agents with targeted chemical interventions and environmental engineering measures. This evolution reflects a heightened regulatory scrutiny, shifting consumer preferences for safer alternatives, and the imperative to curb resistance development in vector populations. Against this backdrop, the insights presented here aim to illuminate the transformative shifts, tariff implications, granular segmentation drivers, and region-specific nuances that will guide decision-makers through the unfolding vector control landscape.

Exploring the Convergence of Technological Innovation, Regulatory Reset, and Environmental Imperatives Redefining Vector Control Practices and Outcomes Across the Globe

Over the past decade, the vector control industry has undergone a fundamental reorientation driven by technological breakthroughs, evolving regulatory mandates, and mounting environmental imperatives. This transformation has been marked by a progression from reliance on broad-spectrum chemical insecticides to the adoption of sophisticated genetic, biopesticide, and remote monitoring solutions. Pioneering approaches such as sterile insect techniques, RNA interference, and precision-release aerial platforms exemplify the integration of digital and biological tools to suppress vector populations with minimal non-target impacts. Simultaneously, regulatory authorities in key markets are introducing more stringent evaluation frameworks that prioritize human and ecosystem safety while incentivizing novel active ingredients and sustainable formulations.

Moreover, increasing global awareness of biodiversity conservation has prompted industry leaders to align with environmental stewardship goals, embedding circular economy principles into product design and disposal protocols. This shift is reinforced by collaborative research consortia that pool resources to accelerate the development of bio-based larvicides and airborne repellents. As a result, the landscape of vector control is being redefined by a convergence of cross-disciplinary innovation, policy recalibration, and stakeholder engagement models that emphasize transparency, resilience, and shared value creation.

Assessing the Multifaceted Impact of New United States Tariffs Imposed in 2025 on Supply Chains, Pricing Dynamics, and Industry Competitiveness in Vector Control

The implementation of new tariff measures by the United States in early 2025 has introduced a multifaceted impact on the vector control ecosystem, spanning raw material sourcing, product importation costs, and downstream pricing dynamics. Manufacturers reliant on intermediates such as active ingredient precursors now contend with elevated procurement expenses that have necessitated the reevaluation of supply chain strategies and inventory management protocols. In response, several leading producers have announced the diversification of procurement lanes by forging partnerships with regional suppliers and exploring in-country production capabilities to mitigate tariff exposure and ensure consistent availability of critical chemistries.

Concurrently, distributors and end-users are adapting to a recalibrated pricing environment by renegotiating long-term contracts and optimizing order volumes to capture economies of scale. The tariff-induced cost inflation has also accelerated interest in higher-margin, non-chemical solutions that can circumvent import duties altogether. Consequently, the sector is experiencing an uptick in co-development agreements between technology providers and end-market incumbents, aiming to localize innovation, share risk, and streamline regulatory approvals. As these strategic shifts take root, the industry is poised to emerge with more resilient, collaborative frameworks capable of weathering future trade policy fluctuations.

Unveiling Critical Segmentation Insights Spanning Control Methods, Vector Types, Formulations, Application Settings, and Sales Channels to Drive Strategic Decision Making

An in-depth examination of control methods reveals that biological control agents, chemical interventions, environmental management coupled with source reduction measures, and mechanical and physical barriers each play distinct roles in shaping market trajectories. Within chemical approaches, differentiated categories such as insecticides designed for broad contact suppression, specialized larvicides targeting aquatic breeding sites, and repellents for personal protection highlight the nuanced application needs across end-use scenarios. Meanwhile, mechanical innovations-ranging from fine mesh insect nets to strategic sealants and custom-engineered traps-have evolved to deliver effective barriers without relying on active chemistries, catering to both urban residential settings and agricultural sites.

When analyzing vector-specific preferences, the prominence of mosquito control solutions is balanced by sustained demand for fly and rodent management strategies, as well as specialized tick mitigation services. Formulation complexity further emerges as a decisive factor, with liquid concentrates offering rapid deployment in public health emergencies and solid forms providing longer shelf stability for agricultural distributors. Application contexts span crop protection and livestock management under agricultural use, hygiene maintenance within hospitality and manufacturing environments, targeted interventions for dengue, malaria, and Zika virus control in the public health sphere, and direct consumer solutions in residential settings. Sales channel evaluations indicate that traditional pharmacy chains and large-format supermarkets remain critical for retail penetration, while digital platforms and dedicated company websites are driving direct engagement and customized service offerings.

This comprehensive research report categorizes the Vector Control market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Control Methods

- Vector Type

- Formulation

- Application

- Sales Channel

Decoding Regional Vector Control Dynamics by Examining Trends, Challenges, and Opportunities Across the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics within the vector control marketplace are characterized by both shared challenges and distinctive opportunities across the Americas, Europe Middle East and Africa, and Asia Pacific zones. In the Americas, rising urbanization and variable climate patterns have intensified mosquito-borne outbreaks, prompting federated public health initiatives and accelerated adoption of integrated environmental management programs. At the same time, the continental preference for high-volume liquid larvicide applications has spurred manufacturers to tailor concentrate formulations that align with municipal spraying equipment.

In the Europe Middle East and Africa region, stringent regulatory frameworks and heightened environmental standards drive adoption of bio-pesticides and mechanical controls that minimize ecological footprints. Meanwhile, localized R&D collaborations, particularly in disease-endemic areas, are fostering novel biocontrol solutions optimized for regional vector species. Conversely, the Asia Pacific landscape is defined by densely populated urban centers grappling with periodic dengue surges. Here, the demand for personal protection repellents and targeted residual insecticide treatments is being complemented by smartphone-enabled surveillance and analytics tools that empower rapid response teams. Across each region, cross-border knowledge exchange and funding mechanisms are catalyzing the diffusion of best practices while underscoring the necessity for context-driven deployment strategies.

This comprehensive research report examines key regions that drive the evolution of the Vector Control market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives, Innovation Portfolios, and Collaborative Partnerships of Leading Global Companies Shaping the Vector Control Sector’s Evolution

Leading companies in the vector control domain are distinguishing themselves through strategic investments in R&D, cross-sector partnerships, and portfolio diversification. Established agrochemical players have leveraged their formulation expertise to expand into public health segments, while biotech startups are advancing proprietary microbial agents that offer targeted action with minimal collateral impact. Collaboration between pharmaceutical firms and environmental service providers has also intensified, as integrated service models emerge to deliver end-to-end solutions encompassing pre-emptive site assessments, ongoing monitoring, and remediation services.

At the same time, digital transformation agendas have elevated the importance of data-driven platforms that integrate IoT sensors, geospatial mapping, and predictive modeling to anticipate vector hotspots. Several top-tier organizations have piloted subscription-based programs that bundle automated traps with cloud-based dashboards, enabling real-time decision support for municipal authorities and large estates. Concurrently, strategic acquisitions of specialty chemical manufacturers and investments in localized production facilities demonstrate a commitment to supply chain resilience. Taken together, these initiatives highlight the sector’s gravitation toward convergence between traditional vector control practices and next-generation tech-enabled methodologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vector Control market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adama Agricultural Solutions Ltd.

- Albaugh, LLC

- BASF SE

- Bayer AG

- Bonide Products, Inc.

- Central Garden & Pet Company

- Corteva, Inc.

- Ecolab Inc.

- Ensystex, Inc.

- FMC Corporation

- Knockout Pest Control

- Lonza Group AG

- Merck KGaA

- Mitsui Chemicals Agro, Inc.

- NEOGEN Corporation

- Nufarm Limited

- Rentokil Initial plc

- Rollins, Inc.

- SC Johnson & Son, Inc.

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- The Clarke Group, Inc.

- UPL Limited

- Valent BioSciences LLC

Delivering Targeted and Actionable Recommendations to Guide Industry Leaders in Enhancing Operational Agility, Collaboration, and Sustainable Vector Control Outcomes

Industry leaders seeking to strengthen their market position should first prioritize the integration of cross-functional teams to foster collaboration among R&D, regulatory affairs, and commercial divisions. By aligning these capabilities, organizations can accelerate the translation of novel active ingredients and mechanical designs into market-ready solutions that comply with evolving safety standards. Additionally, establishing flexible procurement frameworks with multiple regional suppliers will mitigate exposure to trade policy shifts and logistical disruptions.

Moreover, investing in pilot projects that co-develop localized biocontrol strategies with public health agencies can serve as viable proof points for broader rollout while cultivating stakeholder trust. Equally important is the deployment of digital surveillance and analytics platforms that aggregate entomological data with environmental parameters, thereby enabling proactive interventions rather than reactive responses. Finally, embracing circular economy concepts-such as repurposing spent nets and recycling residual chemical containers-can differentiate brands committed to sustainability and resonate with increasingly eco-conscious end-users.

Detailing a Robust Multi-Phase Research Methodology Incorporating Comprehensive Secondary Research, In-Depth Expert Consultations, and Rigorous Data Triangulation Protocols for Vector Control Analysis

The research underpinning this analysis was constructed through a meticulously designed, multi-phase methodology that ensured comprehensive coverage and data integrity. Initially, extensive secondary research drew from peer-reviewed journals, regulatory filings, and specialized technical publications to map the current state of vector control practices and innovation pipelines. Building upon this foundation, in-depth consultations were conducted with a cross-section of domain experts, including entomologists, environmental engineers, and policy analysts, to validate key assumptions and identify emergent trends.

Subsequently, quantitative data points were triangulated through comparative assessment of trade data, patent filings, and company disclosures to ascertain supply chain dynamics and competitive positioning. Qualitative insights were enriched by structured interviews with senior executives at major vector control firms to capture firsthand perspectives on strategic priorities. Finally, all findings underwent rigorous peer review by an independent panel of subject matter specialists, ensuring that conclusions and recommendations rest on a robust evidentiary base and reflect the latest regulatory and technological developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vector Control market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vector Control Market, by Control Methods

- Vector Control Market, by Vector Type

- Vector Control Market, by Formulation

- Vector Control Market, by Application

- Vector Control Market, by Sales Channel

- Vector Control Market, by Region

- Vector Control Market, by Group

- Vector Control Market, by Country

- United States Vector Control Market

- China Vector Control Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Drawing Strategic Conclusions from Global Vector Control Analysis to Illuminate Future Directions, Address Market Imperatives, and Empower Stakeholder Decision Making

This comprehensive analysis converges on three overarching conclusions regarding the trajectory of the global vector control sector. First, the ascendance of integrated management approaches combining biological, mechanical, and digital components represents a watershed moment, offering scalable, environmentally conscious alternatives to traditional chemical-centric models. Second, the strategic recalibration of supply chains in response to United States tariff impositions underscores the imperative for geographic diversification and local production partnerships to safeguard continuity and cost competitiveness. Third, the rich tapestry of regional dynamics-from urban mosquito prevalence in the Americas to stringent biocontrol regulations in Europe Middle East and Africa and technology-enabled surveillance in Asia Pacific-highlights the need for tailored strategies that align with distinct ecological and policy environments.

Taken together, these findings illuminate a sector at the cusp of sustained innovation, propelled by collaborative research, cross-industry alliances, and digital transformation. As stakeholders navigate this evolving landscape, the emphasis must remain on agility, data-driven decision making, and responsible stewardship to ensure vector control interventions continue to deliver durable public health and agricultural benefits.

Engage with Ketan Rohom to Elevate Strategic Decisions with a Tailored Vector Control Market Research Report

Discover unparalleled depth and clarity by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive vector control market research report today. This report empowers your organization with nuanced insights into evolving regulatory landscapes, segmentation drivers, regional dynamics, and competitive strategies that underpin effective decision making. By connecting with Ketan Rohom, you’ll gain personalized guidance on tailoring the research deliverables to your strategic priorities, from granular analysis of control methods to region-specific opportunities and tariff impacts. This tailored approach ensures your team can swiftly translate intelligence into actionable initiatives, whether optimizing product portfolios, negotiating supply chain resilience against tariff shifts, or forging collaborative partnerships with leading innovators. Initiating this engagement will unlock direct access to proprietary data, expert commentary, and a bespoke consultation that aligns with your timeline and objectives. Don’t miss the opportunity to stay ahead of market disruptions and accelerate your vector control strategy with confidence and precision; reach out to Ketan Rohom now to transform insight into impact and drive sustainable outcomes.

- How big is the Vector Control Market?

- What is the Vector Control Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?