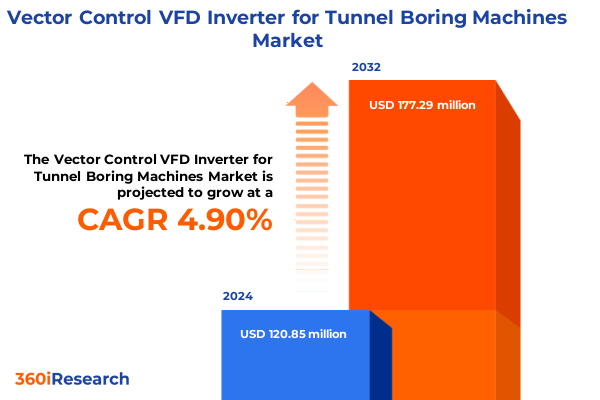

The Vector Control VFD Inverter for Tunnel Boring Machines Market size was estimated at USD 126.00 million in 2025 and expected to reach USD 132.69 million in 2026, at a CAGR of 4.99% to reach USD 177.29 million by 2032.

Unlocking the Strategic Importance of Vector Control VFD Inverters in Elevating Tunnel Boring Machine Performance and Operational Reliability

The integration of Vector Control Variable Frequency Drive (VFD) inverters within Tunnel Boring Machines has become an indispensable component for achieving precise motor control, enhanced operational efficiency, and extended equipment longevity. By leveraging advanced algorithms that continuously adjust torque and speed, these inverters enable TBMs to adapt to complex geological conditions in real time, minimizing wear on critical components and reducing energy consumption. Such adaptability is particularly vital as tunneling projects increasingly encounter heterogeneous ground compositions and unpredictable subterranean challenges, demanding versatile drive systems to maintain performance benchmarks.

Moreover, the convergence of predictive maintenance solutions with Internet of Things (IoT) platforms has transformed how TBM fleets are monitored and managed. Real-time telemetry from VFDs provides actionable data on temperature, current harmonics, and vibration patterns, empowering operators to anticipate potential failures and schedule interventions before costly downtime occurs. This proactive maintenance paradigm not only safeguards project timelines but also optimizes resource allocation, reinforcing the strategic importance of vector control VFD inverters in modern tunneling operations.

Revolutionary Shifts Shaping the Future of Tunnel Boring Machine Inverter Technologies Through Digitalization and Advanced Semiconductors

Over the past several years, the tunnel boring industry has experienced a seismic shift driven by the advent of smart manufacturing and advanced semiconductor materials. The integration of Industry 4.0 principles has enabled the deployment of digital twins and edge computing solutions that deliver real-time analytics on motor performance, thermal characteristics, and power factor correction. These innovations allow VFDs to execute field-oriented control strategies with unprecedented precision, ensuring consistent torque delivery even under fluctuating loads. Enhanced by silicon carbide (SiC) and gallium nitride (GaN) semiconductors, modern inverters achieve higher switching frequencies, reduced losses, and compact form factors-factors essential for confined TBM operations.

Simultaneously, cloud-based monitoring platforms are empowering predictive maintenance frameworks that preempt unscheduled downtimes. By correlating drive performance metrics with environmental variables, operators can identify degradation trends and intervene before mechanical failures emerge. Regulatory mandates around energy efficiency have further catalyzed the adoption of VFD topologies capable of near-unity power factor correction, bolstering sustainability credentials and total cost of ownership profiles. Together, these transformative shifts are setting new performance and reliability benchmarks, reshaping how TBM inverters are designed and deployed across global tunneling initiatives.

Analyzing the Comprehensive Impact of Escalating U.S. Tariffs on Vector Control VFD Inverter Supply Chains and Cost Structures in 2025

Since January 1, 2025, U.S. Section 301 tariffs on semiconductors have doubled to 50 percent, directly impacting the cost base for Vector Control VFD inverters that rely on advanced IGBTs and power modules. Concurrently, Section 232 duties on steel and aluminum products at 25 percent impose additional burdens on enclosure fabrication and heat-sink manufacturing. These combined levies have driven components sourcing costs upward by an estimated 10 to 15 percent, compelling inverter manufacturers to reassess supply chain strategies and explore tariff-mitigating measures such as country-of-origin diversification and local assembly.

The reinstatement of exclusions on certain imported motors and machinery has provided marginal relief, yet the cumulative impact on production margins remains significant. Many suppliers are negotiating long-term contracts or shifting to alternative regional suppliers to hedge against volatility. The net result is a recalibration of price structures-contractors are facing higher unit costs, which in turn exerts downward pressure on adoption rates for premium inverter solutions. To maintain market competitiveness, vendors must balance cost pass-through with value-added services such as remote diagnostics and performance guarantees, ensuring that end users continue to realize efficiency gains despite elevated duty expenses.

Integrating Inverter Types, Control Voltages, Machine Classifications and End User Demands to Decode Market Segmentation Insights

The market’s segmentation by inverter type reveals a diverse technology landscape where Pulse Width Modulation drives-sub‐categorized into Sine Pulse Width Modulation and Space Vector Pulse Width Modulation-deliver superior torque precision for most TBM applications. Regenerative inverters, encompassing braking choppers and regenerative converters, enable energy recovery during deceleration phases, aligning with sustainability mandates. Meanwhile, Current Source and Voltage Source inverters address specific stability and fault-tolerance requirements in extreme drilling environments.

Control voltage segmentation further refines this landscape: Low Voltage drives are implemented above and below the 600 V threshold, catering to smaller TBMs and auxiliary equipment, while Medium Voltage solutions in the 3.3–6.6 kV and 6.6–11 kV tiers power large-diameter, high-torque machines. Machine type classification underscores the distinct inverter demands of Double Shield, Earth Pressure Balance, Hard Rock Shield, and Slurry Shield TBMs, each with unique load profiles and feedback requirements. Finally, end-user segmentation differentiates the private and public sector arms of construction companies from specialized mining operators and tunnel operators, each prioritizing customized drive features-from ruggedized enclosures to advanced remote diagnostics-based on operational scale and lifecycle objectives.

This comprehensive research report categorizes the Vector Control VFD Inverter for Tunnel Boring Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Inverter Type

- Machine Type

- End User

Comparative Analysis of Americas, EMEA and AsiaPacific Regions Revealing Distinct Growth Drivers and Infrastructure Development Patterns

In the Americas, robust infrastructure funding under federal initiatives has propelled a pipeline of nearly 30 large-scale TBM projects worth approximately $50 billion, including marquee programs such as the Hudson Tunnel Project and Silicon Valley Phase II, driving demand for energy-efficient VFD solutions that can navigate diverse North American geology. The recent ASCE Report Card’s acknowledgment of incremental improvements in U.S. infrastructure further underscores the imperative for advanced drive systems capable of meeting stringent resilience and performance standards.

Europe, Middle East & Africa (EMEA) confronts stringent energy efficiency directives-such as the EU’s Eco-Design framework-spurring wide-scale retrofits of TBM fleets with vector control VFD inverters that deliver near-unity power factor under variable loads. Landmark projects like London’s Crossrail have validated these solutions, demonstrating energy savings of up to 30 percent and significant reductions in maintenance cycles. Meanwhile, the Middle East’s metro expansions and Africa’s mining-driven tunneling projects are leveraging modular, high-voltage drive architectures to optimize productivity in megaproject environments.

Asia-Pacific remains the epicenter of TBM innovation, underpinned by mega-projects such as China’s Haizhu Bay Tunnel, where super-large-diameter slurry TBMs equipped with compact, high-power VFD inverters achieved breakthrough rates exceeding 300 meters per month. China’s emergence as a leading exporter of ultra-large shield TBMs underscores the region’s dominance in drive manufacturing and OEM integration, while India’s bullet train tunnels and Australia-bound shield machines further demonstrate the global reach of Asia-Pacific’s tunneling ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Vector Control VFD Inverter for Tunnel Boring Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Providers of Vector Control VFD Inverters Demonstrating Technological Differentiation and Market Leadership

ABB, headquartered in Switzerland, is a powerhouse in industrial automation and power electronics, offering a comprehensive range of low-voltage and medium-voltage VFD solutions under its Motion business segment. Its digital powertrain platform integrates remote monitoring, predictive analytics, and energy management, enabling end users to realize measurable efficiency gains and reduce lifecycle costs.

Siemens, based in Germany, commands significant market share through its SINAMICS series, leveraging advanced IoT connectivity and AI-driven maintenance to deliver high-performance drives for TBM applications. The company’s focus on electrification and automation is bolstered by strategic acquisitions and continuous enhancement of cloud-enabled diagnostics, ensuring superior uptime and system reliability.

Schneider Electric, a leading French energy management specialist, provides its Altivar line of VFD inverters with integrated EcoStruxure solutions that facilitate seamless integration across multiple tunneling assets. With an extensive global distribution network and sustained R&D investment, Schneider has secured a strong foothold in both retrofit and greenfield projects, emphasizing sustainability and operational scalability.

Danfoss and Rockwell Automation round out the list of top players, offering modular drive platforms and robust control software tailored to the high-torque, dynamic load profiles of TBMs. Their complementary expertise in hydraulics, automation, and electrification enhances the competitive landscape, driving continuous innovation in vector control inverter technology.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vector Control VFD Inverter for Tunnel Boring Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Danfoss A/S

- Delta Electronics Inc

- Eaton Corporation

- Emerson Electric Co

- Fuji Electric Co Ltd

- General Electric Company

- Hitachi Ltd

- Honeywell International Inc

- Inovance Technology

- Johnson Controls International plc

- Mitsubishi Electric Corporation

- Nidec Corporation

- Parker Hannifin Corp

- Rockwell Automation Inc

- Schneider Electric SE

- Siemens AG

- Sumitomo Heavy Industries Ltd

- TMEIC

- Toshiba International Corporation

- WEG SA

- Yaskawa Electric Corporation

Delivering Strategic Recommendations to Foster Innovation Adoption, Streamline Supply Chains and Enhance Competitiveness in the VFD Inverter Market

Industry leaders should prioritize the deployment of smart, IoT-enabled drive platforms that deliver real-time performance data and predictive maintenance alerts. By integrating digital twins and edge analytics, organizations can unlock deeper operational insights, minimize unplanned outages, and optimize project timelines. Concurrently, establishing diversified supply chains-spanning regional fabrication hubs and modular subassembly partners-will mitigate tariff exposure and ensure resilient production workflows.

To capture the full value of advanced inverter technologies, stakeholders must invest in workforce upskilling programs focused on digital control systems, power electronics, and data interpretation. Partnerships with OEMs and technology providers can facilitate knowledge transfer and accelerate the adoption curve. Finally, adopting modular, scalable drive architectures will enable rapid configuration changes across TBM fleets, reducing integration complexity and supporting agile responses to evolving project demands.

Outlining a Comprehensive Research Methodology Integrating Primary Interviews, Secondary Data Analysis and Rigorous Validation Protocols

This research combines extensive secondary analysis with targeted primary engagements to ensure data integrity and contextual relevance. Secondary sources include public filings, tariff schedules, industry journals, and regulatory databases, providing a solid foundation for market dynamics assessment. Primary research efforts comprised in-depth interviews with TBM OEM engineers, VFD suppliers, project consultants, and tier-one tunnel operators, capturing diverse perspectives on technology adoption and procurement criteria.

Data triangulation was employed to reconcile quantitative findings with qualitative insights, supported by statistical validation techniques and cross-referencing against historical benchmarks. A stringent quality control protocol-encompassing source verification, consistency checks, and peer review-safeguards the accuracy of our conclusions. Research limitations are acknowledged, including the evolving nature of tariff regimes and potential delays in project commissioning, which have been addressed through sensitivity analyses and scenario planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vector Control VFD Inverter for Tunnel Boring Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vector Control VFD Inverter for Tunnel Boring Machines Market, by Inverter Type

- Vector Control VFD Inverter for Tunnel Boring Machines Market, by Machine Type

- Vector Control VFD Inverter for Tunnel Boring Machines Market, by End User

- Vector Control VFD Inverter for Tunnel Boring Machines Market, by Region

- Vector Control VFD Inverter for Tunnel Boring Machines Market, by Group

- Vector Control VFD Inverter for Tunnel Boring Machines Market, by Country

- United States Vector Control VFD Inverter for Tunnel Boring Machines Market

- China Vector Control VFD Inverter for Tunnel Boring Machines Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Summarizing Core Insights and Strategic Imperatives Driving the Adoption of Vector Control VFD Inverters in Modern Tunnel Boring Operations

The escalating complexity of tunneling projects demands VFD inverters that blend precision vector control, energy efficiency, and robust connectivity. Advanced semiconductor technologies, coupled with digitalization strategies, are redefining performance benchmarks by enabling real-time torque management and predictive maintenance frameworks. However, rising tariffs and supply chain constraints underscore the need for strategic sourcing and localized production models to maintain cost competitiveness.

As infrastructure spending accelerates across the Americas, EMEA, and Asia-Pacific, a nuanced understanding of regional drivers-from regulatory mandates to project scale-is crucial for tailored value propositions. Leading industrial players must leverage their technological strengths and global footprints while fostering agile, innovation-driven ecosystems. By aligning segmentation insights with actionable recommendations and rigorous market intelligence, stakeholders can navigate evolving market dynamics and capitalize on the growth opportunities that vector control VFD inverters present in the tunnel boring machine sector.

Connect with Associate Director Ketan Rohom to Secure Your Comprehensive Market Research Report and Accelerate Strategic Decision Making

To gain unparalleled insights into the evolving dynamics of the Vector Control VFD Inverter for Tunnel Boring Machines market-and to ensure your organization remains at the forefront of innovation-I invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise and deep understanding of global market forces will guide you through tailored solutions that align with your strategic goals. Reach out to him via LinkedIn or through the research services portal to discuss how this report can inform your next move. Empower your decision-making today by securing access to comprehensive analysis, practical recommendations, and actionable intelligence that will drive your competitive advantage.

- How big is the Vector Control VFD Inverter for Tunnel Boring Machines Market?

- What is the Vector Control VFD Inverter for Tunnel Boring Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?