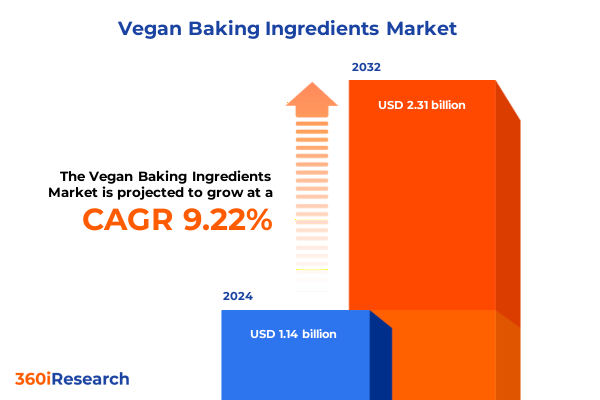

The Vegan Baking Ingredients Market size was estimated at USD 1.22 billion in 2025 and expected to reach USD 1.31 billion in 2026, at a CAGR of 9.50% to reach USD 2.31 billion by 2032.

Unveiling the Rising Tide of Vegan Baking Ingredients: Navigating an Era of Plant-Based Innovations and Consumer Demand in Contemporary Culinary Markets

As plant-based lifestyles transition from niche to mainstream, vegan baking ingredients stand at the forefront of culinary innovation and consumer demand. This introduction delves into the intersection of evolving dietary preferences, environmental consciousness, and the culinary creativity that fuels growth in the vegan baking segment. It explores the motivations driving consumers toward plant-derived ingredients, including health considerations, ethical values, and a desire for novel taste experiences.

In recent years, the bakery aisle has witnessed a transformation from conventional recipes reliant on animal-derived components to formulations driven by scientific breakthroughs in ingredient technology. Ingredient developers are responding with substitutes that replicate the texture, flavor, and functionality of traditional eggs, dairy products, and leavening agents without compromising on quality. These advancements have democratized access to vegan baked goods, enabling both artisanal and industrial producers to meet rising expectations for clean label and sustainable formulations.

Moving forward, the vegan baking ingredients landscape will be shaped by a dynamic interplay of consumer education, regulatory frameworks, and cross-industry collaboration. This section sets the stage for a deeper examination of the forces driving change, the implications of tariff policies, and the strategic pathways that will define success for stakeholders across the value chain.

Transformative Forces Shaping the Vegan Baking Landscape: From Clean Label Movement to Technological Advancements Driving Ingredient Innovation

The vegan baking market is undergoing transformative shifts driven by heightened consumer focus on health, sustainability, and ingredient transparency. Clean label trends have accelerated the replacement of artificial additives with recognizable, plant-based alternatives, catalyzing innovation across the spectrum of dairy, egg, fat, and flour substitutes. This movement toward cleaner formulations has spurred research into novel protein fortifiers derived from pulses, algae, and precision fermentation, resulting in textural and functional enhancements previously unattainable in vegan applications.

Simultaneously, technological advancements in processing and formulation are enabling more efficient extraction of functional plant proteins and fibers, reducing costs and improving sensory profiles. Emerging methods such as enzymatic modification and microencapsulation help stabilize volatile plant oils and enhance emulsification, strengthening the performance of butter and cream analogues. Additionally, digitalization of supply chains-from blockchain-enabled traceability to AI-driven demand forecasting-ensures that ingredient quality and availability align with evolving market requirements.

These converging forces are redefining the vegan baking industry, establishing new benchmarks for ingredient performance, sustainability credentials, and consumer engagement. As ingredient suppliers and manufacturers adapt to this shifting landscape, strategic collaborations and integrated R&D efforts will be pivotal in driving core innovations and capturing new growth opportunities.

Assessing the Ripple Effects of 2025 United States Tariffs on Plant-Based Baking Inputs and Their Influence on Supply Chain Dynamics and Pricing

In 2025, adjustments to United States import tariffs have exerted significant influence on the cost structures and sourcing strategies for plant-based baking components. Duty increases on key commodity imports such as coconut-derived flours, almond meal, and specialty sugars have prompted manufacturers to reevaluate procurement channels and explore domestic cultivation partnerships. These changes have also incentivized local suppliers to expand capacity for ingredients like oat and pulse flours, aiming to offset tariff impacts and safeguard ingredient affordability for large-scale production.

Beyond raw materials, tariff adjustments have spurred innovation in ingredient formulation as suppliers work to streamline imported inputs. Fat substitute developers, for instance, are optimizing processes to reduce reliance on high-duty coconut oils by incorporating byproducts from domestic oilseed processing. Similarly, egg substitute providers have intensified efforts to source aquafaba from local chickpea processors, minimizing cross-border exposure and enhancing supply chain resilience.

As a result, the 2025 tariff landscape has become a catalyst for regional supply chain diversification and vertical integration. Industry leaders are leveraging these shifts to establish strategic partnerships with domestic growers, invest in localized manufacturing facilities, and accelerate R&D on alloyed ingredient blends that harmonize performance with cost-effectiveness. This evolving environment underscores the importance of proactive trade policy analysis and agile sourcing strategies for stakeholders throughout the vegan baking ecosystem.

Decoding Consumer Preferences through Ingredient, Application, Distribution, Form, and End User Segmentation for Vegan Baking Product Development

The vegan baking ingredients market can be understood through multiple segmentation lenses that reveal nuanced consumer preferences and innovation pathways. When examined by ingredient type, the prominence of dairy substitutes such as butter alternatives, cream analogues, milk replacements and yogurt alternatives underscores rising demand for functionality that mirrors traditional dairy in baking applications. Within the dairy substitute category, milk alternatives-spanning almond, coconut, oat, and soy variants-have gained significant traction due to their familiarity and versatility. Egg substitutes also play a critical role, with options like aquafaba, commercial egg replacers, and flaxseed meal becoming essential for achieving structure and moisture retention in vegan recipes.

Exploring the market through the application prism sheds light on end-use dynamics across bread and rolls, cakes, cookies and biscuits, muffins, cupcakes, and pastries. Cake formulations, including layered, pound, and sponge varieties, drive innovation in emulsification and leavening, while cookies-ranging from biscotti to drop cookies and sandwich biscuits-spotlight the need for precise sweetener profiles and texture control. Muffins and cupcakes demand moisture-stabilizing protein fortifiers, and the pastries and confectionery segment thrives on advanced fat substitutes to recreate flakiness and mouthfeel without animal lipids.

Distribution channels illustrate the shifting terrain of consumer access and preference. Convenience stores and specialty outlets, including health and organic stores, are cultivating curated vegan baking ingredient portfolios, whereas supermarkets and hypermarkets leverage scale to bundle broad assortments. The rise of direct-to-consumer and e-commerce platforms underscores an omnichannel future, complemented by traditional food service partners such as cafeterias, hotels, and restaurants. Consideration of product form-liquid, powdered, or ready mix-drives supply chain and packaging decisions, with liquid extracts catering to artisanal bakers, while powdered formats and pre-mixed baking kits offer convenience for home bakers.

Finally, end-user segmentation between commercial foodservice operators-from bakeries to catering services and restaurants-and household consumers reveals diverging purchasing motivations. Professional bakers prioritize consistency, functional performance, and bulk procurement efficiencies, whereas home bakers seek user-friendly formulations that simplify recipe success and align with health and environmental goals. Together, these segmentation insights inform targeted product development and go-to-market strategies across the vegan baking landscape.

This comprehensive research report categorizes the Vegan Baking Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Form

- Application

- Distribution Channel

- End User

Unearthing Regional Variations in Vegan Baking Ingredients Across the Americas, EMEA, and Asia-Pacific and Their Unique Market Drivers

Regional dynamics play a pivotal role in shaping the evolution of vegan baking ingredients, with each geography presenting distinct drivers and challenges. In the Americas, robust plant-based movements in North America are propelled by mature retail networks, high consumer awareness, and extensive product innovation. Key markets in the United States and Canada are characterized by strong partnerships between ingredient suppliers and craft bakeries, driving demand for specialized butter and egg alternatives with clean label credentials.

Across Europe, the Middle East & Africa, regulatory frameworks emphasizing sustainability and food safety catalyze market growth. European Union policies promoting plant-based agriculture, along with emerging halal vegan certifications in Middle Eastern markets, support the adoption of dairy and egg substitutes. Meanwhile, African producers leverage local crops, such as cassava and sorghum, to create regionally adapted flour alternatives, reinforcing supply chain resilience and generating cost advantages.

The Asia-Pacific region represents the fastest-growing market for vegan baking ingredients, with expanding urbanization, rising disposable incomes, and a burgeoning middle class fueling consumption. Local manufacturers are innovating with rice and chickpea flours, while Japan, Australia, and China lead in developing advanced sweeteners such as erythritol and stevia. Rapid growth in e-commerce and modern trade channels further amplifies market access, enabling niche ingredient offerings to reach homogenous demand across diverse urban centers.

This comprehensive research report examines key regions that drive the evolution of the Vegan Baking Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players and Their Competitive Strategies to Lead the Evolving Vegan Baking Ingredients Market Toward Sustainable Growth

The competitive landscape of vegan baking ingredients is shaped by established agribusiness giants, specialized ingredient developers, and agile startups focused on novel formulations. Leading suppliers leverage global footprint and extensive R&D capabilities to introduce next-generation protein fortifiers, optimized emulsifiers, and tailored flour blends. These incumbents invest in strategic acquisitions of niche technology companies to bolster their clean label portfolios, while expanding production capacity of liquid and powdered ingredient formats in key manufacturing hubs.

Emerging players distinguish themselves through pioneering approaches such as precision fermentation for dairy protein substitutes and plant-based lipid technologies that replicate animal fat functionality. Collaborations between innovative startups and traditional food processors enable the scaling of specialty ingredients that deliver improved thermal stability and sensory profiles. Meanwhile, ingredient distributors and co-manufacturers forge long-term supply agreements with raw material growers to ensure traceability and sustainability certifications, catering to both commercial foodservice operators and health-conscious home bakers.

Overall, competitive differentiation hinges on seamless integration of sustainability practices, transparency in sourcing, and a robust pipeline of product innovations. Organizations that excel are those that build cross-functional teams encompassing food scientists, regulatory experts, and marketing strategists to navigate evolving consumer expectations and complex trade environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vegan Baking Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Bunge Limited

- Cargill, Incorporated

- Corbion N.V.

- Dawn Food Products Inc.

- IFF, Inc.

- Ingredion Incorporated

- Puratos NV

- Roquette Frères S.A.

- Tate & Lyle PLC

- Tereos S.A.

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Trends and Mitigate Risks in the Vegan Baking Ingredients Ecosystem

To thrive in the dynamic vegan baking ingredients market, industry leaders should prioritize investment in advanced research and development focused on novel plant proteins and fermentation-derived compounds. Establishing collaborative innovation hubs with academic institutions and technology providers will accelerate formulation breakthroughs and reduce time-to-market for clean label substitutes. In parallel, diversifying supply chains through strategic partnerships with domestic growers and alternative crop producers can mitigate the impact of import tariffs and safeguard ingredient availability.

Strengthening quality assurance programs and obtaining third-party sustainability certifications will bolster brand reputation and consumer trust. Embracing digital transformation-such as leveraging AI-driven analytics for demand forecasting and blockchain-enabled traceability-will enhance transparency across the value chain and improve responsiveness to shifting consumer trends. Additionally, optimizing omnichannel distribution strategies by integrating e-commerce platforms with brick-and-mortar retail can unlock new revenue streams and enhance market penetration.

Finally, developing targeted marketing campaigns that highlight functionality, sensory attributes, and environmental benefits will resonate across both commercial foodservice and household segments. By adopting a data-driven approach to consumer insights, companies can tailor product offerings and communication strategies to specific application niches, ensuring relevance and competitive advantage in a fast-evolving marketplace.

Exploring Rigorous Research Methodologies Underpinning Market Insights in Vegan Baking Ingredients for a Robust and Reliable Analysis Framework

The research underpinning this analysis combines both primary and secondary methodologies to ensure a robust and reliable intelligence framework. Primary research involved in-depth interviews with senior R&D leaders, procurement managers, and culinary experts across ingredient suppliers, bakery manufacturers, and foodservice operators. These qualitative insights were complemented by structured surveys targeting both commercial foodservice executives and home baking enthusiasts to capture demand-side perspectives on product performance, formulation preferences, and purchasing drivers.

Secondary research comprised a comprehensive review of public filings, regulatory databases, patent filings, and trade association publications to validate market dynamics and identify emerging technological developments. This dual approach enabled triangulation of data, ensuring that qualitative insights were reinforced by quantitative evidence. Rigorous data validation protocols were applied, including cross-referencing supplier disclosures, customs import-export records, and price tracking databases, to confirm the veracity of trends and supply chain analyses.

Methodological rigor was further enhanced by scenario planning exercises, stress-testing the impact of variables such as tariff fluctuations, raw material shortages, and consumer sentiment shifts. The collective outcome is a multidimensional research framework designed to deliver actionable insights and strategic foresight for stakeholders navigating the complexities of the vegan baking ingredients landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vegan Baking Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vegan Baking Ingredients Market, by Ingredient Type

- Vegan Baking Ingredients Market, by Form

- Vegan Baking Ingredients Market, by Application

- Vegan Baking Ingredients Market, by Distribution Channel

- Vegan Baking Ingredients Market, by End User

- Vegan Baking Ingredients Market, by Region

- Vegan Baking Ingredients Market, by Group

- Vegan Baking Ingredients Market, by Country

- United States Vegan Baking Ingredients Market

- China Vegan Baking Ingredients Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Concluding Insights on the Future Trajectory of Vegan Baking Ingredients Emphasizing Sustainability, Innovation, and Market Adaptability

The evolution of vegan baking ingredients reflects a broader shift toward sustainable, health-conscious, and ethically driven consumption patterns. As ingredient innovations accelerate, market stakeholders must maintain a delicate balance between functional performance, sensory quality, and environmental stewardship. The interplay of tariff policies, technological advancements, and shifting consumer preferences underscores the need for adaptive strategies that can respond to emerging risks and capitalize on new opportunities.

Looking ahead, the convergence of precision fermentation, novel plant protein extraction techniques, and AI-enabled supply chain optimization will define the next frontier of product differentiation. Companies that invest in integrated R&D, transparent sourcing, and digital transformation will be well-positioned to meet the rigorous demands of both commercial foodservice providers and home bakers. Furthermore, regional variations in consumer behavior and regulatory landscapes will continue to drive localized innovation and strategic partnerships across global markets.

In conclusion, the vegan baking ingredients market presents a compelling landscape for growth, innovation, and strategic collaboration. Stakeholders equipped with nuanced segmentation insights, robust research methodologies, and a clear understanding of regional and policy-driven influences will be poised to lead the industry toward a resilient and sustainable future.

Take Action Today to Secure Comprehensive Intelligence on Vegan Baking Ingredients from Ketan Rohom for Informed Strategic Decision Making

Unlock unparalleled depth and actionable intelligence by securing the full market research report on vegan baking ingredients from Ketan Rohom (Associate Director, Sales & Marketing). Engage with expert analysis, proprietary data, and strategic insights tailored to elevate your business strategy. Whether you seek to refine product development, optimize supply chains, or anticipate regulatory shifts, this comprehensive report offers the clarity and foresight you need to stay ahead of competitors. Reach out today to purchase the definitive guide that empowers decision-makers to drive growth, innovation, and market leadership in the dynamic landscape of plant-based baking ingredients.

- How big is the Vegan Baking Ingredients Market?

- What is the Vegan Baking Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?