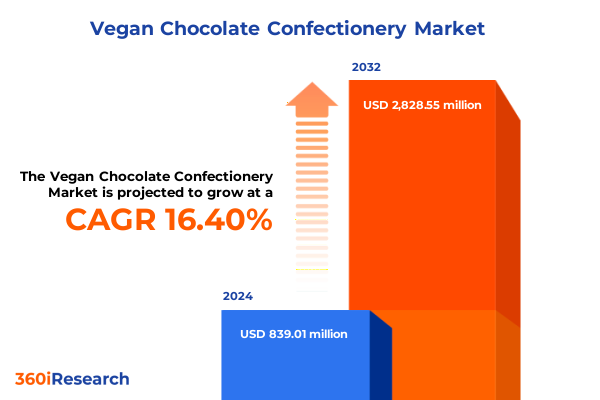

The Vegan Chocolate Confectionery Market size was estimated at USD 1.04 billion in 2025 and expected to reach USD 1.10 billion in 2026, at a CAGR of 5.89% to reach USD 1.56 billion by 2032.

Setting the Stage for the Rising Appeal of Vegan Chocolate Confectionery in a Health-Conscious and Eco-Aware Consumer Landscape

The landscape of confectionery has been undergoing a profound transformation as consumers increasingly seek indulgent experiences that align with their ethical, environmental, and health values. Vegan chocolate confectionery has emerged at the forefront of this evolution, reflecting a convergence of plant-based innovation, premium flavor profiles, and responsible sourcing practices. As dietary preferences shift beyond traditional dairy paradigms, vegan chocolate has transcended niche positioning to become a dynamic category that resonates with a broad spectrum of consumers-from dedicated vegans and lactose-intolerant individuals to flexitarians drawn by the promise of cleaner ingredients and transparent supply chains.

Against this backdrop of heightened consumer awareness and evolving retail channels, understanding the fundamentals of vegan chocolate confectionery is essential for stakeholders across the value chain. From bean selection and processing techniques to packaging innovations and go-to-market strategies, the factors driving category expansion are multifaceted. This executive summary offers a focused introduction to the key thematic pillars shaping the sector, providing a coherent foundation for deeper exploration in subsequent sections.

Identifying the Transformative Shifts Reshaping the Global Vegan Chocolate Confectionery Ecosystem with Innovation and Purpose

In recent years, the vegan chocolate confectionery sector has witnessed a series of transformative shifts that are redefining both product development and consumer engagement. A growing emphasis on ingredient transparency has catalyzed the adoption of cleaner-label formulations, with brands reformulating recipes to eliminate synthetic emulsifiers and refined sugars. Concurrently, the proliferation of sustainable packaging solutions-ranging from compostable wrappers to minimalistic, recyclable cartons-reflects a broader commitment to environmental stewardship that resonates deeply with eco-conscious shoppers.

Equally impactful has been the integration of novel plant-based proteins and alternative fats, enabling manufacturers to deliver indulgent textures and mouthfeel that rival their dairy counterparts. These technical breakthroughs, coupled with sophisticated flavor engineering incorporating botanicals, spices, and functional ingredients, have elevated product differentiation within a crowded marketplace. As direct-to-consumer e-commerce platforms and subscription models gain traction, brands are also refining their digital narratives to forge emotional connections and cultivate loyal communities around purpose-driven missions.

Analyzing the Cumulative Impact of Recent Tariff Adjustments on Domestic Vegan Chocolate Confectionery Dynamics and Supply Chains

Recent tariff adjustments enacted in early 2025 have exerted a palpable influence on cost structures and sourcing strategies within the vegan chocolate confectionery domain. By raising import duties on cocoa beans and semi-processed chocolate from key origin countries, these policy changes have amplified procurement complexity for manufacturers reliant on traditional trade channels. As a result, many producers have been compelled to reevaluate their supplier networks, seeking alternative origins or investing in farm-level partnerships to secure more stable, tariff-optimized cocoa flows.

In response to these pressures, companies are adopting a multi-pronged approach to mitigate margin erosion and ensure uninterrupted production. Some have turned toward domestic or nearshore cacao processing facilities, leveraging regional trade agreements to circumvent elevated import levies. Others are passing incremental cost increases to consumers, particularly in premium and artisanal segments where brand storytelling and ethical credentials can justify higher retail pricing. Looking ahead, the capacity for adaptive supply chain strategies will be critical for preserving competitive agility as geopolitical and trade landscapes continue to evolve.

Unlocking Actionable Insights Through Comprehensive Segmentation of Distribution Channels Product Types and Consumer Preferences

A granular view of the vegan chocolate confectionery market reveals a complex tapestry of consumer touchpoints and product configurations. Distribution channels span convenience stores where impulse purchases intersect with urban footfall, online retail platforms that include proprietary brand websites, curated subscription boxes, and third-party marketplaces, as well as specialty outlets such as health food stores and vegan boutiques, alongside traditional supermarket and hypermarket formats that deliver broad reach. Each channel demands a tailored approach to assortment, pricing, and promotional cadence, influenced by distinct shopper expectations and purchase occasions.

Equally diverse are the offerings defined by product type, from chocolate-coated nuts that blend crunch and sweetness to dark chocolate bars prized for their rich, intense profiles, and filled chocolates which further subdivide into fruit-infused, nut-infused, and spiced varieties. Truffles and white chocolate rounds out the array of indulgence occasions. The cocoa percentage dimension-ranging from 55 to 70 percent, 70 to 85 percent, and above 85 percent-further calibrates bitterness and functional benefits, while pricing tiers from mass market through mid-tier and upward to premium segments address the spectrum of consumer willingness to pay. Packaging formats such as bars, bulk packs, gift configurations, and single-serve portions cater to sharing, gifting, and personal snacking rituals. Certification credentials, including Fair Trade, non-GMO, organic, or no certification, serve as trust signals that reinforce brand authenticity. Lastly, flavor profiles-spanning fruit-infused, nut-infused, plain, and spiced-enable precise positioning for targeted taste preferences.

This comprehensive research report categorizes the Vegan Chocolate Confectionery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Cocoa Percentage

- Packaging Format

- Flavor

- Distribution Channel

Revealing Regional Variations in Consumer Demand and Market Dynamics Across the Americas Europe Middle East Africa and Asia Pacific

Regional distinctions continue to shape the trajectory of vegan chocolate confectionery consumption and innovation. In the Americas, the United States commands attention with its robust demand for premium dark and artisanal offerings, while Canada and select Latin American markets accelerate plant-based adoption through localized flavor inflections. Across Europe, Middle East, and Africa, Western Europe leads in product diversity and sustainability commitments, leveraging stringent regulatory frameworks to advance ethical sourcing practices, whereas emerging markets in the Middle East and Africa are tapping into growing urban middle-class cohorts and halal certification opportunities to expand category penetration.

Asia-Pacific presents a dynamic convergence of rapid urbanization and rising health consciousness, with markets such as Japan and South Korea embracing refined low-sugar formulations, while China and India exhibit appetite for both Western-influenced indulgence and regionally inspired flavor innovations. E-commerce channels proliferate throughout the region, enabling niche and international brands to gain foothold through targeted digital marketing strategies. Collectively, these regional nuances underscore the importance of adaptive market entry strategies that respect local consumer rituals, regulatory environments, and distribution infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Vegan Chocolate Confectionery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positioning and Innovation Trajectories of Leading Players in Vegan Chocolate Confectionery

Leading companies within the vegan chocolate confectionery space have adopted divergent innovation trajectories to capture evolving consumer segments and fortify their market positions. Established multinational confectioners are allocating significant research and development resources toward vegan sub-brands, leveraging existing production footprints to scale alternative formulations at competitive cost points. Their strategic focus often centers on broad accessibility, utilizing mass market and mid-tier pricing to introduce plant-based options into mainstream retail environments.

In contrast, artisanal and craft-oriented startups are emphasizing bean-to-bar provenance, premium flavor craftsmanship, and direct relationships with cacao farmers to justify elevated price tiers and attract discerning connoisseurs. These smaller players frequently pioneer experimental formats-such as single-origin percentage assortments and botanical-infused truffles-that are rapidly adopted by larger brands seeking inspiration. Collaborations among ingredient innovators, packaging specialists, and certification bodies further exemplify the sector’s collaborative ethos, driving a continuous cycle of product differentiation and sustainable practice enhancement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vegan Chocolate Confectionery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alter Eco LLC

- Barry Callebaut AG

- Chocoladefabriken Lindt & Sprüngli AG

- Endangered Species Chocolate, LLC

- Equal Exchange, Inc.

- Mars, Incorporated

- Mondelez International, Inc.

- Moo Free Chocolates Ltd.

- Nestlé S.A.

- No Whey Foods, Inc.

- NOMO

- Taza Chocolate LLC

- The Hershey Company

- The Vego Chocolate Company GmbH

- Theo Chocolate, Inc.

Formulating Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends and Strengthen Market Positioning

Industry leaders seeking to maximize their competitive edge should prioritize supply chain resilience by diversifying cocoa sourcing across multiple geographies and investing in traceability technologies. Simultaneously, accelerating product portfolio diversification-through the introduction of novel flavor infusions, functional additives, and limited-edition formats-can capture consumer interest and reinforce brand equity. Strategic alliances with e-commerce platforms and lifestyle subscription services will bolster direct-to-consumer capabilities, supporting data-driven personalization and fostering long-term brand loyalty.

To sustain differentiation, companies must also champion sustainability commitments that extend beyond packaging to include regenerative agricultural practices and robust social impact initiatives. Pursuing meaningful certifications and transparently communicating those achievements can strengthen consumer trust. Finally, targeted marketing communications that weave together brand narratives, health positioning, and experiential storytelling will be pivotal in breaking through the noise and cultivating enduring emotional connections with key demographics, especially millennials and Gen Z.

Detailing the Rigorous Research Methodology Underpinning Comprehensive Insights into Vegan Chocolate Confectionery Markets

The insights presented here are underpinned by a rigorous, multi-phased research methodology designed to capture the full spectrum of market intelligence. Initial secondary research involved an exhaustive review of industry publications, regulatory filings, and trade association reports to chart macroeconomic and policy frameworks. This was followed by primary qualitative interviews with senior executives from leading confectionery manufacturers, distributors, retailers, and e-commerce specialists to validate market drivers and competitive dynamics.

Quantitative data collection entailed structured surveys administered to a panel of health-focused and mainstream consumers across key regions, providing statistically robust input on purchase behaviors, price sensitivity, and product feature prioritization. Data triangulation techniques ensured consistency between primary findings and secondary benchmarks, while a final expert panel review refined key themes and resolved discrepancies. Throughout the process, quality control protocols and peer reviews were rigorously applied to uphold analytical integrity and ensure actionable, reliable outcomes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vegan Chocolate Confectionery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vegan Chocolate Confectionery Market, by Product Type

- Vegan Chocolate Confectionery Market, by Cocoa Percentage

- Vegan Chocolate Confectionery Market, by Packaging Format

- Vegan Chocolate Confectionery Market, by Flavor

- Vegan Chocolate Confectionery Market, by Distribution Channel

- Vegan Chocolate Confectionery Market, by Region

- Vegan Chocolate Confectionery Market, by Group

- Vegan Chocolate Confectionery Market, by Country

- United States Vegan Chocolate Confectionery Market

- China Vegan Chocolate Confectionery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Key Themes and Opportunities That Define the Future Trajectory of Vegan Chocolate Confectionery Industry

As vegan chocolate confectionery continues its ascent, several core themes emerge: the imperative of ingredient transparency, the power of sustainable practices, and the necessity of agile supply chain strategies. Consumer expectations are evolving beyond basic plant-based assurances toward holistic ethical narratives that encompass both environmental and social impact dimensions. Flavor experimentation and premiumization are set to drive category premium growth, supported by digital platforms that facilitate direct consumer engagement and real-time feedback loops.

Looking forward, the intersection of advanced processing technologies-such as precision fermentation and solubility-enhancement techniques-with mainstream confectionery craftsmanship will unlock new frontiers in taste and texture. Market entrants who balance bold innovation with disciplined execution will be best positioned to capture shifting preferences and expand the vegan chocolate confectionery ecosystem. These convergent opportunities establish a clear pathway for companies to differentiate, scale responsibly, and meet the demands of the modern conscious consumer.

Motivating Decision Makers to Engage with an Associate Director for Tailored Insights by Acquiring a Comprehensive Vegan Chocolate Confectionery Report

To unlock the full potential of this comprehensive vegan chocolate confectionery research and align strategic initiatives with emerging consumer trends, decision makers are encouraged to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with Ketan, organizations will gain tailored guidance on interpreting the study’s nuanced insights, identifying priority market opportunities, and developing bespoke go-to-market approaches that leverage unique strengths and address key challenges. This direct engagement ensures that the strategic roadmap derived from the research is calibrated to each company’s operational capabilities, growth aspirations, and sustainability commitments.

Reaching out to schedule a personalized consultation with Ketan opens the door to an in-depth discussion of the findings most relevant to your business context, including deep dives into regional variances, segmentation dynamics, and competitive positioning. Through this collaborative exchange, industry leaders can refine investment strategies, optimize product portfolios, and fortify supply chains against evolving market disruptions. Embark on a journey to transform strategic ambition into tangible market success by securing your access to this essential research report through Ketan’s expert guidance

- How big is the Vegan Chocolate Confectionery Market?

- What is the Vegan Chocolate Confectionery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?