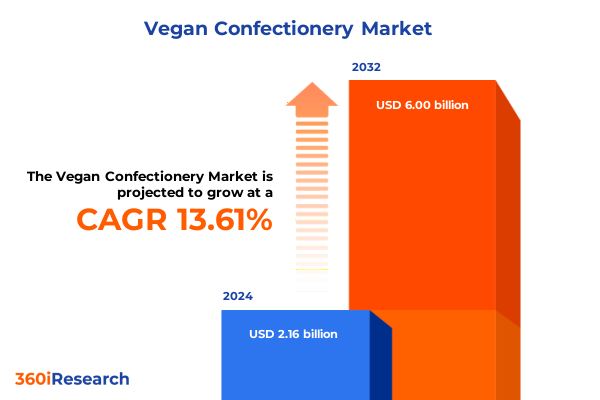

The Vegan Confectionery Market size was estimated at USD 2.45 billion in 2025 and expected to reach USD 2.75 billion in 2026, at a CAGR of 13.62% to reach USD 6.00 billion by 2032.

Uncover How the Emerging Vegan Confectionery Market Is Redefining Indulgence Through Health Focused Sustainability and Innovative Plant-Based Ingredients

The vegan confectionery market represents a paradigm shift in how consumers approach indulgence, marrying the timeless pleasure of treats with the modern imperative for ethical, sustainable choices. Driven by growing awareness of animal welfare, environmental stewardship, and holistic health, plant-based confections have transcended niche status to become a vital component of mainstream retail offerings. This shift has catalyzed a proliferation of innovative formulations that replace traditional dairy and animal-derived ingredients with plant proteins, nut butters, and sustainable sweeteners, effectively redefining the boundaries of what confectionery can achieve.

As consumer priorities evolve, brands and manufacturers must navigate a complex landscape of emerging preferences, regulatory considerations, and competitive pressures. This executive summary distills comprehensive research into the latest drivers, challenges, and opportunities shaping the vegan candy and baked goods space. By examining transformative trends, tariff impacts, segmentation dynamics, and regional nuances, the report equips decision makers with the insights necessary to chart strategic growth pathways. In an industry propelled by rapid innovation and shifting values, this overview lays the foundation for actionable strategies that align product development with consumer expectations and operational resilience.

Explore the Rapidly Transforming Vegan Confectionery Landscape Shaped by Rising Eco-Conscious Consumers Technological Innovation and Novel Flavor Profiles

Over the past five years, the vegan confectionery market has undergone transformative evolution fueled by a convergence of consumer values and technological advancements. Eco-conscious shoppers now demand transparency not only in labeling but throughout the entire supply chain, prompting manufacturers to adopt ethical sourcing practices and renewable packaging solutions. Similarly, heightened interest in gut health and functional snacking has driven product developers to incorporate prebiotics, adaptogens, and high–fiber plant powders into sweets, elevating traditional confections into multitasking treats that offer both pleasure and wellness benefits.

Technological breakthroughs in plant-based proteins, including isolates derived from pea, fava bean, and rice, have enabled texture and mouthfeel profiles that closely mimic dairy. These innovations are complemented by progress in natural emulsifiers and fat replacers, ensuring that vegan chocolates and baked goods deliver indulgent experiences without compromise. Concurrently, cross-industry collaborations with food technology startups have accelerated ingredient discovery, with trials of algae proteins and fermented dairy analogs already under way.

Meanwhile, digital engagement has reshaped go-to-market strategies in vegan confectionery. Brands are leveraging direct-to-consumer channels, social media influencer partnerships, and subscription models to cultivate loyal communities and gather real-time feedback. This increasingly agile approach to product iteration and consumer outreach underscores a broader shift away from mass production toward personalized, purpose-driven offerings.

Assess the Far Reaching Effects of 2025 United States Tariff Adjustments on Supply Chains and Strategic Sourcing for Vegan Confectionery Ingredients

In 2025, the United States enacted targeted tariffs on key imported inputs integral to vegan confectionery production, including certain cocoa powders, specialty sugars, and plant-based protein isolates. These adjustments aimed to protect domestic agriculture and encourage local processing, but the immediate consequence has been a recalibration of global supply chains. Confectioners reliant on West African cocoa have faced higher landed costs, triggering a pivot toward alternative origins or investments in vertical integration to mitigate exposure to import duties.

The ripple effects extend beyond primary ingredients. Specialty sugars like coconut blossom and date syrups, often sourced from Asia-Pacific, are subject to new duty structures, compelling brands to reevaluate formulation strategies or absorb margin pressures. Similarly, tariffs on pea and fava bean protein isolates have prompted some manufacturers to explore in-house extraction partnerships or to source novel alternatives such as sunflower and chickpea derivatives, thus diversifying their supplier base.

Looking ahead, companies are adopting a two-pronged response: short-term cost management through renegotiated contracts and forward purchasing agreements, and long-term resilience via nearshoring initiatives and domestic milling investments. Trade associations and industry coalitions are simultaneously engaging with policy makers to seek tariff-rate quota adjustments that safeguard the burgeoning plant-based sector. As the regulatory environment continues to evolve, strategic sourcing and agile procurement will remain central to sustaining growth in the vegan confectionery category.

Reveal the Critical Segmentation Insights Driving Differentiation Across Product Types Distribution Channels Price Tiers and Certification Standards in Vegan Confectionery

Insights into product segmentation reveal that baked confectionery forms a cornerstone of market development, with cakes and pastries-particularly muffins and scones-garnering traction among health-minded consumers seeking portion-controlled indulgences. Within cookies, drop cookie formats and the resurgence of sandwich cookies infused with fruit-based fillings reflect a blend of nostalgia and innovation, while the differentiation between cake and yeast donuts highlights consumer demand for novelty in texture and flavor. Chocolate confectionery retains its dominant appeal as dark chocolate bars and milkless chocolate bars extend cocoa’s health halo, whereas coated chocolates-ranging from crisped rice and fruit coatings to nut enrobements-offer layered sensory experiences that resonate in premium segments. Meanwhile, sugar confectionery’s gummies continue to expand through sour and vitamin-fortified varieties, and hard candy innovations like menthol infusions straddle the wellness and indulgence duality.

Channel dynamics underscore the sustained importance of traditional retail, as supermarkets and hypermarkets-supported by tier 1 and tier 2 chain partnerships-remain critical for mass distribution. However, the surge in online retail channels, across both brand websites and e-commerce marketplaces, is redefining consumer purchasing journeys by offering subscription services, personalized bundles, and rapid direct shipments. Specialty retailers and convenience stores complement this ecosystem by catering to impulse purchases and localized trends, creating layered access points that brands must integrate into omnichannel strategies.

Price tier analysis indicates that premium offerings command higher margins through artisanal claims and certifications, yet economy options have demonstrated resilience by attracting value seekers within the vegan demographic. Ingredient certifications such as Fair Trade, Non-GMO, and Organic have become table stakes for premium positioning, with organic claims driving trial among eco-advocates and Non-GMO assurances reassuring mainstream audiences. This certification landscape underscores a bifurcation in consumer priorities, wherein both ethical provenance and health safety serve as powerful purchase motivators.

This comprehensive research report categorizes the Vegan Confectionery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- By Form

- Distribution Channel

Illuminate the Diverse Regional Dynamics Shaping Growth Potential Across the Americas Europe Middle East Africa and Asia Pacific Vegan Confectionery Markets

Across the Americas, North America leads with robust infrastructure, established distribution networks, and a large base of health-oriented consumers. The United States in particular benefits from extensive retail penetration and a mature direct-to-consumer digital ecosystem that empowers emerging vegan brands to scale rapidly. In Latin America, rising middle-class populations coupled with traditional sugar confectionery heritage have created fertile ground for plant-based alternatives, especially in markets where sugar consumption is under scrutiny for health reasons.

In Europe, Middle East, and Africa, Western Europe remains the epicenter of premium vegan confectionery innovation, driven by stringent labeling regulations and a well-developed organic movement. Germany and the Nordics exemplify early adopters, showcasing strong retail alliances and robust certification frameworks. Meanwhile, markets in the Middle East and North Africa are witnessing growing demand among young urban consumers seeking Western-style plant-based indulgences, prompting local and international players to tailor offerings to regional tastes and halal requirements.

Asia-Pacific stands out as the fastest growing region, anchored by burgeoning vegan communities in Australia and New Zealand as well as by accelerated adoption in East Asia. In China and Japan, premium dark chocolate bars and functional gummies are capitalizing on wellness trends, while Southeast Asian markets are exploring rice-based and coconut milk–infused confectionery formats. This regional diversity underscores the imperative for brands to adopt nuanced go-to-market approaches that align with local taste profiles, regulatory standards, and distribution complexities.

This comprehensive research report examines key regions that drive the evolution of the Vegan Confectionery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncover Strategic Product Innovations Partnerships and Sustainability Initiatives Driving Competitive Leadership Within the Vegan Confectionery Sector

Industry leaders are increasingly forging strategic partnerships and leveraging acquisitions to scale innovation and expand geographic footprints. Multinational confectionery companies have launched dedicated vegan sub-brands and collaborated with food technology startups to fast-track development cycles, ensuring rapid commercialization of plant-based novelties. Meanwhile, agile challenger brands have attracted significant venture investment, enabling them to refine proprietary formulations that address lingering taste and texture challenges.

Furthermore, sustainability initiatives are central to competitive differentiation. Leading companies are setting ambitious goals for renewable energy use, circular packaging, and zero-deforestation procurement policies. These efforts not only address consumer concerns but also preempt regulatory pressures related to environmental disclosures. As the landscape matures, the convergence of R&D prowess, brand storytelling, and operational transparency will define market leaders capable of resonating with both early adopters and mainstream audiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vegan Confectionery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alter Eco Inc.

- Chocolate Inspirations LLC

- Divine Chocolate Ltd.

- Endangered Species Chocolate LLC

- Equal Exchange Inc.

- Free2b Foods LLC

- GoMaxGo Foods LLC

- Goodio Oy

- Hu Kitchen Holdings LLC

- iChoc Schokolade GmbH

- Ludwig Schokolade GmbH

- Mondelez International Inc.

- Montezuma's Direct Ltd.

- Moo Free Chocolates Ltd.

- Nib Mor LLC

- Pascha Chocolate Co.

- Plamil Foods Ltd.

- Premium Chocolatiers LLC

- Rigoni di Asiago

- Sjaak's Organic Chocolates LLC

- Tony's Chocolonely

- Unreal Brands Inc.

- Vego Chocolate GmbH

Drive Future Success with Actionable Strategies for Ingredient Sourcing Product Development and Market Expansion in the Competitive Vegan Confectionery Field

To navigate the evolving landscape and secure sustainable growth, industry players should prioritize resilient procurement strategies that mitigate tariff-related volatility. Establishing long-term contracts with diversified suppliers, investing in domestic processing partnerships, and exploring strategic nearshoring can reduce exposure to global trade shifts. Simultaneously, companies must accelerate product innovation pipelines by integrating emerging plant proteins and functional ingredients that meet the dual consumer demands for indulgence and wellness.

Complementing product development, brands should harness omnichannel distribution by aligning traditional retail expansions with robust e-commerce capabilities. Leveraging subscription models, limited-edition releases, and personalized marketing can drive consumer loyalty while providing data-driven insights for iterative product enhancements. In price tier management, a balanced portfolio that spans economy, mid-price, and premium offerings will ensure accessibility without diluting brand equity.

Finally, obtaining and clearly communicating certification credentials-from Fair Trade to Organic-will remain essential for building trust in premium segments. Transparent storytelling around sourcing practices and environmental impacts can further enhance brand resonance. By adopting an integrated approach that combines supply chain agility, innovation leadership, and consumer-centric distribution, companies can position themselves at the forefront of the next wave in vegan confectionery.

Outline the Rigorous Multi Method Research Approach Combining Qualitative and Quantitative Techniques Expert Interviews and Robust Data Triangulation Processes

This research employed a rigorous multi-method approach to ensure robustness and reliability. Primary insights were gathered through in-depth interviews with executives spanning ingredient suppliers, manufacturers, and key retailers across the Americas, Europe, and Asia-Pacific. These conversations explored strategic priorities, operational challenges, and emerging consumer trends, enriching quantitative findings with nuanced industry perspectives.

Secondary research comprised an extensive review of trade publications, regulatory filings, and corporate sustainability reports, supplemented by data from open-source databases. The integration of qualitative and quantitative methods facilitated comprehensive segmentation analyses across product types, distribution channels, price tiers, and certification categories. Each data point underwent rigorous triangulation, cross-checked against multiple sources to validate consistency and mitigate bias. This layered methodology ensures that the insights presented are both actionable and reflective of the current market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vegan Confectionery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vegan Confectionery Market, by Product Type

- Vegan Confectionery Market, by By Form

- Vegan Confectionery Market, by Distribution Channel

- Vegan Confectionery Market, by Region

- Vegan Confectionery Market, by Group

- Vegan Confectionery Market, by Country

- United States Vegan Confectionery Market

- China Vegan Confectionery Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2703 ]

Synthesize Key Findings to Highlight Strategic Imperatives Industry Opportunities and the Urgent Need for Agility in the Vegan Confectionery Industry

The collective findings underscore that the vegan confectionery market is at an inflection point characterized by accelerated consumer adoption, supply chain recalibrations, and dynamic competitive strategies. Brands that align their innovation pipelines with evolving taste and wellness preferences will capture premium positioning, while those that invest in agile sourcing practices stand to fortify margins amid tariff-induced cost challenges.

Looking ahead, success will hinge on the ability to integrate advanced plant-based ingredients, leverage omnichannel distribution frameworks, and transparently communicate ethical and environmental commitments. Stakeholders equipped with this deep dive into market transformations can make informed decisions that drive sustainable growth. The imperative is clear: embrace agility, prioritize consumer-centric innovation, and cultivate resilience across every facet of the vegan confectionery value chain.

Prompt Decision Makers to Connect with Ketan Rohom for Access to the Vegan Confectionery Market Research Report to Enhance Competitive Edge

For tailored insights and strategic guidance, decision makers poised to leverage the rapidly evolving vegan confectionery market should connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding industry leaders through complex market dynamics ensures that stakeholders gain unparalleled access to proprietary analyses, supplier intelligence, and risk mitigation strategies essential for securing a competitive edge. Engaging with Ketan unlocks the opportunity to transform abstract data into actionable plans, align product portfolios with emerging consumer demands, and drive accelerated growth across key global regions. Reach out to initiate a conversation and secure the report that will shape your next wave of success in vegan confectionery.

- How big is the Vegan Confectionery Market?

- What is the Vegan Confectionery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?