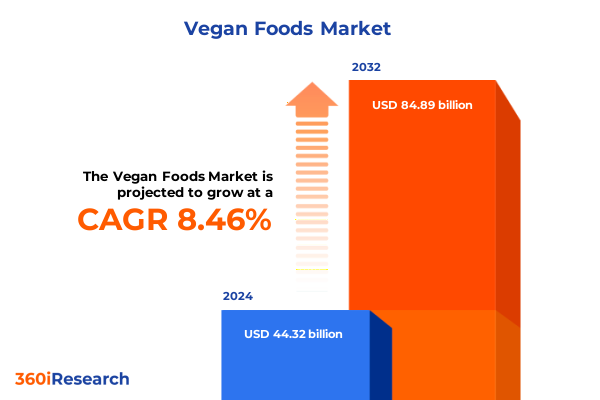

The Vegan Foods Market size was estimated at USD 48.12 billion in 2025 and expected to reach USD 51.86 billion in 2026, at a CAGR of 8.44% to reach USD 84.89 billion by 2032.

Unveiling the Pivotal Intersection of Consumer Demand Health Drivers and Innovation Catalysts Reshaping the Vegan Foods Ecosystem

The vegan foods sector has transcended its niche origins to emerge as a robust and transformative force within the global food industry. What began as a peripheral movement driven primarily by ethical concerns and environmental stewardship has evolved into a multidisciplinary innovation hub, fueled by advancements in food science, shifts in consumer preferences, and mounting regulatory encouragement toward plant-based eating. As a result, business leaders and stakeholders are compelled to reevaluate their strategic approach, recognizing plant-based offerings as a central pillar of future growth rather than a supplementary trend.

Navigating the Breakthrough Advancements and Hybrid Innovations Driving the Rapid Evolution of Plant-Based and Alternative Protein Offerings

In recent years, the landscape of vegan foods has undergone a series of seismic transformations that extend far beyond product availability on store shelves. The sector has witnessed a pronounced shift toward precision fermentation and cellular agriculture, allowing companies to replicate dairy proteins and muscle fibers with scientific rigor. This evolution in technological capability underscores the industry’s commitment to delivering sensory experiences indistinguishable from animal-derived products, while simultaneously addressing sustainability and resource constraints. Moreover, the rise of hybrid products-combining animal and plant ingredients at varying ratios-reflects an adaptive strategy to engage mainstream meat eaters, evidenced by the growing popularity of balanced protein options such as Perdue’s Chicken PLUS nuggets and lab-grown pork-fat bacon prototypes.

Assessing the Far-Reaching Consequences of 2025 Tariff Measures on Ingredient Sourcing Cost Structures and Product Affordability

The imposition of cumulative tariffs by the United States in 2025 has introduced a complex layer of operational pressure across vegan food supply chains. Many essential ingredients, including coconut and palm oils, often sourced from Indonesia and Malaysia, now face duties upward of 24% to 32%, prompting manufacturers to reassess sourcing strategies and absorb added costs. For products reliant on exotic nuts, such as cashews used in plant-based cheeses and desserts, the tariff burden has reached a staggering 46% on Vietnamese imports, leaving few viable domestic alternatives and heightening reformulation challenges. Against this backdrop, some innovators like Beleaf Foods have implemented dual payment models to freeze consumer prices until 2026, sharing the tariff load between manufacturing and branding sides to maintain affordability and stave off volume declines.

Uncovering Critical Segment-Level Dynamics That Illuminate Consumer Preferences Across Product Categories Channels and Occasions

Insight into the vegan foods market is refined by a nuanced segmentation approach that examines product types, source materials, consumer occasions, channels, and end users to reveal distinct patterns of growth and preference. Across product categories, dairy alternatives such as plant-based milk and cheese coexist with meat substitutes ranging from seitan to tempeh and tofu, each attracting unique consumer segments. Beyond these primary groupings, snack innovations and ready meals further expand the portfolio of opportunities, illustrating the market’s capacity to address diverse eating contexts.

This comprehensive research report categorizes the Vegan Foods market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Meal Occasion

- Distribution Channel

- End User

Examining How Regional Consumer Preferences Regulatory Environments and Distribution Models Are Shaping the Vegan Foods Revolution Globally

Regional dynamics play a pivotal role in shaping global vegan food trends, with distinct patterns emerging in the Americas, Europe Middle East Africa, and Asia-Pacific zones. In the Americas, particularly the United States and Canada, high levels of consumer awareness have sustained a mature retail environment, where plant-based foods occupy established shelf space and attract repeat buyers in roughly six out of ten households. Meanwhile, Europe, Middle East & Africa exhibits a dual narrative: Western European markets such as Germany, France, and the UK are buoyed by private-label affordability initiatives and government support plans, whereas emerging economies in the Middle East and Africa present greenfield prospects, marked by nascent regulatory frameworks and rising urbanization. In the Asia-Pacific region, a rapid acceleration in consumer adoption is driven by lactose intolerance prevalence, environmental concerns, and progressive government incentives, positioning non-dairy segments as frontrunners in markets such as China India and Australia.

This comprehensive research report examines key regions that drive the evolution of the Vegan Foods market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Maneuvers and Funding Initiatives Underpinning Market Leadership Among Top Vegan Foods Manufacturers

Leading companies in the vegan foods arena are navigating a delicate balance between innovation investment, consumer price sensitivity, and financial resilience. Impossible Foods, for instance, is exploring a liquidity event-ranging from a potential IPO to private capital raising-to secure funding for expanded distribution in mainstream channels such as dollar stores and club warehouses. Beyond Meat has similarly recalibrated its go-to-market strategy, focusing on private-label partnerships to regain value-conscious consumers. Dairy alternative giant Oatly remains committed to vertical integration, partnering with oat growers across North America while optimizing its supply chain to shield against tariff escalations. Startups like Eat Just continue to diversify their product suite, investing $15.2 million in egg substitute capacity and leveraging joint ventures to penetrate the European food service sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vegan Foods market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpro S.A.

- Amy's Kitchen, Inc.

- Beyond Meat, Inc.

- Daiya Foods Inc.

- Danone S.A.

- Follow Your Heart, Inc.

- Gardein

- GoodDot Pvt. Ltd.

- Greenleaf Foods LP

- Impossible Foods Inc.

- Miyoko’s Creamery, Inc.

- Oatly AB

- Plamil Foods Ltd.

- Quorn Foods Ltd.

- The Hain Celestial Group, Inc.

- Tofutti Brands Inc.

- Turtle Island Foods, LLC

- VBites Foods Ltd.

- Veganz Group AG

- Vitasoy International Holdings Ltd.

Implementing Strategic Supply Chain Diversification Innovation Partnerships and Pricing Models to Propel Sustainable Growth in Vegan Foods

Industry leaders should prioritize strategic investments in resilient ingredient sourcing, balancing supply chain diversification with direct collaborations in origin countries to mitigate tariff shocks. Concurrently, bolstering R&D capabilities in precision fermentation and enzyme-driven texturization can accelerate the launch of next-generation products that command stronger consumer loyalty. Embracing tiered pricing structures-encompassing premium, mainstream, and value private-label tiers-will enable brands to capture broader market segments without compromising margins. Furthermore, forging alliances with food service providers and major retailers through co-branded innovation hubs can amplify consumer exposure and drive trial, while targeted regional partnerships in emerging markets can unlock new distribution channels and regulatory support.

Detailing the Rigorous Combination of Primary Interviews Secondary Trade Data and Qualitative Consumer Feedback Underpinning This Analysis

This research synthesizes insights from an extensive review of industry publications, regulatory filings, and trade data, supplemented by interviews with supply chain executives and product development leaders across key vegan foods companies. Secondary sources included domestic and international trade commission reports, peer-reviewed journals on food technology advances, and proprietary retail sales data from leading analytics firms. Qualitative analysis was informed by expert roundtables and structured feedback from consumer focus groups spanning North America Europe and Asia-Pacific. All data points were cross-validated against third-party market intelligence platforms, ensuring methodological rigor and the highest standards of accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vegan Foods market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vegan Foods Market, by Product Type

- Vegan Foods Market, by Source

- Vegan Foods Market, by Meal Occasion

- Vegan Foods Market, by Distribution Channel

- Vegan Foods Market, by End User

- Vegan Foods Market, by Region

- Vegan Foods Market, by Group

- Vegan Foods Market, by Country

- United States Vegan Foods Market

- China Vegan Foods Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing the Confluence of Innovation Consumer Shifts and Trade Dynamics Charting the Course for Future Market Leaders Who Capitalize on Emerging Opportunities

The vegan foods market stands at a strategic inflection point where technological breakthroughs, evolving consumer priorities, and geopolitical trade developments converge to define the next phase of expansion. While tariff dynamics have introduced near-term challenges, they have also catalyzed innovation in sourcing and formulation, strengthening the resilience of forward-thinking companies. As segmentation and regional insights reveal differentiated growth trajectories, industry participants equipped with granular data and actionable recommendations will be poised to seize emerging opportunities. Ultimately, those who adeptly integrate sustainable practices with consumer-centric innovation will shape the leading edge of this dynamic market.

Partner with Ketan Rohom to Access Exclusive Vegan Foods Market Intelligence and Drive Your Strategic Growth Plans

To explore deeper insights, tailor your strategic roadmap, and gain exclusive access to comprehensive data, reach out today. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the definitive vegan foods market research report. Equip your organization with the knowledge and recommendations needed to navigate evolving consumer behaviors, tariff challenges, and innovation opportunities in this dynamic industry.

- How big is the Vegan Foods Market?

- What is the Vegan Foods Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?