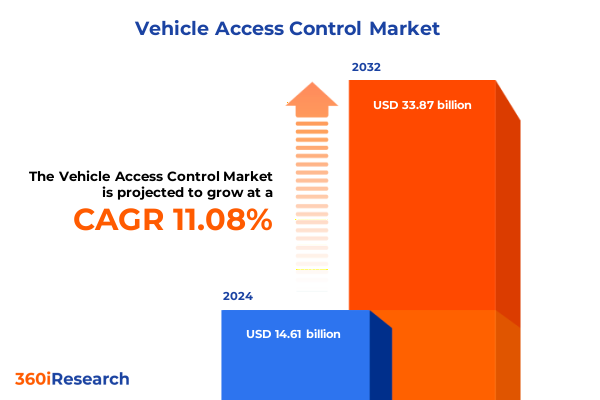

The Vehicle Access Control Market size was estimated at USD 16.21 billion in 2025 and expected to reach USD 17.83 billion in 2026, at a CAGR of 11.09% to reach USD 33.87 billion by 2032.

Setting the Stage for the Future of Secure and Connected Vehicle Access Solutions Amid Rapid Technological and Regulatory Evolution

The evolution of vehicle access control represents a pivotal transformation in mobility security and user convenience. Over the past decade, traditional mechanical lock-and-key systems have steadily given way to sophisticated electronic and biometric solutions, reflecting a broader shift toward digitalization and intelligent connectivity. Consumers now expect seamless and secure entry experiences that integrate with their digital lifestyles, driving automakers and suppliers to adopt advanced authentication methods such as fingerprint, facial recognition, and proximity-based keys. Meanwhile, regulatory bodies are introducing stricter safety standards and data privacy mandates, placing additional emphasis on robust cybersecurity measures and compliance protocols.

This executive summary distills the essential findings of a comprehensive investigation into the vehicle access control market, highlighting the most influential drivers, industry disruptions, and critical growth opportunities. Readers will be guided through a detailed assessment of transformative shifts, the ramifications of the 2025 U.S. tariff regime, and nuanced segmentation insights across technology, component, lock, vehicle, and end-user categories. Complementing these insights are regional analyses, competitive landscapes, and strategic recommendations designed to inform decision-making at every level. Together, these elements provide a clear roadmap for stakeholders seeking to navigate the complexities of this dynamic sector.

Unveiling the Paradigm Shifts Driving Innovation in Vehicle Access Control Across Electrification Connectivity and Autonomous Mobility

In recent years, the vehicle access control landscape has been reshaped by a convergence of technological breakthroughs and evolving consumer expectations. The rise of connectivity-enabled vehicles has fueled the integration of Internet of Things platforms and over-the-air update capabilities, allowing manufacturers to enhance security protocols and introduce new user experiences without physical recalls. At the same time, electrification and the development of autonomous driving systems have heightened the importance of fail-safe entry mechanisms that can operate in disconnected or battery-depleted scenarios, prompting the adoption of multi-modal authentication approaches.

Concurrently, the proliferation of smartphones and the expansion of mobile application ecosystems have redefined user interactions with vehicles, enabling features such as remote unlocking, geofencing, and digital key sharing. These innovations are accelerating the shift away from dedicated key fobs toward smartphone-based credentials, while simultaneously raising the stakes for cybersecurity resilience. As both OEMs and aftermarket suppliers invest in advanced biometric modalities and encrypted communication channels, stakeholders must stay abreast of interoperability standards and emerging regulatory frameworks to maintain competitive advantage.

Assessing the Cumulative Impact of 2025 United States Tariffs on Global Vehicle Access Control Supply Chains and Cost Structures

The imposition of new tariff measures in 2025 has introduced a complex layer of cost considerations for the vehicle access control ecosystem. Manufacturers reliant on imported components have seen material and assembly expenses rise, particularly where specialized electronic modules and advanced sensors cross national boundaries. These escalated input costs have prompted some suppliers to revisit their sourcing strategies, in turn spurring regionalization efforts and partnerships with domestic vendors to mitigate the impact of duty surcharges. However, this recalibration has also exposed vulnerabilities in supply chain agility, as localized production may not yet match the scale or expertise of established global operations.

Despite these challenges, certain market participants have leveraged the tariff environment as an opportunity to accelerate vertical integration and downstream investment. By internalizing component assembly and forging alliances with chip manufacturers, they have enhanced control over critical hardware pipelines and reduced exposure to import levies. Meanwhile, OEMs are increasingly incorporating total landed cost analyses into their procurement processes, evaluating the trade-offs between near-shore manufacturing and potential efficiency gains from centralized, high-volume facilities. As the tariff landscape continues to evolve, sustained vigilance and strategic flexibility will be essential for maintaining cost competitiveness across the value chain.

Deciphering Critical Market Segments Revealing How Access Technologies Components and End Users Shape the Evolution of Vehicle Entry Mechanisms

A nuanced understanding of market segmentation reveals the diverse pathways through which vehicle access control solutions are adopted. When considering access technology, biometric methods such as facial recognition and fingerprint authentication are gaining traction in premium vehicle segments, valued for their high security and user convenience, while traditional key fobs and proximity keys remain prevalent in mid-tier models. Radio-frequency identification solutions are bifurcated into active systems offering extended range and passive configurations suited for cost-sensitive implementations. Smartphone-based access is swiftly expanding, with Android and iOS applications empowering remote key management and integrating with broader mobility ecosystems.

Component type segmentation further delineates market dynamics, as control modules-both network-integrated and standalone-serve as the system’s intelligence hub, orchestrating authentication protocols and interfacing with the vehicle’s electronics. Ignition switch variants, encompassing push-button and turn-key options, reflect consumer preferences for intuitive start experiences, while lock assemblies address both door and trunk security needs. When viewed through the lens of lock type, electronic mechanisms dominate growth trajectories, though mechanical locks persist in utility and budget-oriented two-wheeler and commercial vehicle sectors. Finally, end-user segmentation underscores the strategic bifurcation between OEM and aftermarket channels, each with unique performance requirements and service models, shaping product roadmaps and distribution strategies.

This comprehensive research report categorizes the Vehicle Access Control market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Access Technology

- Component Type

- Lock Type

- Vehicle Type

- End User

Mapping Regional Dynamics and Growth Drivers Across the Americas EMEA and Asia-Pacific Vehicle Access Control Ecosystem

Regional landscapes display distinct growth patterns driven by varying regulatory, economic, and infrastructure factors. In the Americas, stringent safety regulations and growing vehicle connectivity rates are propelling demand for advanced access control solutions. Meanwhile, established automotive hubs in North America are investing in localized production capabilities to buffer against tariff volatility. Shifting focus southward, Latin American markets are characterized by a blend of aftermarket retrofitting opportunities and rising consumer interest in smartphone-based keys, supported by expanding mobile network coverage.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts around vehicle cyber resilience are shaping adoption curves, while robust urbanization trends and fleet electrification programs in the Gulf Cooperation Council region foster demand for integrated access systems. In the Asia-Pacific arena, rapid expansion of shared mobility services and high vehicle production volumes in East Asia underpin technology rollouts, with China and Japan leading in biometric integration. Southeast Asian and Oceania markets present incremental growth potential, fueled by improving road safety standards and increasing consumer willingness to invest in connected car features.

This comprehensive research report examines key regions that drive the evolution of the Vehicle Access Control market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Innovation Roadmaps and Partnership Synergies of Leading Players in the Vehicle Access Control Arena

The competitive environment is defined by a blend of legacy automotive suppliers and emerging technology innovators. Established component manufacturers are leveraging decades of experience in electronic lock systems and sensor integration, while new entrants are introducing software-centric platforms that prioritize user interface and cloud connectivity. Strategic partnerships between traditional OEM suppliers and software development firms have yielded hybrid offerings that combine robust hardware engineering with agile digital services, elevating overall system capabilities.

Mergers and acquisitions have further reshaped market contours, as larger players seek to broaden their portfolios through the acquisition of niche biometric technology firms and cybersecurity specialists. Concurrently, joint ventures with semiconductor companies aim to secure prioritized access to critical chipsets and accelerate the development of bespoke authentication modules. The ongoing convergence of the physical and digital domains within vehicle access control has incentivized collaborations that transcend historical industry boundaries, underscoring the importance of cross-sector alliances in sustaining competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vehicle Access Control market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- Alps Alpine Co. Ltd.

- Brose Fahrzeugteile SE & Co. KG

- Continental AG

- Denso Corporation

- Hella GmbH & Co. KGaA

- Hyundai Mobis Co. Ltd.

- I.G. Bauerhin GmbH

- Kiekert AG

- Lear Corporation

- LG Electronics Inc.

- Magna International Inc.

- Marquardt GmbH

- Methode Electronics Inc.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Silca S.p.A.

- Strattec Security Corporation

- Tokai Rika Co. Ltd.

- U-Shin Ltd.

- Valeo SA

- ZF Friedrichshafen AG

Elevating Strategic Priorities with Actionable Recommendations to Propel Growth Innovation and Resilience in Vehicle Access Control

Industry leaders should prioritize the integration of multi-modal authentication ecosystems that combine biometric, RFID, and smartphone capabilities to meet diverse end-user requirements and enhance security resilience. Collaborating with cybersecurity experts and forging alliances with mobile platform providers will be essential in safeguarding data integrity and enabling secure over-the-air updates. Furthermore, investing in modular control architectures that support rapid software enhancements can provide a competitive edge in responding to evolving consumer preferences and regulatory mandates.

To navigate tariff-induced cost pressures, executives are advised to pursue near-shore manufacturing partnerships and explore vertical integration opportunities with component suppliers. Establishing strategic inventories and adopting just-in-time logistics frameworks can mitigate supply chain disruptions. Simultaneously, expanding presence in high-growth aftermarket channels through value-added service offerings will create additional revenue streams and foster long-term customer loyalty. By aligning product roadmaps with regional regulatory timelines and urban mobility trends, stakeholders can position themselves to capitalize on the next wave of growth in vehicle access control.

Outlining a Rigorous Multi-Method Research Approach Leveraging Qualitative and Quantitative Techniques for Vehicle Access Control Analysis

This study employs a hybrid research methodology that integrates primary qualitative interviews and quantitative data analysis to ensure robust and actionable insights. Primary data was collected through in-depth discussions with industry veterans, including technology developers, OEM procurement leaders, and aftermarket service providers. These conversations provided firsthand perspectives on market drivers, technological adoption rates, and emerging regulatory considerations. Quantitative validation was achieved through structured surveys distributed to a diverse panel of stakeholders, enabling the triangulation of findings and reinforcing confidence in the conclusions drawn.

Secondary research encompassed a thorough review of industry publications, regulatory filings, patent landscapes, and publicly available financial reports. Data triangulation techniques were applied to reconcile discrepancies and identify consistent trends, while expert workshops facilitated iterative hypothesis testing. The research period spanned eighteen months, with continuous updates incorporated to reflect tariff changes and technology rollouts. Rigorous quality control procedures, including peer reviews and methodological audits, have been undertaken to uphold the integrity and reproducibility of the analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vehicle Access Control market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vehicle Access Control Market, by Access Technology

- Vehicle Access Control Market, by Component Type

- Vehicle Access Control Market, by Lock Type

- Vehicle Access Control Market, by Vehicle Type

- Vehicle Access Control Market, by End User

- Vehicle Access Control Market, by Region

- Vehicle Access Control Market, by Group

- Vehicle Access Control Market, by Country

- United States Vehicle Access Control Market

- China Vehicle Access Control Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Drawing Together Core Research Findings to Illuminate Emerging Opportunities and Navigate Challenges in Vehicle Access Control Innovation

The progression towards intelligent and secure vehicle access control is poised to redefine automotive user experiences and reshape competitive dynamics. Key insights underscore the growing prominence of biometric and smartphone-based solutions, the strategic imperative of supply chain diversification in the face of tariffs, and the critical role of cybersecurity in sustaining consumer trust. Regional analyses reveal differentiated adoption curves, driven by regulatory frameworks, manufacturing footprints, and consumer behavior nuances. Competitive landscapes continue to evolve, with collaboration and consolidation emerging as central themes.

Ultimately, stakeholders that embrace innovation through cross-industry partnerships, leverage data-driven strategies, and maintain operational agility will be best positioned to capture the significant opportunities ahead. The vehicle access control market represents a nexus of technological, regulatory, and consumer-driven forces, and its trajectory will be shaped by those who can anticipate shifts and proactively adapt. This report offers a comprehensive foundation for informed decision-making and strategic planning as the mobility sector transitions into a new era of secure, connected, and user-centric entry solutions.

Unlock Comprehensive Vehicle Access Control Market Intelligence by Collaborating with Ketan Rohom to Secure Your Customized Research Report

Engaging with Ketan Rohom for a tailored engagement unlocks unparalleled value for stakeholders seeking to deepen their understanding of the vehicle access control landscape. Through a personalized consultation, you will gain access to the full breadth of our market intelligence, including detailed company profiles, strategic SWOT analyses, and comprehensive insights into emerging technologies shaping the future of secure vehicle entry. This collaboration ensures that you receive not only standardized research outputs, but also a bespoke advisory framework that aligns with your unique business objectives and market positioning.

By commissioning the complete report, decision-makers and strategic planners will be equipped with the actionable intelligence necessary to make informed investments, plan technology partnerships, and design innovative solutions. Reach out to schedule a conversation with Ketan Rohom, Associate Director of Sales & Marketing, to explore customized pricing options and report add-ons that address your precise requirements. Take the next step toward cementing your competitive advantage by securing this critical market resource today.

- How big is the Vehicle Access Control Market?

- What is the Vehicle Access Control Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?