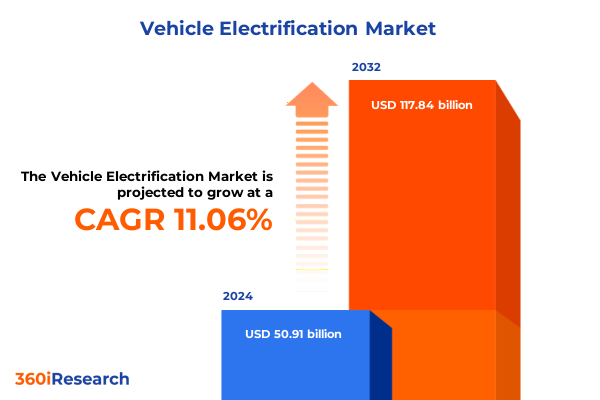

The Vehicle Electrification Market size was estimated at USD 55.78 billion in 2025 and expected to reach USD 61.12 billion in 2026, at a CAGR of 11.27% to reach USD 117.84 billion by 2032.

Pioneering Strategies Driving the Rapid Adoption of Electrified Vehicles in an Era of Decarbonization and Technological Breakthroughs

The global shift toward vehicle electrification represents a convergence of environmental imperatives, technological maturation, and shifting consumer preferences that together redefine the automotive landscape. As governments worldwide commit to ambitious decarbonization targets, automotive manufacturers are under increasing pressure to accelerate innovation in electric propulsion systems. This urgency has spurred monumental investments in battery chemistry research, power electronics refinement, and next-generation motor designs that are progressively closing the performance gap with traditional internal combustion engines.

Simultaneously, macroeconomic factors including fluctuating oil prices and evolving regulatory frameworks have amplified the appeal of electric mobility solutions for both individual and commercial users. Incentive mechanisms, from tax credits to direct subsidies, are now widely deployed to hasten adoption, while charging infrastructure development is evolving into a cornerstone of urban planning and commercial real estate strategies. Transitioning from niche offerings to mainstream viability, electrified vehicles are rapidly integrating into fleets and private ownership models, marking a pivotal departure from legacy automotive paradigms.

As the convergence of market forces, policy initiatives, and technological breakthroughs unfolds, stakeholders across the value chain-from raw material suppliers to OEMs and infrastructure providers-must navigate a landscape characterized by unprecedented complexity and potential. A nuanced understanding of these foundational shifts is essential for any organization seeking to harness the transformative power of vehicle electrification.

Unprecedented Market Disruptions Shaping Electrification Through Breakthrough Innovations in Batteries Charging Infrastructure Motors and Power Electronics

The vehicle electrification landscape is undergoing a profound transformation as breakthroughs in battery density, motor efficiency, and charging speeds reshape consumer expectations and industry roadmaps. Lithium ion technologies now achieve energy densities once thought untenable, while emerging solid-state chemistries promise enhanced safety profiles and accelerated charging capabilities. Concurrently, power electronics architectures are moving toward integrated, silicon carbide-based solutions that deliver higher thermal stability and reduced energy losses, enabling vehicles to extract maximum range from every kilowatt-hour.

Charging infrastructure has evolved from rudimentary home units to strategically distributed networks of high-power stations capable of replenishing vehicle batteries in minutes. Urban centers and highway corridors are witnessing the rollout of direct current fast charging points that leverage grid modernization and smart energy management systems to balance demand and minimize grid strain. Moreover, interoperability standards are gaining traction, facilitating seamless user experiences across different charging networks and incentivizing further investment from both private and public-sector stakeholders.

In motor technology, the shift toward permanent magnet and switched reluctance architectures has unlocked unprecedented torque densities and efficiency gains. Induction motors remain a cost-effective choice for certain segments, but the convergence of material science and design optimization has elevated alternative motor topologies to the forefront of high-performance applications. Taken together, these innovations are not merely incremental improvements but represent fundamental shifts that will define the next decade of electrification.

Assessing the Profound Implications of United States 2025 Tariffs on Electric Vehicle Imports Components and Domestic Supply Chain Resilience

In 2025, the United States introduced a series of targeted tariffs on imported electric vehicles and critical components, reflecting a strategic intent to bolster domestic manufacturing capabilities. These measures encompass increased duties on battery modules, electric motors, and power electronics sourced from certain countries, effectively raising the cost of imported assemblies by a significant margin. The policy objective centers on incentivizing local production while protecting emerging manufacturing clusters from external competitive pressures.

Beyond immediate cost implications, the tariffs have catalyzed a reconfiguration of global supply chains. International suppliers are reevaluating their footprints, with several electing to establish production facilities on U.S. soil to mitigate tariff exposure. At the same time, domestic manufacturers have accelerated investments in upstream materials processing and advanced assembly lines, thereby reinforcing the resilience of the national supply base. This strategic recalibration carries long-term benefits for job creation and technological sovereignty but also introduces transitional complexities that companies must diligently manage.

Consequently, organizations operating within the U.S. ecosystem are increasingly focused on optimizing production locales, sourcing strategies, and inventory management to navigate the heightened tariff environment. Success in this context requires a comprehensive understanding of tariff nomenclatures, eligibility for exemption waivers, and the interplay with existing incentives under broader industrial policy frameworks.

Revealing Critical Insights from Component and Vehicle Type Segmentation to Illuminate Key Drivers and Opportunities across the Electrification Ecosystem

Diving into the component segmentation reveals that battery systems serve as the cornerstone of electrified vehicles, with lithium ion chemistry dominating current production and solid-state variants emerging as a disruptive force that promises enhanced energy density and safety. Charging infrastructure segmentation highlights the evolving coexistence of alternating current charging for residential and workplace applications alongside direct current fast charging networks that cater to long-distance mobility needs. In the electric motor segment, induction machines continue to offer cost-effective solutions, while permanent magnet and switched reluctance motors secure leadership in high-efficiency, performance-sensitive applications. Power electronics segmentation uncovers the critical role of controllers that orchestrate energy flow, converters that regulate voltage, and inverters that transform DC to AC power with minimal losses.

When viewed through the lens of vehicle type segmentation, passenger cars represent the largest adoption pool, driven by consumer preferences for compact and luxury offerings that blend performance with sustainability. Commercial vehicles are rapidly electrifying to meet urban emission regulations and to optimize total cost of ownership in logistics and transit operations. Two wheelers, particularly in densely populated regions, illustrate a high-growth niche propelled by affordability, convenience, and lower infrastructure requirements. Altogether, these intertwined segmentations illuminate clear pathways for targeted R&D investments, strategic partnerships, and product differentiation strategies that align with specific application needs.

This comprehensive research report categorizes the Vehicle Electrification market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Vehicle Type

- Voltage Architecture

- Degree of Electrification

- Channel

Comparative Regional Dynamics Illustrating Divergent Electrification Strategies Across the Americas Europe Middle East Africa and Asia Pacific

The Americas region exhibits a diverse electrification narrative, anchored by robust policy frameworks such as the Inflation Reduction Act and state-level mandates that incentivize domestic battery manufacturing and vehicle assembly. North American markets are notable for their heavy investment in gigafactories and the proliferation of charging corridors along interstates, while South American nations are exploring hybrid models that leverage existing hydroelectric capacity and natural gas infrastructure to support interim electrified transit solutions.

In Europe, the Middle East, and Africa cluster, stringent CO₂ emission targets and urban low-emission zones have accelerated the shift toward electrified fleets, with Western Europe leading in EV adoption rates. Charging infrastructure is increasingly integrated into urban planning, leveraging smart city platforms to optimize load management. Meanwhile, the Middle East is harnessing solar and wind resources to fuel future charging networks, and select African markets are exploring decentralized off-grid charging models to overcome grid limitations.

The Asia-Pacific arena remains the most dynamic in terms of new vehicle registrations and component manufacturing capacity. Exports from key Asian economies continue to shape global supply chains, while domestic demand in markets such as China and India drives scale economies in battery production. Collaborative initiatives between governments and local manufacturers are fostering innovation in solid-state battery research and incentivizing the deployment of ultra-fast charging solutions in urban centers.

This comprehensive research report examines key regions that drive the evolution of the Vehicle Electrification market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Positioning Competitive Edge and Collaborative Endeavors of Leading Players Steering the Vehicle Electrification Landscape

Leading automakers and technology firms are deploying multifaceted strategies to secure competitive advantage in the electrification domain. Legacy OEMs are partnering with battery innovators and semiconductor specialists to integrate next-generation cells and power electronics into their vehicle platforms. These alliances enable rapid iteration on thermal management systems, cell chemistry formulations, and pack architectures, thus preserving brand heritage while meeting modern performance benchmarks.

Simultaneously, pure-play electric vehicle manufacturers are expanding production footprints and diversifying their model portfolios to address emerging segments, from entry-level commuters to high-performance luxury vehicles. These companies are also forging collaborations with charging network operators and digital mobility platforms to deliver end-to-end customer experiences, encompassing vehicle purchase, charging, and fleet management services.

Component suppliers specializing in advanced materials, inverters, and motor technologies are capitalizing on the technology race by scaling pilot lines for next-generation solutions and securing long-term supply contracts with OEMs. Meanwhile, energy management providers are innovating in grid integration, vehicle-to-grid credentials, and software-defined charging services, positioning themselves as indispensable partners in an increasingly electrified transportation ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vehicle Electrification market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bayerische Motoren Werke AG

- BYD Company Limited

- Canoo Inc.

- ChargePoint Holdings, Inc.

- Chery Automobile Co., Ltd.

- Ford Motor Company

- General Motors Company

- Li Auto Inc.

- Lucid Group, Inc.

- NIO Inc.

- Polestar Automotive Holding UK PLC

- Rivian Automotive, Inc.

- Tesla, Inc.

- Volkswagen AG

- XPeng Inc.

Actionable Roadmap for Industry Leaders to Strengthen Supply Chains Accelerate Innovation Expand Infrastructure and Optimize Policy Engagement in Electrification

Industry leaders should prioritize the establishment of resilient, geographically diversified supply chains that hedge against tariff fluctuations and geopolitical disruptions. By forging strategic partnerships with raw material processors and cell manufacturers, organizations can gain early access to advanced chemistries and tighten integration between upstream and downstream value chain tiers. In parallel, investing in modular production platforms will facilitate rapid retooling to accommodate next-generation battery formats and motor topologies, ensuring adaptability as technologies evolve.

Accelerating the rollout of scalable charging infrastructure demands collaboration with utilities, real estate developers, and municipal governments. Joint ventures and co-investment models can defray capital expenditures while aligning incentives across stakeholders. Additionally, embedding smart grid interfaces and dynamic pricing mechanisms will optimize load management and reduce operational costs, enhancing the overall attractiveness of electrified mobility to end users.

To capitalize on emerging policy frameworks, companies must engage proactively in regulatory dialogues and subsidy programs, ensuring that incentive structures align with long-term strategic priorities. Comprehensive workforce development initiatives should be launched to cultivate specialized talent in battery engineering, power electronics design, and charging network optimization. By combining these approaches, industry participants will be well-positioned to drive sustainable growth, technological leadership, and market share expansion.

Comprehensive Research Approach Incorporating Rigorous Primary Secondary Data Collection Expert Interviews and Robust Data Triangulation Techniques

This research integrates a dual-pronged methodology that combines rigorous primary data collection with extensive secondary research. In the primary phase, structured interviews and surveys were conducted with senior executives from OEMs, battery developers, charging service providers, and regulatory agencies to capture firsthand perspectives on strategic priorities, technology adoption timelines, and tariff impact assessments. The secondary phase included analysis of publicly available corporate filings, patent databases, government policy documents, and academic publications to validate and enrich the insights derived from stakeholder consultations.

Data triangulation techniques were employed to reconcile information from multiple sources, ensuring consistency and reducing the risk of bias. Quantitative inputs were cross-verified against industry benchmarks and historical trend analyses, while qualitative findings were subjected to thematic coding to extract recurring patterns and strategic imperatives. This blended approach ensures that the final insights reflect both the overarching market dynamics and the nuanced considerations of individual stakeholder groups.

Expert review panels comprising academic researchers, industry veterans, and policy specialists were convened at critical junctures to scrutinize methodologies, challenge assumptions, and endorse the robustness of our findings. The result is a comprehensive, transparent framework that stakeholders can rely upon to inform strategic planning, investment decisions, and policy advocacy in the vehicle electrification sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vehicle Electrification market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vehicle Electrification Market, by Component Type

- Vehicle Electrification Market, by Vehicle Type

- Vehicle Electrification Market, by Voltage Architecture

- Vehicle Electrification Market, by Degree of Electrification

- Vehicle Electrification Market, by Channel

- Vehicle Electrification Market, by Region

- Vehicle Electrification Market, by Group

- Vehicle Electrification Market, by Country

- United States Vehicle Electrification Market

- China Vehicle Electrification Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings to underscore the Imperatives and Future Directions for Stakeholders in the Evolving Vehicle Electrification Market

The evolution of vehicle electrification is characterized by a delicate interplay of technological innovation, policy incentives, and strategic collaboration across the value chain. From breakthroughs in solid-state battery chemistry to the deployment of ultra-fast charging networks, the industry is charting an accelerated trajectory toward a low-carbon future. At the same time, the 2025 tariff revisions underscore the importance of supply chain resilience and the strategic imperative of regional manufacturing footprints.

Segmentation analysis highlights clear opportunities in battery advancements, charging solutions, niche motor architectures, and power electronics refinements, while regional insights reveal differentiated pathways in the Americas, EMEA, and Asia-Pacific markets. Leading companies are responding through targeted alliances, production expansions, and software-defined services that span the entire mobility ecosystem. Yet, success will ultimately hinge on the ability to integrate these disparate elements-technology, policy, infrastructure, and human capital-into cohesive, forward-looking strategies.

As market entrants and incumbents alike navigate this complex terrain, strategic foresight, operational agility, and collaborative innovation will determine winners in the race toward electrification. The insights presented herein provide a roadmap for organizations seeking to capitalize on emerging trends, mitigate risks, and shape the future of mobility.

Engage with Our Associate Director of Sales and Marketing to Unlock In-Depth Insights and Secure Your Definitive Vehicle Electrification Market Research Report

To gain unparalleled clarity on the strategic levers, technological breakthroughs, and policy dynamics shaping the rapidly evolving vehicle electrification sector, reach out to Ketan Rohom who stands ready to guide you through our exhaustive market analysis. Engage in a personalized consultation to explore bespoke insights on component supply chains, regional developments, and competitive landscapes that will empower your organization to make informed, confident decisions. By connecting with Ketan Rohom, Associate Director of Sales & Marketing, you ensure access to exclusive data, timely updates, and a comprehensive roadmap for capitalizing on emerging opportunities. Take the next step toward securing your definitive market research report and transform uncertainty into strategic advantage through an immediate dialogue with an expert dedicated to your success

- How big is the Vehicle Electrification Market?

- What is the Vehicle Electrification Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?